AI Sensor Market Size, Share, Trends, Industry Analysis Report

By Sensor Type (Motion Sensor, Pressure Sensor, Temperature Sensor, Optical Sensor, Others), By Application, By Type, By Technology, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 129

- Format: PDF

- Report ID: PM3236

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

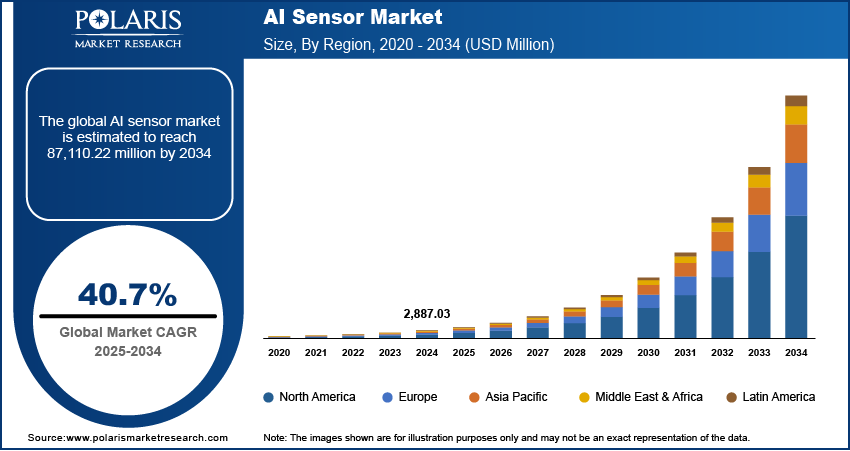

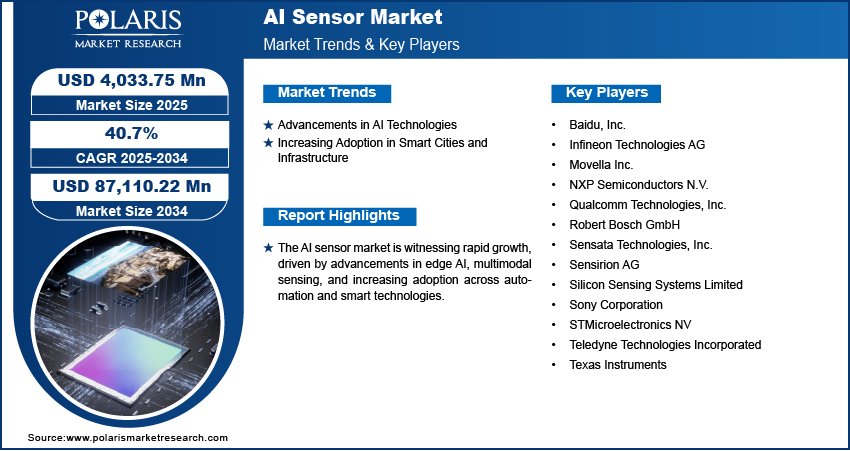

The global artificial intelligence (AI) sensor market was valued at USD 2,887.03 million in 2024 and is expected to register a CAGR of 40.7% from 2025 to 2034.Increasing requirement for efficiency, automation, and data-driven insights propels the demand for AI sensors across multiple sectors. As IoT adoption continues to increase, AI sensors will remain a crucial component in driving operational efficiency and innovation across industries.

Key Insights

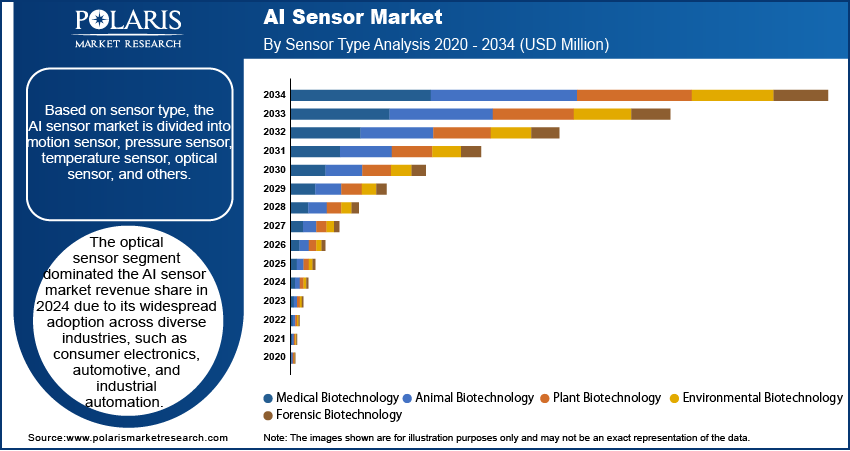

- The optical sensor segment dominated the revenue share in 2024. It is due to its widespread adoption across diverse industries, including consumer electronics and industrial automation.

- The robotics segment is expected to hold the largest share during the forecast period. The increasing adoption of AI-powered robots across industries contributes to this dominance.

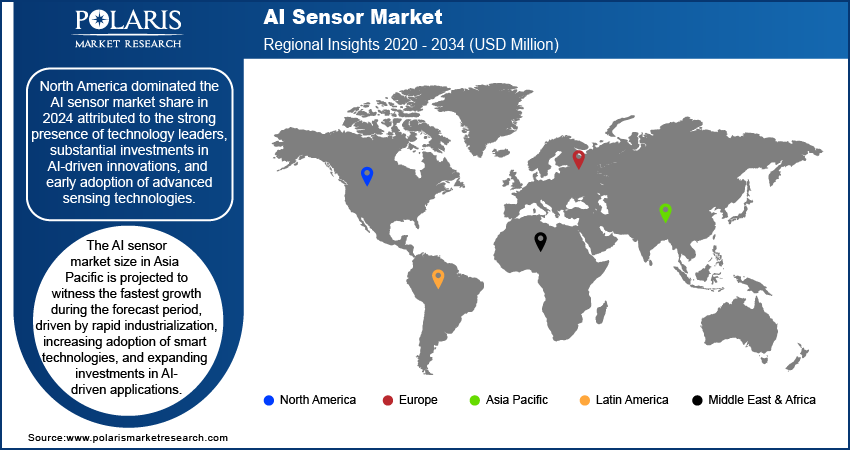

- North America dominated in 2024. It is due to the strong presence of technology leaders and substantial investments in AI-driven innovations.

- The AI sensor industry in Asia Pacific is projected to witness the fastest growth during the forecast period. Rapid industrialization, increasing adoption of smart technologies, and expanding investments in AI-driven applications boost the growth.

Industry Dynamics

- Rising advancements in AI technologies are contributing to the growing adoption of AI sensors.

- The increasing adoption of AI in the development of smart cities and infrastructure propels the industry expansion.

- The growing adoption of AI-integrated wearables is expected to offer opportunities during the forecast period.

- High installation and maintenance costs hinder the demand for AI sensors.

Market Statistics

2024 Market Size: USD 2,887.03 million

2034 Projected Market Size: USD 87,110.22 million

CAGR (2025–2034): 40.7%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Artificial intelligence (AI) sensors are intelligent sensing devices that integrate artificial intelligence to analyze data in real time and improve automation across various applications. The AI sensor market is experiencing growth, driven by the rising demand for smart devices. AI sensors play a critical role in allowing real-time decision-making, predictive analytics, and improved user experiences as consumers and industries increasingly adopt smart home systems, wearables, and autonomous systems. In June 2024, Elliptic Labs launched its AI virtual proximity sensor on honor’s magic V flip smartphone. The software-based sensor replaces hardware, allowing proximity detection for screen management during calls, reducing costs, and improving user experience while conserving battery life. These sensors facilitate advanced functionalities such as gesture recognition, voice assistance, and adaptive learning, making them indispensable in next-generation consumer electronics, healthcare, and industrial automation. The increasing need for efficiency, automation, and data-driven insights is propelling the AI sensors market demand across multiple sectors.

Another driver penetrating the AI sensor market application is the growth of the Internet of Things (IoT) ecosystem. AI-powered sensors are essential in processing vast amounts of data efficiently and allowing seamless communication between devices with the rapid proliferation of connected devices across industries. In February 2023, bitsensing launched TIMOS, a 24GHz radar sensor with edge AI for smart traffic management. It detects traffic statistics, violations, and incidents in real time, improving road safety and efficiency. Deployed in Korea and globally, it supports advanced smart city infrastructure. This innovation highlights how AI sensors improve IoT applications, allowing smarter, safer, and more efficient urban environments. Additionally, these sensors improve IoT applications by improving accuracy, reducing latency, and allowing intelligent decision-making at the edge. The growing deployment of smart infrastructure, industrial automation, and intelligent transportation systems further amplifies the demand for AI sensors, as they optimize performance and assure real-time data analysis. Therefore, as IoT adoption continues to rise, AI sensors will remain a crucial component in driving operational efficiency and innovation across industries.

Market Driver Dynamics

Advancements in AI Technologies

Advancements in AI technologies allow AI sensors to process complex data with higher accuracy, lower latency, and improved efficiency, making them essential for real-time decision-making in various applications. Improved AI algorithms allow sensors to recognize patterns, detect irregularity, and adapt to changing environments, increasing their effectiveness in industries such as healthcare, automotive, and manufacturing as continuous improvements in machine learning, deep learning, and edge AI improve sensor capabilities. In December 2024, Dexcom launched its GenAI platform, integrating Google Cloud’s Vertex AI and Gemini models into glucose biosensing, which improves Stelo’s Weekly Insights; it provides personalized health recommendations, marking a notable step in empowering users to manage metabolic health through AI-driven insights. The integration of AI with sensor technology also allows predictive maintenance, autonomous operations, and intelligent automation, further driving demand across multiple sectors. As AI capabilities continue to evolve, AI sensors will play a crucial role in allowing smarter, more responsive systems. Hence, rising advancements in AI technologies propel the AI sensor market development.

Increasing Adoption in Smart Cities and Infrastructure

Governments and organizations are investing in intelligent infrastructure solutions that rely on AI-powered sensors for real-time monitoring, traffic management, energy optimization, and security as urbanization accelerates. For instance, in September 2024, Huawei launched 10 intelligent solutions at its global manufacturing and large enterprise summit, focusing on AI, cloud, and digital transformation. The solutions aim to drive enterprise value growth, improve intelligent infrastructure, and foster global collaboration for high-quality development. AI sensors facilitate the efficient operation of smart grids, automated transportation systems, and environmental monitoring networks by collecting and analyzing vast amounts of data. The sensors improve the functionality of connected infrastructure by allowing predictive analytics, adaptive control systems, and seamless automation. Therefore, as smart city initiatives continue to expand globally, the demand for AI sensors is expected to grow during the forecast period, supporting the development of more sustainable, efficient, and technologically advanced urban environments.

Segment Insights

Market Assessment by Sensor Type Outlook

The global AI sensor market segmentation, based on sensor type, includes motion sensor, pressure sensor, temperature sensor, optical sensor, and others. The optical sensor segment dominated the AI sensor market share in 2024 due to its widespread adoption across diverse industries, such as consumer electronics, automotive, and industrial automation. Optical sensors, equipped with AI capabilities, allow high-precision imaging, object recognition, and advanced surveillance applications, making them essential for smart devices, autonomous vehicles, and security systems. Their ability to process visual data efficiently and improve real-time decision making has contributed to the AI sensor market growth opportunities. Additionally, the growing demand for AI-driven imaging solutions in healthcare, robotics, and smart infrastructure has further strengthened the adoption of optical sensors. Thus, as industries continue to integrate AI for enhanced vision-based applications, optical sensors are expected to maintain a strong market presence during the forecast period.

Market Evaluation by Application Outlook

The global AI sensor market segmentation, based on application, includes automotive, consumer electronics, manufacturing, robotics, and others. The robotics segment is expected to hold the largest market share during the forecast period, driven by the increasing adoption of AI-powered robots across industries. AI sensors are critical in robotics for allowing real-time object detection, motion tracking, and autonomous navigation, improving operational efficiency and precision. The integration of AI with robotic systems allows for improved adaptability, predictive maintenance, and human-robot collaboration in manufacturing, logistics, and healthcare. AI sensors play a pivotal role in enhancing robotic capabilities as industries invest in automation to optimize productivity and reduce operational costs. The demand for intelligent sensing solutions is expected to accelerate with advancements in AI-driven robotics, fueling AI sensor market growth.

Regional Analysis

By region, the report provides the AI sensor market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the AI sensor market revenue in 2024 attributed to the strong presence of technology leaders, substantial investments in AI-driven innovations, and early adoption of advanced sensing technologies. In October 2024, Microsoft and Rezolve AI collaborated to improve retail digital engagement using Rezolve’s AI-powered Brain Suite on Microsoft Azure. The collaboration aimed to transform customer experiences and operations, supported by Microsoft’s global co-sell channels and go-to-market strategies. The region's well-established industrial base, particularly in sectors such as automotive, healthcare, and smart infrastructure, has driven the demand for AI-powered sensors. Additionally, the increasing deployment of AI-enabled smart devices, automation solutions, and intelligent security systems has propelled market growth. Government initiatives supporting AI research and development, along with a robust technological ecosystem, have contributed to North America's leadership in AI sensor adoption. In May 2023, the US National Science Foundation allocated USD 140 million to establish seven National AI Research Institutes with an aim to advance responsible AI innovation, strengthen R&D infrastructure, and promote a diverse AI workforce to support national AI leadership and development.

The AI sensor market size in Asia Pacific is projected to witness the fastest growth during the forecast period, driven by rapid industrialization, increasing adoption of smart technologies, and expanding investments in AI-driven applications. Countries in the region are actively deploying AI sensors in smart manufacturing, autonomous transportation, and urban infrastructure projects. In November 2024, NTT DATA showcased AI innovations at Microsoft Ignite, highlighting AI-driven business transformation. They launched tsuzumi, a bilingual AI model on Azure, and introduced GenAI TechHub for rapid AI solution deployment, accelerating legacy app modernization and improving enterprise efficiency with Microsoft technologies. The growing consumer electronics sector, along with advancements in robotics and automation, has further boosted the demand for AI-powered sensing solutions. Additionally, government initiatives promoting AI adoption and digital transformation have accelerated the AI sensor market growth. Asia Pacific is expected to emerge as a key growth hub for AI sensors in the coming years, with rising demand for AI-driven innovations and expanding industrial applications.

Key Players & Competitive Analysis Report

The competitive landscape of the AI sensor market reveals global leaders and regional players aiming for dominance through innovation and strategic alliances. Industry leaders such as Bosch, Siemens, and Intel leverage strong R&D capabilities, technological advancements, and extensive distribution networks to deliver refined AI-embedded sensors that address emerging technologies and sustainable value chains. Current AI sensor market trends highlight increasing demand driven by economic growth, geopolitical shifts, and macroeconomic trends, particularly in autonomous vehicles, smart manufacturing, and healthcare. Companies prioritize strategic investments, mergers and acquisitions, and joint ventures to strengthen their competitive positioning. Post-merger integration and regional growth strategies remain critical for developing global footprints. Regional players successfully address localized needs by offering cost-effective AI sensor solutions tailored to specific economic landscapes. Competitive benchmarking includes revenue opportunity assessments, expansion opportunities, and partner ecosystems to meet the demand for innovative AI sensing products. Disruptive technologies such as edge AI and neuromorphic computing are reshaping industry ecosystems, with companies investing in supply chain management, procurement strategies, and sustainability transformation. Pricing insights and revenue growth analysis remain essential for identifying untapped opportunities in smart cities and industrial IoT. The future development strategies focus on technological innovation, business transformation, and regional investments. Major players emphasize strategic developments and internationalization behavior to navigate economic and geopolitical shifts, ensuring sustained growth in today's hypercompetitive global AI sensor market ecosystem. A few key major players are Baidu, Inc.; Infineon Technologies AG; Movella Inc.; NXP Semiconductors N.V.; Qualcomm Technologies, Inc.; Robert Bosch GmbH; Sensata Technologies, Inc.; Sensirion AG; Silicon Sensing Systems Limited; Sony Corporation; STMicroelectronics NV; Teledyne Technologies Incorporated; and Texas Instruments.

Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated, is a developer of innovative digital wireless communications products and services. The company is headquartered in San Diego, California, and plays a crucial role in advancing wireless technology, such as 5G, 4G, and other mobile communications standards. The company's business model is centered around designing and developing integrated circuits and system software for mobile devices and other wireless products, with applications in various sectors such as smartphones, laptops, automotive, and smart homes. In the domain of Artificial Intelligence (AI), Qualcomm is actively involved in developing AI technologies to improve device capabilities. The company's AI Engine includes dedicated hardware that enables high-performance, low-power AI processing on devices. This technology supports complex AI use cases, making AI more ubiquitous across various devices. Additionally, Qualcomm's focus on AI sensors and related technologies aims to improve perception, reasoning, and action capabilities in devices, contributing to the evolution of intelligent computing everywhere. Its commitment to research and development has led to substantial investments in AI and other advanced technologies. The company has expanded its presence globally, with a strong focus on innovation and collaboration with other tech companies to drive growth in the wireless ecosystem. Qualcomm continues to shape the future of wireless communications and AI-driven devices as a leader in the semiconductor industry.

Teledyne Technologies Incorporated is an American industrial company founded in 1960. The company has evolved over the years, transforming into a provider of enabling technologies for industrial growth markets that require advanced technology and high reliability. Teledyne operates across four major segments: Digital Imaging, Instrumentation, Engineered Systems, and Aerospace and Defense Electronics. Its products, such as digital imaging sensors, cameras, and systems within the visible, infrared, and X-ray spectra, can be integrated with AI for improved sensing capabilities. These AI-enabled sensors can be used in various applications such as aerospace, defense, and environmental monitoring, allowing for more precise data collection and analysis. Teledyne's AI sensor capabilities are particularly relevant in its digital imaging segment, where advanced sensors can be combined with AI algorithms to improve image processing and analysis. This integration enhances the company's offerings in areas such as medical imaging, pharmaceutical research, and deepwater oil and gas exploration. Teledyne aims to strengthen its position in high-barrier markets characterized by specialized products and services by leveraging AI in sensor technology. The company's strategic focus on operational excellence and targeted acquisitions further supports its growth in core markets, assuring continued innovation and expansion of its product portfolio. In the UK, Canada, and Western and Northern Europe, Teledyne Technologies is well-positioned to serve global markets with its advanced technologies with operations primarily in the US.

List of Key Companies

- Baidu, Inc.

- Infineon Technologies AG

- Movella Inc.

- NXP Semiconductors N.V.

- Qualcomm Technologies, Inc.

- Robert Bosch GmbH

- Sensata Technologies, Inc.

- Sensirion AG

- Silicon Sensing Systems Limited

- Sony Corporation

- STMicroelectronics NV

- Teledyne Technologies Incorporated

- Texas Instruments

AI Sensor Industry Developments

January 2025: Elliptic Labs launched its AI Virtual Tap Sensor and AI Virtual Human Presence Sensor on Lenovo’s ThinkPad Aura Edition laptops. These sensors allow seamless photo sharing and human presence detection, enhancing user experience and energy efficiency.

January 2025, Bosch Sensortec launched AI-enabled sensors combining MEMS, microcontrollers, and software for health, smart homes, and cities. Featuring edge AI, they ensure privacy, low latency, and energy efficiency, allowing real-time feedback, air quality monitoring, and gesture control.

AI Sensor Market Segmentation

By Sensor Type Outlook (Revenue, USD Million, 2020–2034)

- Motion Sensor

- Pressure Sensor

- Temperature Sensor

- Optical Sensor

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Automotive

- Consumer Electronics

- Manufacturing

- Robotics

- Others

By Type Outlook (Revenue, USD Million, 2020–2034)

- Case-Based Reasoning

- Ambient-Intelligence

- Neural Networks

- Inductive Learning

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Machine Learning

- Natural Language Processing

- Context-Aware Computing

- Computer Vision

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

AI Sensor Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,887.03 million |

|

Market Size Value in 2025 |

USD 4,033.75 million |

|

Revenue Forecast in 2034 |

USD 87,110.22 million |

|

CAGR |

40.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global AI sensor market size was valued at USD 2,887.03 million in 2024 and is projected to grow to USD 87,110.22 million by 2034.

The global market is projected to register a CAGR of 40.7% during the forecast period.

North America dominated the market revenue share in 2024.

A few of the key players in the market are Baidu, Inc.; Infineon Technologies AG; Movella Inc.; NXP Semiconductors N.V.; Qualcomm Technologies, Inc.; Robert Bosch GmbH; Sensata Technologies, Inc.; Sensirion AG; Silicon Sensing Systems Limited; Sony Corporation; STMicroelectronics NV; Teledyne Technologies Incorporated; and Texas Instruments.

The optical sensor segment dominated the market share in 2024.

The robotics segment is expected to witness the fastest growth during the forecast period.