B2B Digital Payment Market Share, Size, Trends, Industry Analysis Report

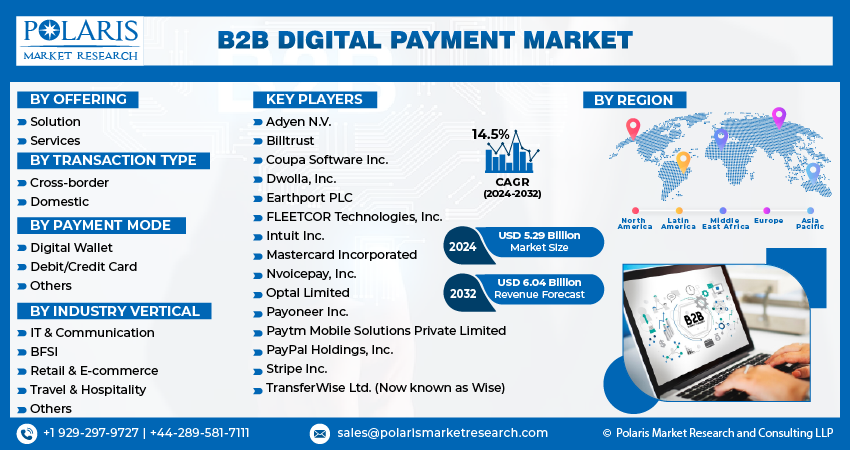

By Offering (Solution, Services); By Transaction Type; By Payment Mode; By Industry Vertical; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3999

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

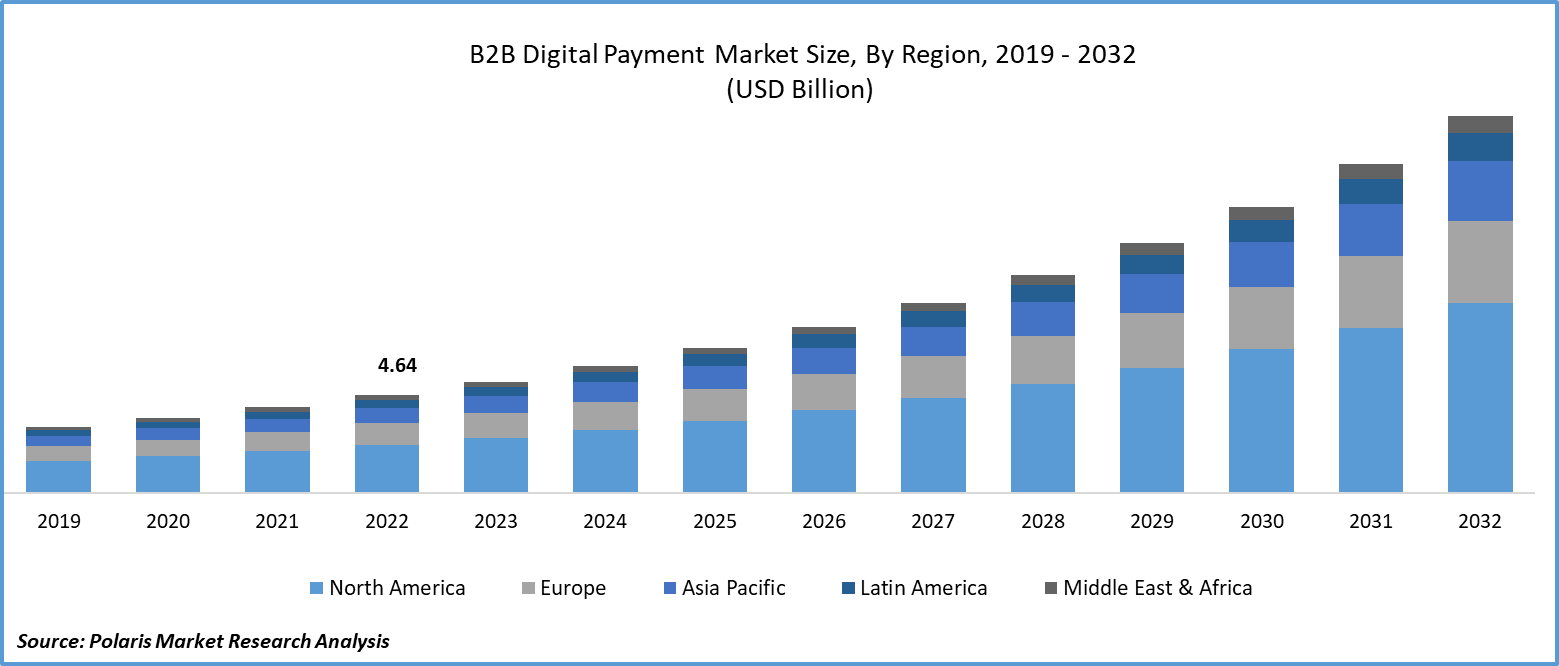

The global B2B digital payment market was valued at USD 5.29 billion in 2023 and is expected to grow at a CAGR of 14.5% during the forecast period.

The research report offers a quantitative and qualitative analysis of the B2B digital payment market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

The B2B digital payment market is becoming increasingly important in today's rapidly changing business environment. It is transforming the way companies conduct transactions. This sector offers a range of electronic payment methods that are customized to meet the unique needs of businesses that engage in commerce with each other. The B2B digital payment market is witnessing a surge in innovation and adoption, with a variety of options available, ranging from EFTs to virtual cards and blockchain-based solutions.

To Understand More About this Research: Request a Free Sample Report

The B2B digital payment sector is undergoing substantial expansion, propelled by critical factors such as the increased global reach of businesses, which demands streamlined and efficient cross-border payment mechanisms. Conventional approaches, frequently hindered by protracted processing times and steep charges, are yielding ground to digital substitutes that deliver swiftness, transparency, and economic transactions.

Moreover, the COVID-19 pandemic accelerated the shift toward digital payments as businesses sought contactless and remote-friendly solutions. The imperative for efficiency and reduced physical interaction further catalyzed the adoption of B2B digital payment platforms.

- For instance, in September 2023, KredX partnered with Mastercard to enhance the efficiency of B2B digital payments. This alliance aims to seamlessly integrate Mastercard's commercial card service with KredX's cutting-edge platform, simplifying the typically intricate process of utilizing cards for B2B transactions.

While the B2B digital payment market presents immense opportunities, it has its challenges. One significant hurdle is the diverse regulatory landscape, both domestically and internationally. Compliance with various regional and industry-specific regulations demands a sophisticated approach from payment providers.

Additionally, security remains a paramount concern. As digital transactions increase, the need for robust cybersecurity measures to protect sensitive financial data is critical. Innovation in encryption technologies and multi-factor authentication solutions is essential to bolstering trust in digital payment systems.

Growth Drivers

- Increased efficiency and speed in real-time payment

The surge in digital payments in B2B transactions is driven by various compelling factors. The primary factor is the need for efficiency and speed in today's fast-paced business environment. Digital payments enable instant transactions, eliminating the delays inherent in traditional paper-based processes. Additionally, automated features and electronic invoicing integration streamline the entire payment cycle, improving operational productivity.

Moreover, the COVID-19 pandemic has accelerated the shift toward digital payments. The need for contactless transactions and remote operations has prompted businesses to explore digital payment alternatives, further consolidating their role as an essential component of modern commerce. Collectively, these driving factors are reshaping the B2B payment landscape, propelling the B2B digital payment market towards a digitally-driven future.

Report Segmentation

The market is primarily segmented based on offering, transaction type, payment mode, industry vertical, and region.

|

By Offering |

By Transaction Type |

By Payment Mode |

By Industry Vertical |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Offering Analysis

- Services segment is expected to witness the highest growth during the forecast period

The services segment is projected to grow at a CAGR during the projected period. The Services segment in B2B digital payment has flourished due to its focus on tailored solutions. These providers excel at integrating digital payment systems with existing business platforms, enhancing operational efficiency. Moreover, robust security measures, including advanced encryption and fraud detection, instill trust in businesses. Comprehensive reporting and analytics tools empower informed decision-making, while expertise in compliance ensures regulatory adherence. The Services segment also offers a diverse array of payment methods, accommodating various business preferences. Value-added services like invoice financing further optimize cash flow management, driving the impressive growth of this segment in the B2B digital payment landscape.

By Transaction Type Analysis

- Domestic segment accounted for the largest market share in 2022

The domestic segment accounted for the largest market share in 2022 and is likely to retain its market position throughout the forecast period. This is due to its focus on localized solutions. By catering specifically to in-country transactions, providers in this segment offer streamlined and cost-effective payment methods for domestic businesses. This eliminates the complexities associated with cross-border payments, such as currency conversion and international transaction fees. Moreover, the domestic segment benefits from a deep understanding of local regulatory frameworks, ensuring compliance and building trust with businesses. This localized approach has been a pivotal factor driving the impressive expansion of the domestic segment in the B2B digital payment market.

By Payment Mode Analysis

- Debit/Credit card segment held a significant market revenue share in 2022

The debit/credit card segment held a significant market share in revenue share in 2022. , The credit/debit card segment in B2B digital payments is thriving, maintained by its widespread acceptance and familiarity. Its convenience and ease of use have made it a preferred choice for businesses, facilitating swift and secure transactions. The availability of corporate credit cards, along with incentives like cashback and rewards, further incentivizes adoption. Enhanced security measures, including EMV chips and tokenization, instill confidence in users. Additionally, the global acceptance of credit/debit cards ensures their relevance across international business transactions. These factors collectively drive the robust growth of the credit/debit card segment in the B2B digital payment landscape.

By Industry Vertical Analysis

- BFSI segment is expected to witness the highest growth during the forecast period

The Banking, Financial Services, and Insurance (BFSI) segment in B2B digital payments is witnessing exponential growth fueled by its core expertise in financial transactions. BFSI entities have spearheaded the development of secure and efficient digital payment platforms, leveraging their extensive industry knowledge. Their established infrastructure and regulatory compliance proficiency instill confidence in businesses. Moreover, BFSI institutions are driving innovation, introducing features like real-time settlements, automated reconciliation, and advanced fraud detection. This heightened level of service and security is accelerating the adoption of digital payment solutions in the B2B sector. The BFSI segment remains a pivotal force in shaping the future of B2B digital payments.

Regional Insights

- North America region dominated the global market in 2022

The North America region dominated the global market with the largest market share in 2022 and is expected to maintain its dominance over the anticipated period. Increased digitalization, with businesses rapidly transitioning from traditional payment methods to more efficient and secure digital solutions. Factors driving this shift include the need for streamlined cross-border transactions, cost savings, and the pursuit of operational efficiency. North America's robust technological infrastructure and widespread adoption of electronic payment methods, including credit cards and ACH transfers, have further catalyzed this trend. With strong regulatory frameworks and advanced cybersecurity measures in place, B2B digital payments in North America continue to grow, paving the way for a more digitized and interconnected business landscape.

The Asia-Pacific region is expected to witness the highest growth during the forecast period. This is due to technological, regulatory, and market-driven factors. Understanding and navigating these dynamics is essential for businesses and payment providers looking to succeed in this dynamic and rapidly evolving market.

The region's diverse economies engage in significant cross-border trade. B2B digital payments offer a streamlined and cost-effective alternative to traditional methods, reducing complexities associated with international transactions.

Key Market Players & Competitive Insights

The B2B digital payment market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Adyen N.V.

- Billtrust

- Coupa Software Inc.

- Dwolla, Inc.

- Earthport PLC

- FLEETCOR Technologies, Inc.

- Intuit Inc.

- Mastercard Incorporated

- Nvoicepay, Inc.

- Optal Limited

- Payoneer Inc.

- Paytm Mobile Solutions Private Limited

- PayPal Holdings, Inc.

- Stripe Inc.

- TransferWise Ltd. (Now known as Wise)

Recent Developments

- In August 2023, Belo, the digital wallet provider, unveiled a web platform designed to facilitate cross-border transactions for businesses. This initiative targets the specific hurdles encountered by micro, small, and medium enterprises (SMEs) in Latin America when engaging in international transactions, as reported by Contxto.

B2B Digital Payment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5.29 billion |

|

Revenue Forecast in 2032 |

USD 6.04 billion |

|

CAGR |

14.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Offering, By Transaction Type, By Payment Mode, By Industry Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Explore the landscape of B2B digital payment in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Dyslexia Treatment Market Size, Share 2024 Research Report

Marine Hatch Covers Market Size, Share 2024 Research Report

Heated Jacket Market Size, Share 2024 Research Report

3D Printing Gases Market Size, Share 2024 Research Report

Automotive Hypervisors Market Size, Share 2024 Research Report