Australia Cloud Security Posture Management Market Size, Share, Trends, & Industry Analysis Report

By Component (Solution and Services), By Cloud Service, By Enterprise Size, By Cloud, By Industry Vertical – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5824

- Base Year: 2024

- Historical Data: 2020-2023

Overview

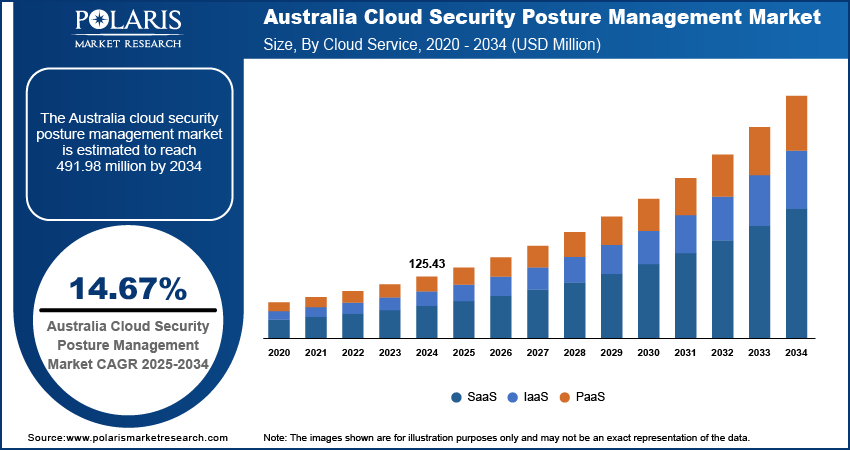

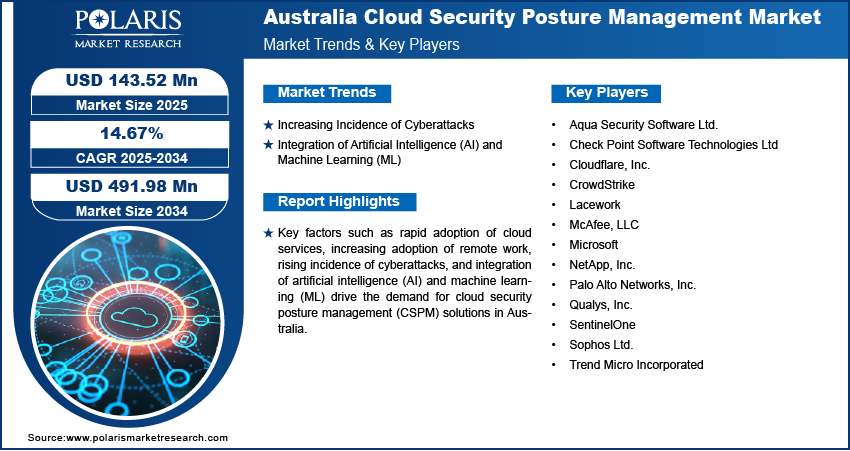

The Australia cloud security posture management market size was valued at USD 125.43 million in 2024, growing at a CAGR of 14.67% from 2025 to 2034. Key factors driving demand for cloud security posture management in Australia include rapid adoption of cloud services, increasing adoption of remote work, rising incidence of cyberattacks, and integration of artificial intelligence (AI) and machine learning (ML).

Cloud security posture management (CSPM) empowers organizations to secure, monitor, and optimize their cloud environments by continuously identifying and addressing security risks, misconfigurations, and compliance violations across cloud infrastructure. Security teams use cloud security posture management tools to gain real-time visibility into cloud assets and configurations, which allows them to detect vulnerabilities and policy violations as soon as they arise.

The rapid adoption of cloud services in Australia is driving the Australia CSPM market growth. Increasing cloud services are making it harder for security teams to maintain visibility and enforce consistent policies manually, driving the need for CSPM tools. CSPM solutions automate security assessments, continuously monitor risks, and ensure compliance, helping organizations proactively address threats in dynamic cloud infrastructures. Therefore, businesses are prioritizing cloud security posture management to mitigate risks and maintain robust security with surging cloud usage.

To Understand More About this Research: Request a Free Sample Report

In Australia, the demand for cloud security posture management solutions is driven by the increasing adoption of remote work. This shift is expanding the incidence of cyberattacks with employees connecting from various locations and devices, increasing exposure to misconfigurations, unauthorized access, and compliance risks. This is propelling businesses to invest in cloud security posture management (CSPM) tools to detect vulnerabilities, ensure regulatory compliance, and prevent breaches in remote work. Therefore, the increasing adoption of remote work in Australia is fueling demand for automated security solutions such as cloud security posture management that maintain strong cloud security without hindering productivity.

Industry Dynamics

Increasing Incidence of Cyberattacks

The increasing incidence of cyberattacks in Australia is pushing businesses to adopt cloud security posture management (CSPM) solutions for continuous risk assessment and remediation. CSPM tools automatically detect gaps in security policies, enforce compliance standards, and alert teams to real-time threats, reducing the window of exposure for cyberattacks. Australian Cyber Security Centre received over 36,700 calls in FY2023–24, an increase of 12% from the previous financial year. Therefore, companies in the country are prioritizing CSPM to proactively harden their cloud infrastructure and prevent exploits, driven by the rising incidence of cyberattacks.

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

Cloud security posture management (CSPM) solutions are now integrating AI and ML to analyze vast amounts of cloud configuration data, identify anomalies, and predict potential threats in real time. These advanced capabilities of cloud security posture management, powered by artificial intelligence, are driving their adoption among businesses operating on the cloud to ensure system safety and compliance management.

Segmental Insights

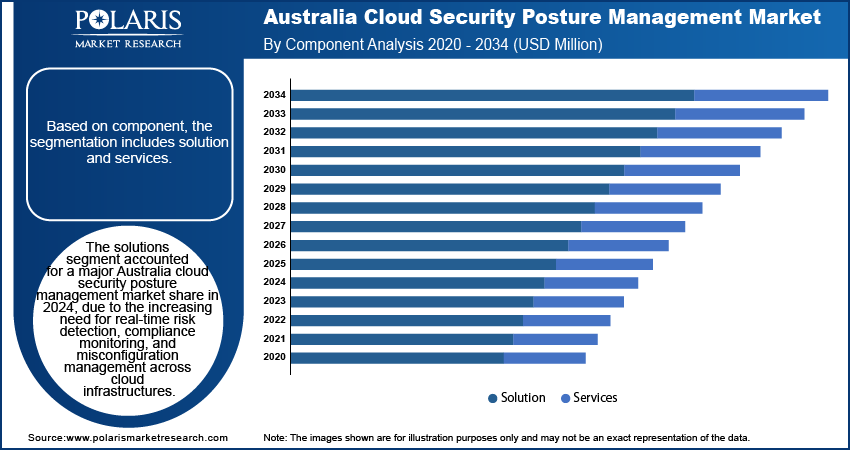

Component Analysis

Based on component, the segmentation includes solution and services. The solutions segment accounted for a major Australia cloud security posture management market share in 2024 due to the increasing need for real-time risk detection, compliance monitoring, and misconfiguration management across cloud infrastructures. Enterprises across sectors such as BFSI, healthcare, and retail adopted cloud security posture management solutions to automate security assessments and mitigate risks associated with hybrid and multi-cloud environments. The rising frequency of data breaches and the need to comply with stringent data protection regulations, including the Australian Privacy Act and APRA CPS 234, further accelerated the adoption of these solutions. Moreover, the growing reliance on Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) models fueled demand for scalable, AI-driven CSPM solutions that provide continuous visibility and control over complex cloud environments.

Cloud Service Analysis

In terms of cloud service, the segmentation includes SaaS, IaaS, and PaaS. The IaaS segment held the largest market share in 2024. Organizations in Australia rapidly migrated their workloads to IaaS platforms such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud to achieve flexibility, scalability, and cost efficiency. However, this shift exposed enterprises to configuration errors, identity mismanagement, and increased surface area for cyber threats. Thus, demand for CSPM solutions upsurged as they offer visibility, compliance tracking, and automated remediation across IaaS environments. The dynamic and elastic nature of IaaS infrastructure further fueled the need for cloud security posture management, especially in industries handling sensitive data, including finance, government, and healthcare.

Enterprise Size Analysis

Based on enterprise size, the segmentation includes large enterprises and small and medium enterprises. The large enterprises segment dominated the Australia cloud security posture management market share in 2024. These organizations operate complex, multi-cloud environments and manage vast volumes of sensitive data, making them prime targets for cyber threats. Thus, they prioritize investments in advanced CSPM solutions to safeguard their cloud infrastructure, ensure compliance with regulatory standards such as the Australian Privacy Act, and minimize operational risks.

The small and medium enterprises segment is projected to grow at a rapid pace in the coming years. SMEs are increasingly adopting cloud technologies to enhance business agility, reduce IT costs, and support remote work models. However, limited in-house security expertise and constrained budgets leave them vulnerable to misconfigurations and data breaches. This growing exposure is driving demand for user-friendly and cost-effective CSPM solutions tailored to SME needs.

End User Analysis

Based on end user, the segmentation includes BFSI, healthcare, manufacturing, IT & telecom, retail, defense/government, energy, and others. The BFSI segment accounted for 32.03% revenue market share in 2024 due to stringent regulatory requirements and the increasing adoption of cloud-based solutions to enhance operational efficiency. Financial institutions prioritized robust security posture management to safeguard sensitive customer data and comply with frameworks such as APRA CPS 234. The rise in cyber threats, such as phishing and ransomware attacks, further compelled BFSI organizations to invest heavily in cloud security solutions. Additionally, the shift toward digital banking and fintech innovations fueled demand for real-time threat detection and compliance monitoring, contributing to BFSI’s dominance in the market.

The IT & telecom segment is projected to grow at a rapid pace in the coming years, owing to the rapid expansion of 5G and private 5Gnetworks, coupled with Australia’s growing reliance on cloud infrastructure for data storage and communication services. Telecom providers in the country are facing risks from sophisticated cyberattacks targeting critical infrastructure, necessitating the use of advanced posture management tools.

Key Players and Competitive Analysis

The Australia cloud security posture management (CSPM) market is highly competitive, with key players offering solutions to help organizations detect and remediate misconfigurations, enforce compliance, and improve cloud security governance. Microsoft and Palo Alto Networks lead the market with integrated platforms that combine CSPM with Cloud Workload Protection (CWP) and threat detection. Check Point Software and Trend Micro also provide robust CSPM capabilities, focusing on compliance automation and real-time risk assessment, appealing to regulated industries such as finance and healthcare.

A few major companies operating in the Australia cloud security posture management industry include Aqua Security Software Ltd.; Check Point Software Technologies Ltd; Cloudflare, Inc.; CrowdStrike; Lacework; Microsoft Corporation; NetApp, Inc.; Palo Alto Networks, Inc.; Qualys, Inc.; SentinelOne; Sophos Ltd.; and Trend Micro Incorporated.

Key Players

- Aqua Security Software Ltd.

- Check Point Software Technologies Ltd

- Cloudflare, Inc.

- CrowdStrike

- Lacework

- Microsoft

- NetApp, Inc.

- Palo Alto Networks, Inc.

- Qualys, Inc.

- SentinelOne

- Sophos Ltd.

- Trend Micro Incorporated

Industry Developments

February 2025: Check Point Software Technologies Ltd announced a strategic partnership with a major cloud security provider, Wiz, to address the growing challenges in securing hybrid cloud environments across enterprises.

October 2024: Cognizant and Palo Alto Networks partnered to deliver AI-driven cybersecurity capabilities and services for enterprises across industries.

Australia Cloud Security Posture Management Market Segmentation

By Component Outlook (Revenue, USD Million, 2020–2034)

- Solution

- Services

By Cloud Service Outlook (Revenue, USD Million, 2020–2034)

- SaaS

- IaaS

- PaaS

By Enterprise Size Outlook (Revenue, USD Million, 2020–2034)

- Large Enterprises

- Small and Medium Enterprises

By Cloud Outlook (Revenue, USD Million, 2020–2034)

- Public

- Private

- Hybrid

By Industry Vertical Outlook (Revenue, USD Million, 2020–2034)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecom

- Retail

- Defense/Government

- Energy

- Others

Australia Cloud Security Posture Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 125.43 Million |

|

Market Size in 2025 |

USD 143.52 Million |

|

Revenue Forecast by 2034 |

USD 491.98 Million |

|

CAGR |

14.67% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 125.43 million in 2024 and is projected to grow to USD 491.98 million by 2034.

The market is projected to register a CAGR of 14.67 % during the forecast period.

A few of the key players in the market are Aqua Security Software Ltd.; Check Point Software Technologies Ltd; Cloudflare, Inc.; CrowdStrike; Lacework; McAfee, LLC; Microsoft Corporation; NetApp, Inc.; Palo Alto Networks, Inc.; Qualys, Inc.; SentinelOne; Sophos Ltd.; and Trend Micro Incorporated.

The solutions segment dominated the market share in 2024.

The IT & Telecom segment is expected to witness the fastest growth during the forecast period.