Asia Pacific Wind Turbine Market Size, Share, Trends, Industry Analysis Report

By Axis (Vertical, Horizontal), By Installation, By Components, By Application, By Capacity, By Connectivity, By Rating, By Country – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6150

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

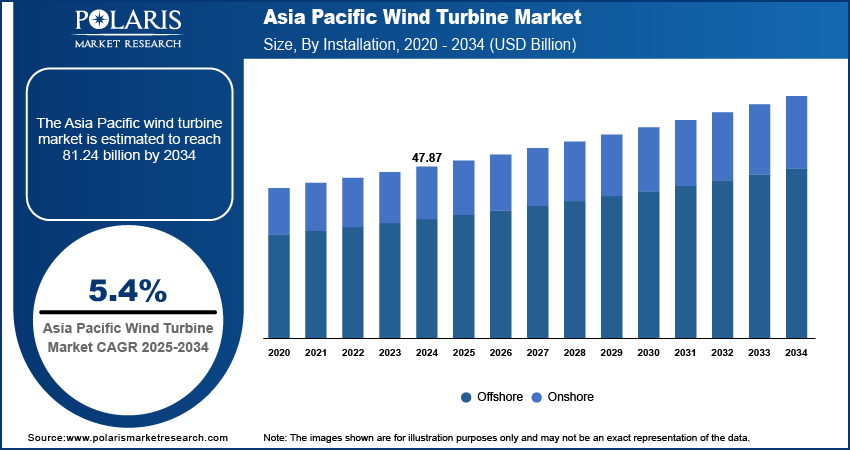

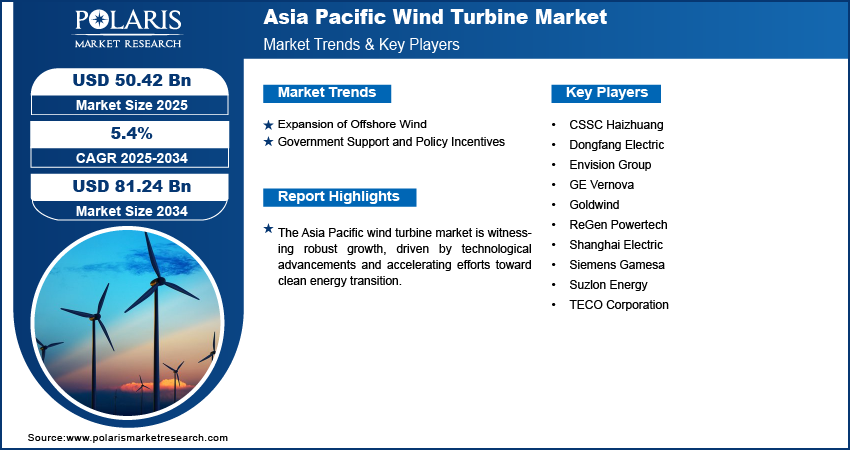

The Asia Pacific wind turbine market size was valued at USD 47.87 billion in 2024, growing at a CAGR of 5.4% from 2025 to 2034. Key factors driving demand include the increasing commitments toward decarbonization and long-term sustainability goals, expansion of offshore wind energy, government support and policy incentives.

Key Insights

- The horizontal segment accounted for the largest revenue share in 2024 owing to its superior efficiency, scalability, and widespread deployment across utility-scale projects.

- The offshore segment is expected to experience substantial growth across Asia Pacific over the forecast period, driven by increasing investments in large-scale renewable energy initiatives and the availability of stronger, more consistent wind currents in open seas.

- The rotator blade segment dominated the market in 2024 due to its critical role in capturing wind energy and enhancing overall turbine efficiency.

- The utility segment dominated the market in 2024, primarily driven by the region’s growing focus on large-scale power generation and integration with national grids.

- The market in China is expanding due to the country's large-scale wind power installations and consistent investments in renewable energy infrastructure.

Industry Dynamics

- Offshore wind expansion taps into stronger, steadier winds at sea, creating scalable opportunities for clean energy generation.

- Feed-in tariffs, renewable mandates, and competitive auctions are attracting global and local investors to accelerate market participation.

- Grid infrastructure limitations and complex permitting processes hinder rapid wind energy deployment across emerging markets in Asia Pacific, delaying project timelines.

- Falling technology costs and rising energy demand create strong growth potential, particularly in offshore wind and hybrid renewable projects.

Market Statistics

- 2024 Market Size: USD 47.87 billion

- 2034 Projected Market Size: USD 81.24 billion

- CAGR (2025–2034): 5.4%

To Understand More About this Research: Request a Free Sample Report

A wind turbine is a mechanical device that converts the kinetic energy of wind into electrical energy, forming a cornerstone of modern renewable power systems. In Asia Pacific, the market for wind turbines is experiencing steady growth, primarily driven by increasing commitments toward decarbonization and long-term sustainability goals. Governments of the region are implementing regulatory frameworks and renewable energy targets to reduce their reliance on fossil fuels. This transition is being driven by increasing environmental awareness, upsurging energy demands resulting from urbanization, and national climate pledges. As a result, wind energy has emerged as a strategic solution to achieve carbon neutrality and support energy security in both developed and emerging economies across Asia Pacific.

Advancements in wind turbine technology are enhancing the efficiency, scalability, and cost-effectiveness of wind energy projects. Innovations such as longer rotor blades, higher-capacity turbines, and smart grid-compatible systems are enabling more efficient power generation even in areas with low wind speeds, which are common in several parts of the Asia Pacific. Moreover, the adoption of advanced materials, digital monitoring solutions, and predictive maintenance technologies is improving turbine lifespan and reducing operational costs. In November 2022, Covestro and TMT produced their 1,000th polyurethane wind blade for China, which offers better mechanical properties and cost efficiency than traditional epoxy blades. The blades, measuring 59.5 to 94 meters, support larger turbines, including a 94-meter blade for 8 MW output, advancing wind energy technology. These technological enhancements are making wind energy more competitive with conventional sources and expanding its applicability across diverse geographic and climatic zones in the region.

Drivers & Opportunities

Expansion of Offshore Wind: The expansion of offshore wind energy is driving opportunities for growth, as it unlocks access to stronger and more consistent wind resources found in open seas. In June 2024, India's Union Cabinet approved a USD 890 million VGF scheme for offshore wind, including USD 820 million for 1 GW projects with 500 MW each in Gujarat and Tamil Nadu. Offshore installations offer the advantage of higher capacity factors and reduced land-use constraints, making them ideal for densely populated coastal nations across the region. Technological progress in floating foundations and subsea power transmission has enhanced the feasibility and scalability of offshore wind farms. This shift toward offshore development enables countries to tap into vast, previously untapped marine wind potential, thereby accelerating the deployment of large-scale wind power infrastructure and supporting long-term energy diversification goals.

Government Support and Policy Incentives: Government support and policy incentives play a crucial role in driving growth opportunities by creating an environment that enables investment and development. For instance, in March 2023, Japan's Offshore Wind Policy pledged USD 153.8 billion in investments for renewable energy, hydrogen, and energy efficiency to achieve carbon neutrality by 2050, targeting over USD 1.2 trillion in public-private funding over the next decade. Regulatory mechanisms such as feed-in tariffs, renewable portfolio standards, and auction-based procurement models are encouraging both domestic and international players to enter the market. In addition, strategic national energy roadmaps and grid integration initiatives are providing clear signals to stakeholders about long-term renewable energy commitments. These supportive policies mitigate the financial risks associated with wind energy projects, promoting innovation, boosting competitiveness, and driving sustained capacity additions across the region.

Segmental Insights

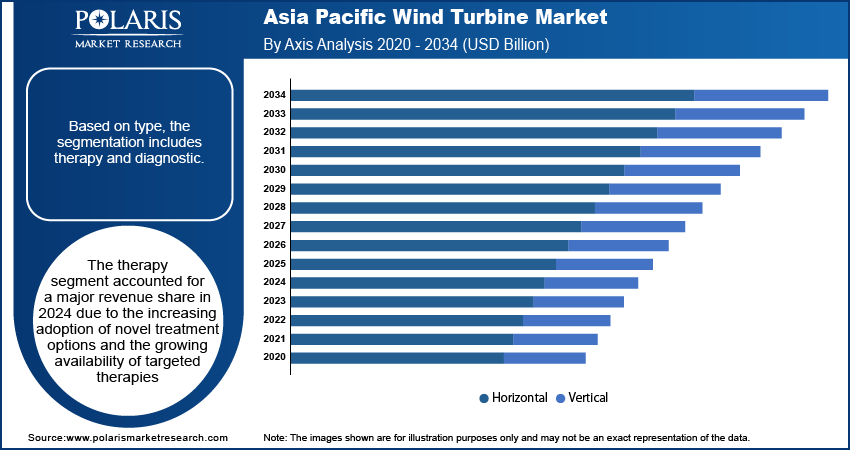

Axis Analysis

Based on axis, the segmentation includes vertical and horizontal. The horizontal segment accounted for the largest revenue share in 2024 owing to its superior efficiency, scalability, and widespread deployment across utility-scale projects. These turbines are particularly preferred in Asia Pacific due to their ability to deliver higher power outputs in areas with stable and consistent wind conditions. Their aerodynamic design facilitates optimal energy conversion and seamless integration with existing grid infrastructure. Furthermore, the maturity of horizontal-axis technology, cost-effectiveness per megawatt, and simplified maintenance processes further solidify their dominant position in the regional market.

Installation Analysis

In terms of installation, the Asia Pacific wind turbine market segmentation includes offshore and onshore. The offshore segment is expected to experience substantial growth over the forecast period, driven by increasing investments in large-scale renewable energy initiatives and the availability of stronger, more consistent wind currents in open seas. Offshore wind turbines in the region can operate at higher capacities without the spatial limitations typically encountered on land. Additionally, advancements in floating platform technologies and subsea power transmission are improving the technical and economic feasibility of offshore projects, thus accelerating segmental growth.

Components Analysis

The segmentation, based on components, includes, rotator blade, generator, gearbox, and nacelle. The rotator blade segment dominated the market in 2024 due to its critical role in capturing wind energy and enhancing overall turbine efficiency. Rotor blades have a substantial impact on turbine output, performance, and operational longevity. Manufacturers are focusing on developing lightweight, high-strength blades using advanced composite materials to meet the rising demand for larger and more powerful turbines across Asia Pacific. Innovations aimed at reducing aerodynamic drag and expanding blade surface area are further reinforcing this segment’s dominance.

Application Analysis

In terms of application, the segmentation includes residential, utility, industrial, and commercial. The utility segment dominated the market in 2024, primarily driven by the region’s growing emphasis on large-scale power generation and integration with national grids. Utility providers across the region are actively investing in wind energy infrastructure to diversify their energy portfolios and fulfill decarbonization commitments. Utility-scale wind projects offer cost-effective, high-output solutions to meet rising energy demand. Additionally, supportive government regulations and increased access to green financing are propelling consistent growth in this segment.

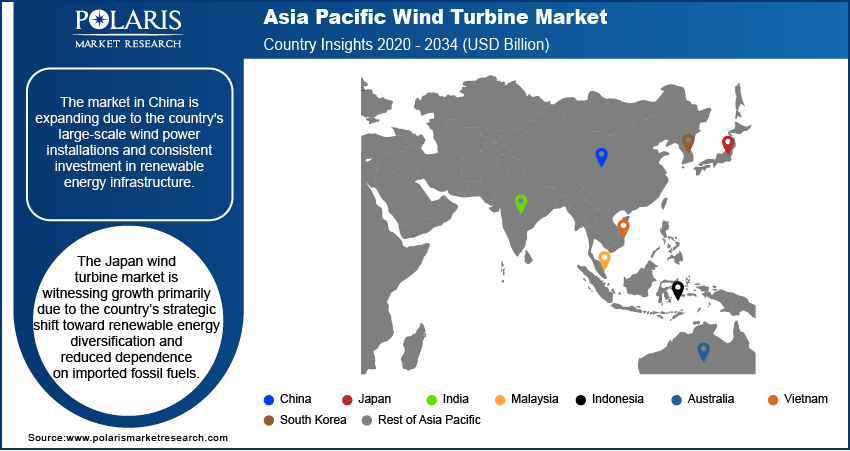

Country Analysis

China Asia Pacific Wind Turbine Market Overview

The market in China is expanding due to the country's large-scale wind power installations and consistent investment in renewable energy infrastructure. China's strategic focus on energy security and industrial decarbonization has accelerated the development of wind farms, especially in regions with high wind potential. Furthermore, domestic manufacturers play a crucial role in driving innovation and reducing costs, thereby facilitating the broader deployment of these technologies. The country’s strong supply chain capabilities and emphasis on self-sufficiency in clean energy technologies continue to highlight its dominant contribution to regional expansion.

Japan Wind Turbine Market Analysis

The Japan wind turbine market is witnessing growth primarily due to the country’s strategic shift toward renewable energy diversification and reduced dependence on imported fossil fuels. The limited availability of onshore space has led to a growing focus on offshore wind development, particularly floating wind technology, which is suited to deep waters. Government-backed initiatives, regulatory reforms, and technological partnerships are fostering favorable conditions for project implementation. Additionally, Japan’s focus on energy efficiency and carbon neutrality is further boosting the adoption of wind turbines, particularly in coastal and island regions where wind resources are consistently strong.

South Korea Wind Turbine Market Assessment

In South Korea, the wind turbine market is growing due to the nation’s comprehensive energy transition plans and increased commitment to offshore wind power. The country’s coastal geography offers substantial potential for high-capacity offshore projects, aligning with national goals to reduce greenhouse gas emissions and achieve energy independence. South Korea’s industrial base and advanced manufacturing capabilities are also contributing to domestic turbine production and innovation. Moreover, continued collaboration between the public and private sectors is accelerating infrastructure development and ensuring long-term market growth within the region.

India Wind Turbine Market Insights

The wind turbine market in India is expanding due to rising electricity demand, supportive renewable energy targets, and the abundance of wind resources across several states. The country’s policy framework encourages both grid-connected and captive wind power generation, with particular focus on cost-effective onshore installations. Additionally, India’s focus on localized manufacturing under clean energy programs is strengthening the supply chain and attracting investment. The integration of wind power into hybrid renewable projects and transmission upgrades is further enhancing the scalability and reliability of wind energy in the region.

Key Players and Competitive Analysis

The Asia Pacific wind turbine sector is witnessing intense competition, driven by emerging markets such as India and Vietnam scaling up renewable capacity, while developed markets such as Japan and Australia focus on offshore expansion. Major players such as Goldwind, Envision, and Vestas are leveraging strategic investments in R&D to enhance turbine efficiency and cater to latent demand in low-wind regions. Disruptions and trends, including AI-driven predictive maintenance and hybrid energy systems, are reshaping industry trends, enabling sustainable value chains. Revenue growth is propelled by economic and geopolitical shifts, including government incentives and carbon neutrality targets. Vendor strategies emphasize localization, with over 80% of components sourced regionally to mitigate supply chain disruptions. Future development strategies highlight offshore wind as a high-growth market, particularly in Southeast Asia, where expansion opportunities align with rising electricity demand. Competitive intelligence reveals that small and medium-sized businesses are gaining traction through niche innovations, while larger firms dominate the market share. China and India are leading capacity additions, supported by technological advancements in turbine design and grid integration.

A few major companies operating in the industry include CSSC Haizhuang, Dongfang Electric, Envision Group, GE Vernova, Goldwind, ReGen Powertech, Shanghai Electric, Siemens Gamesa, Suzlon Energy, and TECO Corporation.

Key Players

- CSSC Haizhuang

- Dongfang Electric

- Envision Group

- GE Vernova

- Goldwind

- ReGen Powertech

- Shanghai Electric

- Siemens Gamesa

- Suzlon Energy

- TECO Corporation

Asia Pacific Wind Turbine Industry Developments

- December 2024: Envision Energy secured a contract to supply 344.5 MW Asia Pacific Wind Turbines for ACEN’s Quezon North Wind project, the Philippines’ largest single wind deal. This follows their collaboration on the 600 MW Monsoon Wind in Laos, Southeast Asia’s first cross-border wind initiative.

- September 2024: Senvion India launched its 4.2M160 Wind Turbine, a 4 MW WTG with a 160m rotor, designed for low-wind conditions. Featuring adaptive controls, DFIG technology, and compliance with IEC/IECRE standards, it is optimized for reliability in diverse climates, including high temperatures and dusty environments.

- February 2024: Juniper Green Energy partnered with Envision Energy for 300 MW wind projects in Gujarat. Envision will supply 91 units of 3.3 MW turbines, with phased commissioning by 2025, generating 1,000 GWh/year to support India’s net-zero targets.

Asia Pacific Wind Turbine Market Segmentation

By Axis Outlook (Revenue, USD Billion, 2020–2034)

- Vertical

- Horizontal

By Installation Outlook (Revenue, USD Billion, 2020–2034)

- Offshore

- Onshore

By Components Outlook (Revenue, USD Billion, 2020–2034)

- Rotator blade

- Generator

- Gearbox

- Nacelle

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Utility

- Industrial

- Commercial

By Capacity Outlook (Revenue, USD Billion, 2020–2034)

- Small

- Medium

- Large

By Connectivity Outlook (Revenue, USD Billion, 2020–2034)

- Grid Connected

- Stand Alone

By Rating Outlook (Revenue, USD Billion, 2020–2034)

- < 100 kW

- 100 kW to 250 kW

- > 250 kW to 500 kW

- > 500 kW to 1 MW

- 1 MW to 2 MW

- >2 MW

By Country Outlook (Revenue, USD Billion, 2020–2034)

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

Asia Pacific Wind Turbine Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 47.87 Billion |

|

Market Size in 2025 |

USD 50.42 Billion |

|

Revenue Forecast by 2034 |

USD 81.24 Billion |

|

CAGR |

5.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 47.87 billion in 2024 and is projected to grow to USD 81.24 billion by 2034.

The market is projected to register a CAGR of 5.4% during the forecast period.

A few of the key players in the market are CSSC Haizhuang, Dongfang Electric, Envision Group, GE Vernova, Goldwind, ReGen Powertech, Shanghai Electric, Siemens Gamesa, Suzlon Energy, and TECO Corporation.

The horizontal segment accounted for the largest revenue share in 2024.

The offshore segment is expected to witness significant growth during the forecast period.