Astaxanthin Market Size, Share, Trends, Industry Analysis Report

By Source (Natural, Synthetic), By Product, By Form, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM1812

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

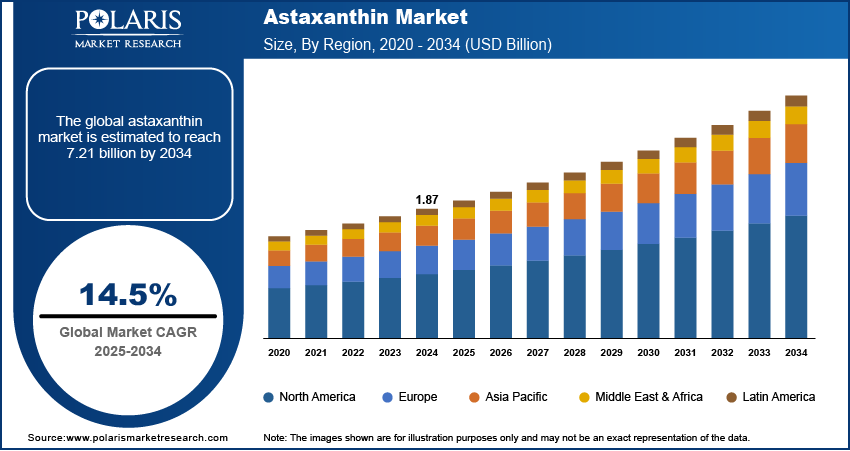

The global astaxanthin market size was valued at USD 1.87 billion in 2024 and is anticipated to register a CAGR of 14.5% from 2025 to 2034. The increasing use of astaxanthin in the nutraceuticals, cosmetics, and aquaculture industries propels the market growth. Consumers are also becoming more aware of its health benefits as a strong antioxidant, which is boosting demand for natural supplements.

Key Insights

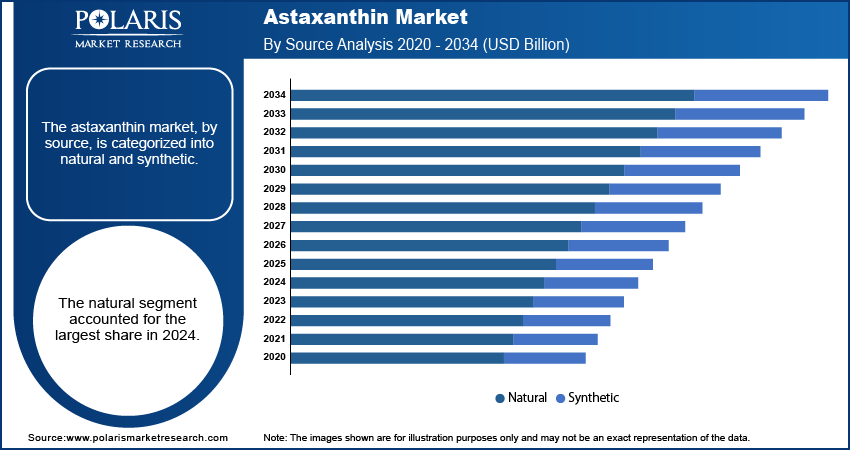

- By source, the natural source segment held the largest share in 2024, due to growing preference among consumers for products with "clean labels" and natural ingredients.

- By product, the dried algae meal or biomass segment dominated in 2024. This is driven by its widespread use in aquaculture feed due to its high nutritional content and cost-effectiveness.

- By form, the dry form segment contributed to the revenue share in 2024. This is supported by its longer shelf life and suitability for dietary supplements and food formulations.

- By region, North America held the largest share of the global landscape in 2024. This is fueled by rising consumer demand for natural antioxidants in nutraceuticals and functional foods.

Industry Dynamics

- There is a growing demand for natural antioxidants in the food and beverage industry, as consumers are becoming more health-conscious and looking for products with clean labels. Astaxanthin's strong antioxidant properties make it a popular ingredient for these products.

- The increasing use of astaxanthin in the aquaculture and animal feed industries is also a major driver. It is widely used as a feed additive for fish such as salmon and trout to enhance their color and improve their overall health.

- The expanding use in nutraceuticals and cosmetics is a key factor as well. Astaxanthin is used in dietary supplements for its potential to support eye, skin, and cardiovascular health. It is also used in skincare products for its antiaging benefits.

Market Statistics

- 2024 Market Size: USD 1.87 billion

- 2034 Projected Market Size: USD 7.21 billion

- CAGR (2025–2034): 14.5%

- North America: Largest market in 2024

AI Impact on Astaxanthin Market

- AI-based photobioreactors improve the efficiency of microalgae cultivation, as they help in adjusting temperature, light, and nutrient levels in real time to increase astaxanthin yield.

- Machine learning (ML) models are used to predict optimal harvest times, which improves bioactive potency and reduces waste.

- AI-driven green extraction methods such as deep eutectic solvents are minimizing costs and helping to meet sustainability goals.

- AI image recognition ensures product quality by detecting inconsistencies and impurities in raw materials.

Astaxanthin is a natural carotenoid pigment known for its powerful antioxidant properties. It is commonly found in microalgae. It gives the reddish-pink color to certain seafood such as salmon, trout, and shrimp that consume these algae. Due to its many potential health benefits, it is used in a variety of industries.

One driver for the astaxanthin market growth is the growing trend of using natural ingredients in pet food and supplements. Pet owners are becoming more interested in natural products to support their pets' overall health and well-being. Astaxanthin is used in pet foods and supplements to maintain skin and coat health, joint function, and provide antioxidant support.

Another factor is the increasing focus on the nutritional quality of food from aquaculture. Astaxanthin is a necessary additive in the feed for farmed fish and other marine animals to enhance their pigmentation and nutritional content. This improves their market value and appearance. For example, the FDA has approved astaxanthin for use as a color additive in feed for salmon, trout, and crustaceans to give them their natural-looking reddish-pink color. This is a key reason for its continued use and demand in the aquaculture industry.

Drivers and Trends

Rising Consumer Interest in Health and Wellness: Consumers are becoming more aware of their health, which is leading them to seek out natural and preventive healthcare options. This trend has created a high demand for nutraceuticals and dietary supplements. As a result, consumers are increasingly choosing products such as astaxanthin, as it is known for its powerful antioxidant properties and potential benefits for eye, skin, and cardiovascular health. This shift in consumer behavior is pushing companies to develop new products with astaxanthin to meet the growing demand for natural health solutions.

According to WHO, in 2022, the number of individuals aged 60 and above is expected to increase significantly, reaching 2.1 billion by 2050. This aging population is a major reason for the growth in the nutraceuticals market, as older adults often need extra nutrients to stay healthy and boost their immunity. This demographic shift is directly increasing the demand for health-focused supplements and functional foods, which drives the market growth for astaxanthin.

Expanding Use in Aquaculture and Animal Feed: Astaxanthin is widely used in the aquaculture and animal feed industries to improve the quality of farmed fish and other marine animals. It is a key ingredient for enhancing the pigmentation of fish such as salmon and trout, giving them the desirable reddish-pink color. This makes the products more appealing to consumers and indicates better health and nutritional value. The expanding aquaculture industry, driven by rising global demand for seafood, is a significant consumer of astaxanthin.

The use of astaxanthin in animal feed is supported by government regulations. The FDA, in its "Regulatory Status of Color Additives" document, has permanently listed astaxanthin as a color additive for use in the feed for salmonids, such as salmon and trout. This regulatory approval assures producers of its safety and efficacy, further encouraging its adoption. The increasing production of farmed fish, along with this regulatory support, is a major factor driving the market for astaxanthin.

Segmental Insights

Source Analysis

Based on source, the segmentation includes natural and synthetic. The natural segment held the largest share in 2024. This is because consumers are increasingly seeking products with "clean labels" and natural ingredients, moving away from chemically derived alternatives. Natural astaxanthin is primarily sourced from microalgae, especially Haematococcus pluvialis, which is cultivated and harvested for its high astaxanthin content. Its use is prevalent in nutraceuticals and cosmetics where a natural origin is a significant selling point for health-conscious buyers. The superior quality and proven benefits of the naturally derived version for human consumption also contribute to its large market share, as it is often preferred for dietary supplements and skincare products.

The synthetic segment is anticipated to register the highest growth rate during the forecast period. This growth is mainly driven by its use in the aquaculture and animal feed industries. Synthetic astaxanthin is a more cost-effective option for large-scale applications, such as providing pigmentation to farmed salmon and trout. It is produced through chemical synthesis and offers consistency and reliable supply, which are essential for commercial feed production. As the global demand for seafood continues to rise and the aquaculture industry expands to meet this need, the demand for affordable and effective feed additives also increases. This trend is fueling the growth of the synthetic segment, as it provides a practical and economical solution for producers.

Product Analysis

Based on product, the segmentation includes dried algae meal or biomass, oil, softgel, liquid, and others. The dried algae meal or biomass segment held the largest share in 2024 as it serves as the foundational raw material for many other astaxanthin products and applications. The biomass, which is harvested from microalgae, is a cost-effective and efficient way to produce large quantities of astaxanthin. It is widely used as a primary ingredient in the aquaculture and animal feed industries to give farmed fish, such as salmon and trout, their reddish-pink color. The high demand from this sector, along with its use in creating supplements and other formulations, makes it the dominant product form. The ability to produce it in bulk and at a lower cost compared to other forms also contributes to its market leadership.

The softgel segment is anticipated to register the highest growth rate during the forecast period. This is largely attributed to its increasing popularity in the nutraceutical and dietary supplement industries. Softgels are a preferred format for consumers as they are easy to swallow, have a long shelf life, and protect the astaxanthin from oxidation, which helps maintain its potency. As more consumers become aware of astaxanthin's health benefits, such as its effects on eye, skin, and cardiovascular health, the demand for convenient and effective supplement forms such as softgels is rising. The rise of the aging population, which often uses dietary supplements, further fuels this growth, as softgels are an accessible and popular delivery method for them.

Form Analysis

Based on form, the segmentation includes dry form and liquid form. The dry form segment held the largest share in 2024. This form, which includes powders and dried biomass, is favored for its extended shelf life, ease of storage, and stability. It is particularly important in the animal feed and aquaculture industries, where it is used in large volumes to enhance the coloration and nutritional value of farmed fish such as salmon. The dry form is also a key raw material for manufacturing other products, such as capsules and tablets for dietary supplements. Its ability to be produced in bulk and its compatibility with existing high-volume production lines make it a cost-effective and preferred choice for many manufacturers.

The liquid form segment is anticipated to register the highest growth rate during the forecast period. This growth is driven by its increasing use in products where bioavailability and easy integration are important. Liquid astaxanthin is often found in high-end dietary supplements, functional beverages, and cosmetic products. Its form allows for better absorption by the body, which is a key selling point for consumers interested in maximizing the health benefits of antioxidants. Furthermore, the liquid format is highly versatile and can be easily incorporated into various formulations. As consumer demand for convenient, high-efficacy health and wellness products continues to rise, the liquid astaxanthin segment is poised for significant expansion in the coming years.

Application Analysis

Based on application, the segmentation includes nutraceuticals, cosmetics, aquaculture and animal feed, food, and others. The aquaculture and animal feed segment held the largest share in 2024. This is because astaxanthin is a critical ingredient in the diets of farmed fish and other marine life. It is primarily used to provide the reddish-pink coloration in fish like salmon and trout, which is a key factor for consumers when making a purchase. The expanding global demand for seafood, driven by population growth and a rising trend toward healthier diets, has led to a major increase in aquaculture operations worldwide. This large-scale farming requires a steady supply of astaxanthin to ensure the quality and appearance of the final product, solidifying this segment's position as the market leader.

The nutraceuticals segment is anticipated to register the highest growth rate during the forecast period. This growth is fueled by a rising awareness of astaxanthin's potent antioxidant properties and its potential health benefits. Consumers are becoming more proactive about their health and are turning to dietary supplements to support everything from eye and skin health to cardiovascular function. Astaxanthin's powerful ability to fight oxidative stress makes it a popular ingredient in antiaging and wellness supplements. The rising popularity of personalized nutrition and the growing number of consumers using supplements as part of their daily wellness routines are major factors contributing to the rapid expansion of the nutraceuticals segment.

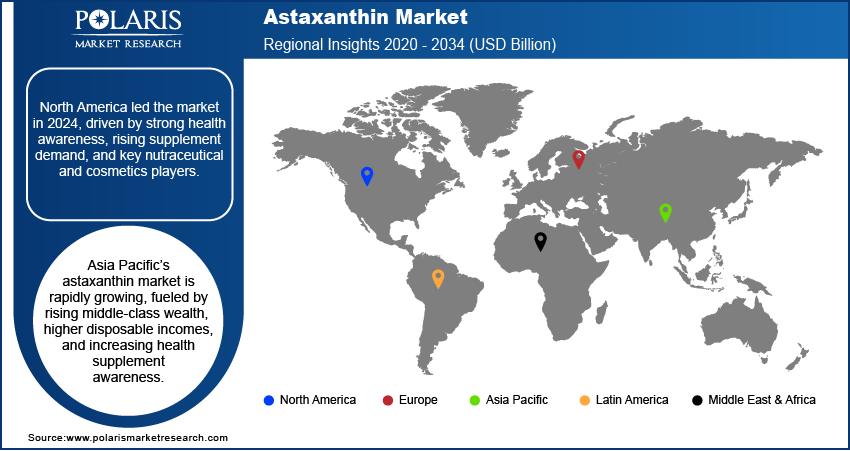

Regional Analysis

North America Astaxanthin market accounted for the largest share in 2024, mainly because of high consumer awareness of health and wellness. The region has a large and well-established dietary supplement industry, where astaxanthin's potent antioxidant properties are a major selling point. The growing demand for products that support eye health, skin health, and antiaging has been a key driver. Additionally, the presence of major companies and research facilities in the region helps support continuous innovation and product development.

U.S. Astaxanthin Market Insights

The U.S. is a major country in the North America industry landscape, with a strong consumer base for nutraceuticals and cosmetics. The demand for astaxanthin is driven by an aging population that is actively seeking supplements to support a healthy lifestyle. The country's strict regulations from agencies such as the FDA ensure product safety and quality, which helps build consumer trust. The U.S. also has a well-developed aquaculture industry, creating a steady demand for astaxanthin as a feed additive for fish and other marine animals.

Europe Astaxanthin Market Trends

Europe is a significant hub for astaxanthin, driven by a strong focus on health, wellness, and natural ingredients. Regulatory bodies have played a role in shaping the landscape by establishing clear guidelines for the use of astaxanthin in food supplements. The region is home to several key players who are investing in research and development to improve production methods and explore new applications. European consumers are increasingly seeking out high-quality, natural-source products, which favors the use of astaxanthin in premium supplements and cosmetics.

The Germany astaxanthin market is a major player in Europe due to its advanced biotechnology and strong nutraceutical sector. The country's robust research capabilities have helped to advance the production of astaxanthin, particularly from natural sources such as algae. German consumers are well-informed about health trends and have a high demand for supplements that are based on natural, scientifically-backed ingredients, which supports the continued demand for astaxanthin across the country.

Asia Pacific Astaxanthin Market Overview

Asia Pacific is a fast-growing market for astaxanthin. This growth is a result of a rising middle class, increasing disposable incomes, and a growing awareness of the benefits of health supplements. Countries in this region are seeing a surge in demand for products that offer both cosmetic and health benefits. The region is also a hub for aquaculture, particularly in countries with extensive coastlines and strong seafood industries, which provides a significant requirement for astaxanthin as a feed additive.

China Astaxanthin Market Overview

China is a major country driving the growth in the Asia Pacific industry. It is one of the world's largest aquaculture producers, and the use of astaxanthin in fish and shrimp feed is widespread. The country's large and growing population, along with increasing health consciousness, has also boosted the demand for astaxanthin in nutraceuticals. Furthermore, China's manufacturing capabilities and a favorable environment for producing astaxanthin have made it a key player in both production and consumption.

Key Players and Competitive Insights

The astaxanthin has a competitive landscape with several key players. These companies often focus on natural or synthetic astaxanthin production. They compete on factors such as product quality, cost, and technological innovation. The landscape includes a mix of large chemical companies, specialized biotechnology firms, and smaller, regional players. The competitive dynamics are shaped by research and development efforts to improve production efficiency, discover new applications, and meet strict quality and regulatory standards, especially in the nutraceutical and cosmetics industries.

A few prominent companies in the industry include Cyanotech Corporation; Fuji Chemical Industry Co., Ltd.; BASF SE; DSM; Algatechnologies Ltd.; Algalíf Iceland ehf; Parry Nutraceuticals; Beijing Gingko Group; ENEOS Corporation; and Valensa International.

Key Players

- Algalíf Iceland ehf

- Algatechnologies Ltd.

- BASF SE

- Beijing Gingko Group

- Cyanotech Corporation

- DSM

- ENEOS Corporation

- Fuji Chemical Industry Co., Ltd.

- Parry Nutraceuticals

- Valensa International

Astaxanthin Industry Developments

April 2024: Algalíf Iceland announced that its Astalíf astaxanthin products, including biomass and oleoresins, have received Vegan certification from the Vegan Society.

March 2024: Cyanotech Corporation introduced a new sugar-free, vegan gummy format for its BioAstin Hawaiian Astaxanthin.

Astaxanthin Market Segmentation

By Source Outlook (Revenue – USD Billion, 2020–2034)

- Natural

- Synthetic

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Dried Algae Meal or Biomass

- Oil

- Softgel

- Liquid

- Others

By Form Outlook (Revenue – USD Billion, 2020–2034)

- Dry Form

- Liquid Form

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Nutraceuticals

- Cosmetics

- Aquaculture and Animal Feed

- Food

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Astaxanthin Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.87 billion |

|

Market Size in 2025 |

USD 2.13 billion |

|

Revenue Forecast by 2034 |

USD 7.21 billion |

|

CAGR |

14.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.87 billion in 2024 and is projected to grow to USD 7.21 billion by 2034.

The global market is projected to register a CAGR of 14.5% during the forecast period.

North America dominated the share in 2024.

A few key players include Cyanotech Corporation; Fuji Chemical Industry Co., Ltd.; BASF SE; DSM; Algatechnologies Ltd.; Algalíf Iceland ehf; Parry Nutraceuticals; Beijing Gingko Group; ENEOS Corporation; and Valensa International.

The natural segment accounted for the largest share in 2024.

The softgel segment is expected to witness the fastest growth during the forecast period.