AI Deception Tools Market Size, Share, Trends, Industry Analysis Report

By Technology, By Application (Fraud Detection, Cyber Security, and Others), By End-User Industry, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6072

- Base Year: 2024

- Historical Data: 2020-2023

Overview

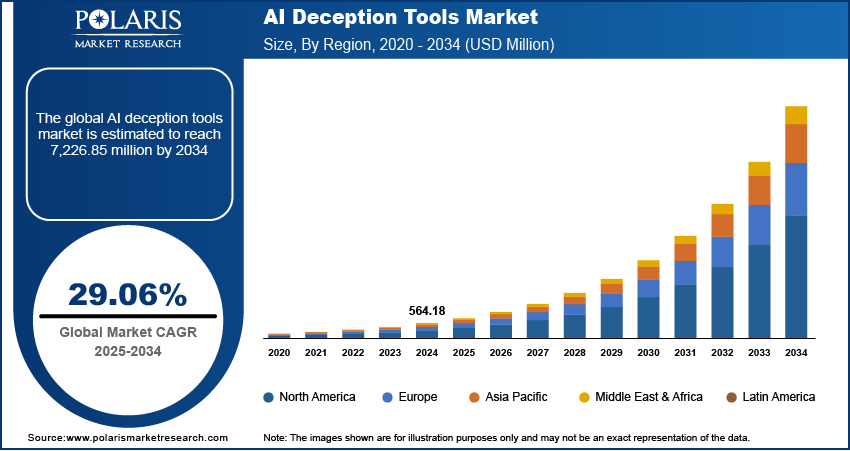

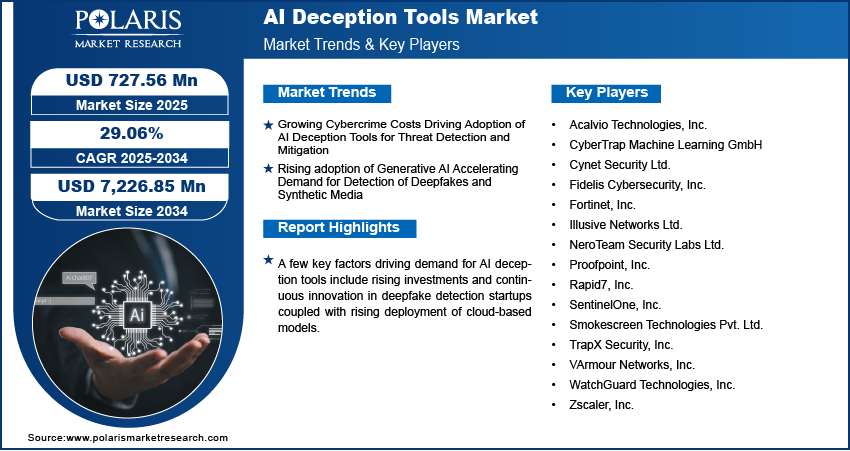

The global AI deception tools market size was valued at USD 564.18 million in 2024, growing at a CAGR of 29.06% from 2025 to 2034. Key factors driving demand for AI deception tools include increasing cybercrime expenses along with increasing use of generative AI solutions.

Key Insights

- The NLP segment of the market accounted for the largest share in 2024.

- The healthcare segment is projected to grow at a rapid pace in the coming years due to increasing threats of data manipulation, ransomware, and AI-based fraud on patient records and telemedicine platforms.

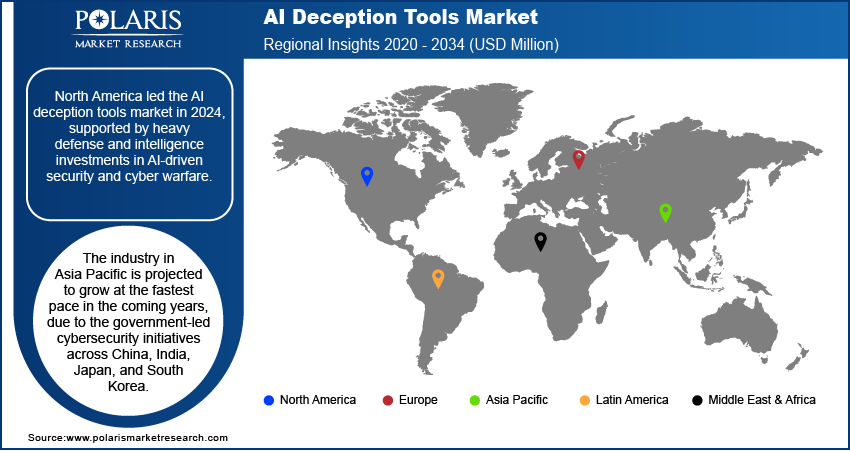

- The North America AI deception tools market held the largest global market share in 2024.

- The U.S. AI deception tools market is fueled by the elevated rate of cyberattacks on BFSI, healthcare, and government institutions.

- The market in Asia Pacific is projected to grow at a fast pace from 2025-2034, due to the government-driven cybersecurity initiatives in China, India, Japan, and South Korea.

- The market in China is growing rapidly due to the increasing digitalization in banking, telecom, and e-commerce industries.

Industry Dynamics

- Increasing cybercrime expenses are fueling AI deception tools adoption, as organizations look to more sophisticated threat detection and mitigation techniques to protect their key assets and reduce financial loss.

- Growing adoption of generative AI is driving demand for deception technology that is capable of detecting deepfakes, synthetic media, and sophisticated adversarial attacks on online platforms.

- Zero Trust architecture integration are creating market opportunity based on increasing momentum to integrate deception-based defense layers into identity, access, and network security architectures within organizations.

- High deployment and operations costs continue to restrain the market growth, limiting its adoption among small and medium-sized businesses with low cybersecurity budgets.

Market Statistics

- 2024 Market Size: USD 564.18 Million

- 2034 Projected Market Size: USD 7,226.85 Million

- CAGR (2025–2034): 29.06%

- North America: Largest Market Share

The market for AI deception tools encompasses technologies with the ability to simulate, manipulate, and create realistic content. The tools are extensively applied in testing for cybersecurity, military training, fraud detection, digital media, and adversarial AI studies. They allow simulation of deceptive behavior for both defensive and analytical purposes. Advances in generative AI, deep learning, and natural language processing are improving synthetic text, images, audio, and video outputs. This makes deception strategies more convincing and adaptable across different applications.

Investments in deepfake detection startups are accelerating market growth. Businesses, governments, and security agencies are adopting advanced detection and verification tools to counter risks linked to AI-generated disinformation. In July 2025, IdentifAI, an Italian startup, received USD 5.8 million from United Ventures to grow globally and develop detection technology. Efforts like these are boosting international action against synthetic media threats and are among the factors behind the increasing use of AI deception tools.

The adoption of cloud-based models is accelerating growth in the AI deception tools market. These models provide scalability, cost efficiency, and easier access for a wide range of organizations. Enterprises are moving to secure cloud platforms that simplify deployment and improve operational flexibility. In April 2025, Kyndryl introduced a set of AI Private Cloud services combined with NVIDIA's AI Enterprise platform via the Kyndryl Bridge layer. The services include support for containerization, MLOps/LLMOps, data science workflow, and microservices. This allows enterprises to architect, deploy, and run AI workloads, such as deception detection tools, in secure and production-ready environments. This is enhancing availability of AI deception tools for finance, defense, and media.

Drivers & Opportunities

Growing Costs of Cybercrime Fueling AI Deception Technology Adoption to Detect and Prevent Advanced Attacks: Increasing cyberattacks, phishing tricks, and AI-enabled fraud are compelling organizations to implement cutting-edge detection technologies. Organizations, governments, and banks are adopting AI technologies to counter sophisticated attacks and protect sensitive information. Cybersecurity Ventures estimates global cybercrime expenses at USD 10.5 trillion in 2025, up from USD 3 trillion in 2015. The high growth is increasing the requirement for high-volume AI deception solutions to prevent financial and reputational risks.

Rising Adoption of Generative AI Driving Demand for Deepfake and Synthetic Media Detection: Rising adoption of generative AI is driving more threats in the areas of deepfakes, synthetic voices, and fake media. These technologies are misused for identity theft, disinformation operations, and social engineering. In a recent Real-Time Population Survey conducted by the Federal Reserve Bank of St. Louis, close to 40% of US adults between 18–64 years have used generative AI as of August 2024, with a third reporting use on a daily or several times a week basis. This widespread adoption emphasizes the extent of exposure to AI-generated deception and the increasing need for detection mechanisms that guarantee digital communication security and defend public trust.

Segmental Insights

By Technology

Based on technology, the AI deception tools market is segmented into natural language processing (NLP), machine learning, large language models (LLMs), generative AI (GANs), computer vision, and others. NLP held the largest share in 2024. It possesses the ability to detect phishing threats, fake content, and social engineering scams. Real-time pattern analysis capability has fueled BFSI, telecom, and government adoption.

Generative AI (GANs) is expected to grow fastest through the forecast period. Its role in creating deepfakes, synthetic identities, and manipulated media is expanding. GAN-powered detection solutions are in high demand for cybersecurity, fraud prevention, and identity verification.

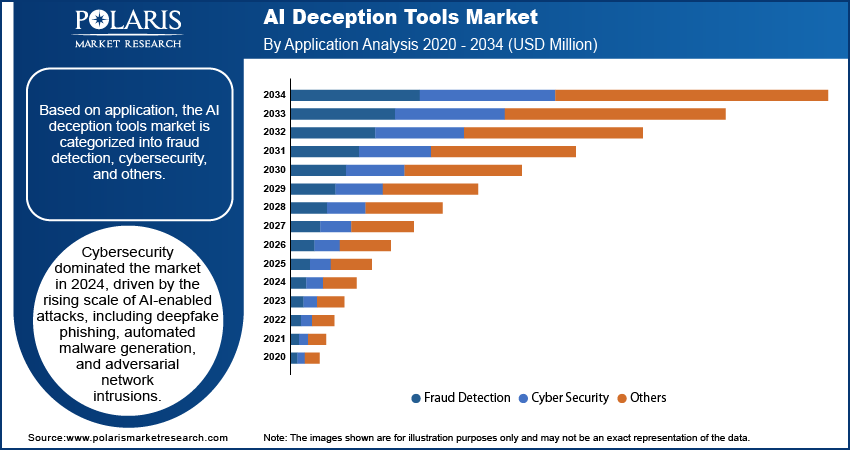

By Application

Based on application, the AI deception tools market is categorized into fraud detection, cybersecurity, and others. Cybersecurity held the dominating market share in 2024. Increasing AI-powered threats like deepfake phishing, automated malware, and adversarial intrusions are driving businesses to implement deception technology. These technologies are able to trap, observe, and disarm sophisticated attacks.

Fraud detection is poised for high market growth. Insurers, banks, and e-commerce sites are leveraging AI deception technology to detect fake accounts, identify suspicious transactions, and authenticate identities. This minimizes monetary losses and enhances customer trust.

By End-use Industry

Based on end-user industry, the AI deception tools market is segmented into healthcare, BFSI, telecom & IT, government, retail, and others. BFSI dominated the market share in 2024 based on high susceptibility to AI-based fraud, phishing, and identity theft. Deception tools are used by financial institutions to secure transactions, safeguard customer data, and address compliance requirements.

Healthcare is expected to expand the fastest over the forecast period. Evolving threats from ransomware, manipulated data, and AI-pushed fraud are leveled at patient data and telehealth platforms. Growing dependency on electronic records and networked appliances is driving deception solutions for security and compliance.

Regional Analysis

The North America AI deception tools market accounted for a substantial share in 2024. This is supported by massive defense and intelligence investments in AI-powered deception for cyber war and national security. Sectoral regulations such as the California Consumer Privacy Act (CCPA) and industry standards in BFSI and healthcare are also driving adoption. Business organizations are prioritizing protection of critical infrastructure and restricting advanced persistent threats, leading to growing demand for deception-based solutions.

U.S. AI Deception Tools Market Overview

The U.S. dominated the North America market. High levels of cyberattacks on BFSI, healthcare, and government sectors are driving the shift toward deception-driven detection and containment. AAG IT Services reported that 53.35 million U.S. citizens were victims of cybercrime in the first half of 2022, underlining the vulnerabilities in digital systems. Rising enterprise spending and federal initiatives to counter AI-generated threats are strengthening the market outlook.

Asia Pacific AI Deception Tools Market Assessment

The Asia Pacific AI deception tools market is projected to witness the fastest growth during the forecast period. Governments across China, India, Japan, and South Korea are driving cybersecurity initiatives to combat misinformation, disinformation, and data loss. The dissemination of generative AI is inducing threats of synthetic identity fraud, deepfake scams, and voice cloning attacks. Businesses and governments are plowing funds into sophisticated deception tools to protect digital infrastructure and national defense.

China AI Deception Tools Market Analysis

China accounted for the largest share in Asia Pacific. Rising digitalization in banking, telecom, and e-commerce has introduced new susceptibilities. The China Academy of Information and Communications Technology documented that the digital economy of the nation grew from USD 1.74 trillion in 2012 to USD 7.46 trillion in 2022, increasing its GDP contribution from 21.6% to 41.5%. All this has made exposure to AI-facilitated disinformation and identity theft more prevalent, while demand for customized deception detection tools has gone up.

Europe AI Deception Tools Market Outlook

Europe held a significant share in 2024. EU AI Act and robust data privacy regulations are pushing companies to use deception technology for compliance and resiliency. UK, German, and French governments are increasing cyber defense spending. In July 2025, the UK launched its Cyber Growth Action Plan with USD 20.4 million. In this investment, USD 12.7 million went to the CyberASAP program to bring academic research to market and USD 7.6 million to SME and startup assistance through the Cyber Runway accelerator. These programs are driving AI deception tool adoption across private and public sectors.

Key Players & Competitive Analysis

The market for global AI deception tools is highly competitive. Major players are Acalvio Technologies, Inc., Illusive Networks Ltd., and TrapX Security, Inc. These players are leading innovation in deception-based cybersecurity, threat detection through AI, and incident response automation. Acalvio is bringing AI deception together with zero-trust architecture to enhance the resilience of enterprise security. Illusive Networks is growing its solution lines in BFSI, healthcare, and defense industries. TrapX Security is adding machine learning to deception-based threat intelligence to detect early lateral movement and insider threats. AI-driven deception technology is in growing demand as organizations hunt for proactive protection against AI-spawned cyberattacks, phishing, and AI-generated fraud. Suppliers are targeting scalable cloud-based deception platforms with sophisticated analytics, real-time monitoring, and SOAR integration.

Leading players in the market of AI deception tools are Acalvio Technologies, Inc., CyberTrap Machine Learning GmbH, Cynet Security Ltd., Fidelis Cybersecurity, Inc., Fortinet, Inc., Illusive Networks Ltd., NeroTeam Security Labs Ltd., Proofpoint, Inc., Rapid7, Inc., SentinelOne, Inc., Smokescreen Technologies Pvt. Ltd., TrapX Security, Inc., VArmour Networks, Inc., WatchGuard Technologies, Inc., and Zscaler, Inc.

Key Players

- Acalvio Technologies, Inc.

- CyberTrap Machine Learning GmbH

- Cynet Security Ltd.

- Fidelis Cybersecurity, Inc.

- Fortinet, Inc.

- Illusive Networks Ltd.

- NeroTeam Security Labs Ltd.

- Proofpoint, Inc.

- Rapid7, Inc.

- SentinelOne, Inc.

- Smokescreen Technologies Pvt. Ltd.

- TrapX Security, Inc.

- VArmour Networks, Inc.

- WatchGuard Technologies, Inc.

- Zscaler, Inc.

AI Deception Tools Industry Developments

In January 2024, Acalvio Technologies and Velaspan partnered to unveil the Active Cyber Engagement (ACE) service, powered by Acalvio's ShadowPlex platform. The solution enhances insider threat, ransomware, and zero-day attack protection with deception technology complemented by Velaspan's 24/7 SOC.

In July 2023, Fidelis Cybersecurity introduced the Active Directory Intercept feature in Fidelis Elevate, combining AD-aware detection, deception, and real-time monitoring to improve defenses against advanced AD attacks and improve threat visibility. It speeds up response times and strengthens organizations' ability to defend critical infrastructure from evolving cyber threats.

AI Deception Tools Market Segmentation

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Natural Language Processing (NLP)

- Machine Learning

- LLM

- Generative AI (GANs)

- Computer Vision

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Fraud Detection

- Cyber Security

- Others

By End-User Industry Outlook (Revenue, USD Million, 2020–2034)

- Healthcare

- BFSI

- Telecom & IT

- Government

- Retail

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

AI Deception Tools Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 564.18 Million |

|

Market Size in 2025 |

USD 727.56 Million |

|

Revenue Forecast by 2034 |

USD 7,226.85 Million |

|

CAGR |

29.06% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 564.18 million in 2024 and is projected to grow to USD 7,226.85 million by 2034.

The global market is projected to register a CAGR of 29.06% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Acalvio Technologies, Inc., CyberTrap Machine Learning GmbH, Cynet Security Ltd., Fidelis Cybersecurity, Inc., Fortinet, Inc., Illusive Networks Ltd., NeroTeam Security Labs Ltd., Proofpoint, Inc., Rapid7, Inc., SentinelOne, Inc., Smokescreen Technologies Pvt. Ltd., TrapX Security, Inc., VArmour Networks, Inc., WatchGuard Technologies, Inc., and Zscaler, Inc.

The natural language processing (NLP) segment dominated the market revenue share in 2024, owing to its widespread deployment in detecting phishing attempts, fraudulent text content, and social engineering scams.

The fraud detection applications segment is projected to witness the fastest growth during the forecast period, propelled by rising demand in banking, e-commerce, and insurance sectors.