Antibody Contract Manufacturing Market Size, Share, & Industry Analysis Report

By Product, By Product (Monoclonal Antibodies, Polyclonal Antibodies), By Source, By Therapeutic Area, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM6086

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

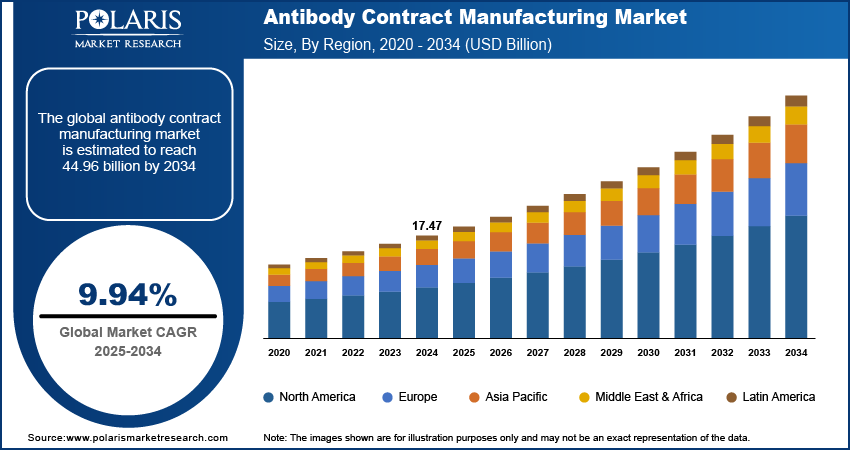

The global antibody contract manufacturing market size was valued at USD 17.47 billion in 2024, growing at a CAGR of 9.94% during 2025–2034. Rising cancer cases worldwide and the increasing global research and development (R&D) spending is fueling the growth of the antibody contract manufacturing market.

Key Insights

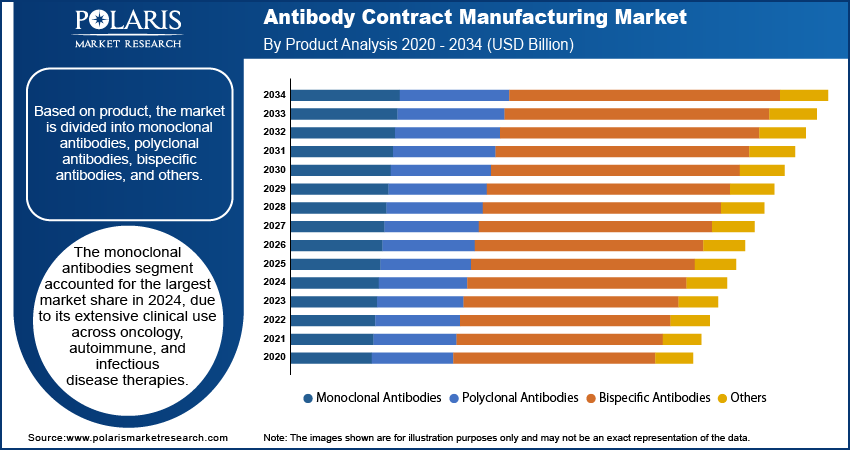

- The monoclonal antibodies segment dominated the market share in 2024.

- The infectious segment is projected to grow at a rapid pace in the coming years, driven by the rising incidence of viral and bacterial infections and increasing research on antibody-based prophylactics and therapeutics.

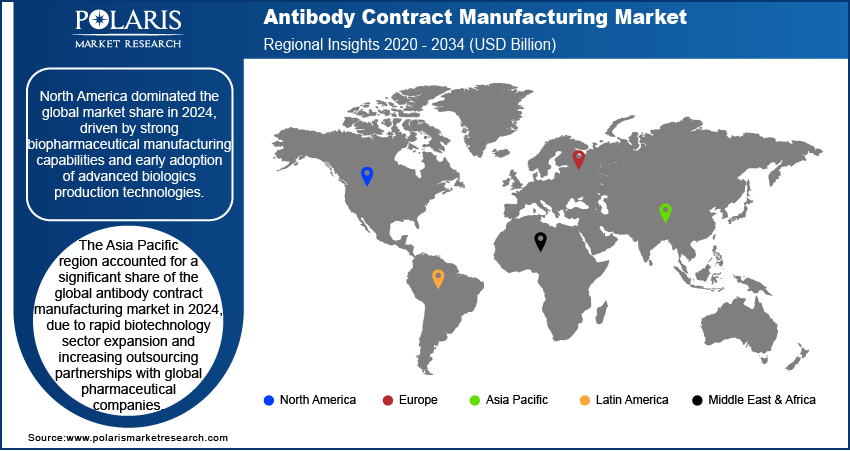

- The North America antibody contract manufacturing market dominated the global market share in 2024.

- The U.S. antibody contract manufacturing market is growing due to technological advancements in bioprocessing and increased investment in large-scale monoclonal antibody production.

- The market in Asia Pacific is projected to grow at the highest CAGR from 2025-2034, propelled by the rapid expansion of the biotechnology sector and cost-competitive large-scale manufacturing.

- Countries such as China and Japan are playing a key role in regional growth, due to expanding biologics pipelines and increasing outsourcing partnerships with global pharmaceutical companies.

Industry Dynamics

- Increasing global cancer burden is driving demand for antibody contract manufacturing by expanding the need for advanced bioprocessing technologies to support large-scale monoclonal and bispecific antibody production.

- The rising global R&D expenditures is fueling market growth by boosting biotechnology and pharmaceutical companies to outsource antibody development for faster clinical translation and commercial supply.

- The growing focus on personalized medicine and targeted biologics is creating significant opportunities for CMOs specializing in high-yield, quality-compliant antibody manufacturing.

- The high manufacturing cost and complex regulatory compliance requirements are limiting the participation of smaller CMOs, posing a challenge to market expansion.

Market Statistics

- 2024 Market Size: USD 17.47 billion

- 2034 Projected Market Size: USD 44.96 billion

- CAGR (2025-2034): 9.94%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Antibody contract manufacturing refers to outsourced services dedicated to the large-scale production of monoclonal and polyclonal antibodies for therapeutic, diagnostic, and research purposes. These services are widely used by pharmaceutical and biotechnology companies to support drug development, vaccine production, and diagnostic assay manufacturing. Contract manufacturers offer capabilities such as cell line development, upstream and downstream processing, purification, and formulation to deliver high-quality clinical and commercial-grade antibodies. These facilities are equipped with advanced bioreactors, single-use systems and automated process controls to ensure consistency, scalability and regulatory compliance. The services offered by antibody contract manufacturers are utilized by biopharmaceutical companies, research institutions and diagnostic developers for reliable and cost-efficient production to meet growing demand for targeted biologics.

The global rise in chronic illnesses is driving demand for antibody contract manufacturing by increasing the need for targeted biologics and immunotherapies. The growing prevalence of conditions such as cancer, rheumatoid arthritis, and cardiovascular diseases is expanding biologics pipelines, pushing pharmaceutical and biotechnology companies to outsource large-scale antibody production to contract manufacturing organizations. According to the Eurostat 2023 data, approximately 50.6% of Finland’s population and 43.2% of Germany’s population are living with chronic illness. Similarly, the U.S. Department of Health and Human Services reports that around 129 million people in the U.S. suffer from at least one major chronic disease. This trend is driving antibody manufacturing capacity worldwide and fueling steady market growth.

The growth in the pharmaceutical industry is fueling the antibody contract manufacturing market due to increasing development of biologics and targeted therapies. The expanding demand for therapeutic antibodies is enabling pharmaceutical companies to collaborate with contract manufacturing organizations (CMOs) to access advanced bioprocessing technologies and scale up production efficiently. This trend is accelerating clinical and commercial antibody manufacturing, contributing to steady market growth.

Drivers & Opportunities

Increasing Cases of Cancer Worldwide: The surge in global cancer cases is driving demand in the antibody contract manufacturing market due to the increasing adoption of monoclonal and bispecific antibodies in oncology treatments. According to the World Health Organization (WHO), around 20 million new cancer cases and 9.7 million cancer deaths were reported in 2022. About 53.5 million people were living within five years of a cancer diagnosis, and roughly 1 in 5 people are expected to develop cancer in their lifetime. By 2050, new cancer cases are expected to rise to over 35 million, a 77% increase from 2022. This rising burden underscores the growing focus on antibody-based immunotherapies for innovation in cancer treatment. In addition, the rising oncology drug pipelines are pushing pharmaceutical and biotechnology companies to outsource production to contract manufacturing organizations (CMOs) to meet growing clinical and commercial demand. This trend is boosting large-scale antibody production capabilities that is driving consistent market growth.

Rising Global R&D Expenditure: Rising global R&D spending is fueling demand in the antibody contract manufacturing market due to expanding biologics pipelines and increasing outsourcing of large-scale production. According to the World Intellectual Property Organization (WIPO), global R&D spending accounted for 2.39% in 2020 and it increased to 2.75% by 2023. This higher investment in drug discovery and clinical trials is stimulating pharmaceutical and biotechnology companies to collaborate with contract manufacturing organizations (CMOs) for advanced bioprocessing, faster production timelines and regulatory compliance. This trend is accelerating antibody production capacity and boosting market growth worldwide.

Segmental Insights

Product Analysis

Based on product, the segmentation includes monoclonal antibodies, polyclonal antibodies, bispecific antibodies, and others. The monoclonal antibodies segment accounted for the largest market share in 2024, due to its extensive clinical use across oncology, autoimmune, and infectious disease therapies. The high specificity, well-established regulatory pathways, and growing demand for biosimilars are emphasizing large-scale manufacturing contracts. Moreover, the approvals of next-generation monoclonal antibodies, including antibody-drug conjugates and checkpoint inhibitors, continue to fortify this segment’s position in clinical and commercial pipelines.

The bispecific antibodies segment is projected to expand at the highest rate through 2034, due to its dual-targeting capabilities, which enhance therapeutic efficacy in complex diseases such as cancer and immune disorders. Increasing contract manufacturing partnerships for scalable production of bispecific formats in oncology, is contributing to rapid market expansion. For instance, in April 2023, Lonza partnered with ABL Bio for the development and manufacturing of ABL Bio’s new bispecific antibody candidate. This collaboration aims to accelerate and optimize the pathway to clinical and commercial readiness for ABL Bio’s antibody product.

Source Analysis

In terms of source, the segmentation includes mammalian and microbial. The mammalian segment held the dominant market share in 2024, owing to its ability to produce complex, glycosylated antibodies with high efficacy and stability. Chinese Hamster Ovary (CHO) and Human Embryonic Kidney (HEK) cells remain the preferred expression systems for therapeutic-grade antibodies due to their proven scalability and regulatory acceptance. Moreover, technological advancements in single-use bioreactors and perfusion-based systems are enhancing yield and reducing production timelines for contract manufacturers, further firming this segment’s leadership in commercial-scale manufacturing.

The microbial segment is estimated to hold a significant market share in 2034, driven by its cost-effectiveness and suitability for producing antibody fragments and research-grade antibodies. Advancements in recombinant DNA technology are further improving scalability and reducing contamination risks, making microbial systems viable for specific therapeutic and diagnostic applications.

Therapeutic Area Analysis

Based on therapeutic area, the segmentation includes oncology, neurology, cardiology, infectious diseases, and other therapeutic areas. The oncology segment held the largest market share in 2024, due to the dominance of monoclonal and bispecific antibodies in cancer immunotherapy. Increasing approvals of targeted biologics, coupled with a robust clinical pipeline for solid tumors and hematologic malignancies, is driving demand for large-scale manufacturing contracts in this segment.

The infectious diseases segment is expected to expand at a notable pace during the forecast period. The growing incidence of viral and bacterial infections, coupled with active research into antibody-based prophylactics and therapeutics, is inspiring biopharmaceutical companies to outsource production to specialized contract manufacturers.

End User Analysis

Based on end user, the segmentation includes biopharmaceutical companies, research laboratories, and others. The biopharmaceutical companies segment accounted for the largest market share in 2024, due to the rising outsourcing of large-scale antibody production to reduce operational costs and accelerate time-to-market. This approach enables companies to reduce infrastructure and operational costs while focusing on core competencies such as drug discovery and clinical development. Contract manufacturers are offering end-to-end solutions, including cell line development, process optimization, and regulatory compliance management, making them strategic partners for biopharmaceutical firms.

The research laboratories segment is projected to grow at the fastest CAGR during the forecast period, driven by the expansion of academic and preclinical research in antibody engineering, immunology, and therapeutic discovery. Universities and research institutes are relying on CMOs for custom antibody production for early-stage proof-of-concept studies and clinical trial material. Additionally, the growing adoption of advanced technologies such as high-throughput screening and recombinant antibody engineering is creating new opportunities for contract manufacturers serving this segment.

Regional Analysis

North America antibody contract manufacturing industry dominated the global market share in 2024. This growth is driven by strong biopharmaceutical production capabilities and early adoption of advanced biologics. Additionally, increasing investment in large-scale monoclonal antibody (mAb) production and contract development partnerships is boosting the region’s manufacturing ecosystem across the US and Canada.

The U.S. Antibody Contract Manufacturing Market Insight

The U.S. dominated the regional market, due to technological advancements in antibody manufacturing that are fueling demand for contract manufacturing services by improving production efficiency and reducing operational costs. Biopharmaceutical companies are relying on CMOs that integrate advanced purification and bioprocessing technologies to optimize large-scale antibody production. For instance, in June 2025, Ecolab Life Sciences launched Purolite AP+50, a new affinity chromatography resin designed to boost efficiency and lower costs in antibody manufacturing. Such innovations are propelling the adoption of CMOs, enabling faster production timelines and contributing to market growth.

Asia Pacific Antibody Contract Manufacturing Market

The Asia Pacific antibody contract manufacturing industry is projected to reach by 2034. This is driven by the rapid expansion of the regional biotechnology sector and increasing outsourcing partnerships with global pharmaceutical companies. Countries such as China, South Korea, and Japan are witnessing significant growth in biologics pipelines, enabling biotech firms to collaborate with CMOs to access advanced bioprocessing facilities and scale up clinical and commercial production. Moreover, growing regulatory reforms and cost-competitive manufacturing are attracting international biotech firms to outsource production to Asia Pacific CMOs.

India Antibody Contract Manufacturing Market Insight

Rapid expansion of the biotechnology sector is driving demand for antibody contract manufacturing by increasing the development of monoclonal antibodies, bispecific antibodies, and other biologics. Biotech firms are outsourcing production to CMOs to access advanced bioprocessing facilities, ensure regulatory compliance, and scale up manufacturing for clinical and commercial supply. According to the Department of Biotechnology- Biotechnology Industry Research Assistance Council (DPT-BIRAC) of India, the country’s biotechnology industry was valued at USD 44 billion in 2017 and is projected to reach USD 300 billion by 2030, growing at a CAGR of over 15.8%. This rapid growth in biologics pipelines is expected to drive strong demand for antibody CMOs in this area.

Europe Antibody Contract Manufacturing Market Overview

Increasing R&D expenditure in Europe is driving the market due to growing investment in biologics and advanced therapeutic research, which is boosting pharmaceutical and biotech firms to outsource large-scale antibody production to CMOs for faster development and supply. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), research and development (R&D) expenditure increased from USD 20.4 million in 2020 to USD 54.1 million in 2023. This sustained rise in research funding is solidifying commercial-scale antibody manufacturing and helping in steady market growth across the region.

Key Players & Competitive Analysis Report

The antibody contract manufacturing market is highly competitive, with leading players competing on production capacity, process efficiency, and regulatory compliance. These companies focus on advanced bioprocessing technologies, including single-use systems, continuous manufacturing, and high-yield cell culture platforms, to meet the growing demand for monoclonal antibodies, bispecifics and other complex biologics. The competitive dynamics are further shaped by long-term supply agreements, technology licensing, and partnerships with biotech firms to accelerate clinical and commercial production.

Key companies in the industry include Lonza Group AG, Samsung Biologics, WuXi Biologics, Boehringer Ingelheim International GmbH, Fujifilm Diosynth Biotechnologies, Catalent, Inc., AbbVie Inc., Thermo Fisher Scientific Inc., Shilpa Medicare Ltd., Lotte Biologics, Merck Group, and Charles River Laboratories.

Key Players

- AbbVie Inc.

- Boehringer Ingelheim International GmbH

- Catalent, Inc.

- Charles River Laboratories

- Fujifilm Diosynth Biotechnologies

- Lonza Group AG

- Lotte Biologics

- Merck Group

- Samsung Biologics

- Shilpa Medicare Ltd.

- Thermo Fisher Scientific Inc.

- WuXi Biologics

Industry Developments

July 2025: Lotte Biologics partnered with Ottimo Pharma to produce the antibody drug substance for Jankistomig, a dual PD1/VEGFR2-targeting cancer therapy. This collaboration aims to enhance LOTTE’s growing role as a competitive global CDMO in antibody therapeutics.

June 2025: MilliporeSigma, the CDMO division of Merck KGaA partnered with Simtra BioPharma Solutions to provide a comprehensive, turnkey antibody-drug conjugate (ADC) manufacturing service. This partnership aims to simplify and accelerate the development process for biopharma companies by integrating expertise across the ADC manufacturing value chain.

March 2025: Shilpa Medicare launched its new full-service hybrid Contract Development and Manufacturing Organization (CDMO) platform to offer integrated solutions from early development to commercial-scale manufacturing. The platform is designed to accelerate drug development by combining complex generics, biologics, and oncology with advanced technology and integrated capabilities.

Antibody Contract Manufacturing Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Monoclonal Antibodies

- Polyclonal Antibodies

- Bispecific Antibodies

- Others

By Source Outlook (Revenue, USD Billion, 2020–2034)

- Mammalian

- Microbial

By Therapeutic Area (Revenue, USD Billion, 2020–2034)

- Oncology

- Neurology

- Cardiology

- Infectious Diseases

- Other Therapeutic Areas

By End User (Revenue, USD Billion, 2020–2034)

- Biopharmaceutical Companies

- Research Laboratories

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Antibody Contract Manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 17.47 Billion |

|

Market Size in 2025 |

USD 19.16 Billion |

|

Revenue Forecast by 2034 |

USD 44.96 Billion |

|

CAGR |

9.94% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

Antibody Contract Manufacturing Industry Trend Analysis (2024) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 17.47 billion in 2024 and is projected to grow to USD 44.96 billion by 2034.

The global market is projected to register a CAGR of 9.94% during the forecast period.

North America dominated the market share in 2024 due to strong biopharmaceutical manufacturing capabilities and early adoption of advanced antibody production technologies.

A few of the key players in the market are Lonza Group AG, Samsung Biologics, WuXi Biologics, Boehringer Ingelheim International GmbH, Fujifilm Diosynth Biotechnologies, Catalent, Inc., AbbVie Inc., Thermo Fisher Scientific Inc., Shilpa Medicare Ltd., Lotte Biologics, Merck Group, and Charles River Laboratories.

The monoclonal anitibodies segment dominated the market share in 2024, due to its extensive clinical use in oncology, autoimmune, and infectious disease therapies, along with a robust biosimilar pipeline.

The microbial segment is expected to witness the fastest growth during the forecast period, due to its cost-effectiveness and suitability for producing antibody fragments and research-grade antibodies.