Aseptic Sampling Market Share, Size, Trends, Industry Analysis Report

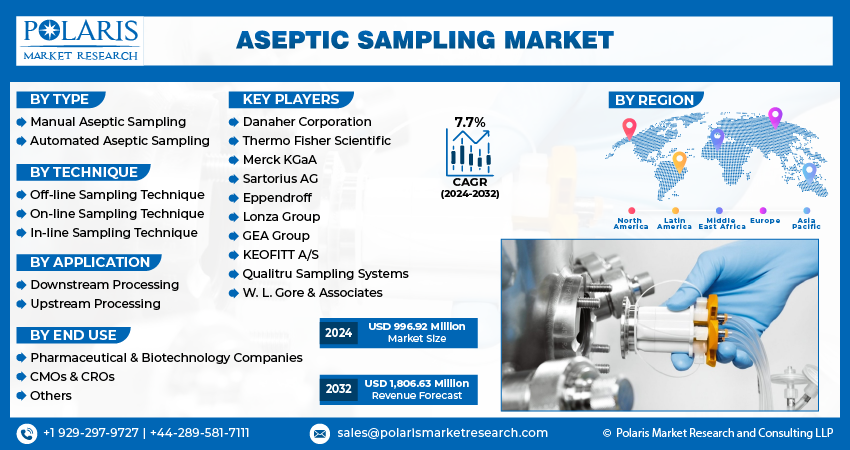

By Type (Manual Aseptic Sampling, Automated Aseptic Sampling); By Technique; By Application; By End-use; By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Mar-2024

- Pages: 115

- Format: PDF

- Report ID: PM4397

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

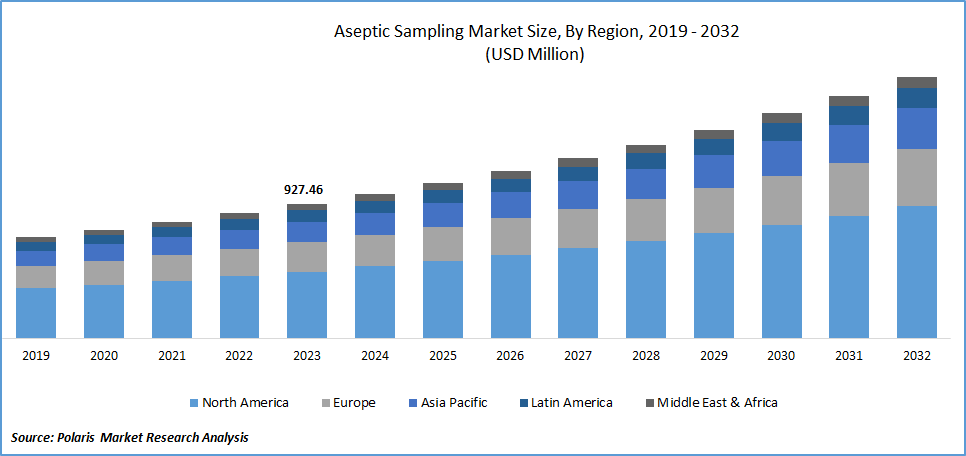

The global aseptic sampling market was valued at USD 927.46 million in 2023 and is expected to grow at a CAGR of 7.7% during the forecast period.

Factors such as the increasing global population, a growing demand for personalized medicines, and advancements in technology are expected to drive the growth of the market. Additionally, the rising investments in research and development activities, a growing focus on vaccine and drug development, and increased awareness of contamination risks are further anticipated to propel market growth throughout the forecast period.

The increasing shift towards personalized medicine has resulted in a broader array of pharmaceutical products, necessitating specific aseptic sampling techniques to enhance the production of various drug developments. This is driven by the rising number of research and development activities aimed at ensuring the production of higher-quality drugs. The pursuit of personalized medicine involves extensive research and development endeavors, encompassing the exploration of new biomarkers & diagnostic tools. Aseptic sampling plays a crucial role in research settings by preserving the quality of the biological samples used for the exploration & development of personalized therapies.

To Understand More About this Research:Request a Free Sample Report

The rising demand within the pharmaceuticals & biotechnology sectors has a substantial influence on the industry. As the global population continues to grow, and there is an increasing need for healthcare solutions, pharmaceutical companies frequently scale up their production volumes. Consequently, the escalating production levels are expected to enhance the growth of these methods, ensuring a consistent standard of product quality & safety.

Industry Dynamics

Growth Drivers

- Aseptic sampling technologies thrive in the boom of pharmaceutical and biotech sectors

The market has experienced a positive impact from the COVID-19 pandemic, especially within the pharmaceutical and biotech sectors. The intensified emphasis on vaccine development and the manufacturing of treatments has led to a heightened need for aseptic sampling technologies to guarantee sterile processes. This surge in demand has created opportunities for companies operating in the market. Moreover, the increased importance of maintaining rigorous hygiene standards in response to the pandemic has spurred industries to invest in advanced aseptic sampling solutions, fostering growth and innovation within the sector.

As per a WHO article, the supply of vaccine doses reached around 16 billion in 2021, with a cumulative value of USD 141 billion. In comparison, in 2019, about 5.8 billion vaccine doses were manufactured and supplied, amounting to a total market value of USD 38 billion during that year. This substantial increase is primarily attributed to the production of COVID-19 vaccines, significantly impacting market growth throughout the forecast period.

Report Segmentation

The market is primarily segmented based on type, technique, application, end use and region.

|

By Type |

By Technique |

By Application |

By End Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Type Analysis

- Manual segment accounted for the largest revenue share in 2023

The manual sampling segment accounted for the largest revenue share of the market in 2023. Manual methods offer a substantial degree of customization tailored to the specific requirements of a given sampling scenario. Researchers and companies can adapt techniques and tools according to the sample type and environmental conditions, offering a level of flexibility that may pose challenges to achieve with automated systems.

The automated sampling segment will grow rapidly over the market forecast period. The heightened efficiency, accuracy, and adherence to aseptic conditions in automated systems mitigate the risk of contamination often associated with human handling. This stands as a significant factor expected to propel the market forward. Additionally, ongoing advancements in automation technology have resulted in the creation of more sophisticated and reliable aseptic sampling systems, fostering increased adoption of enhanced processing capabilities.

By Application Analysis

- Downstream processing segment held the significant market share in 2022

The downstream processing segment held a significant market share. Downstream processing plays a crucial role in bio-pharmaceutical production, encompassing the isolation & purification of therapeutic proteins, antibodies, & biologics. Aseptic sampling is imperative during downstream processing to guarantee the sterility & quality of the product.

Furthermore, downstream processing involves intricate procedures like filtration, chromatography, and purification. Aseptic sampling is integrated at different stages to oversee and regulate the process, ensuring that the final product adheres to quality specifications. These elements are anticipated to be significant contributors to the segment's growth throughout the forecast period.

By Technique Analysis

- In-line sampling segment held the significant market share in 2023

The in-line sampling segment held a significant revenue share of the market in 2023. This technique provides a comprehensive set of both qualitative & quantitative data. Various parameters, such as pH, dissolved CO₂, dissolved O2, ORP (redox potential), as well as conductivity and temperature measurements, are promptly assessed and transmitted to Programmable Logic Controller (PLC) or Supervisory Control and Data Acquisition (SCADA) systems for automated control.

This technique facilitates the continuous measurement of such parameters throughout the entire process run, spanning weeks to months, without the need for manual intervention. This ensures the delivery of reliable and accurate data in industrial manufacturing processes. These aspects are anticipated to drive progress in pharmaceutical applications within the aseptic sampling process.

By End Use Analysis

- Pharmaceutical segment held the significant market share in 2023

The pharmaceutical segment held a significant market revenue share in 2022. The adoption of the aseptic sampling process by these companies encompasses the scrutiny of the manufacturing process to monitor both physical and chemical quality attributes. This includes activities related to quality control and evaluating the stability of active ingredients in pharmaceuticals. The anticipated factors driving market growth include optimized yields, decreased downtime, expedited process development, and scale-up, and reduced human intervention, leading to minimal errors.

The CMOs and CROs segment is expected to witness a substantial growth rate over the forecast period. Aseptic sampling provides the flexibility to adapt to various processes and products. Additionally, the increasing demand for biologics and other complex medicines, necessitating stringent control over product sterility and purity, further contributes to the adoption of aseptic sampling. This, in turn, is expected to minimize losses from processes, reduce errors, and eliminate batch failures. These factors are projected to drive the adoption of aseptic sampling in CMOs and CROs, thereby fostering market growth in the foreseeable future.

Regional Insights

- North America dominated the global market in 2023

North America dominated the global market and is likely to continue its dominance over the market forecast period. This dominance can be ascribed to the significant presence of major pharmaceutical and biotechnology companies, coupled with increased expenditures on R&D activities for diverse biopharmaceutical developments. Additionally, the region benefits from ongoing technological advancements in aseptic sampling systems and a well-established healthcare infrastructure aimed at enhancing product quality. Furthermore, the burgeoning number of research activities and clinical trials in the region are anticipated to contribute significantly to the growth of the aseptic sampling market.

The Asia Pacific will grow at a substantial pace. This growth can be attributed to increased government investments in the biotechnology sector & regulatory initiatives aimed at advancing pharmaceutical manufacturing development. For instance, in August 2023, the Japanese health ministry approved the 1st developed COVID-19 vaccine by the Daiichi Sankyo. The government expedited the approval process for the country’s home-grown coronavirus vaccine.

Key Market Players & Competitive Insights

Some of the major players operating in the global market include:

- Danaher Corporation

- Thermo Fisher Scientific

- Merck KGaA

- Sartorius AG

- Eppendroff

- Lonza Group

- GEA Group

- KEOFITT A/S

- Qualitru Sampling Systems

- W. L. Gore & Associates

Recent Developments

- In October 2023, Saphetor & ICON joined forces to launch an innovative initiative aimed at advancing the planning and execution of clinical trials within precision medicine. This collaboration is centered around optimizing potential and improving understanding of the epidemiology, prevalence, and geographic patterns of genetic mutations.

- In October 2023, GenScript ProBio & Curocell forged a strategic partnership through an MOU to collaboratively manufacture viral vectors crucial for the progress of the next generation of CAR-T therapy.

Aseptic Sampling Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 996.92 million |

|

Revenue forecast in 2032 |

USD 1,806.63 million |

|

CAGR |

7.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2023 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Technique, By Application, by End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Aseptic Sampling Market Size Worth $ 1,806.63 Million By 2032.

The top market players in Aseptic Sampling Market include Danaher, Thermo Fisher Scientific, Merck, Sartorius, Eppendroff.

North America is region contribute notably towards the Aseptic Sampling Market.

The global aseptic sampling market is expected to grow at a CAGR of 7.7% during the forecast period.

Aseptic Sampling Market report covering key segments are type, technique, application, end use and region.