Atopic Dermatitis Clinical Trials Market Share, Size, Trends, Industry Analysis Report

By Study Design (Observational, Interventional); By Molecule Type; By Phase; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4553

- Base Year: 2022

- Historical Data: 2019 – 2022

Report Outlook

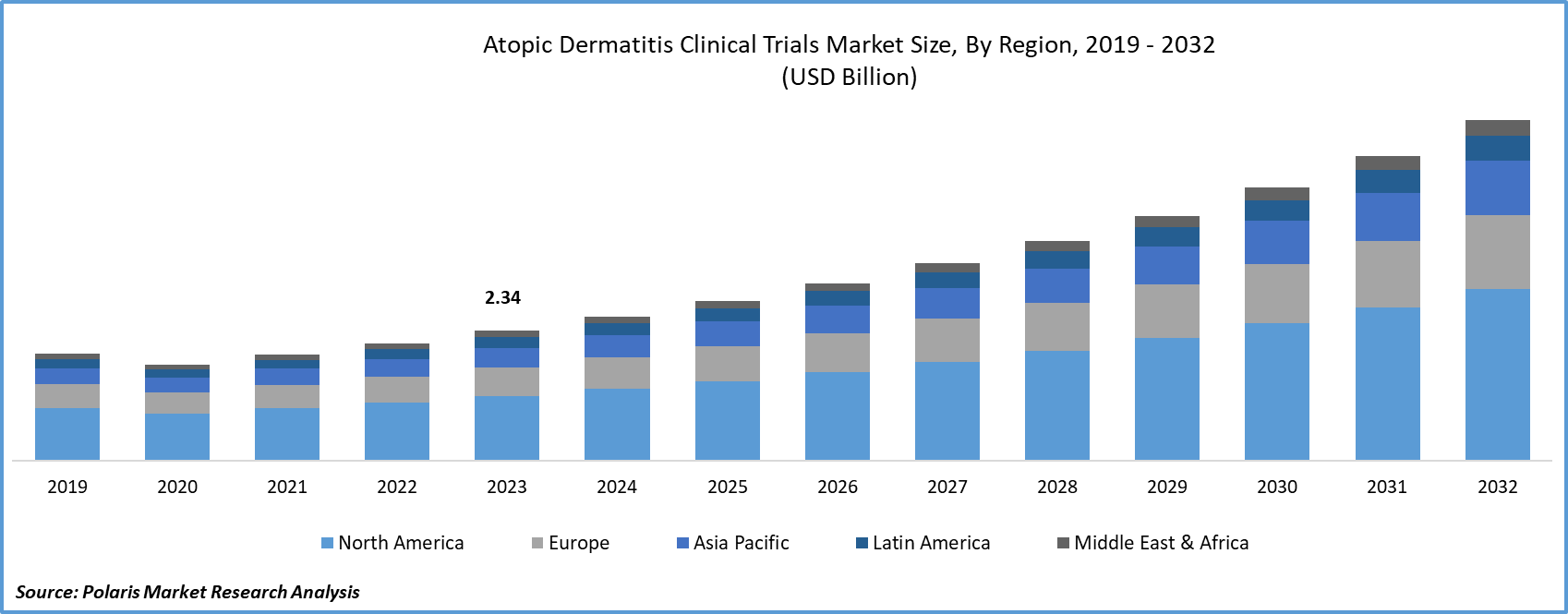

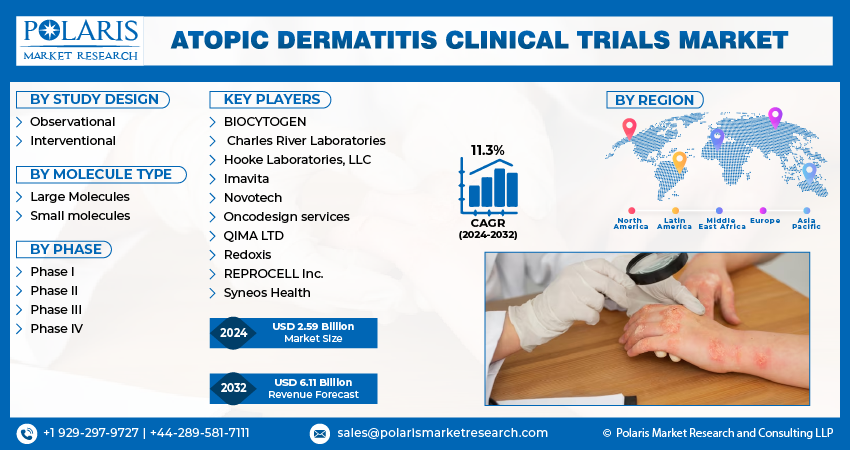

Global atopic dermatitis clinical trials market size was valued at USD 2.34 billion in 2023. The market is anticipated to grow from USD 2.59 billion in 2024 to USD 6.11 billion by 2032, exhibiting a CAGR of 11.3% during the forecast period

Atopic Dermatitis Clinical Trials Market Overview

The atopic dermatitis clinical trials market size is being driven by the increasing development of new pipeline drugs, rising demand for innovative biologics, and a surge in product approvals, all contributing to the growth of the atopic dermatitis industry. The rapid progress of cutting-edge pipeline medications is expected to drive the expansion of the atopic dermatitis market, with substantial growth anticipated in the projected period. Furthermore, the growth of the atopic dermatitis sector, coupled with the increasing demand for novel biologics and product approvals, is poised to bolster the overall market scope.

The anticipated market expansion is expected to be driven by the rising occurrence of atopic dermatitis and favorable reimbursement policies in developing nations. Moreover, it is projected that heightened government initiatives aimed at providing improved and cost-effective care, coupled with increased awareness of treatment options for the disease, will impact the global market share for atopic dermatitis. Additionally, the rapid advancement of technology, increased funding, and expanded government support for research and development are expected to create numerous new opportunities that will influence the atopic dermatitis market growth over the forecast period.

To Understand More About this Research: Request a Free Sample Report

For instance, in June 2022, Olumiant, a collaborative product of Eli Lilly and Incyte, became the initial and sole advanced systemic therapy authorized for adults with severe alopecia areata (AA). One year after its approval, assessments of the oral JAK continue to be positive, drawing parallels to the introduction of Dupixent in treating atopic dermatitis (AD). These evaluations align in terms of satisfaction, comfort, and perceived level of advancement. Nonetheless, there are variations in the user bases and patient initiations of the two brands. Specifically, Olumiant's AD user base may have already begun to level off, whereas Dupixent's patient initiations and AD user base exhibit steady growth at a comparable post-launch period.

Atopic Dermatitis Clinical Trials Market Dynamics

Market Drivers

Increasing Prevalence of Atopic Dermatitis Globally Bolstering the Growth of Atopic Dermatitis Clinical Trials Market

The clinical trials market for atopic dermatitis is witnessing expansion due to several significant factors. Primarily, the increasing global prevalence of atopic dermatitis has spurred heightened research and development efforts, creating a greater demand for effective therapeutic solutions. Additionally, insights into the intricate immunological and genetic components of atopic dermatitis have paved the way for exploring tailored and precise treatments. The growing inclination towards personalized medicine has further advanced the management of atopic dermatitis, with a focus on customizing medications to individual patient profiles. Moreover, robust collaborations among biotech firms, research institutes, and pharmaceutical companies have fueled innovation, leading to the discovery and development of new treatments. The emphasis on comparative effectiveness research not only fosters competition but also encourages the introduction of improved and unique therapy options, enhancing existing treatment protocols. As these factors synergize, the clinical trials market for atopic dermatitis is anticipated to grow steadily, presenting opportunities for enhanced patient care and outcomes.

Market Restraints

The Elevated Expenses Linked to the Treatment of Atopic Dermatitis are Likely to Hamper the Growth of the Market

Presently, numerous developing and underdeveloped nations face challenges in accessing skin treatments due to issues such as side effects, high treatment costs, and the absence of reimbursement policies in developing countries.

The primary factor impeding the growth of the market is the treatment cost of atopic dermatitis. However, globally, stringent regulations for product approvals and generic competition are additional factors that act as obstacles to the market growth for atopic dermatitis.

Report Segmentation

The market is primarily segmented based on study design, molecule type, phase, and region.

|

By Study Design |

By Molecule Type |

By Phase |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Atopic Dermatitis Clinical Trials Market Segmental Analysis

By Study Design Analysis

- The Interventional segment held the largest share of the market. This is attributed to the increasing adoption of interventional study designs in clinical trials. For instance, according to data from clinicaltrials.gov, in 2022, around 60 to 70% of clinical trials for atopic dermatitis involve interventional studies. These trials commonly feature a controlled design, often involving a comparison between the intervention group (those receiving treatment) and a control group (those receiving a placebo or standard treatment). Furthermore, the expanding number of clinical trials for atopic dermatitis is another noteworthy factor playing a role in the growth of the atopic dermatitis clinical trial market segmentation.

- The segment of observational trials is expected to experience a highly favorable growth rate throughout the analysis period. The substantial growth of this segment is primarily attributed to the increasing global demand for products addressing atopic dermatitis and eczema. Additionally, the growing prevalence of such conditions stands as a key factor driving the demand for effective therapeutics and contributing to the overall growth of this segment. For instance, based on estimates from the Global Burden of Disease (GBD), atopic dermatitis is a prevalent and non-communicable chronic skin condition. It ranks 15th among non-fatal diseases in terms of disability-adjusted life years and holds the top position among all skin diseases. The significant impact is particularly notable in children.

By Phase Analysis

- The Phase II segment claimed the largest market share in 2023. This substantial share is primarily attributed to the increasing number of drugs undergoing Phase II trials. Additionally, the significant cost of developing Phase II trials contributes to higher investments in this phase, supporting the segment's dominance. Moreover, various pharmaceutical companies are allocating substantial capital to the clinical development of drugs in this phase.

- The Phase III segment is expected to experience a profitable growth rate throughout the analysis period. The significant growth of the segment can be attributed to the increasing number of pipeline drugs for atopic dermatitis progressing into the Phase III development stage. Additionally, the growing collaborations among biopharmaceutical companies to expand their clinical drug pipelines are substantial factors contributing to the growth of this segment. Furthermore, factors such as competition in the pharmaceutical industry, a robust developmental pipeline, collaborative efforts, the demand for improved treatments, scientific advancements, regulatory requirements, and patient-centric approaches to address challenges associated with this prevalent skin condition are crucial factors supporting the growth of this segment.

Atopic Dermatitis Clinical Trials Market Regional Insights

The North American Region Dominated the Global Market with the Largest Market Share in 2023

In the North American atopic dermatitis drugs market, there is a notable emphasis on biologics and targeted therapies, highlighting a strong commitment to innovation. The region has experienced heightened investments in research and development, resulting in the introduction of novel treatment alternatives. The adoption of patient-centric care models and telemedicine has become more prevalent, enhancing accessibility to specialized care. With regulatory approvals and a well-established healthcare infrastructure, North America stands as a pivotal market, witnessing an increasing demand for effective treatments for atopic dermatitis.

Asia Pacific is expected to experience substantial market growth, emerging as the fastest-growing region. This growth is attributed to the outsourcing of clinical trials by numerous developed economies to countries like India, China, and South Korea. The evolving business model of outsourcing and increased research and development (R&D) activities by major global companies are anticipated to boost the demand for clinical trial services in the region. This is primarily due to the cost efficiency provided by Contract Research Organizations (CROs) in countries such as India and China. Additionally, factors such as large and diverse patient pools, efficient recruitment for clinical trials, well-established clinical infrastructure, and the availability of skilled medical practitioners are contributing to market revenue growth.

Competitive Landscape

The Atopic Dermatitis Clinical Trials Market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

The European market for atopic dermatitis drugs is defined by active research and development initiatives, giving rise to innovative therapeutic solutions. The region demonstrates an increased awareness of the impact of atopic dermatitis on patients' lives, prompting a greater focus on patient-centric care models and the integration of telehealth solutions. Europe benefits from streamlined regulatory processes, providing a conducive environment for drug approvals and promoting market growth in the region.

Some of the major players operating in the global market include:

- BIOCYTOGEN

- Charles River Laboratories

- Hooke Laboratories, LLC

- Imavita

- Novotech

- Oncodesign services

- QIMA LTD

- Redoxis

- REPROCELL Inc.

- Syneos Health

Recent Developments

- In May 2023, Sciences reported favorable results from ADORING 1, the second Phase 3 trial assessing the effectiveness and safety of VTAMA (taping of) cream, 1%, for treating moderate to severe atopic dermatitis in both adults and pediatric subjects as young as two years old. The findings were obtained from a double-masked, randomized trial.

- In May 2023, LEO Pharma revealed encouraging results from the pivotal phase 3 clinical trial, DELTA 1, evaluating delgocitinib cream—an investigative topical pan-Janus kinase (JAK) inhibitor—for its potential application in treating adults with moderate to severe chronic hand eczema (CHE).

- In January 2022, Pfizer's CIBINQO (abrocitinib) received approval from the U.S. Food and Drug Administration (FDA) for the treatment of moderate-to-severe atopic dermatitis in adults.

Report Coverage

The Atopic Dermatitis Clinical Trials market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, study design, molecule type, phase, and their futuristic growth opportunities.

Atopic Dermatitis Clinical Trials Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2.59 billion |

|

Revenue Forecast in 2032 |

USD 6.11 billion |

|

CAGR |

11.3% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Study Design, By Molecular Type, By Phase, By Region |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

key companies in Atopic Dermatitis Clinical Trials Market are BIOCYTOGEN, Charles River Laboratories, Hooke Laboratories, LLC

Atopic Dermatitis Clinical Trials Market exhibiting a CAGR of 11.3% during the forecast period

The Atopic Dermatitis Clinical Trials Market report covering key segments are study design, molecule type, phase, and region.

key driving factors in Atopic Dermatitis Clinical Trials Market are Increasing prevalence of atopic dermatitis

The global Atopic Dermatitis Clinical Trials market size is expected to reach USD 6.11 billion by 2032