AI Vision Market Size, Share, & Industry Analysis Report

By Technology (Machine Learning and Generative AI), By Service Type, By Component, By Vertical, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5776

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

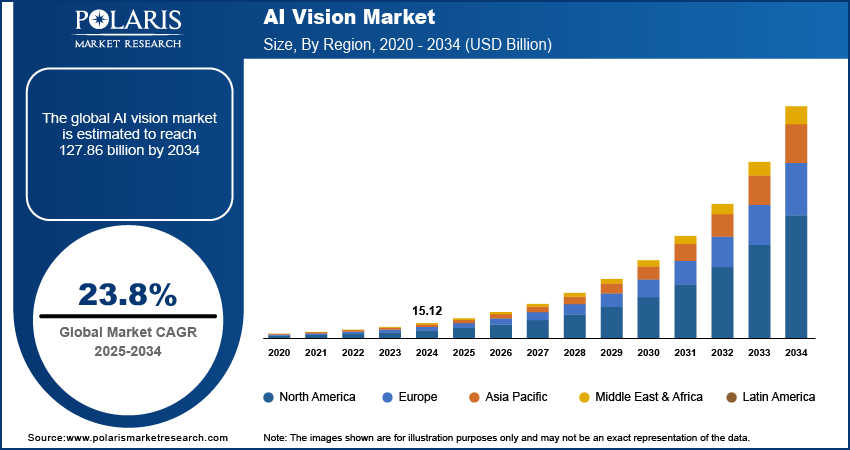

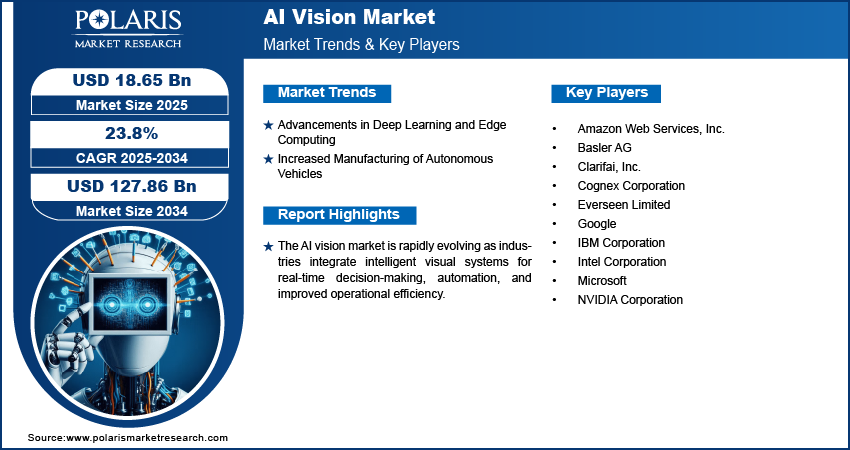

The global artificial intelligence vision market size was valued at USD 15.12 billion in 2024, growing at a CAGR of 23.8% during 2025–2034. The growth is driven by the increasing demand for computer vision solutions.

Artificial intelligence (AI) vision refers to the integration of AI technologies with computer vision systems to allow machines to analyze and understand visual data like human vision. The rising adoption of machine vision & vision-guided robotics is fueling growth opportunities. Industries such as manufacturing, logistics, and automotive are increasingly deploying robotic systems equipped with AI-powered vision capabilities for tasks such as object detection, quality inspection, and precision assembly. According to a September 2024 report by the International Federation of Robotics (IFR), the latest World Robotics data revealed 42,81,585 industrial robotics in operations across global factories, with a 10% year-over-year increase. These systems improve operational efficiency by allowing real-time decision-making and reducing dependence on manual interventions. The integration of AI allows robots to adapt to dynamic environments and perform complex tasks with greater accuracy, thereby addressing the growing demand for flexible and intelligent automation solutions.

The increasing need for automation across various sectors boosts the expansion opportunities in the AI sector. According to a 2024 report by Our World in Data, global corporate investments in AI reached USD 217.97 billion annually, reflecting the growing focus on AI development across industries. Organizations are focusing on streamlining workflows and minimizing human error through the deployment of AI vision systems in areas such as retail analytics, smart surveillance, and autonomous vehicles. These systems can analyze large volumes of visual data in real-time, extracting actionable insights that support critical business decisions. The demand for intelligent automation powered by AI vision technologies continues to rise as industries aim to improve productivity and operational safety. This broader focus on automation is creating substantial opportunities for the adoption and advancement of AI vision solutions across a wide range of applications.

Industry Dynamics

Advancements in Deep Learning and Edge Computing

Advancements in deep learning and edge computing are accelerating the market development. Deep learning algorithms improve the ability of vision systems to identify, classify, and interpret complex visual inputs with high precision, even in unstructured or unpredictable environments. Integrated with edge computing, which helps data processing directly at the source of capture. AI vision systems operate with reduced latency and increased responsiveness. In February 2024, Intel launched its Edge Platform, a modular open software solution designed to streamline the development, deployment, and management of edge and AI applications. The platform simplifies scaling while reducing operational costs for enterprises, reflecting advancements in deep learning and edge computing. This combination improves performance in time-sensitive applications such as industrial automation and smart surveillance, and it also minimizes dependency on cloud infrastructure, further improving data security and reducing bandwidth usage. The integration of deep learning with edge computing is thus enabling scalable and real-time AI vision deployments across various industries.

Increased Manufacturing of Autonomous Vehicles

The increased manufacturing of autonomous vehicles contributes to the expansion of the artificial intelligence (AI) vision market. Autonomous vehicles rely heavily on vision systems powered by AI to perceive their surroundings, detect obstacles, recognize traffic signs, and make navigation decisions. The need for advanced AI vision technologies becomes necessary to assure safety, efficiency, and seamless human-machine interaction as automakers boost efforts to bring higher levels of vehicle autonomy to the sector. In May 2024, Wayve, an AI for autonomous driving company, received USD 1.05 billion in Series C funding led by SoftBank, with NVIDIA and Microsoft. The investment will advance its AI technology for autonomous vehicles, improving real-world interaction and safety through machine learning. These systems function reliably under diverse and challenging environmental conditions, which drives continuous innovation and investments in AI vision capabilities. As a result, the rapid development and deployment of autonomous vehicle technologies are creating an increasing demand for AI-powered vision systems.

Segmental Insights

By Technology Analysis

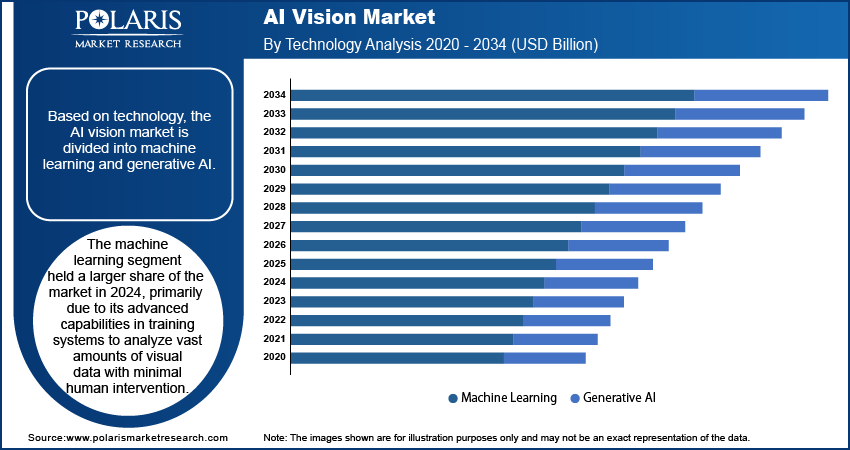

The segmentation, based on technology, includes machine learning and generative AI. The machine learning segment held the largest share of the market in 2024, primarily due to its advanced capabilities in training systems to analyze vast amounts of visual data with minimal human intervention. Machine learning models improve the accuracy and reliability of image and video analysis by allowing continuous learning and adaptability. These models are widely adopted in industrial automation, healthcare diagnostics, and security systems where high-speed and high-volume processing is critical. Furthermore, their integration with existing vision systems allows for scalable deployment across various sectors, driving their widespread acceptance.

By Service Type Analysis

The segmentation, based on service type, includes behavioral analysis, optical character recognition, spatial analysis, and image recognition. The behavioral analysis segment is expected to witness the fastest growth during the forecast period driven by the increasing demand for intelligent systems that can interpret human behavior through facial expressions, gestures, and movement patterns. This service type is gaining traction across sectors such as retail, smart cities, and surveillance, where understanding consumer or public behavior leads to improved service delivery, security, and operational efficiency. The growing adoption of AI-powered behavioral analytics in fraud detection, employee monitoring, and public safety applications further accelerates its market penetration.

By Component Analysis

The segmentation, based on component, includes hardware, software, and services. The services segment is expected to register the highest CAGR during the forecast period, fueled by rising demand for consulting, integration, and maintenance services essential for the deployment and optimization of AI vision systems. The need for expert support in customizing and scaling these systems becomes critical as organizations implement AI vision solutions across diverse applications. Service providers play a major role in assuring smooth transitions, upgrading legacy infrastructure, and allowing real-time analytics capabilities, making this segment essential to the sector’s growth.

By Vertical Analysis

The segmentation, based on vertical, includes government, banking and finance, consumer electronics, healthcare, transport/logistics, defense & security, and others. The banking and finance segment is expected to witness the fastest growth during the forecast period as financial institutions increasingly integrate AI vision technologies for improved security, customer experience, and operational efficiency. AI vision is being employed for facial recognition-based authentication, ATM surveillance, and fraud detection through behavioral pattern analysis. There is an increasing need for intelligent visual systems that support automated and secure financial operations, with the sector’s growing focus on digital transformation and cybersecurity.

Regional Analysis

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America AI vision market dominated the revenue share in 2024, supported by strong technological infrastructure, significant investments in R&D, and high adoption of AI-powered systems across industries. For instance, a 2024 Bipartisan Policy Center report found AI adoption rates in the US were highest among large firms (7.2% for 250+ employees) and micro-enterprises (5.5% for 1–4 employees). The region remains a frontrunner in deploying AI vision across various sectors such as manufacturing, healthcare, and autonomous vehicles, while it is also witnessing an increased interest in smart surveillance and robotics. The presence of major AI solution providers and early adopters contributes significantly to the region’s leadership position.

The US AI vision market is expected to grow significantly in North America during the forecast period, driven by rising focus on AI innovation and the widespread integration of computer vision across numerous industries such as healthcare, defense, and autonomous mobility. The growing demand for real-time surveillance, patient monitoring, and automated quality control in manufacturing is encouraging the broader adoption of AI vision systems.

The Asia Pacific AI vision market is projected to witness the fastest growth during the forecast period, driven by rapid industrialization, rising adoption of automation technologies, and increasing investments in smart manufacturing and urban infrastructure. Government-led digital transformation initiatives are accelerating AI vision deployment across the region. As per a March 2025 report by India's Ministry of Electronics & IT, India plans to build a major AI computing infrastructure with 18,693 GPUs with the ~USD 1.2 billion IndiaAI Mission, boosting the nation's digital economy, with countries leading in smart surveillance and robotics, focusing on factory automation, and India expanding AI applications in healthcare and retail.

The China AI vision market is experiencing growth due to its aggressive investments in public surveillance systems and industrial automation. The integration of AI vision into large-scale infrastructure and urban monitoring projects is creating vast opportunities for domestic technology providers. Additionally, China’s expanding manufacturing base is increasingly utilizing AI-powered vision systems for defect detection and predictive maintenance.

The Europe AI vision market is projected to witness substantial growth during the forecast period, driven by strong regulatory frameworks supporting AI adoption and increasing demand for smart technologies across automotive, logistics, and public safety sectors. Germany is advancing in AI-driven automotive systems, whereas France is investing in AI research. The region’s focus on ethical AI deployment and digital infrastructure modernization is boosting a favorable environment for AI vision technology growth.

The UK AI vision market is expected to grow during the forecast period as the country continues to prioritize AI-driven innovation across the healthcare, finance, and transportation sectors. The UK is creating an ecosystem to adopt technological advancements, with strong academic and research institutions contributing to advancements in visual AI algorithms. Applications such as AI-powered diagnostic imaging, smart traffic monitoring, and biometric security systems are witnessing increased deployment.

Key Players and Competitive Analysis

The AI vision industry is experiencing substantial growth, fueled by advancements in deep learning and edge computing that improve real-time data processing and accuracy. Major players such as NVIDIA and Intel and emerging startups such as Wayve are making strategic investments, highlighting the sector's revenue potential in areas such as autonomous vehicles, industrial automation, and smart surveillance. Industry trends show a move toward decentralized AI systems, which reduce reliance on cloud infrastructure while improving data security. Growth forecasts indicate strong demand across both mature economies as well as emerging markets, where government initiatives are actively boosting AI infrastructure.

Competition is boosting, with companies focusing on sustainable value chains and partnerships to scale their solutions effectively. However, challenges such as semiconductor supply chain disruptions are encouraging firms to explore new strategies, including localized GPU production. Businesses that leverage these trends while addressing technical and logistical limitations are positioned for long-term success as the industry evolves.

A few key players are Amazon Web Services, Inc.; Basler AG; Clarifai, Inc.; Cognex Corporation; Everseen Limited; Google; IBM Corporation; Intel Corporation; Microsoft; and NVIDIA Corporation.

Key Players

- Amazon Web Services, Inc.

- Basler AG

- Clarifai, Inc.

- Cognex Corporation

- Everseen Limited

- IBM Corporation

- Intel Corporation

- Microsoft

- NVIDIA Corporation

Industry Developments

June 2025: AI-powered inventory automation firm LuminX received USD 5.5 million in seed funding. The investment will support the advancement of its logistics and warehousing solutions, enhancing operational efficiency through improved inventory visibility and automation.

June 2025: Made4net (cloud WMS provider) and Flymingo (Vision AI logistics platform) formed a strategic partnership. Their integrated solution combines real-time warehouse data with AI-driven insights to enhance operational accuracy, SOP compliance, and visibility for supply chain managers.

March 2025: Samsung Electronics launched its upgraded "AI Home" ecosystem at a Seoul launch event. The showcase highlighted smarter appliances with enhanced AI capabilities and interactive displays, aiming to deliver more intuitive and secure smart home experiences.

AI Vision Market Segmentation

By Service Type Outlook (Revenue, USD Billion, 2020–2034)

- Behavioral Analysis

- Optical Character Recognition

- Spatial Analysis

- Image Recognition

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Machine Learning

- Generative AI

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Vertical Outlook (Revenue, USD Billion, 2020–2034)

- Government

- Banking and Finance

- Consumer Electronics

- Healthcare

- Transport/Logistics

- Defense & Security

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

AI Vision Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 15.12 billion |

|

Market Size in 2025 |

USD 18.65 billion |

|

Revenue Forecast by 2034 |

USD 127.86 billion |

|

CAGR |

23.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 15.12 billion in 2024 and is projected to grow to USD 127.86 billion by 2034.

The global market is projected to register a CAGR of 23.8% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Amazon Web Services, Inc.; Basler AG; Clarifai, Inc.; Cognex Corporation; Everseen Limited; Google; IBM Corporation; Intel Corporation; Microsoft; and NVIDIA Corporation.

The machine learning segment dominated the market in 2024.

The behavioral analysis segment is expected to witness the fastest growth during the forecast period.