Airborne Pods Market Size, Share, Trends, Industry Analysis Report

: By Aircraft Type (Combat Aircraft, Helicopters, UAVs, and Others), Pod Type, Material Type, Sensor Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 128

- Format: PDF

- Report ID: PM1662

- Base Year: 2024

- Historical Data: 2020-2023

Airborne Pods Market Overview

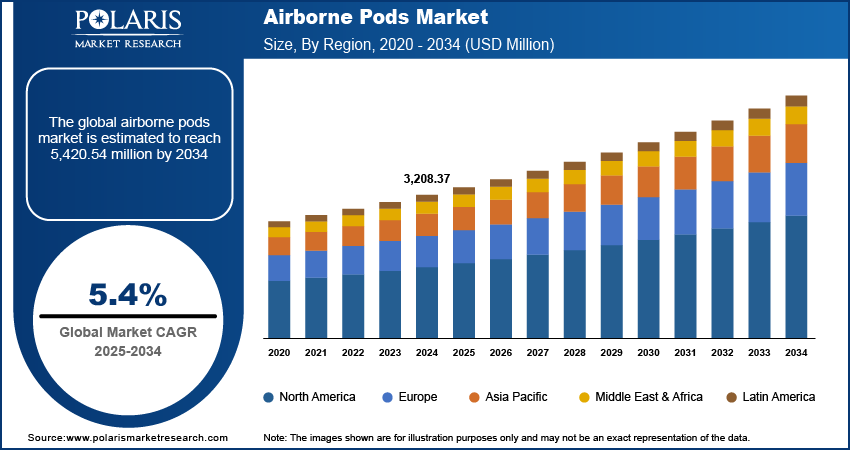

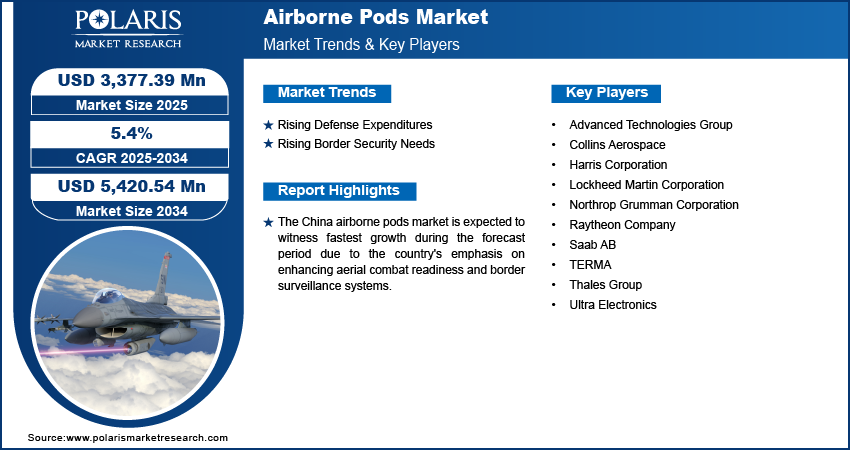

The airborne pods market size was valued at USD 3,208.37 million in 2024. The market is projected to grow from USD 3,377.39 million in 2025 to USD 5,420.54 million by 2034, exhibiting a CAGR of 5.4% during 2025–2034.

The airborne pods market focuses on the development, manufacturing, and deployment of modular airborne systems. These pods are commonly used in sectors such as defense, aerospace, and commercial aviation for various purposes such as surveillance, reconnaissance, electronic warfare, cargo transport, or environmental monitoring. The market is driven by technological advancements in aerial platforms, increasing demand for modular and customizable solutions, and the growing use of drones and aircraft for military and civilian applications. Furthermore, the rising use of drones and commercial unmanned aerial vehicles (UAVs) for military and environmental purposes is boosting demand for specialized pods, which is further contributing to the airborne pods market demand. The expansion of use cases in disaster response, environmental monitoring, and cargo delivery is significantly fueling the market growth. Moreover, emerging applications such as in-flight connectivity and aerial surveying in civil aviation are opening new avenues for the airborne pods market expansion.

To Understand More About this Research: Request a Free Sample Report

Airborne Pods Market Trends Analysis

Rising Defense Expenditures

Rising global defense budgets are driving increased demand for advanced airborne systems specifically designed for intelligence, surveillance, and reconnaissance (ISR) missions. In November 2024, the US Department of Defense reported that the defense budget increased from USD 700 billion to USD 850 billion over the past three years, reflecting a 21.4% rise in fiscal allocation. Military forces are prioritizing enhanced situational awareness and strategic capabilities, leading to greater reliance on airborne pods equipped with sophisticated sensors, cameras, and communication technologies. These systems provide real-time intelligence, enable better surveillance of adversary movements, and support more informed decision-making on the battlefield. Thus, the rising defense expenditures boost the airborne pods market demand.

Rising Border Security Needs

Rising geopolitical tensions and the increasing need for enhanced border surveillance are driving significant investments in airborne ISR and communication pods. Since countries focus on strengthening their security infrastructures, airborne pods equipped with advanced sensors and communication systems are becoming crucial for monitoring borders, detecting potential threats, and ensuring real-time intelligence dissemination. These investments are particularly important for addressing emerging threats and securing critical national assets, with airborne pods offering a flexible, cost-effective solution for continuous surveillance in volatile regions. Therefore, the growing emphasis on national security and border integrity is accelerating the adoption of airborne pods.

Airborne Pods Market Segment Insights

Airborne Pods Market Assessment by Aircraft Type Outlook

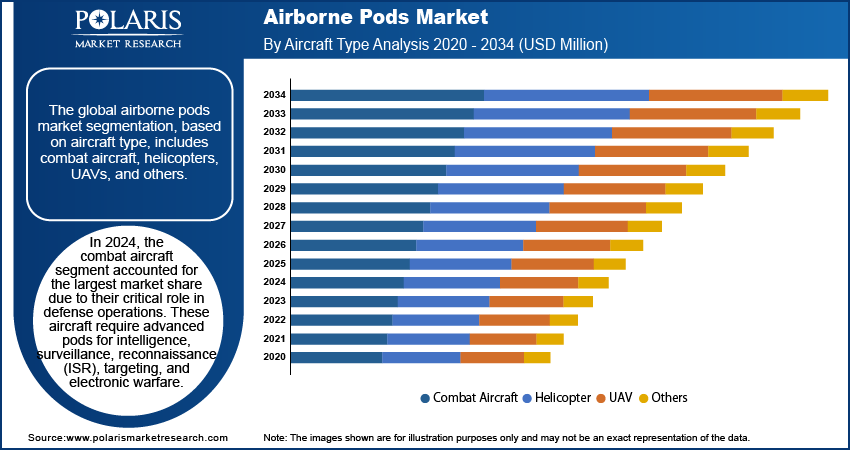

The global airborne pods market segmentation, based on aircraft type, includes combat aircraft, helicopters, UAVs, and others. In 2024, the combat aircraft accounted for the largest market share due to their critical role in defense operations, requiring advanced pods for intelligence, surveillance, reconnaissance (ISR), targeting, and electronic warfare. Their high deployment rate, coupled with continuous modernization efforts and increasing demand for versatile mission capabilities, has significantly driven this segment's dominance.

Airborne Pods Market Evaluation by Pod Type Outlook

The global airborne pods market segmentation, based on pod type, includes ISR, targeting, countermeasure, and others. The ISR segment is projected to experience the highest growth rate during the forecast period due to the escalating need for real-time intelligence gathering, border surveillance, and enhanced situational awareness across defense and security operations. Geopolitical tensions and the evolving nature of modern warfare have heightened the demand for ISR systems capable of providing accurate and timely data to support strategic decision-making. Additionally, advancements in sensor technologies such as high-resolution cameras, radar systems, and signal interception tools have enhanced the capabilities of ISR pods, making them indispensable in manned and unmanned aerial platforms. The growing adoption of UAVs for intelligence and reconnaissance missions further drives this segment, as these systems offer cost-effective, flexible, and efficient solutions for long-duration surveillance in high-risk or remote areas.

Airborne Pods Market Regional Analysis

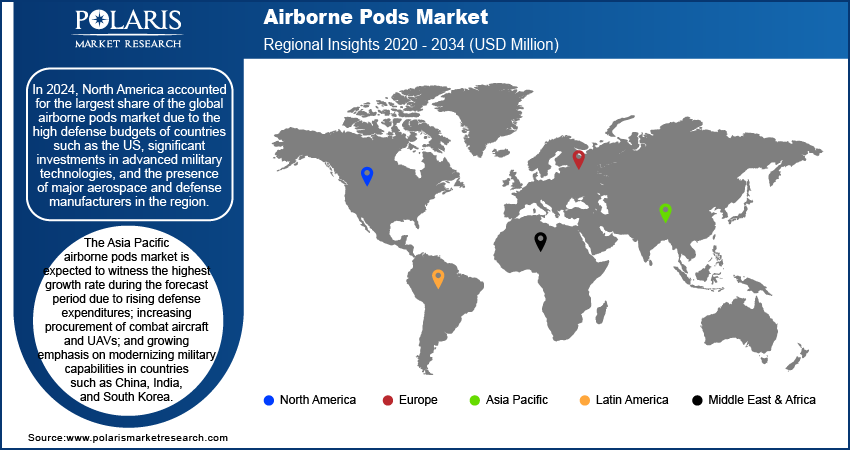

By region, the study provides airborne pods market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest airborne pods market share due to the high defense budgets of countries such as the US, significant investments in advanced military technologies, and the presence of major aerospace and defense manufacturers in the region. The region's focus on enhancing ISR capabilities, upgrading existing military aircraft with advanced pods, and deploying UAVs for surveillance and reconnaissance further contributed to its market dominance. In September 2024, Honeywell acquired CAES Systems Holdings LLC from Advent International for a USD 1.9 billion, all-cash deal. This acquisition supports Honeywell’s defense technology offerings across multiple sectors, including land, sea, air, and space, and is expected to drive growth within Honeywell's Aerospace Technologies division. Additionally, ongoing modernization programs and strong demand for airborne systems to address national security challenges have driven the regional airborne pods market expansion.

The US holds the largest share of the North America airborne pods market revenue due to the country's substantial defense budget, continuous investments in advanced military technologies, and the presence of leading aerospace and defense manufacturers.

The Asia Pacific airborne pods market is expected to witness the fastest growth during the forecast period due to rising defense expenditures; increasing procurement of combat aircraft and UAVs; and growing emphasis on modernizing military capabilities in countries such as China, India, and South Korea. In October 2024, India secured a USD 4 billion deal with the US for 31 MQ-9B Reaper drones from General Atomics. The region's heightened focus on border security, coupled with ongoing geopolitical tensions and territorial disputes, is driving demand for advanced ISR systems and electronic warfare pods. Additionally, domestic production and technological advancements in the aerospace and defense sectors are further fueling the market expansion.

The China airborne pods market is expected to witness the fastest growth during the forecast period. The country’s emphasis on enhancing aerial combat readiness and border surveillance systems, driven by regional security concerns and geopolitical ambitions, is fueling the demand for airborne pods. Additionally, China's advancements in UAV technology and its growing domestic aerospace manufacturing capabilities further contribute to this rapid market growth.

Airborne Pods Market – Key Players and Competitive Analysis

The competitive landscape of the airborne pods market is characterized by the presence of several leading global and regional players specializing in aerospace and defense systems. Key market participants focus on product innovation, technological advancements, and strategic partnerships to strengthen their market position. Major companies invest heavily in R&D to develop next-generation pods with enhanced capabilities for ISR, targeting, and electronic warfare applications. Collaborations with government agencies and defense forces are common, enabling tailored solutions for specific mission requirements. Additionally, the market sees increased competition in emerging regions as local manufacturers enter the space, driven by government initiatives to boost domestic defense industries. The competitive dynamics are influenced by factors such as cost-efficiency, scalability of solutions, and the ability to integrate systems with modern aerial platforms such as UAVs and next-gen combat aircraft. A few key major players are Advanced Technologies Group, Collins Aerospace, Harris Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Company, Saab AB, TERMA, Thales Group, and Ultra Electronics.

Thales Group is a solution provider of electronic systems, smart technologies, software, space, ground transportation, services, and equipment to the aerospace, defense, and security industries. The company supplies telecommunications satellites, avionics equipment, signaling systems, flight deck systems, navigation solutions, as well as air traffic management and maintenance services. It also provides air traffic management systems, avionics equipment, navigation solutions, flight avionics, electrical systems, and training solutions for the aerospace industry. Thales Group offers advanced airborne pods like TALIOS, a 2-in-1 targeting and reconnaissance system integrating AI for enhanced mission capabilities.

Lockheed Martin Corporation is a security and aerospace company formed by combining the businesses of Martin Marietta Corporation and Lockheed Corporation. The company engaged in diverse industry sectors, including research, development, design, integration, and manufacture of advanced technology products, systems, and services. It provides a wide range of technical, scientific, engineering, management, information, and logistic services. Lockheed Martin serves the US and international markets with applications in civil, defense, and commercial industries. The multinational company has a strong presence across North America, Asia, Europe, and Australia. It offers counter-drone solutions such as counter-drone swarms, Area Defense Anti-Munitions (ADAM) systems, and Lcarus. Lockheed Martin offers advanced airborne pods such as the Sniper Advanced Targeting Pod (ATP), which provides precision targeting and intelligence, surveillance, and reconnaissance capabilities for air-to-air and air-to-ground missions.

List of Key Companies in Airborne Pods Market

- Advanced Technologies Group

- Collins Aerospace

- Harris Corporation

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Company

- Saab AB

- TERMA

- Thales Group

- Ultra Electronics

Airborne Pods Industry Developments

In October 2024, Northrop Grumman’s LITENING targeting pod conducted initial flight tests on the US Navy’s F/A-18 E/F Super Hornet, a key step toward fleet integration. The pod, equipped with advanced daylight and infrared sensors, provides high-definition video in multiple wavelengths, enhancing surveillance and precision targeting.

In August 2022, Collins Aerospace completed the inaugural flight test of its MS-110 Multispectral Airborne Reconnaissance System on an F-16 for an undisclosed international client. The test confirmed aircraft integration, full-system performance, and flightworthiness within the rigorous operational parameters of tactical jet missions.

Airborne Pods Market Segmentation

By Aircraft Type Outlook (Revenue, USD Million; 2020–2034)

- Combat Aircraft

- Helicopter

- UAV

- Others

By Pod Type Outlook (Revenue, USD Million; 2020–2034)

- ISR

- Targeting

- Countermeasure

- Others

By Material Type Outlook (Revenue, USD Million; 2020–2034)

- Composites

- Metals

By Sensor Type Outlook (Revenue, USD Million; 2020–2034)

- EO/IR

- EW/EA

- IRCM

By Regional Outlook (Revenue, USD Million; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Airborne Pods Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,208.37 million |

|

Market Size Value in 2025 |

USD 3,377.39 million |

|

Revenue Forecast by 2034 |

USD 5,420.54 million |

|

CAGR |

5.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million, 2020–2034 and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global airborne pods market size was valued at USD 3,208.37 million in 2024 and is projected to grow to USD 5,420.54 million by 2034.

• The global market is projected to register a CAGR of 5.4% during the forecast period.

• In 2024, North America accounted for the largest share of the market due to the high defense budgets of countries such as the US and significant investments in advanced military technologies

• A few key players in the market are Advanced Technologies Group, Collins Aerospace, Harris Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Company, Saab AB, TERMA, Thales Group, and Ultra Electronics

• In 2024, the combat aircraft segment accounted for the largest market share due to their critical role in defense operations. These aircraft require advanced pods for intelligence, surveillance, reconnaissance (ISR), targeting, and electronic warfare

• The ISR segment is projected to experience the highest growth rate during the forecast period due to the escalating need for real-time intelligence gathering, border surveillance, and enhanced situational awareness across defense and security operations.