Aorto-Iliac Occlusive Disease Treatment Market Size, Share, & Industry Analysis Report

: By Device Type (Endovascular Devices and Surgical Devices), By Procedure, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5750

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

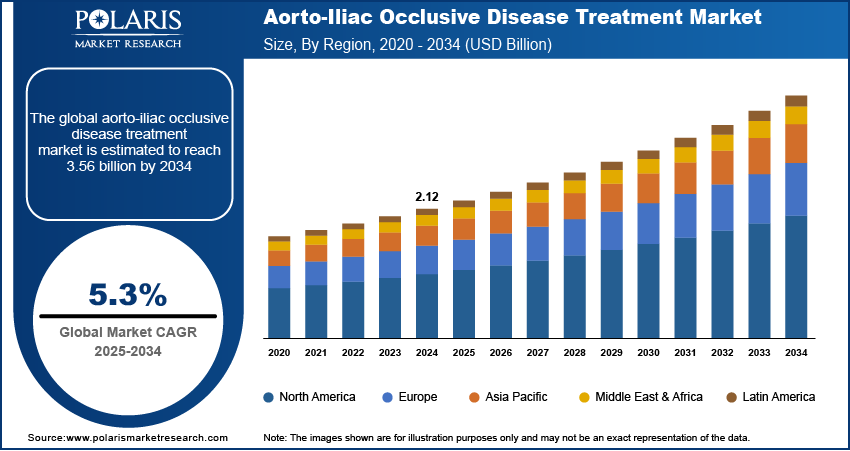

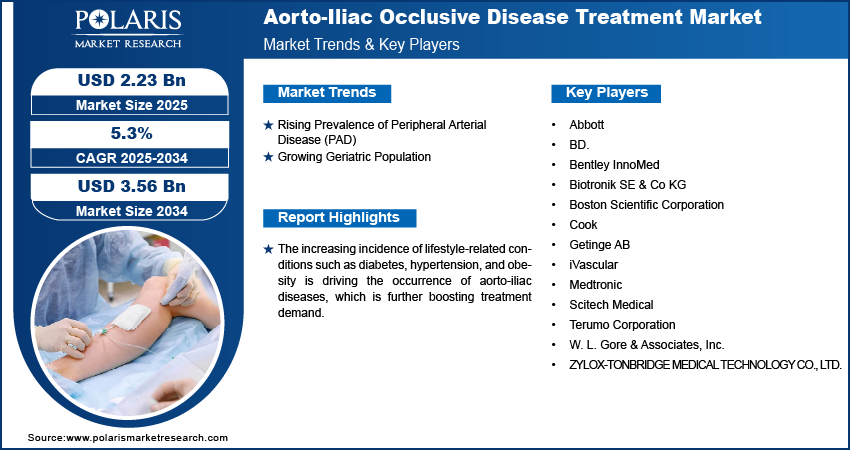

The global aorto-iliac occlusive disease treatment market size was valued at USD 2.12 billion in 2024 and is projected to register a CAGR of 5.3% during 2025–2034. The increasing prevalence of lifestyle-related conditions such as diabetes, hypertension, and obesity is driving the occurrence of aorto-iliac diseases, which is further boosting treatment demand.

The aorto-iliac occlusive disease treatment market refers to the segment of vascular therapies focused on diagnosing and managing blockages or narrowing in the aorta and iliac arteries, typically caused by atherosclerosis. These conditions lead to reduced blood flow to the lower limbs, causing pain, ulcers, or even limb-threatening ischemia. Treatments include lifestyle modifications, medications, minimally invasive surgery (such as angioplasty and stenting), and open surgical interventions. Technological advancements in endovascular techniques, including drug-eluting stents and atherectomy devices, are enhancing patient outcomes and encouraging adoption.

To Understand More About this Research: Request a Free Sample Report

Rising awareness about vascular health and improved screening protocols are leading to earlier detection and timely intervention of aorto-iliac occlusive disease. Additionally, continuous R&D in vascular devices and biocompatible materials is expanding treatment options, making them safer and more effective for broader use.

Industry Dynamics

Rising Prevalence of Peripheral Arterial Disease (PAD)

The growing number of people affected by lifestyle-related conditions such as diabetes, high blood pressure, and obesity is leading to a higher risk of peripheral arterial disease (PAD), which often involves the aorto-iliac arteries. According to the American Heart Association, 200 million individuals are affected by peripheral arterial disease worldwide. These health issues cause damage to blood vessels over time, making individuals more prone to blockages in major arteries. As a result, more patients are being diagnosed with aorto-iliac occlusive disease, which is creating greater demand for effective treatment options. Early detection and awareness around PAD are improving, leading to timely medical interventions. This trend is pushing healthcare providers and medical device makers to expand treatment solutions tailored for such conditions.

Growing Geriatric Population

An increase in the aging population is directly contributing to the rise in aorto-iliac occlusive disease cases. According to the World Health Organization, 1 in 6 people will be aged 60 and above, increasing from 1 billion in 2020 to 1.4 billion by 2030. By 2050, this population will double to 2.1 billion, with those aged 80 and above expected to triple to 426 million. Older adults naturally experience wear and tear in their blood vessels, making them more vulnerable to arterial blockages and related complications. This population group often requires regular check-ups, imaging tests, and interventional procedures to manage their condition effectively. The growing demand for minimally invasive treatments and supportive care solutions among the elderly is pushing the healthcare sector to invest in better diagnostic services and safer therapies. Hence, the rising geriatric population drives the demand for aorto-iliac occlusive disease treatment.

Segment Insights

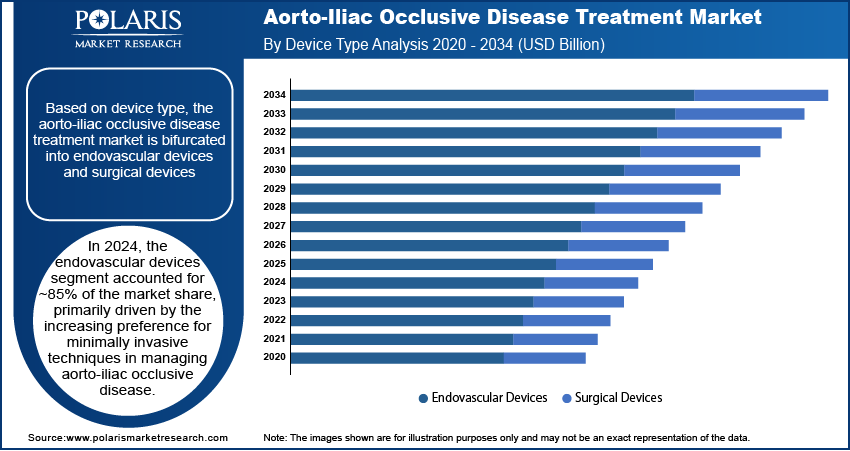

Market Assessment by Device Type

In 2024, the endovascular devices segment accounted for ~85% of the share, primarily driven by the increasing preference for minimally invasive techniques in managing aorto-iliac occlusive disease. Surgeons and interventional radiologists favor stents, balloons, and atherectomy devices for their ability to restore blood flow with minimal trauma, reduced recovery times, and fewer complications compared to open surgery. Advancements in drug-eluting stents and flexible delivery systems have improved procedural success in tortuous iliac anatomies. The clinical adoption of image-guided endovascular tools has further contributed to precision and positive outcomes, establishing these devices as a standard in first-line intervention strategies.

The surgical devices segment is projected to register the highest CAGR during the forecast period due to the growing use of open bypass surgery in complex or long-segment aorto-iliac occlusions that are unsuitable for endovascular repair. High-risk patients with heavily calcified vessels or failed prior stenting procedures often require durable surgical solutions. Innovations in vascular graft materials and improved perioperative care are enhancing outcomes, reducing infection risks, and promoting faster healing. Surgeons are increasingly integrating advanced surgical equipment such as surgical staplers, vessel-sealing devices, and custom graft configurations, supporting the growth of this segment in tertiary care and specialty cardiovascular centers.

Market Assessment by Procedure

In 2024, the endovascular procedures segment accounted for the largest share, due to their growing acceptance as the first-line treatment for aorto-iliac occlusive disease. The less invasive nature of these procedures allows for shorter hospital stays, reduced post-operative complications, and faster return to normal activities. Physicians prefer angioplasty and stenting for their repeatability, cost-effectiveness, and favorable risk-benefit profile, especially in patients with comorbidities. Widespread training in endovascular techniques and increased availability of cath labs in urban hospitals have boosted procedure volumes. Ongoing clinical trials and favorable reimbursement policies have also contributed to their rapid integration into routine practice.

The hybrid procedures segment is expected to register the highest CAGR during the forecast period, driven by rising clinical demand for combined surgical and endovascular solutions in complex, multilevel arterial disease. Surgeons are increasingly employing a hybrid approach such as iliac stenting combined with femoral endarterectomy for better long-term outcomes in anatomically challenging cases. Hybrid operating rooms equipped with advanced imaging enable seamless transition between open and catheter-based interventions during a single session. This method minimizes patient risk, especially in those with diffuse disease or failed previous interventions. The shift toward personalized treatment strategies is also encouraging greater use of hybrid techniques in specialized vascular centers.

Market Evaluation by End Use

In 2024, the hospitals segment accounted for ~48% of the share, fueled by their capacity to manage high-risk cases requiring multidisciplinary teams, advanced imaging, and surgical backup. Hospitals remain the primary setting for both endovascular and open surgical interventions, particularly for patients with severe comorbidities needing intensive monitoring. The availability of hybrid operating rooms, vascular ICUs, and around-the-clock specialist care supports complex aorto-iliac reconstructions. Institutions are also increasingly involved in clinical research and the adoption of next-generation devices, further solidifying their role in advanced vascular treatment delivery. Large-scale procurement and institutional funding support are driving hospital-based procedure volumes.

The outpatient facilities segment is expected to register the highest CAGR from 2025 to 2034 due to the growing shift toward same-day procedures using endovascular techniques that do not require extended hospitalization. Improvements in patient screening, local anesthesia protocols, and post-operative monitoring have made ambulatory settings suitable for routine aorto-iliac interventions. These centers offer lower procedural costs, shorter wait times, and greater convenience, leading to increased patient preference and insurer support. Investments in portable imaging systems and compact cath labs have made it feasible to perform high-precision interventions safely outside hospital environments. Vascular-focused outpatient clinics are expanding rapidly to meet the demand for aorto-iliac occlusive disease treamtment.

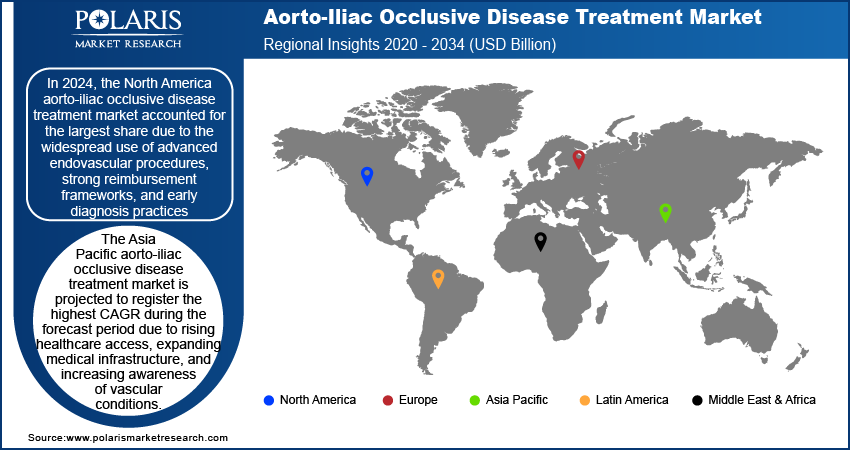

Regional Analysis

In 2024, the North America aorto-iliac occlusive disease treatment market accounted for ~40% of the share due to the widespread use of advanced endovascular procedures, strong reimbursement frameworks, and early diagnosis practices. A well-established healthcare infrastructure and a high number of vascular specialists have made it easier for patients to access effective treatment. Growing awareness about peripheral artery disease, along with increased screening for high-risk individuals, has led to early intervention and better outcomes. Ongoing clinical research and a high adoption rate of new medical devices have also supported steady growth.

US Aorto-Iliac Occlusive Disease Treatment Market

The US holds the largest share in the aorto-iliac occlusive disease treatment landscape in North America due to the presence of a large patient pool affected by diabetes, hypertension, and obesityconditions that often lead to arterial blockages. According to the Centers for Disease Control and Prevention, in the US, the obesity prevalence in adults was 40.3% from 2021 to 2023, with no significant differences by gender. Adults aged 40 to 59 had higher rates than those aged 20 to 39 and 60 or older. A high rate of adoption for minimally invasive procedures, along with access to advanced treatment centers and specialized vascular surgeons, has boosted treatment demand. Continuous investments in vascular research and development, combined with strong regulatory support for device approvals, ensure faster introduction of innovative solutions. Favorable insurance policies and the growing preference for outpatient vascular care have further supported leadership in the country.

Asia Pacific Aorto-Iliac Occlusive Disease Treatment Market

The Asia Pacific market is projected to register the highest CAGR during the forecast period due to rising healthcare access, expanding medical infrastructure, and increasing awareness of vascular conditions. A growing aging population, rising disposable income of the middle-class population, and improved affordability of healthcare services have led to higher diagnosis and treatment rates. For instance, according to the World Health Organization, China is experiencing one of the most rapid increases in its aging population. Projections indicate that by 2040, individuals aged 60 and above are expected to constitute ~28% of the total population. Governments in several countries are focusing on noncommunicable disease control, which includes vascular health, further boosting early screening. Increasing collaboration between global device makers and local hospitals is improving the availability of advanced procedures. The adoption of modern endovascular techniques is growing rapidly in both urban and semi-urban areas, accelerating overall expansion.

Europe Aorto-Iliac Occlusive Disease Treatment Market

The aorto-iliac occlusive disease treatment market in Europe is experiencing steady growth, driven by an aging population and an increase in patients suffering from chronic vascular conditions. Medical professionals are emphasizing early diagnosis and treatment, supported by national health programs and preventive care initiatives. Hospitals across the region are well-equipped to perform both endovascular and open surgical procedures, and ongoing training programs ensure specialists remain updated on evolving techniques. Research centers and clinical trials are promoting the use of innovative devices and hybrid procedures. Strong collaboration between healthcare providers and manufacturers is enabling smoother integration of new technologies into standard treatment pathways.

Key Players and Competitive Analysis

The competitive landscape of the aorto-iliac occlusive disease treatment market is defined by robust industry analysis, increasing collaboration, and innovation-led growth. Players are focusing on strategic alliances and joint ventures to enhance their presence across diagnostic and interventional care segments. Continuous technological advancements, particularly in drug-eluting stents, self-expanding stents, and hybrid revascularization techniques, are reshaping clinical outcomes. Companies are prioritizing market expansion strategies such as acquisitions of specialized device manufacturers and post-merger integration to strengthen their portfolios. Frequent product launches targeting minimally invasive therapies reflect a clear trend toward procedural efficiency and patient-centric care. Strategic efforts are also being made to penetrate outpatient and ambulatory care settings, where demand for quicker recovery and lower costs is surging. Additionally, collaborations between industry and research institutions are increasing clinical trials focused on complex occlusions and long-term outcomes. The competitive space continues to evolve as precision devices and integrated vascular care models gain momentum across the treatment ecosystem.

List of Key Companies

- Abbott

- BD.

- Bentley InnoMed

- Biotronik SE & Co KG

- Boston Scientific Corporation

- Cook

- Getinge AB

- iVascular

- Medtronic

- Scitech Medical

- Terumo Corporation

- W. L. Gore & Associates, Inc.

- ZYLOX-TONBRIDGE MEDICAL TECHNOLOGY CO., LTD.

Aorto-Iliac Occlusive Disease Treatment Industry Developments

In March 2024, Cook Medical signed a distribution deal with Getinge for the iCast covered stent system in the US, aiming to improve access to the device used in treating iliac artery disease.

In January 2024, Zylox-Tonbridge Medical Technology Co., Ltd. received marketing approval from the NMPA for its ZYLOX Peripheral Venous Stent System, designed to treat lower limb and pelvic venous disorders caused by iliac vein compression.

Aorto-Iliac Occlusive Disease Treatment Market Segmentation

By Device Type Outlook (Revenue, USD Billion, 2020–2034)

- Endovascular Devices

- Balloon Angioplasty Devices

- Atherectomy Systems

- Stents

- Surgical Devices

By Procedure Outlook (Revenue, USD Billion, 2020–2034)

- Endovascular Procedures

- Hybrid Procedures

- Open Surgical Procedures

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Outpatient Facilities

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aorto-Iliac Occlusive Disease Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2.12 billion |

|

Market Size Value in 2025 |

USD 2.23 billion |

|

Revenue Forecast by 2034 |

USD 3.56 billion |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.12 billion in 2024 and is projected to grow to USD 3.56 billion by 2034.

The global market is projected to register a CAGR of 5.3% during the forecast period.

In 2024, North America held the largest share due to the widespread use of advanced endovascular procedures, strong reimbursement frameworks, and early diagnosis practices.

A few of the key players are Abbott; BD.; Bentley InnoMed; Biotronik SE & Co KG; Boston Scientific Corporation; Cook; Getinge AB; iVascular; Medtronic; Scitech Medical; Terumo Corporation; W. L. Gore & Associates, Inc.; and ZYLOX-TONBRIDGE MEDICAL TECHNOLOGY CO., LTD.

In 2024, the endovascular devices segment accounted for ~85% of the market share, primarily driven by the increasing preference for minimally invasive techniques in managing aorto-iliac occlusive disease.

In 2024, the hospitals segment accounted for ~48% of the market share, fueled by their capacity to manage high-risk cases requiring multidisciplinary teams, advanced imaging, and surgical backup.