Aircraft Electric Motors Market Share, Size, Trends, Industry Analysis Report

By Application; By Type; By Aircraft Type; By Region; Segment Forecast, 2023 - 2032

- Published Date:May-2023

- Pages: 119

- Format: PDF

- Report ID: PM3242

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

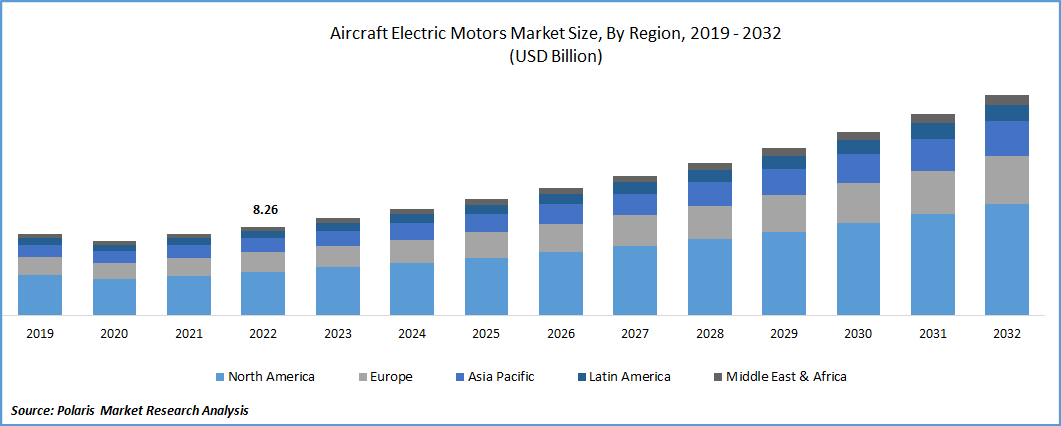

The global aircraft electric motors market was valued at USD 8.26 billion in 2022 and is expected to grow at a CAGR of 9.5% during the forecast period. The demand for aviation electrical systems can be blamed for the constant market revenue growth of aircraft electric motors. An airplane's electrical system is essential to all but the most basic aircraft designs. There are numerous differences in electrical system complexity and capacity between a modern, multi-engine commercial jet aircraft and a single-engine, piston-powered, light general aviation aircraft.

Know more about this report: Request for sample pages

Another aspect influencing the growth of aircraft electric motors market revenue is the increase in aircraft deliveries and renewals. With 611 jet deliveries in 2021, Airbus continues to hold the title of greatest commercial aircraft manufacturer since 2003. The two biggest makers of aircraft worldwide are Airbus and Boeing. Both companies produce commercial and military aircraft as well as satellites, rockets, missiles, and communications equipment. More than half of Boeing's sales are made in the United States, and about a third of its overall revenue comes from its commercial aircraft division. Airbus outnumbers Boeing in Europe and the Asia-Pacific region despite having a lesser market share there.

A significant factor that is anticipated to impede market revenue growth is the power density constraints of electric propulsion technology. The installation of electric propulsion systems in ground transportation seems to be less complicated than that in aviation. Aircraft, which are much more sensitive to mass due to immature electric storage and propulsion systems, cannot tolerate additional weight as well as ground-based vehicles can. Additionally, average flight distances are far longer than those of land transportation (cars, buses, and trains), and aviation safety requirements are highly severe.

Electric planes are becoming more and more popular, which is a recent trend in the market. Entrepreneurs are looking into how using electric aircraft could lower the 3% of global greenhouse gas emissions attributed to air travel. The problem is that an electric aircraft could only securely travel up to 30 miles with between one and twelve other passengers, according to a recent assessment. In many ways, electric flight is a desirable concept. The aviation industry accounts for a sizeable percentage of the greenhouse gas emissions that cause climate change, and battery-powered aircraft could speed up the decarbonization of a sector that is expanding. Even the first electric aircraft could take to the skies before the end of the decade.

Industry Dynamics

Growth Drivers

Businesses from a variety of industries are hopeful about using drones to carry out essential tasks including delivering medical samples, inspecting infrastructure, and providing imaging capabilities. Fully electric propulsion is achieved by the extensive usage of electric motors in UAVs and e-VTOLS to power their flights. Through university pilot initiatives to support smart city models, the multipurpose use of UAVs motivates state and municipal governments to invest in drone technology and research. Defense and military applications account for a significant portion of the industry, which is actively looking to grow in vertical markets. There is an increase in demand for UAVs as a result of their growing viability in commercial applications.

Report Segmentation

The market is primarily segmented based on application, type, aircraft type and region.

|

By Application |

By Type |

By Aircraft Type |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

In 2022, the engine control system segment dominated the market, accounting for the largest market share.

The engine control system segment dominates the global market in terms of revenue share. The use of engine control systems has several advantages. The Electronic Engine Controller (EEC) is a mounted electronic control that keeps track of a number of engine and flight-related variables, including throttle position, fuel flow, temperature, vibration, and pressure. In addition to drawing power from an engine alternator, it also gets data from sensors that track pilot commands.

The DC motor segment will account for a higher share of the market.

During the course of the forecast period, the DC motors segment is anticipated to dominate the global market in terms of revenue share. One of the many uses for the DC motor, commonly referred to as a direct current motor, is radio-controlled aircraft. It primarily transfers electrical energy into mechanical energy. Direct current motors come in three varieties right now: brushed, stepper, and brushless. Different direct current motors have variable torque and speeds depending on the application's load.

Fixed wing segment is expected to hold the significant revenue share

The market for aircraft electric motors has been divided into fixed-wing, rotary-wing, and unmanned aerial vehicles based on the type of aircraft. Over the forecast period, the fixed-wing segment is anticipated to contribute significantly to revenue. A jet engine or a propeller powers the stationary wings of a fixed-wing aircraft. They are used for longer excursions more frequently than rotary-wing aircraft because they can fly farther between refueling stops.

The demand in North America is expected to witness significant growth.

North America is anticipated to account for the greatest revenue share due to the growing use of electric aircraft in the nations. The presence of significant players, OEMs, and component manufacturers along with the increased need for modern aircraft for civil and commercial purposes is influencing market development in North America.

Competitive Insight

Some of the major players operating in the global aircraft electric motors market include Moog Inc., Meggitt PLC, Altra Industrial Motion Corporation, Woodward, Inc., Rolls-Royce PLC, Allied Motion, Inc., Ametek, Inc., MGM Compro, Emrax D.O.O., Maxon.

Recent Developments

- In July 20, 2022, Collins Aerospace developed the first functioning prototype of its 500-kilowatt electric motor that is suitable for the Airlander 10 aircraft in association with Hybrid Air Vehicles and the University of Nottingham. Collins began the motor's fundamental characterisation testing at the University of Nottingham. Airlander 10 is anticipated to begin hybrid-electric operation in 2026, transition to all-electric, zero-emission operation in 2030.

Aircraft Electric Motors Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 9.03 billion |

|

Revenue forecast in 2032 |

USD 20.44 billion |

|

CAGR |

9.5% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Application, By Type, By Aircraft Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Moog Inc., Meggitt PLC, Altra Industrial Motion Corporation, Woodward, Inc., Rolls-Royce PLC, Allied Motion, Inc., Ametek, Inc., MGM Compro, Emrax D.O.O., Maxon |

FAQ's

The global aircraft electric motors market size is expected to reach USD 20.44 billion by 2032.

Key players in the aircraft electric motors market are Moog Inc., Meggitt PLC, Altra Industrial Motion Corporation, Woodward, Inc., Rolls-Royce PLC, Allied Motion, Inc., Ametek, Inc., MGM Compro, Emrax D.O.O., Maxon.

North America contribute notably towards the global aircraft electric motors market.

The global aircraft electric motors market expected to grow at a CAGR of 9.5% during the forecast period.

The aircraft electric motors market report covering key segments are application, type, aircraft type and region.