Digital Health for Obesity Market Size, Share, Trends, & Industry Analysis Report

By Component (Software, Hardware, and Services), By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5781

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

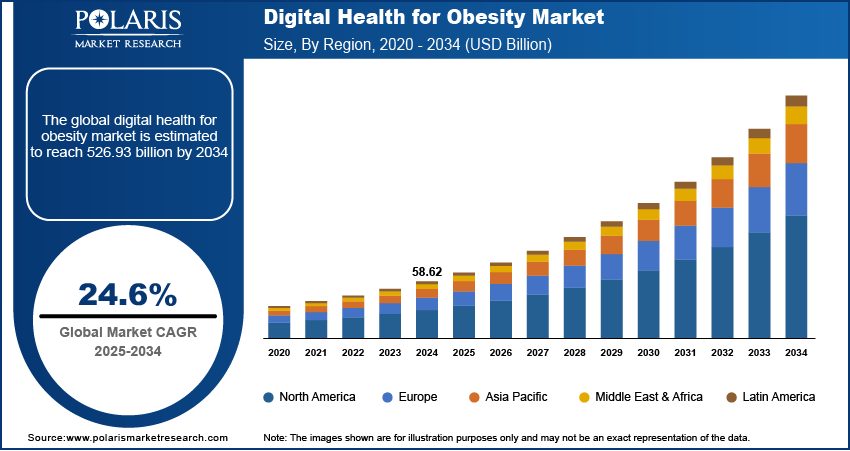

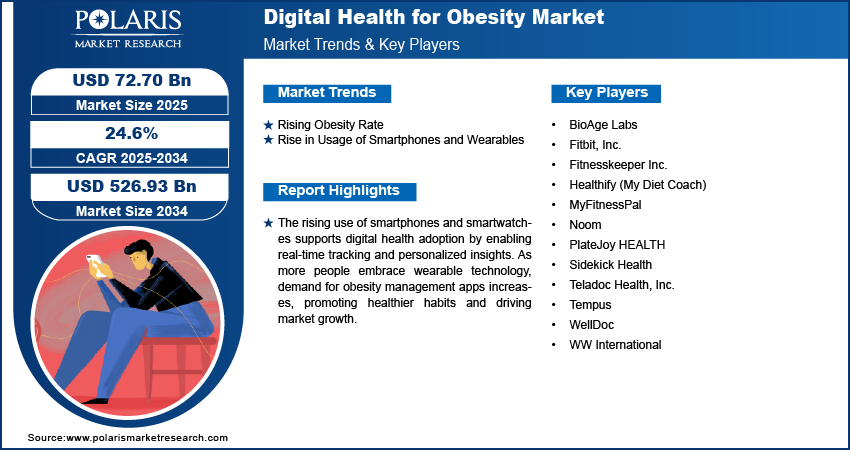

The global digital health for obesity market size was valued at USD 58.62 billion in 2024, growing at a CAGR of 24.6% during 2025–2034. The growth is driven by the rising obesity rate and the increasing usage of smartphones and wearables.

Digital health for obesity involves using technology such as mobile apps, wearable devices, and telehealth platforms to monitor, manage, and support weight loss and healthy lifestyle changes. It enables personalized, data-driven interventions that promote behavior modification, physical activity, and nutritional guidance.

Public awareness about the adverse effects of lifestyle-related diseases such as diabetes, heart disease, and obesity is increasing. People are becoming more conscious of the importance of diet, exercise, and mental well-being. This awareness is pushing individuals to adopt tools that help them prevent or manage obesity effectively. Digital health platforms offer educational resources, goal tracking, and virtual coaching, making it easier for users to take control of their health. More individuals are turning to digital solutions to make informed decisions as health literacy is improving globally, thereby driving the growth.

.

To Understand More About this Research: Request a Free Sample Report

Artificial Intelligence and advanced data analytics are transforming how obesity is managed digitally. These technologies allow apps and platforms to analyze user data and provide personalized recommendations based on individual habits, genetics, and health conditions. AI helps identify behavior patterns, predict health risks, and offer targeted advice, making weight loss programs more effective. Data-driven tools also enable healthcare providers to monitor progress remotely and adjust treatments as needed. These technologies are increasing the effectiveness and appeal of digital health solutions for obesity as these technologies become more sophisticated and widely available, thereby driving the industry growth.

Industry Dynamics

Rising Obesity Rate

The growing number of people who are overweight or obese across the world is a key factor driving the demand for digital health solutions. According to the Centers for Disease Control and Prevention, from August 2021 to August 2023, the prevalence of obesity in the US alone was 40.3%. Obesity has become a serious public health concern as modern lifestyles become more sedentary and diets shift toward processed foods. This rise in obesity increases the need for effective, accessible, and personalized health management tools. Digital platforms offer scalable solutions that reach more people, helping them monitor their weight, get expert advice, and make healthier choices. This growing health crisis is driving the demand for digital platforms to manage it, thereby driving the growth.

Increasing Usage of Smartphones and Wearables

The usage of smartphones and smartwatches is rising. According to Apple's Annual Report, smartphone sales rose from USD 191,973 million in 2021 to USD 205,489 million in 2022. Smartphones and wearables track daily steps, calories burned, heart rate, and even sleep patterns, giving users valuable information about their health. Many digital health apps for obesity management rely on these technologies to collect data and offer personalized recommendations. The demand for digital health solutions grows as more people adopt wearable fitness technology. This trend allows users to stay connected with their health goals in real time, encouraging healthier habits and improving outcomes in obesity management, thereby driving the growth.

Segmental Insights

By Component Analysis

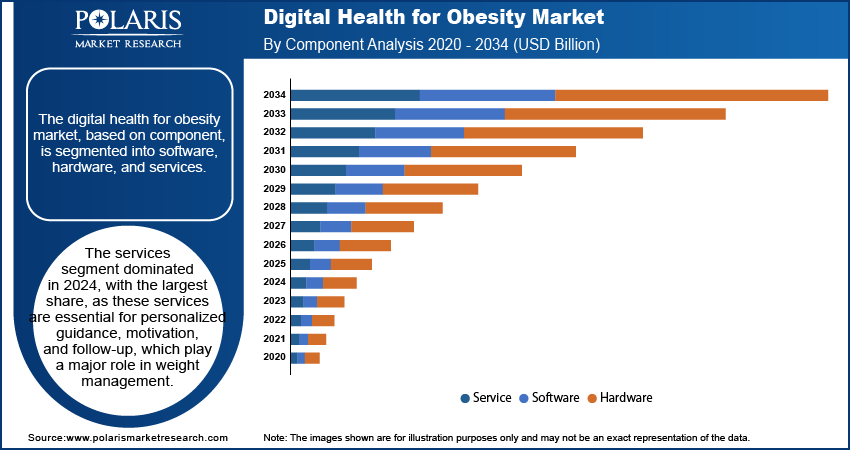

The segmentation, based on component, includes software, hardware, and services. In 2024, the services segment dominated with the largest share. This includes offerings such as teleconsultations, virtual coaching, and remote patient monitoring services provided by healthcare professionals. These services are essential for personalized guidance, motivation, and follow-up, which play a major role in weight management. Patients now easily connect with dietitians, fitness coaches, and doctors from their homes with the increasing availability of internet access and smartphones. The human support behind these services helps improve patient adherence to treatment plans. Their real-time interaction and support make services more trusted and widely adopted, thereby driving the segment growth.

The software segment is expected to record significant growth during the forecast period. People are relying more on apps for tracking meals, physical activity, and weight loss progress, as technology becomes more user-friendly and data-driven. AI-powered features that offer personalized feedback and goal setting are making these tools more effective and engaging. Many software solutions also integrate with wearable devices, creating a complete health ecosystem. The demand for advanced digital obesity software is expected to rise in the coming years, as consumers increasingly seek independence in managing their health, thereby driving segment growth.

By End Use Analysis

The segmentation, based on end use, includes patients, providers, payers, and others. The patient segment held the largest share in 2024 as more individuals are turning to digital tools to monitor their lifestyle and manage weight, with growing health awareness and access to smartphones. These platforms provide patients with self-help resources, meal plans, workout routines, and expert consultations. Many people prefer these private, easy-to-use tools over traditional clinical visits. Additionally, the patient segment's dominance is further driven by the increasing prevalence of obesity and the desire for more flexible, on-demand health solutions that fit modern, busy lifestyles, thereby driving the growth.

The provider segment is expected to record significant growth during the forecast period, as they increasingly adopt digital health tools for obesity in the near future. Providers are using digital platforms to monitor patient progress, deliver virtual consultations, and manage treatment plans more efficiently as the focus shifts toward preventive care and remote health management. These tools further help providers collect and analyze patient data to personalize care and improve outcomes. Providers are investing more in digital technologies with rising pressure to reduce healthcare costs and improve patient engagement, thereby driving the segment growth.

Regional Analysis

Digital Health for Obesity Market in North America

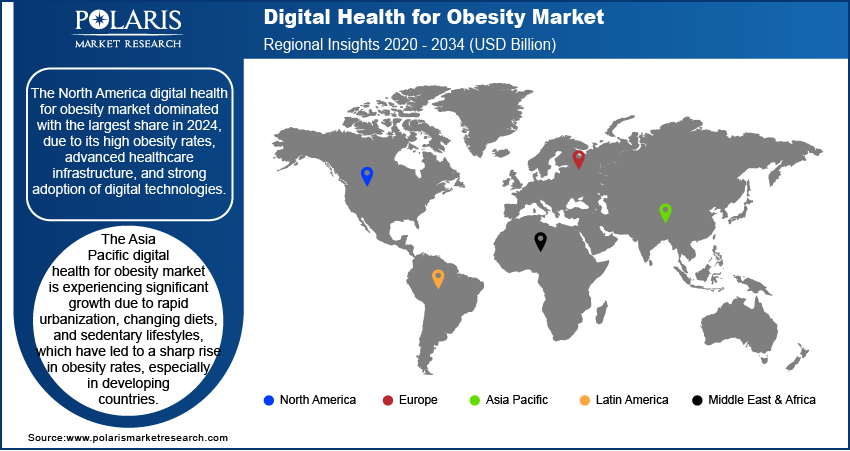

The North America digital health for obesity market dominated with the largest share in 2024, due to its high obesity rates, advanced healthcare infrastructure, and strong adoption of digital technologies. The region has a large number of tech-savvy users who actively use smartphones, fitness trackers, and health apps. Government support for digital health initiatives, along with high healthcare spending, further drives the demand. Furthermore, the presence of leading health tech companies and research institutions has fueled innovation in personalized obesity care, thereby driving the region's growth.

Digital Health for Obesity Market in US

The US digital health for obesity market is expected to witness significant growth during the forecast period. The country has one of the highest obesity rates globally, which has created strong demand for effective, accessible weight management tools. Consumers in the US are increasingly adopting mobile health apps, telemedicine, and wearable fitness technology to manage their health. Insurance companies and healthcare providers are integrating digital platforms into patient care. Additionally, government initiatives such as the Digital Health Innovation Action Plan are encouraging tech development in this space, thereby driving the market growth in the country.

Digital Health for Obesity Market in Asia Pacific

The Asia Pacific digital health for obesity market is projected to witness substantial growth in the coming years. Rapid urbanization, changing diets, and sedentary lifestyles, which have led to a sharp rise in obesity rates, especially in developing countries. Smartphone use and internet access are expanding rapidly, making digital health solutions more accessible. Countries in the region are increasingly investing in healthcare innovation and preventive care. Consumers are becoming more health-conscious and open to using technology for fitness and diet tracking, thereby driving the industry growth in the region.

Digital Health for Obesity Market in China

The China digital health for obesity market is expected to experience significant growth during the forecast period, due to its rising obesity rates and widespread use of mobile technology. The country has one of the world’s largest smartphone user bases, and many people are using fitness apps, online health platforms, and wearable devices to manage their weight. The Chinese government is further actively promoting digital health as part of its broader healthcare reforms. Companies in China are rapidly developing AI-based health apps and virtual fitness programs that cater to local needs. This combination of growing health demand and digital innovation is fueling the industry's growth in China.

Digital Health for Obesity Market in Europe

The Europe digital health for obesity market is expected to experience significant growth in the coming years, driven by rising health awareness, government support, and a strong public healthcare system. European countries are actively promoting preventive healthcare, with many launching national strategies to combat obesity. Digital tools, such as mobile health apps and virtual consultations, are becoming more common across the region. Regulations such as GDPR ensure data privacy, boosting user trust in digital platforms. Additionally, Europe's aging population is increasingly seeking convenient ways to manage health, including weight control, thereby driving the industry growth in the region.

Digital Health for Obesity Market in Germany

The Germany digital health for obesity market is expected to experience significant growth during the forecast period, as Germany is one of the leading European countries in adopting digital health technologies, including those targeting obesity. Digital health apps can be prescribed by doctors and reimbursed through health insurance with government initiatives such as the Digital Healthcare Act (DVG), making them more accessible to the public. Germans are increasingly turning to mobile apps, fitness wearables, and online coaching to manage weight and improve their health. The country’s strong healthcare infrastructure, combined with a focus on innovation and data security, is driving the growth in the country.

Key Players and Competitive Analysis Report

The digital health for obesity market is highly competitive, with key players offering personalized solutions through mobile apps, wearables, AI, and telehealth platforms. Companies such as WW International, Noom, and MyFitnessPal focus on behavior change and nutrition tracking. Fitbit, Sidekick Health, and Fitnesskeeper Inc. integrate activity monitoring with coaching. Teladoc Health and WellDoc offer remote care and chronic condition management. PlateJoy and Healthify provide customized meal planning, while BioAge Labs and Tempus apply data-driven insights for metabolic health. These players compete on user engagement, clinical effectiveness, and technology integration, driving innovation in the fight against obesity through scalable, digital-first approaches.

Key Players

- BioAge Labs

- Fitbit, Inc.

- Fitnesskeeper Inc.

- Healthify (My Diet Coach)

- MyFitnessPal

- Noom

- PlateJoy HEALTH

- Sidekick Health

- Teladoc Health, Inc.

- Tempus

- WellDoc

- WW International

Industry Developments

In April 2025, Ypsomed and Sidekick Health launched an integrated digital health solution, combining smart autoinjectors with Sidekick’s app to support obesity patients using GLP-1 therapies, improving adherence, education, and treatment outcomes through real-time data and personalized care.

In January 2024, Eli Lilly and Company launched LillyDirect, a digital healthcare platform offering US patients with obesity, diabetes, and migraine streamlined access to telehealth providers, disease management tools, and home delivery of select Lilly medications through third-party pharmacies.

Digital Health for Obesity Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Software

- Hardware

- Services

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Patients

- Providers

- Payers

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Digital Health for Obesity Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 58.62 Billion |

|

Market Size in 2025 |

USD 72.70 Billion |

|

Revenue Forecast by 2034 |

USD 526.93 Billion |

|

CAGR |

24.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 58.62 billion in 2024 and is projected to grow to USD 526.93 billion by 2034.

The global market is projected to register a CAGR of 24.6% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are WW International; MyFitnessPal; Teladoc Health, Inc.; Fitnesskeeper Inc.; Healthify (My Diet Coach); Fitbit, Inc.; Noom; PlateJoy HEALTH; Tempus; WellDoc; Sidekick Health; and BioAge Labs.

The service segment dominated the market share in 2024.

The provider segment is expected to witness the significant growth during the forecast period.