E-commerce Software Market Share, Size, Trends, Industry Analysis Report

By Deployment (Cloud, On-premise); By Application; By Region; Segment Forecasts, 2024 - 2032

- Published Date:Mar-2024

- Pages: 115

- Format: PDF

- Report ID: PM4400

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

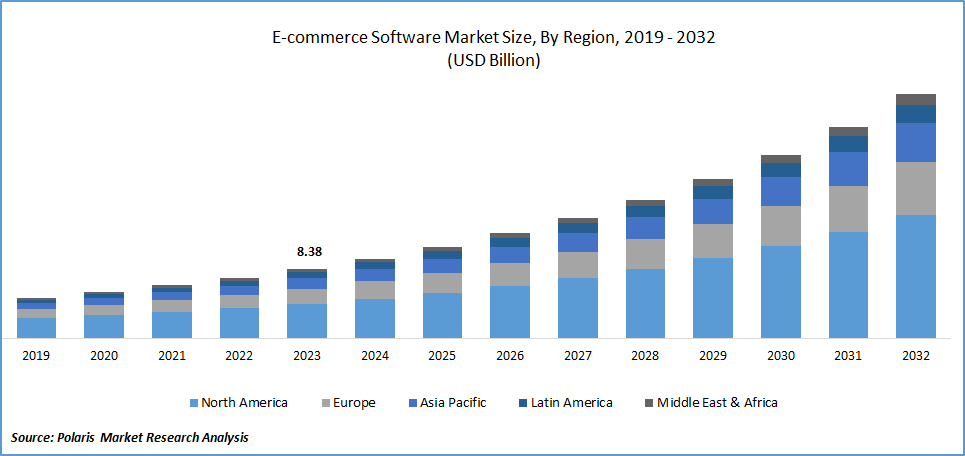

The global e-commerce software market was valued at USD 8.38 billion in 2023 and is expected to grow at a CAGR of 15.0% during the forecast period.

E-commerce software plays a crucial role in simplifying intricate processes, enabling companies to efficiently manage inventory, calculate taxes, and handle various business-related functions. The rising popularity of online shopping has generated a heightened demand for e-commerce software among numerous retailers. For instance, as per the U.S. Department of Commerce, e-commerce sales in the United States constituted approximately 11.0% of the overall retail sales in 2019. Major retailers like Walmart and Kroger Co. are making substantial investments to enhance their e-commerce sales. This trend is expected to contribute significantly to the substantial growth.

The growing trend of using mobile phones for online shopping has prompted market players like Shopify to tailor their software for operation on these devices. With a high rate of internet penetration and an increasing number of mobile users, online shopping through mobile devices is expected to see a significant increase. The GSM Association (GSMA) projects that the internet penetration rate on mobile devices will climb from 48.9% in 2019 to approximately 60.5% in 2025. Additionally, the introduction of high-speed internet technologies such as 4G and 5G is anticipated to have a positive impact on the market growth.

To Understand More About this Research:Request a Free Sample Report

Automating business processes and eliminating manual processing errors are key functionalities of e-commerce software. This software further enhances customer experience by providing options for customizing delivery dates and times. Notably, companies like Shopify are integrating Artificial Intelligence (AI) tools to enable retailers to analyze customers' buying patterns and forecast future demand for different products. The advantages offered by these features are expected to drive an increase in the adoption of e-commerce software by retailers in the coming years.

In developing nations, the percentage of online shoppers among the overall internet user base is currently lower compared to that in developed countries. This indicates that a smaller proportion of internet users engage in online shopping in these regions. However, there is notable growth in online shopper penetration, particularly in urban areas, where it is increasing rapidly. Despite this, the annual spending per online shopper in emerging economies remains lower than that in developed countries. Nevertheless, with the global market poised for significant expansion, there is an anticipation of a rising number of new consumers embracing online shopping platforms. This, in turn, is expected to contribute to the further growth of online shopper penetration.

Industry Dynamics

Growth Drivers

Increased Online Shopping Demand During Lockdowns

The COVID-19 pandemic has reshaped consumer behavior, propelling the E-commerce Software Market to unprecedented growth. With governments worldwide imposing strict lockdown regulations to curb the spread of the virus, traditional retail outlets faced closures, compelling consumers to turn to online platforms for their shopping needs. This surge in demand for online shopping has become a defining factor in the positive trajectory of the E-commerce market.

During lockdowns, the restrictions on purchasing non-essential items prompted a notable increase in bulk buying through e-commerce channels. Businesses swiftly adapted to this shift by modifying their strategies to cater to the changing consumer landscape. This adaptability has proven crucial in sustaining and accelerating market growth.

The trend towards online transactions for essential products and services has become a strategic imperative for businesses looking to raise awareness and drive traffic to their websites. The rising population of smartphone users further amplifies this shift, prompting marketers to expand their advertising reach and promote brands on e-commerce platforms. As a result, the E-commerce Software Market is not only responding to the immediate needs of consumers during the pandemic but is also experiencing a lasting positive impact, marking a paradigm shift in the way people approach retail and commerce.

Report Segmentation

The market is primarily segmented based on deployment, application, and region.

|

By Deployment |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Deployment Analysis

The Cloud Segment Accounted for the Largest Market Share in 2023

The cloud segment accounted for the largest market share. This dominance is linked to the rising adoption of cloud-based technology across diverse industry verticals. The deployment of cloud-based solutions provides numerous advantages, including ample storage capacity, centralized access, high-speed functionality, and enhanced reliability.

The on-premise segment will grow rapidly. Here, users have complete ownership, leading to reduced reliance on additional security measures. This method of deployment affords users full control over software configuration and updates. However, hindrances to the segment's growth are expected due to the proliferation of internet-based startups and companies facing budget constraints.

By Application Analysis

The Apparel Segment Held a Significant Market Share in 2023

The apparel segment held a significant market share. This dominance is linked to the growing trend of adopting online channels for purchasing clothing, accessories, bags, and jewelry. The accessibility of online platforms, characterized by low digital entry barriers, has prompted clothing merchants to embrace digital avenues as a means of expanding their customer base. Moreover, the rise in disposable income in emerging economies, along with the convenience provided by doorstep deliveries, cashless transactions, 24/7 access to products, and online shopping discounts, has encouraged merchants to opt for digital platforms.

The healthcare segment is expected to gain a substantial growth rate. E-commerce software presents a valuable avenue for hospitals, clinics, and other healthcare institutions to streamline their procurement processes for medical equipment and supplies. The increasing inclination of medical device manufacturers toward online platforms has created growth opportunities for participants. Additionally, the integration of telemedicine with e-commerce software is expected to elevate the overall patient experience in the coming years, contributing to the enhanced growth of the market.

Regional Insights

North America Dominated the Global Market Share in 2023

North America dominated the global market share. Growth is attributed to the notable presence of key market players in the region. The surge in e-commerce sales in the United States is a driving force behind the increased demand for e-commerce software among diverse retailers. These retailers are actively adopting new initiatives and making substantial investments to gain a competitive edge within their respective business sectors.

Notably, the U.S. market is set to witness significant advancement in the foreseeable future. This progression is primarily linked to the increasing embrace of m-commerce, the proliferation of online marketplaces, the expansion of international or cross-border e-commerce activities, and the integration of cloud-based platforms along with cutting-edge technologies such as AI, IoT, & blockchain.

The Asia Pacific will grow at a substantial pace. This surge is credited to the proactive measures taken by governments in countries like China and India to promote digitalization. These efforts have resulted in a significant increase in the number of internet users. According to the World Bank Group, approximately 34.5% of India's population had internet access in 2017, marking a notable increase of around 12.5% from 2016. This substantial internet penetration rate has created extensive opportunities for the growth of the e-commerce sector and, consequently, for market players to expand their business in the region.

Key Market Players & Competitive Insights

The market has experienced diverse inorganic growth strategies, including acquisitions, mergers, partnerships, and collaborations, adopted by companies in the recent past.

Some of the major players operating in the global market include:

- Adobe.

- BigCommerce Pty. Ltd.

- HCL Technologies Limited

- Intershop Communications AG

- Oracle

- Pitney Bowes Inc.

- Salesforce.com, Inc.

- SAP SE

- Shift4Shop

- Shopify

Recent Developments

- In June 2023, in collaboration with the Open Network for Digital Commerce (ONDC), Google initiated a partnership. As part of this collaboration, Google has introduced an accelerator program for ONDC, aiming to assist companies by providing a range of tools and resources to build and assess their e-commerce operations.

- In April 2023, Reliance Retail launched Tira, an omnichannel platform dedicated to beauty products. It offers users a convenient & personalized shopping experience, serving as a one-stop destination for a variety of international and domestic brands. This is facilitated through Reliance Retail's omnichannel retail strategy.

E-commerce Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 9.61 billion |

|

Revenue Forecast in 2032 |

USD 29.48 billion |

|

CAGR |

15.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Deployment, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

E-commerce Software Market report covering key segments are deployment, application, and region.

E-commerce Software Market Size Worth $ 29.48 Billion By 2032.

The global e-commerce software market and is expected to grow at a CAGR of 15.0% during the forecast period.

North America is leading the global market.

The key driving factors in E-commerce Software Market are Increased online shopping demand during lockdowns.