E-Commerce Automotive Aftermarket Size, Share, Trends, & Industry Analysis Report

: By Replacement Parts, By End Use (B2B and B2C), and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM5674

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

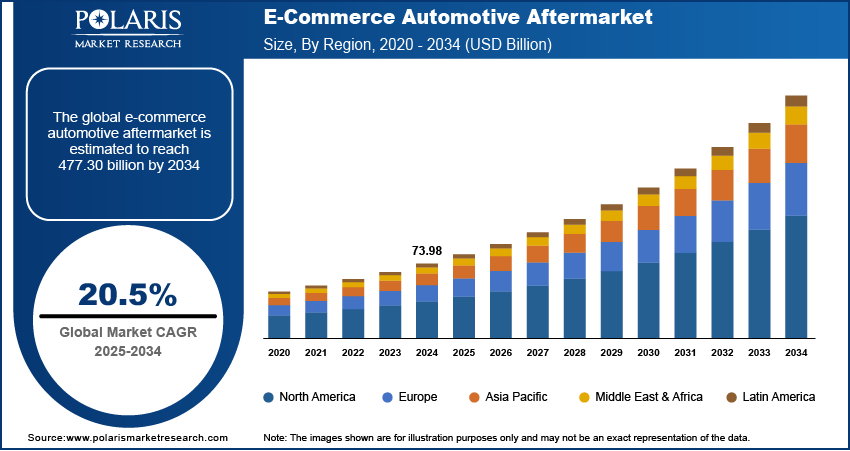

The global e-commerce automotive aftermarket size was valued at USD 73.98 billion in 2024, exhibiting a CAGR of 20.5% during 2025–2034. The market expansion is driven by increasing vehicle ownership, growing demand for personalization, improved pricing and convenience, as well as the adoption of secure digital payment technologies.

Key Insights

- The electrical parts segment is anticipated to expand significantly, driven by the increasing electronic content in automobiles and the convenience of purchasing goods online.

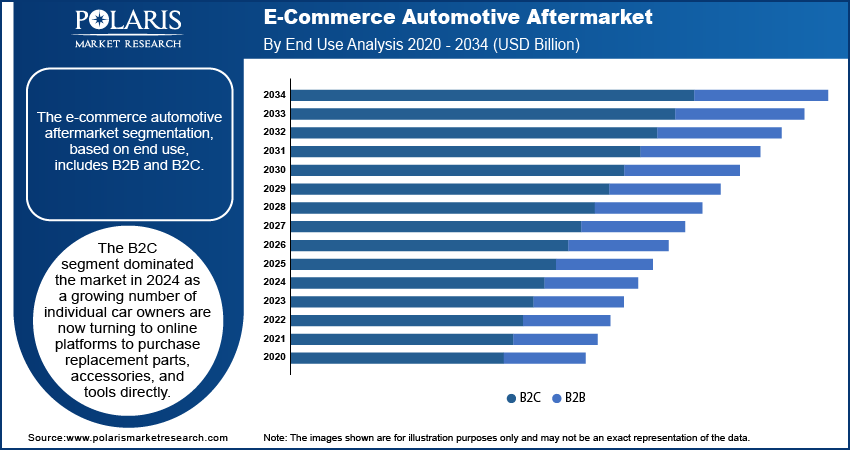

- In 2024, the B2C segment led growth because more people wanted affordable and easy online shopping for car parts and accessories.

- North America led the market in 2024, driven by strong car ownership and the availability of developed, mature retail infrastructure in the online channel.

- Asia Pacific is expected to hold a considerable share, driven by increasing vehicle sales in China, Japan, and South Korea.

Industry Dynamics

- The easy availability of replacement parts and tools through home delivery stimulates demand in both the business and consumer automotive aftermarket segments.

- Low costs and great discounts make online shopping attractive for customers who want to save money.

- The increased use of digital payment options enhances consumer confidence and convenience in purchasing automobile parts online.

- Widening online product range, simple comparisons, and access to DIY manuals make it more likely for customers to buy upgrades online.

- Emerging markets are experiencing increasing digital penetration and vehicle sales, providing opportunities for aftermarket e-commerce growth.

- Narrow technical knowledge on the part of consumers can hinder proper part selection, leading to mismatches and higher return rates.

Market Statistics

2024 Market Size: USD 73.98 billion

2034 Projected Market Size: USD 477.30 billion

CAGR (2025-2034): 20.5%

North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

E-commerce in the automotive aftermarket refers to the online buying and selling of vehicle parts, accessories, and services, catering to both consumers and businesses. This sector allows customers to conveniently purchase replacement parts, upgrades, and tools, often with the added benefit of home delivery and easy comparisons between products.

E-commerce platforms provide better pricing options for automotive aftermarket products compared to traditional brick-and-mortar stores. Online retailers typically have lower overhead costs, which allows them to offer competitive prices, discounts, and promotions to attract consumers. Furthermore, consumers can easily compare prices across different online stores, ensuring they get the best deal. This affordability factor, combined with the convenience of online shopping, makes e-commerce platforms an attractive option for those seeking to save money on vehicle parts, tools, and accessories, thereby driving the demand for e-commerce automotive aftermarket products.

The adoption of secure and reliable digital payment systems is growing. Payment methods such as credit/debit cards, mobile wallets, and online banking have become widely accepted, offering convenience and security for customers. According to the National Payments Corporation of India, in January 2025, transactions through Google Pay, a digital payment platform, were worth USD 110.5 billion. Streamlined and accessible digital payment options have encouraged more people to shift toward online shopping, including automotive parts and accessories. This shift has significantly contributed to the growing preference for e-commerce for the automotive aftermarket.

Market Dynamics

Rising Vehicle Ownership

The rise in vehicle ownership and longer usage periods are leading to greater demand for maintenance and repair parts. According to the International Organization of Motor Vehicle Manufacturers, vehicle sales in 2023 rose by 12% compared to 2022, showcasing the rise in vehicle ownership. Cars need frequent servicing, including oil changes, brake replacements, and engine tune-ups. This consistent need fuels the aftermarket segment, especially for essential components such as filters, tires, and batteries. Millions of aging vehicles are on the roads across the globe, prompting consumers to seek affordable and reliable parts through online platforms. The combination of a growing vehicle base and increasing average vehicle age is driving the growth of the e-commerce automotive aftermarket.

Growing Automotive Customization Demand

Car owners are interested in personalizing their vehicles to match their style, needs, and performance preferences. According to the US Bureau of Labor Statistics, in the US alone, employment in vehicle customization workshops increased by 12% from 2019 to 2023. Custom accessories such as alloy wheels, LED lighting, seat covers, infotainment systems, and performance upgrades are increasingly popular among both casual drivers and auto enthusiasts. Online platforms make it easier than ever to browse, compare, and purchase these products, offering a wide variety of brands, styles, and price points, thereby propelling the e-commerce automotive aftermarket demand.

Segment Analysis

Market Assessment by Replacement Part

The E-commerce automotive aftermarket segmentation, based on replacement part, includes engine parts, transmission and steering, braking system, lighting, electrical parts, suspension systems, wipers, and others. The electrical parts segment is expected to witness significant growth during the forecast period. This includes components such as batteries, alternators, starters, lighting systems, and electronic control units (ECUs). The increasing use of electronic features in modern vehicles, including sensors, infotainment systems, and advanced safety technologies, is driving the demand for high-quality electrical replacements. Consumers prefer shopping for these parts online due to better pricing, easy availability, and fitment tools, thereby driving the segmental growth.

Market Evaluation by End Use

The market segmentation, based on end use, includes B2B, B2C. The B2C dominated the market in 2024. A growing number of individual car owners are now turning to online platforms to purchase replacement parts, accessories, and tools directly. Factors such as user-friendly websites, product reviews, DIY guides, and competitive pricing have made online shopping more attractive for consumers. The convenience of home delivery and easy return policies also play a key role in boosting B2C sales, thereby driving the segmental growth.

Regional Analysis

By region, the study provides the e-commerce automotive aftermarket insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market, due to its high vehicle ownership rates and a well-established online retail ecosystem. Consumers in the US and Canada are increasingly shopping for auto parts online due to fast shipping, detailed product listings, and a wide selection of aftermarket brands. DIY car repair culture is also prevalent in the region, which boosts online sales of tools and replacement parts. Major players in e-commerce and auto parts retailing continue to expand their digital presence. Strong internet penetration and customer trust in online platforms are further driving the market growth in North America.

Asia Pacific is expected to record a significant share during the forecast period. The rapid rise in vehicle sales, especially in countries such as China, Japan, and South Korea, has led to higher demand for replacement parts and accessories. Consumers in the region are becoming more tech-savvy and are increasingly relying on online platforms for convenience and price comparisons. The expansion of e-commerce logistics and the presence of local and international online auto parts sellers are accelerating growth, thereby driving the e-commerce automotive aftermarket industry expansion in Asia Pacific.

India's e-commerce automotive aftermarket is experiencing substantial growth. Growing middle-class population, rising vehicle ownership, and increasing smartphone and internet usage are driving the demand for automotive accessories online across the country. Consumers are turning to online platforms to find affordable, genuine auto parts and accessories, especially in tier 2 and tier 3 cities where offline options are limited. E-commerce companies are investing in local language support, easy payment methods, and logistics to cater to rural and semi-urban areas. The industry in India is likely to witness strong growth during the forecast period as digital adoption continues and the aftermarket ecosystem matures.

Key Players and Competitive Analysis

The e-commerce automotive aftermarket industry is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific sectors. This competitive trend is amplified by continuous progress in product offerings. A few major players in the e-commerce automotive aftermarket are Advance Auto Parts; Alibaba Group Holding Limited; Amazon.com, Inc.; AutoZone Inc.; CARiD.com; eBay Inc.; Flipkart.com; National Automotive Parts Association; O’Reilly Auto Parts; RockAuto, LLC; and US Auto Parts Network, Inc.

Advance Auto Parts, Inc., headquartered in'Raleigh, North Carolina, provides automotive aftermarket parts and accessories. Founded in 1932, it has grown to operate a significant number of stores across North America. As of October 2024, the company had 4,781 locations in the US, Canada, Puerto Rico, and the US Virgin Islands. Additionally, it supports 1,125 independently owned Carquest-branded stores in regions such as Mexico and the Caribbean. The company offers a variety of products for vehicles, including replacement parts such as brakes, belts, and engine components, as well as maintenance items such as motor oil and filters. It also sells accessories such as air fresheners and floor mats. Advance Auto Parts serves three main customer groups: professional installers, independent operators, and individuals who perform repairs themselves. The company operates under several brands, including Advance Auto Parts, Carquest Auto Parts, WORLDPAC, and DieHard, offering both in-store and online purchasing options. Advance Auto Parts primarily operates in North America, with key markets in the US, Canada, Puerto Rico, and the US Virgin Islands. It also has a presence in Mexico and other Caribbean islands through Carquest-branded stores.

AutoZone, Inc. is a major retailer of automotive replacement parts and accessories in the US, with its headquarters located in Memphis, Tennessee. Established in 1979, the company has grown to become a major player in the automotive aftermarket sector. AutoZone offers a wide range of products that include batteries, engine oil, brake pads and rotors, antifreeze, performance parts, and various automotive tools. The company also provides a Loan-A-Tool program, allowing customers to borrow specialty tools for their repair needs. In addition to its product offerings, AutoZone provides several services aimed at assisting customers with automotive maintenance and repair. These services include free in-store testing for alternators, starters, and batteries, as well as a Fix Finder Service that helps diagnose issues indicated by the check engine light. Battery services are also available, including free testing and charging. The company supports DIY enthusiasts by offering online resources that include step-by-step guides and troubleshooting solutions for common automotive repairs. AutoZone operates thousands of stores and e-commerce platforms across the US, ensuring accessibility for a diverse customer base. The company strategically locates its stores to serve both urban and rural communities effectively.

List of Key Companies

- Advance Auto Parts

- Alibaba Group Holding Limited

- Amazon.com, Inc.

- AutoZone Inc.

- CARiD.com

- eBay Inc.

- Flipkart.com

- National Automotive Parts Association

- O’Reilly Auto Parts

- RockAuto, LLC

- US Auto Parts Network, Inc.

E-Commerce Automotive Aftermarket Industry Developments

In December 2023, Epicor launched Automotive B2B eCommerce platform during the 2023 AAPEX Show. The cloud-based solution was designed to streamline the parts ordering process for distributors and their customers.

In October 2022, A new e-commerce website, NAPAAutoparts.co.uk, was launched by Alliance Automotive Group. The platform provided retail customers with access to NAPA products and aftermarket brands.

E-Commerce Automotive Aftermarket Segmentation

By Replacement Parts Outlook (Revenue USD Billion, 2020–2034)

- Engine Parts

- Transmission and Steering

- Breaking System

- Lighting

- Electrical Parts

- Suspension Systems

- Wipers

- Others

By End Use Outlook (Revenue USD Billion, 2020–2034)

- B2B

- B2C

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

E-Commerce Automotive Aftermarket Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 73.98 billion |

|

Market Size Value in 2025 |

USD 88.82 billion |

|

Revenue Forecast in 2034 |

USD 477.30 billion |

|

CAGR |

20.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 73.98 billion in 2024 and is projected to grow to USD 477.30 billion by 2034.

The global market is projected to register a CAGR of 20.5% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players are Advance Auto Parts; Alibaba Group Holding Limited; Amazon.com, Inc.; AutoZone Inc.; CARiD.com; eBay Inc.; Flipkart.com; National Automotive Parts Association; O’Reilly Auto Parts; RockAuto, LLC; and US Auto Parts Network, Inc.

The B2C segment dominated the market in 2024 as a growing number of individual car owners are now turning to online platforms to purchase replacement parts, accessories, and tools directly.

The electrical parts segment is expected to witness significant growth during the forecast period.