Antiparasitic Drugs Market Share, Size, Trends, & Industry Analysis Report

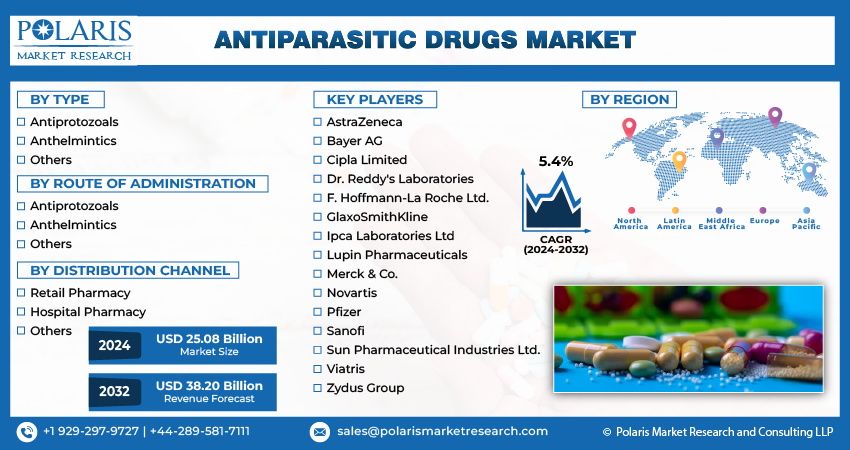

By Type (Antiprotozoals, Anthelmintics, Others); By Route of Administration; By Distribution Channel; By Region; Segment Forecast, 2025- 2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM4409

- Base Year: 2024

- Historical Data: 2020 - 2023

The Antiparasitic Drugs Market is expected to be valued at USD 3.01 billion in 2024 and grow at a CAGR of 4.4% through 2034. Growth is driven by disease outbreaks in tropical regions, growing awareness of zoonotic infections, and veterinary antiparasitic demand.

Market Introduction

The demographics of affected populations significantly drive the demand for antiparasitic drugs, contributing to market expansion. Factors such as population growth, demographic shifts, and urbanization influence the susceptibility to parasitic infections, creating a growing need for effective treatments. The prevalence of these infections in diverse age groups and demographics underscores the broad market demand. As populations expand, particularly in regions prone to parasitic diseases, pharmaceutical companies respond to the evolving patient demographics by developing and offering targeted antiparasitic drugs.

In addition, companies operating in the market are concentrating on developing new solutions to cater to the growing market demand.

- For instance, in March 2022, May & Baker Nigeria Plc., the leading pharmaceutical company in Nigeria, introduced a novel medication aimed at combatting malaria parasites nationwide.

Progress in pharmaceutical research plays a pivotal role in the expansion of the antiparasitic drugs market share. Ongoing advancements, spanning innovative formulations to state-of-the-art therapeutic strategies, contribute to heightened efficacy and safety in antiparasitic drugs. These breakthroughs effectively tackle challenges like drug resistance and adverse effects, thereby fueling the market's progression. Innovations in delivery systems, facilitated by technological strides, improve treatment accuracy and enhance patient adherence.

To Understand More About this Research: Request a Free Sample Report

Industry Growth Drivers

-

Global health initiatives are projected to spur the product demand

Global health initiatives are instrumental in driving up the demand for antiparasitic drugs, specifically targeting prevalent diseases like malaria, leishmaniasis, and helminth infections. Their dedicated efforts are focused on controlling and eradicating parasitic infections, especially in regions grappling with elevated disease prevalence, resulting in an increased market demand. The collaboration between governments, NGOs, and pharmaceutical entities is pivotal, pooling resources and expertise to improve accessibility to effective antiparasitic medications. As these initiatives gain momentum, there is a growing awareness that fosters early diagnosis and treatment. This collective commitment significantly amplifies the importance of antiparasitic drugs, propelling market expansion and contributing to overarching global public health goals.

-

Prevalence of parasitic infections is expected to drive antiparasitic drugs market growth

The widespread occurrence of parasitic infections, spanning ailments like malaria, leishmaniasis, and helminth infections, is a potent catalyst behind the heightened demand for antiparasitic drugs. Particularly prevalent in tropical zones, these infections underscore the urgent need for efficacious treatments. Amidst a rising global health burden, there is an increasing imperative for advanced antiparasitic medications. Pharmaceutical innovation in the development of antiparasitic drugs becomes indispensable, shaping a resilient market response to the escalating healthcare challenges posed by these infections.

Industry Challenges

-

Regulatory challenges are likely to impede the market growth

Regulatory challenges exert influence on the antiparasitic drugs market industry, impacting various facets of drug development. The stringent approval processes mandated by regulatory bodies extend development timelines and escalate costs, creating formidable barriers to market entry. Parasite-specific regulatory requirements introduce intricacies into drug development and approval processes, while rigorous data demands become significant hurdles, necessitating substantial resources and time commitment. Ongoing post-market surveillance requirements for drug safety and efficacy, coupled with the challenge of monitoring drug resistance, further complicate regulatory compliance. Inconsistencies in guidelines across jurisdictions contribute to global compliance challenges, and the dynamic regulatory landscape demands adaptability in drug development strategies. Accessing expedited regulatory pathways becomes crucial for timely approvals, but qualification hurdles pose challenges for manufacturers seeking accelerated processes.

Report Segmentation

The antiparasitic drugs market analysis is primarily segmented based on type, route of administration, distribution channel, and region.

|

By Type |

By Route of Administration |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

-

Anthelmintics segment accounted for significant market share in 2024

The Anthelmintics segment accounted for a significant market share in 2024. Anthelmintics, a specialized class of antiparasitic drugs, are meticulously designed to combat infections caused by parasitic worms known as helminths. Operating by disrupting the physiological processes of parasitic worms, anthelmintics lead to the expulsion of these parasites from the host organism. Available in diverse formulations, including oral medications and injectables, anthelmintics are instrumental in controlling and preventing parasitic worm infestations. Their targeted action and efficacy make them indispensable in addressing the diverse challenges posed by helminthic infections, spanning medical and veterinary applications.

By Route of Administration Analysis

-

Injectable segment accounted for significant market share in 2024

The injectable segment accounted for a significant market share in 2024. Administered through injections, these drugs deliver a rapid and direct response, particularly effective in severe cases or when oral administration is challenging. Injectable formulations ensure precise dosing and swift absorption, contributing to the timely and targeted treatment of parasitic diseases. This mode of administration is often employed in healthcare settings, underlining its significance in managing and combating parasitic infections efficiently. It is particularly beneficial when immediate and potent therapeutic intervention is required for optimal patient outcomes.

By Distribution Channel Analysis

-

Hospital pharmacy segment held significant market revenue share in 2024

The hospital pharmacy segment held a significant revenue share in 2024. These pharmacies are found inside medical facilities and are essential to the supply and accessibility of antiparasitic drugs. Healthcare providers frequently write prescriptions for patients who have been diagnosed with parasite illnesses while they are in a hospital. For quick and controlled access to these recommended antiparasitic medications, hospital pharmacies are the main source. Furthermore, having knowledgeable pharmacists on staff makes it easier to educate patients about possible side effects and how to take medications correctly. The direct correlation between hospital pharmacy and the provision of antiparasitic drugs improves the total efficacy of managing parasitic infections within healthcare systems.

Regional Insights

-

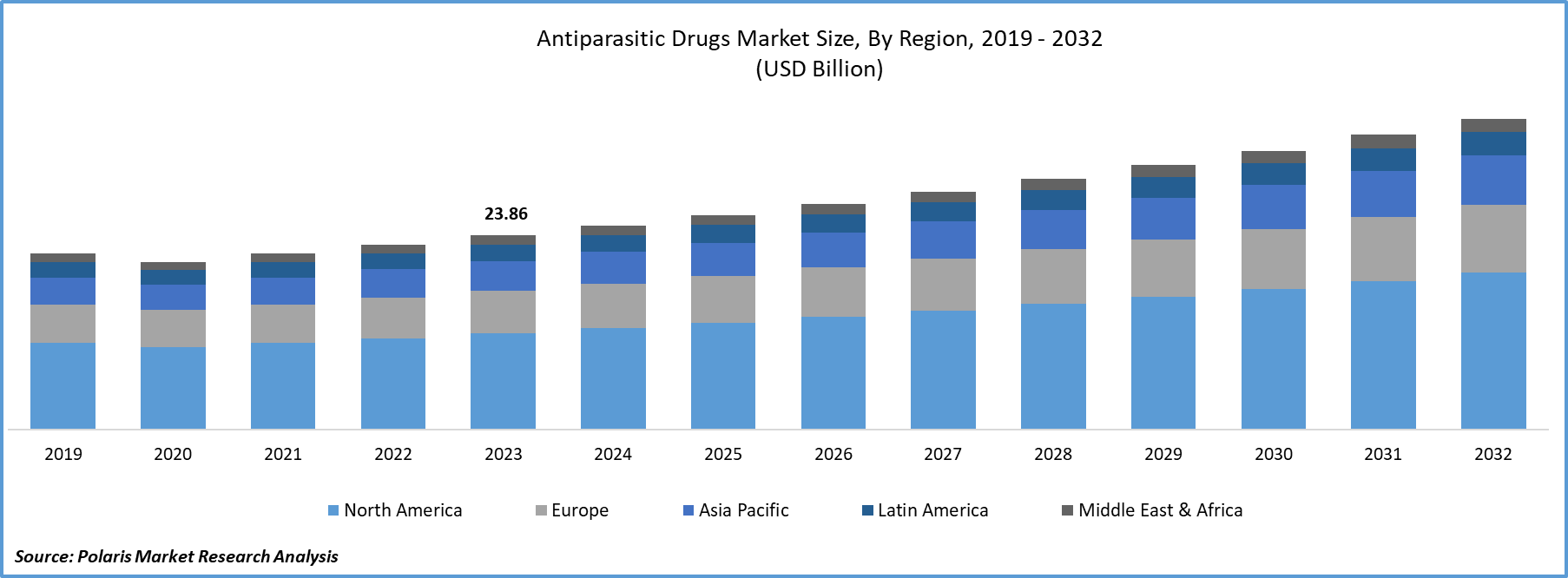

North America region dominated the global market in 2024

In 2024, the North American region dominated the global market. The varied healthcare environment of the region molds the antiparasitic drugs sector in North America. Different geographic areas showcase differing prevalence of parasitic infections, like malaria and Chagas disease, impacting market demand. Notably, major pharmaceutical firms allocate substantial resources to research and development, focusing on innovating drug formulations. To bolster their market standing, these companies partake in strategic partnerships and acquisitions. Rigorous regulatory standards oversee drug approval, assuring both safety and efficacy. North American entities actively contribute to global health endeavors addressing parasitic diseases. Despite growth spurred by heightened awareness and diagnosis, challenges such as drug resistance and healthcare inequalities influence market dynamics.

Over the projected period, the Asia-Pacific region is likely to experience significant growth. Asia-Pacific's disease patterns, which are characterized by a wide variety of parasitic illnesses such as helminthiasis, leishmaniasis, and malaria, are a major factor for antiparasitic drug market growth. The need for focused pharmacological therapies is highlighted by the region's distinct epidemiological environment, which is marked by a variety of parasitic disease kinds and prevalence. Pharmaceutical companies in Asia-Pacific place a high priority on research and development to provide antiparasitic medications that are effective since these diseases have a substantial influence on public health. In order to effectively treat the diverse problems provided by parasite infections throughout Asia-Pacific, it becomes important to customize medicine formulations to target the distinct disease patterns that are prevalent in different places.

Key Market Players & Competitive Insights

The antiparasitic drugs market share landscape is characterized by diversity, and with the entry of multiple new players, competition is anticipated to intensify. Established market leaders continually improve their technologies to uphold a competitive edge, placing emphasis on efficiency, integrity, and safety. These entities prioritize strategic initiatives, including partnerships, product enhancements, and collaborative ventures, aiming to outperform their peers. Their objective is to secure a significant antiparasitic drugs market share.

Some of the major players operating in the global antiparasitic drugs market include:

- AstraZeneca

- Bayer AG

- Cipla Limited

- Dr. Reddy's Laboratories

- F. Hoffmann-La Roche Ltd.

- GlaxoSmithKline

- Ipca Laboratories Ltd

- Lupin Pharmaceuticals

- Merck & Co.

- Novartis

- Pfizer

- Sanofi

- Sun Pharmaceutical Industries Ltd.

- Viatris

- Zydus Group

Recent Developments

- In October 2024 – FDA approves Elanco’s Credelio Quattro canine chewable tablet covering six parasitic infections

- In April 2023, ASTRA Therapeutics secured funding for the development of anti-parasite drugs. The company's objective is to utilize the received funds to generate a panel of additional patented Parabulins, specifically targeting economically significant diseases. Additionally, ASTRA Therapeutics plans to allocate its initial investments towards enhancing its research and development infrastructure.

- In November 2022, Novartis and Medicines for Malaria Venture (MMV) disclosed their intention to advance the ganaplacide/lumefantrine-solid dispersion formulation (SDF) into the Phase 3 stage of development. This progression is geared towards addressing the treatment needs of patients experiencing acute uncomplicated malaria caused by Plasmodium falciparum.

Report Coverage

The market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, types, routes of administration, distribution channels and their futuristic growth opportunities.

Antiparasitic Drugs Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 3.1 billion |

|

Revenue forecast in 2034 |

USD 4.4 billion |

|

CAGR |

4.40% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Delve into the intricacies of Antiparasitic Drugs in 2025 through the meticulously compiled market share, size, and revenue growth rate statistics by Polaris Market Research Industry Reports. Uncover a comprehensive analysis that not only projects market trends up to 2034 but also provides valuable insights into the historical landscape. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report

Browse Our Top Selling Reports

Canopy Market Size, Share 2024 Research Report

Luxury Cigar Market Size, Share 2024 Research Report

Metal Stamping Market Size, Share 2024 Research Report

3D Imaging Market Size, Share 2024 Research Report

Managed SIEM Services Market Size, Share 2024 Research Report

FAQ's

The global Antiparasitic Drugs market size is expected to reach USD 4.4 billion by 2034

Key players in the market are Bayer AG, Cipla Limited, F. Hoffmann-La Roche Ltd., GlaxoSmithKline

North America contribute notably towards the global Antiparasitic Drugs Market

Antiparasitic Drugs Market exhibiting the CAGR of 4.40% during the forecast period.

The Antiparasitic Drugs Market report covering key segments are type, route of administration, distribution channel, and region.