Aircraft Fairings Market Size, Share, Trends, Industry Analysis Report

: By Platform, Aircraft Type, Material Type (Composites and Metals), Manufacturing Process, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM1661

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

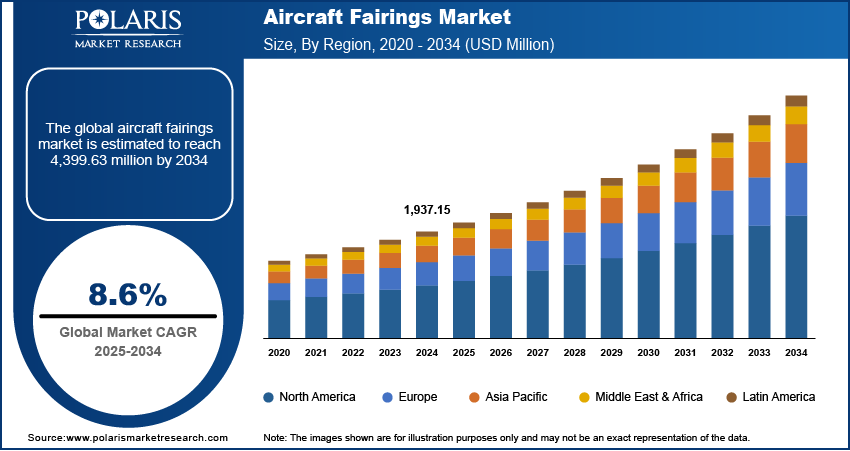

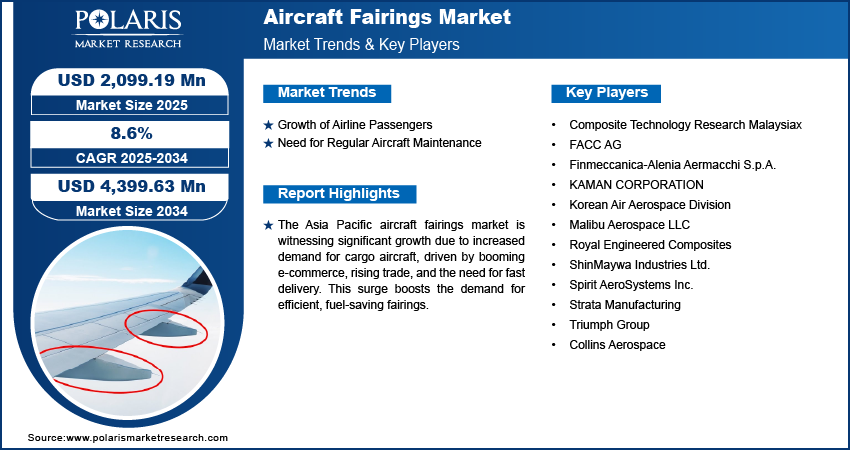

The global aircraft fairings market size was valued at USD 1,937.15 million in 2024, growing at a CAGR of 8.6% during 2025–2034. The market is driven by global fleet expansion, rising air travel and cargo demand, technological advancements in lightweight materials, and the ongoing need for maintenance and fuel-efficient performance.

Key Insights

- The commercial segment is expected to witness a significant growth rate due to rising passenger traffic, fleet expansion, and a push for fuel efficiency.

- The composites sector dominates the market due to its lightweight, corrosion resistance, and superior strength-to-weight ratio, boosting fuel efficiency.

- North America leads the market with strong aerospace manufacturing, technological innovation, and fleet modernization initiatives.

- Asia Pacific is the fastest growing region, fueled by expanding air cargo demand, booming e-commerce, and increasing air passenger traffic.

Industry Dynamics

- Rising global air passenger and cargo traffic is driving fleet expansion and increasing demand for aerodynamic components such as fairings.

- Airlines are upgrading and maintaining aircraft to boost fuel efficiency and performance, increasing the need for high-quality fairings.

- Increasing customization of fairings through 3D printing and advanced materials improves performance and widens adoption in modern aircraft.

- High development and material costs, especially for advanced composites, limit affordability for some aircraft manufacturers and operators.

Market Statistics

2024 Market Size: USD 1,937.15 million

2034 Projected Market Size: USD 4,399.63 million

CAGR (2025–2034): 8.6%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The expansion of the global aircraft fleet, driven by the rise in air cargo and passenger traffic, is driving the demand for aircraft fairings. Airlines and cargo carriers are growing their fleets to meet global travel and logistics demands, due to which there is an increasing need for components such as fairings. This includes new aircraft being built and the maintenance or upgrading of existing fleets. Aircraft fairings are essential in the production of modern aircraft, as they improve aerodynamics and reduce fuel consumption. Therefore, the expansion of the global aircraft fleet is driving the aircraft fairing market demand.

Technological advancements in materials, design, and manufacturing processes are driving the aircraft fairings market development. Modern fairings are made of lightweight, durable materials such as carbon fiber and composites, which offer better performance and fuel efficiency. Advances in 3D printing and precision engineering have enabled the creation of more customized, high-performance fairings. These innovations make fairings more effective in reducing drag, improving aerodynamics, and contributing to overall fuel savings, thereby growing the adoption of advanced fairings.

Aircraft Fairings Market Dynamics

Growth of Airline Passengers

Growing demand for air travel, driven by increasing global passenger traffic, has created operators' need to expand and maintain their fleets to accommodate the rising number of passengers. For instance, according to the Indian Ministry of Civil Aviation, the number of domestic airline passengers grew by 42.85% in 2023 from 2022, showcasing growth in airline passengers. This has led to a higher demand for aircraft components, including fairings, which are crucial for improving aerodynamics and reducing drag. Therefore, the growing number of airline passengers is driving the aircraft fairings market growth.

Need for Regular Aircraft Maintenance

Regular maintenance and replacement of aircraft parts are essential to keep airplanes running safely and efficiently. Over time, fairings can wear out or become damaged, requiring repairs or replacement. According to a report by Niti Aayog, aircraft maintenance and repair must be performed every 6 to 10 years. Therefore, the ongoing need for aircraft maintenance, coupled with the demand for replacements as fleets age, is driving the aircraft fairing market demand.

Aircraft Fairings Market Segment Analysis

Assessment by Platform Outlook

The aircraft fairings market segmentation, based on platform, includes commercial, military, regional, and general aviation. The commercial segment is expected to experience a significant CAGR in the global market during the forecast period due to the rising demand for air travel and fleet expansion. Passenger numbers are increasing globally, due to which airlines are investing in new aircraft and retrofitting existing ones to improve fuel efficiency and reduce operating costs. Additionally, owing to the growing focus on sustainability and fuel efficiency, the commercial segment is expected to witness strong growth during the forecast period.

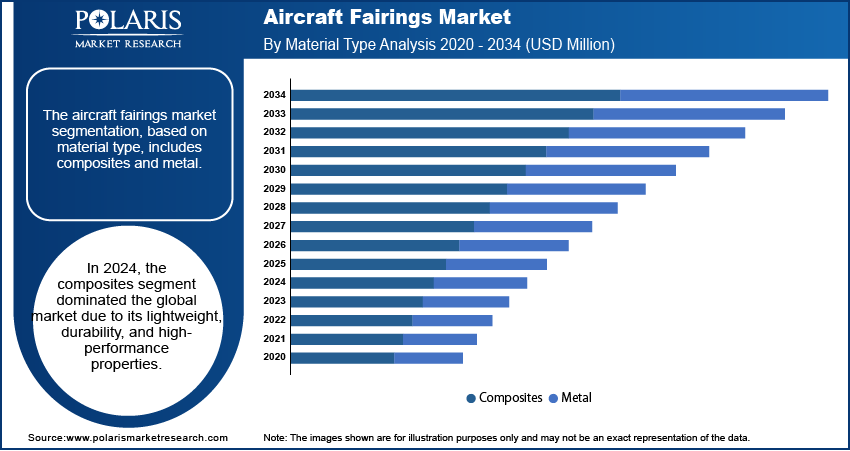

Evaluation by Material Type Outlook

The aircraft fairings market segmentation, based on material type, includes composites and metals. The composite segment dominated the aircraft fairings market share in 2024 due to its lightweight, durability, and high-performance properties. Composites such as carbon fiber and fiberglass offer excellent strength-to-weight ratios, making them ideal for reducing drag and improving fuel efficiency. These materials are highly resistant to corrosion and wear, enhancing the longevity of aircraft components. Their ability to meet stringent safety, performance, and environmental standards has increased the demand for composites, thereby driving the segmental growth.

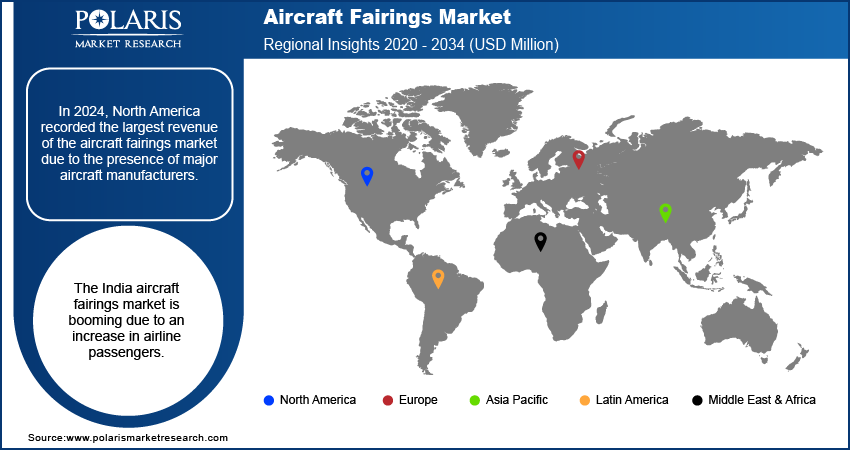

Regional Analysis

By region, the study provides the aircraft fairings market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest share of the aircraft fairings market revenue due to the presence of major aircraft manufacturers such as Boeing and regional suppliers. These companies play a crucial role in the production of commercial, military, and private aircraft, boosting the demand for high-quality fairings. The region's strong aerospace industry, along with its focus on innovation, technology, and fuel efficiency, supports the North America aircraft fairings market expansion. Additionally, the ongoing modernization of fleets and demand for lightweight, durable materials contribute to the market expansion in North America.

The Asia Pacific aircraft fairings market is experiencing significant growth driven by a rise in demand for cargo aircraft. The booming e-commerce industry, increasing trade, and the need for fast delivery services have led countries such as China and India to expand their cargo fleets. According to Aircargo, Asia Pacific accounts for 41% of global cargo aircraft. This surge in air cargo transport is leading to greater demand for efficient, fuel-saving components such as fairings, which reduce drag and improve performance. Therefore, the growing demand for cargo aircraft is driving the Asia Pacific aircraft fairings market expansion.

The aircraft fairings market in India is experiencing substantial growth due to a rise in airline passengers. The country's middle-class population is expanding, and travel is becoming more accessible, due to which the demand for air travel is increasing rapidly. This growth is pushing airlines to expand and modernize their fleets, leading to higher demand for components such as aircraft fairings across India.

Key Players and Competitive Analysis Report

The aircraft fairings market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. A few major aircraft fairings market players are Composite Technology Research Malaysia Sdn Bhd., FACC AG, Finmeccanica-Alenia Aermacchi S.p.A., KAMAN CORPORATION, Korean Air Aerospace Division, Malibu Aerospace LLC, Royal Engineered Composites, ShinMaywa Industries Ltd., Spirit AeroSystems Inc., Strata Manufacturing, Triumph Group, and Collins Aerospace.

Malibu Aerospace LLC is an aerospace company based in Minneapolis, Minnesota, specializing in the Piper PA-46 aircraft. The company provides a range of services that include maintenance, engineering, design, and aircraft management. The primary focus of the company is on improving the performance and safety of the Piper PA-46, which is a popular single-engine aircraft used for various purposes, including personal and business travel. Malibu Aerospace engages in several key activities. One of their main offerings is the design and certification of Supplemental Type Certificates (STCs), which allow for modifications and improvements to the aircraft's capabilities. Additionally, they provide maintenance services, employing technology and meticulous techniques to ensure that aircraft remain in optimal condition. Their aircraft management services encompass training, testing, and prototyping. The company also assists clients in the buying and selling of aircraft. Operating from a 30,000-square-foot facility in Minneapolis, Malibu Aerospace serves clients both locally and internationally.

Spirit AeroSystems Holdings Inc. is an American manufacturer focused on aerostructures for commercial and defense aircraft. Established in 2005 after Boeing divested its Wichita division, the company is headquartered in Wichita, Kansas. Spirit AeroSystems is an independent supplier of aerostructures globally, specializing in the design and manufacture of complex components such as fuselages, wings, nacelles, and other structural parts for various aircraft models. The company operates primarily in three segments. The Commercial segment involves producing fuselage sections and wing components for major aircraft manufacturers, including Boeing and Airbus. Notable projects include contributions to the Boeing 737 and 787 Dreamliner, as well as the Airbus A220 and A350 models. In the Defense & Space segment, Spirit designs and manufactures structural components for military aircraft, focusing on platforms that require high durability and performance. The Aftermarket segment provides support services for commercial and business/regional jets, ensuring ongoing maintenance and parts supply. Spirit AeroSystems has a global footprint with manufacturing facilities located in the US, UK, France, Malaysia, and Morocco.

List of Key Companies

- Composite Technology Research Malaysiax Sdn Bhd

- FACC AG

- Finmeccanica-Alenia Aermacchi S.p.A.

- KAMAN CORPORATION

- Korean Air Aerospace Division

- Malibu Aerospace LLC

- Royal Engineered Composites

- ShinMaywa Industries Ltd

- Spirit AeroSystems Inc.

- Strata Manufacturing

- Triumph Group

- Collins Aerospace

Aircraft Fairings Market Segmentation

By Platform Outlook (Revenue USD Million, 2020–2034)

- Commercial

- Military

- Regional

- General Aviation

By Aircraft Type Outlook (Revenue USD Million, 2020–2034)

- Narrow-Body

- Wide-Body

- Very Large

By Material Type Outlook (Revenue USD Million, 2020–2034)

- Composites

- Metals

By Manufacturing Process Outlook (Revenue USD Million, 2020–2034)

- Prepreg Layup

- Stamping

- Others

By Application Outlook (Revenue USD Million, 2020–2034)

- Fuselage

- Engine

- Control Surfaces

- Radars and Antenna

- Landing Gear

By Regional Outlook (Revenue USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aircraft Fairings Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,937.15 million |

|

Market Size Value in 2025 |

USD 2,099.19 million |

|

Revenue Forecast by 2034 |

USD 4,399.63 million |

|

CAGR |

8.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The market size was valued at USD 1,937.15 million in 2024 and is projected to grow to USD 4,399.63 million by 2034.

• The global market is projected to register a CAGR of 8.6% during 2025–2034.

• North America held the largest share of the global market in 2024.

• A few key players in the market are Composite Technology Research Malaysia, FACC AG, Finmeccanica-Alenia Aermacchi S.p.A., KAMAN CORPORATION, Korean Air Aerospace Division, Malibu Aerospace LLC, Royal Engineered Composites, ShinMaywa Industries Ltd., Spirit AeroSystems Inc., Strata Manufacturing, Triumph Group, and Collins Aerospace.

• The commercial aircraft is expected to experience significant CAGR in the global market during the forecast period due to rising passenger volume.

• The composite segment dominated the market in 2024 due to its lightweight, durability, and high-performance properties.