Aluminum Foil Market Size, Share, Trends, Industry Analysis Report

By Product Type (Foil Wrappers, Pouches, Blister Packs, and Others), By Application, By End-use Industry, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6310

- Base Year: 2024

- Historical Data: 2020-2023

Overview

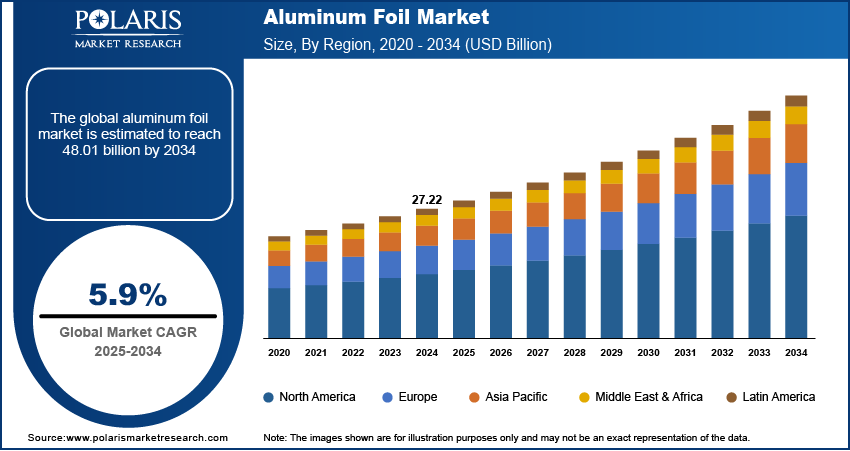

The global aluminum foil market size was valued at USD 27.22 billion in 2024, growing at a CAGR of 5.9% from 2025 to 2034. Demand for aluminum foil is increasing with the need for pharmaceutical packaging and the growth in e-commerce and food delivery services.

Key Insights

- Foil wrappers dominated in 2024, fueled by versatility, light weight, and preservation of freshness.

- Packaging accounted for the largest share in 2024, driven by extensive application in food, pharma, and consumer goods.

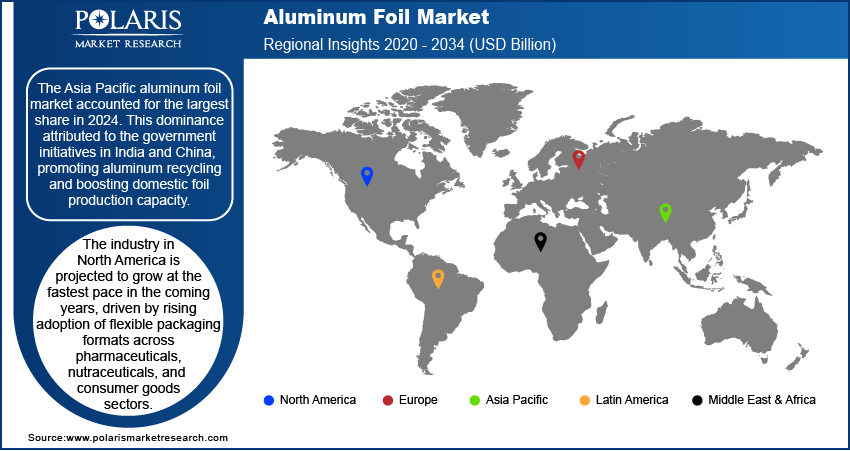

- Asia Pacific held dominating share in 2024, due to recycling efforts and increasing domestic production of foil.

- India is growing significantly in Asia Pacific, driven by expansion of food delivery, online grocery, and e-commerce.

- North America expected to experience the rapid expansion, led by growth of flexible formats in pharma and consumer goods.

- The U.S. is a primary hub in North America, boosted by consumption of ready-to-eat and plant-based foods.

Industry Dynamics

- Pharma growth prompts foil usage in blister packs and sterile drug packaging.

- Food delivery and e-commerce increase foil use for safe, green, and lightweight packaging.

- Foil innovations that are plastic-free drive opportunities in hybrid paper and bio-based material.

- Volatility in raw material prices holds back growth by increasing costs and squeezing margins.

Market Statistics

- 2024 Market Size: USD 27.22 Billion

- 2034 Projected Market Size: USD 28.77 Billion

- CAGR (2025–2034): 5.9%

- Asia Pacific: Largest Market Share

The aluminum foil industry consists of light yet tough materials that make efficient barriers to oxygen, light, moisture, and contaminants. Extensively utilized in food, pharmaceuticals, cosmetics, and industrial packaging, they provide protection, quality, and long shelf life. Performance, sustainability, and cost competitiveness are improved through improvements in thickness, coatings, and recycling technology, making foil an indispensable solution for industries worldwide.

Growing use of sustainable packaging is fueling high demand for aluminum foil in food, drink, pharma, and consumer packs. Concerns around the environment and stringent anti-plastic legislation are compelling businesses towards green solutions. With recyclability, plastic reduction, and better barrier properties, foil is used to increase shelf life, preserve freshness, and protect safe storage, driving market growth globally.

Advances in rolling, lamination, and coating technologies are enhancing the strength, durability, and efficiency of foil. More durable and thin foils are made with less material, saving cost and eco-friendliness. Amcor Capsules and Moët & Chandon introduced ESSENTIELLE, a plastic-free foil that combines 60% aluminum with paper in June 2024, reducing carbon footprint by 31% without compromising on premium looks and production efficiency.

Drivers & Opportunities

Expanding Pharmaceutical Industry Requiring Blister Packs and Sterile Packaging for Medicines: Pharmaceuticals is one such growth driver, with aluminum foil extensively utilized across blister packs, strip packaging, and sterile wraps. It has superior barrier capabilities that shield drugs from light, oxygen, and moisture, thereby securing stability and patient safety. Global expenditure projected to stand at USD 1.9 trillion by the year 2027, as per IQVIA's Global Use of Medicines 2023 report, driving adoption of foil in healthcare packaging and securing adherence to international standards.

Growth in E-Commerce and Online Food Delivery Services Fueling Demand for Safe and Lightweight Packaging: Growing e-commerce and food delivery sectors are driving aluminum foil demand as a lightweight and safe packaging option. Foil maintains freshness, avoids contamination, and facilitates efficient storage and transportation through supply chains. Based on the International Trade Administration, worldwide B2C e-commerce revenues are estimated to reach USD 5.5 trillion by 2027, achieving a CAGR of 14.4%, pushing the use of foil in flexible, recyclable, and effective packaging.

Segmental Insights

By Product Type

On the basis of type, the market of aluminum foil is divided into foil wrappers, pouches, blister packs, and others. Foil wrappers held the highest market share in 2024, followed by its ease of use, lightweight nature, and preservation of freshness in the product along with avoiding any kind of contamination. Foil wrappers are widely utilized in food, confectionery, and household packaging applications.

Blister packs are expected to see significant growth throughout the forecast period due to its critical contribution towards pharmaceutical packaging. Blister packs offer tamper-evident, sterile, and rugged solutions for storing and preserving tablets and capsules that ensure precise dosage and long shelf life. The capacity of blister packs to protect medicine from moisture, light, and contamination further enhancing adoption in the pharmaceutical industry.

By Application

In terms of application, aluminum foil market is segmented into packaging and industrial. The packaging application led the market in 2024, driven by prevalent usage in food, pharmaceutical, and consumer goods sectors. The capability of aluminum foil to safeguard products against moisture, oxygen, and light, with lightweight and affordable packaging solutions, continues to advance its adoption worldwide.

The industrial application segment is anticipated to experience considerable growth in the forecast period, with growth being driven by increasing usage in insulation, wrapping of cables, electronics, and heat exchangers. Increasing requirements for energy-saving solutions and sophisticated materials in the construction and automotive sectors are also propelling the utilization of aluminum foil in industrial applications.

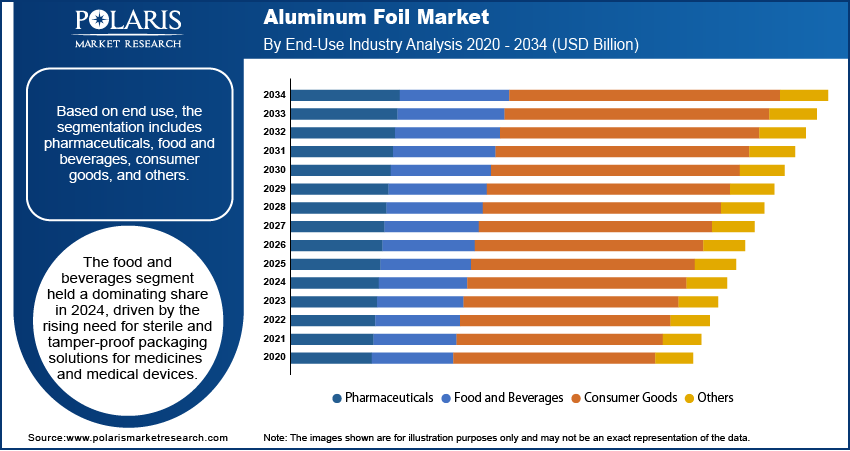

By End-Use Industry

On the basis of end-use industry, the market for aluminum foil is divided into consumer goods, food and beverages, pharmaceuticals, and others. The food and beverages segment accounted for the highest share in 2024, driven by the growing use of aluminum foil for packaging, cooking, and storage due to its superior heat conductivity, light weight, and recyclability. Growing urbanization, the growth in demand for convenience foods, and expansion in online food delivery services are also driving the growth of the segment.

The pharmaceutical industry is expected to develop at a high growth rate throughout the forecast period, driven by the increasing demand for sterile and tamper-proof packaging solutions for pharmaceuticals and medical devices. Consumer goods are becoming an important segment, enabled by increasing usage of aluminum foil in personal care, household, and decorative purposes.

Regional Analysis

Asia Pacific market for aluminum foil held a prominent share on a global level, led by recycling efforts in India and China that enhance domestic production capabilities. Growing pharmaceutical and healthcare industries are driving demand for strip and blister packaging. Increasing packaged food consumption, flexible packaging usage, and e-commerce penetration are driving regional market growth further.

India Aluminum Foil Market Overview

India is becoming a crucial hub led by fast expansion in food delivery, online grocery, and e-commerce markets. India's e-commerce was worth USD 63.17 billion in 2022, according to ITA, and is expected to expand at a CAGR of 14.1% from 2023 through 2027. Increasing demand for ready-to-eat food, growing pharmaceutical manufacturing, and government-sponsored production efforts are driving foil uptake in food services and medical packaging.

North America Aluminum Foil Market Insights

North America had a significant market share in 2024, led by rising consumption of flexible foil packaging in the pharmaceutical, nutraceuticals, and consumer goods sectors. Rising demand for environmentally friendly and recyclable foil products is driving household consumption. A strong food and healthcare sector combined with packaging design innovation is supporting foil usage in various applications in the region.

The U.S. Aluminum Foil Market Analysis

The U.S. dominated the North American market in 2024, underpinned by growing demand in plant-based food and ready-to-eat food markets. SPINS data estimated the U.S. plant-based food market as worth USD 8.1 billion in 2024, demonstrating a strong growth rate. Foil packaging featuring high-barrier recyclability guarantees freshness, flavor, and shelf life, as lightweight sustainable formats continue to drive market demand.

Europe Aluminum Foil Market Assessment

The European aluminum foil market is expected to register the highest growth, driven by EU policies for the circular economy and stringent restrictions on single-use plastics. Policies are inducing producers to implement recyclable foils in packaging applications. Increasing demand for high-end wine and spirits packaging, combined with high adoption in Germany, France, and the UK, is fueling application of innovative aluminum foil solutions congruent with sustainability objectives.

Key Players & Competitive Analysis

The global market is competitive and dominated by Amcor plc, Hindalco Industries Limited, and Reynolds Consumer Products LLC. Players are emphasizing sustainable innovation, plant efficiency, and geographic expansion in food, pharma, and consumer segments. Strategic partnerships, recycling technology investments, and high-barrier and sustainable foil developments are helping players build global reach and align operations with circular economy principles.

Major players in the aluminum foil industry are ACM Carcano Antonio S.p.A., Alcoa Corporation, Amcor plc, Assan Aluminyum Sanayi ve Ticaret A.Ş., Ess Dee Aluminium Ltd., Eurofoil Luxembourg S.A., Hindalco Industries Limited, Huawei Aluminium Co., Ltd., Laminazione Sottile S.p.A., Novelis Inc., Reynolds Consumer Products LLC, Shanghai Metal Corporation, UACJ Foil Corporation, Xiamen Xiashun Aluminium Foil Co., Ltd., and Zhejiang Junma Aluminum Industry Co., Ltd.

Key Players

- ACM Carcano Antonio S.p.A.

- Alcoa Corporation

- Amcor plc

- Assan Aluminyum Sanayi ve Ticaret A.Ş.

- Ess Dee Aluminium Ltd.

- Eurofoil Luxembourg S.A.

- Hindalco Industries Limited

- Huawei Aluminium Co., Ltd.

- Laminazione Sottile S.p.A.

- Novelis Inc.

- Reynolds Consumer Products LLC

- Shanghai Metal Corporation

- UACJ Foil Corporation

- Xiamen Xiashun Aluminium Foil Co., Ltd.

- Zhejiang Junma Aluminum Industry Co., Ltd.

Aluminum Foil Industry Developments

In June 2024: Amcor Capsules partnered with Moët & Chandon to introduce ESSENTIELLE, a plastic-free aluminum-paper foil reducing carbon footprint by 31% for packaging wine and spirits.

In January 2024: SRF Limited opened a new aluminum foil factory in Jetapur, Madhya Pradesh, with state-of-the-art European machinery and process controls compliant with Good Manufacturing Practices.

Aluminum Foil Market Segmentation

By Product Type Outlook (Revenue, USD Billion; Volume, Kilotons; 2020–2034)

- Foil Wrappers

- Pouches

- Blister Packs

- Others

By Application Outlook (Revenue, USD Billion; Volume, Kilotons; 2020–2034)

- Packaging

- Industrial

By End-Use Industry Outlook (Revenue, USD Billion; Volume, Kilotons; 2020–2034)

- Pharmaceuticals

- Food and Beverages

- Consumer Goods

- Others

By Regional Outlook (Revenue, USD Billion; Volume, Kilotons; 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aluminum Foil Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 27.22 Billion |

|

Market Size in 2025 |

USD 28.77 Billion |

|

Revenue Forecast by 2034 |

USD 48.01 Billion |

|

CAGR |

5.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 27.22 billion in 2024 and is projected to grow to USD 48.01 billion by 2034.

The global market is projected to register a CAGR of 5.9% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are ACM Carcano Antonio S.p.A., Alcoa Corporation, Amcor plc, Assan Aluminyum Sanayi ve Ticaret A.?., Ess Dee Aluminium Ltd., Eurofoil Luxembourg S.A., Hindalco Industries Limited, Huawei Aluminium Co., Ltd., Laminazione Sottile S.p.A., Novelis Inc., Reynolds Consumer Products LLC, Shanghai Metal Corporation, UACJ Foil Corporation, Xiamen Xiashun Aluminium Foil Co., Ltd., and Zhejiang Junma Aluminum Industry Co., Ltd.

The foil wrappers segment dominated the market revenue share in 2024.

The industrial segment is projected to witness the fastest growth during the forecast period.