Automation Testing Market Share, Size, Trends, Industry Analysis Report

By Testing Type (Static Testing, Dynamic Testing), By Service, By Verticals, By Organization Size, and By Region -Market Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 118

- Format: PDF

- Report ID: PM2334

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

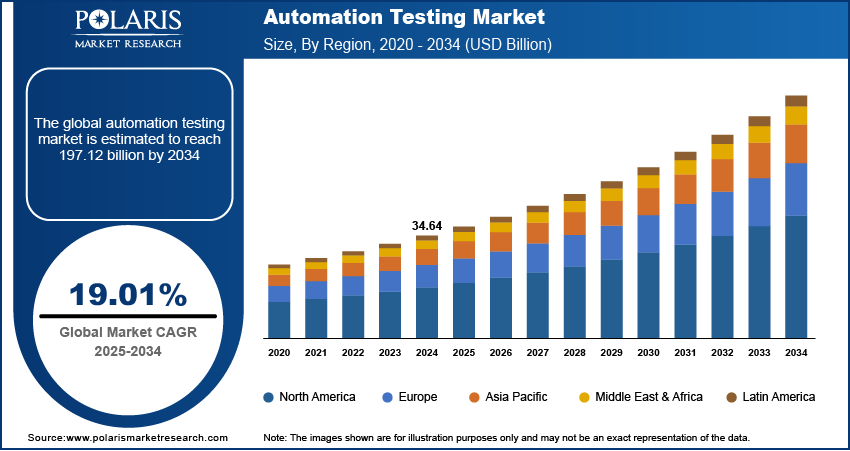

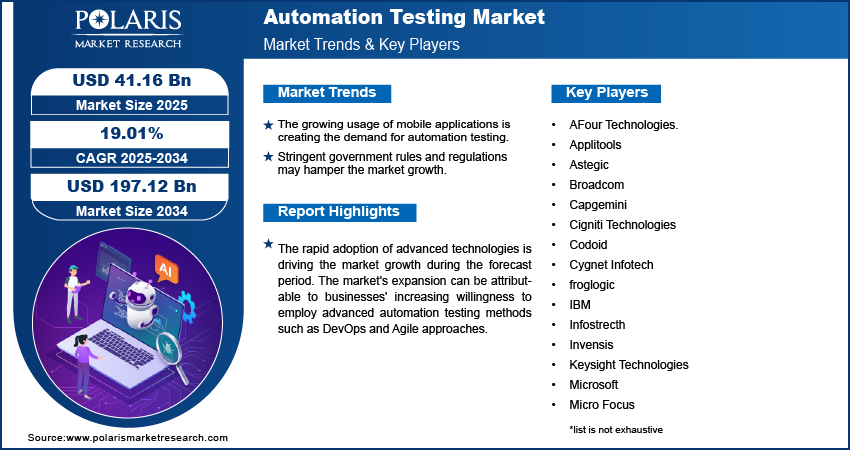

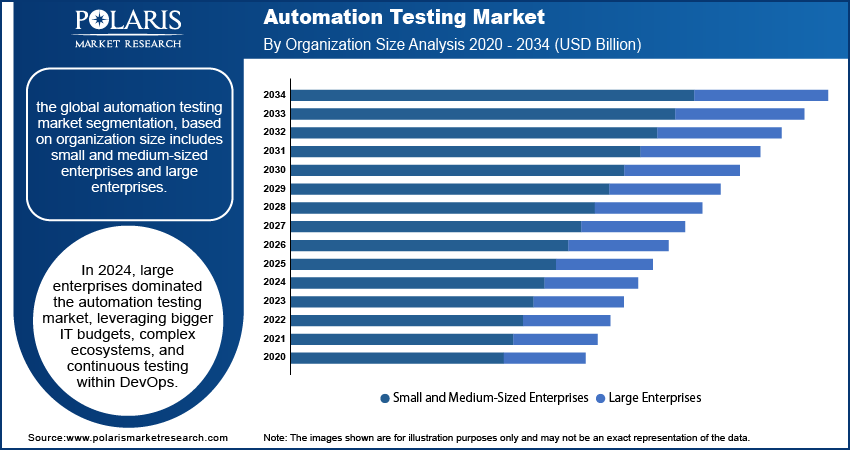

The global automation testing market size was valued at USD 34.64 billion in 2024. The market is projected to grow at a CAGR of 19.01% during 2025 to 2034. Key factors driving demand for automation testing include increasing software complexity, widespread use of mobile applications, and integration of artificial intelligence and machine learning.

Key Insights

- Based on the service segment, the implementation services segment is expected to be the most significant revenue contributor in the global market.

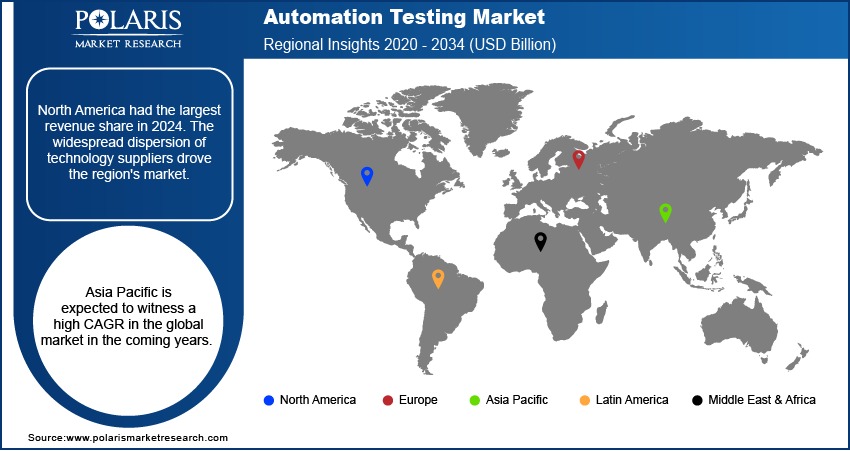

- North America had the largest revenue share in 2024, due to the widespread dispersion of technology suppliers.

- Asia Pacific is expected to witness the fastest CAGR in the global market during the forecast period, owing to the increasing adoption of mobile and web-based apps and cloud-based services.

Industry Dynamics

- The growing usage of mobile applications is creating the demand for automation testing.

- The increasing development of online gaming platforms is further propelling the market growth.

- The ongoing digital transformation across the globe is creating a lucrative market opportunity.

- Stringent government rules and regulations may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 34.64 Billion

- 2034 Projected Market Size: USD 197.12 Billion

- CAGR (2025-2034): 19.01%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on Automation Testing Market

- AI helps in smarter test case generation and faster defect detection.

- AI improves test coverage through predictive analytics.

- AI allows testers to create scripts with minimal coding.

The rapid adoption of advanced technologies is driving the market growth during the forecast period. The market's expansion can be attributable to businesses' increasing willingness to employ advanced automation testing methods such as DevOps and Agile approaches. These approaches assist firms in shortening the time it takes to commercialize their software solutions by reducing the time it takes to automate analysis. Quick bug elimination, post-deployment debugging, and software integration of unforeseen changes are also provided by Agile, and DevOps approaches. These advantages are anticipated to increase demand for elegant and DevOps-based automated analysis across various sectors, including monetary services, telecommunications, automotive, government, and public. To stay competitive, different market competitors are focusing on building test automation solutions based on Agile and DevOps methodologies.

Furthermore, to achieve the goal of the autonomous analysis. Each test cycle produces a large amount of data that can be utilized to discover and resolve test failures. The data from each test run can be sent back to the AI algorithms. With the growing benefits of incorporating AI into analysis, the need for technology has risen. With more AI being used in the development of test tools, the tools will self-heal at runtime. Over the forecast period, self-healing automation analysis is expected to be one of the most popular automation analysis trends. As a result of these, new products are being introduced into the automation testing market.

On the other hand, governments establish data regulatory norms from various economies to protect data from unwanted access. Several regional rules must be followed regarding data storage security and privacy, including the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the Data Protection Directive in the European Union. Data stored on-premises is entirely secure; however, data stored on the cloud is exposed to security risks.

Industry Dynamics

Growth Drivers

The automation testing market has observed extensive developments in the last few decades. For instance, in March 2021, Neotys, a performance analysis firm, was bought by Tricentis. With the addition of NeoLoad to the Tricentis offering, customers will have access to an enterprise-grade performance analysis solution. In addition, in May 2021, QBS Software and martBear have formed a strategic relationship. This collaboration's primary purpose is to increase the efficiency of corporate software solutions to more than 240,000 businesses across EMEA. As a result, key companies' acquisitions and developments drive market expansion over the projection period.

Furthermore, the automated analysis sector has tremendous potential to evaluate these advanced technical applications as modern technologies such as IoT, AI, and machine learning continue to expand. The majority of the company's works are managed digitally and through rule-based software. When it comes to dealing with serious situations, this strategy is limited.

Report Segmentation

The market is primarily segmented based on testing type, service, verticals, organization size, and region.

|

By Testing Type |

By Service |

By Organization Size |

By Vertical |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Service

Based on the service segment, the implementation services segment is expected to be the most significant revenue contributor in the global market. With the help of implementation services, automation may be readily integrated into an existing software automation testing infrastructure. As a result, successful implementation of automated analysis solutions necessitates connecting the solutions with various hardware components and evaluating the overall system's functionality.

Geographic Overview

In terms of geography, North America had the largest revenue share in 2024. The widespread dispersion of technology suppliers drove the region's market. Smart consumer electronics such as smart TVs, home appliances, and laptops are becoming increasingly popular in the U.S. are fueling market demand. In smart consumer gadgets, software, web applications, and operating systems (OS) are intricately linked. As these smart consumer products become more generally accepted, the demand for test automation services in the region will increase.

Asia Pacific is expected to witness a high CAGR in the global market in the coming years. The Asia Pacific region is the most promising since it includes essential economies like Australia, Japan, Singapore, China, New Zealand, and Hong Kong, all of which have significant growth potential for automation analysis organizations. Governments in the region are implementing initiatives to fasten the adoption of new technologies such as artificial intelligence and machine learning, automation, the Internet of Things, mobile and web-based apps, cloud-based services, and other innovations, which is driving the demand for automation testing.

Competitive Insight

Some of the major players operating in the global automation testing market include Sauce Labs, AFour Technologies., Invensis, Keysight Technologies, Broadcom, Applitools, Cygnet Infotech Astegic, Mobisoft Infotech, Parasoft, ProdPerfect, Microsoft, Cigniti Technologies, Infostrecth, QA Source, Codoid, froglogic, Capgemini, Micro Focus, IBM, QA Mentor, Ranorex, Smartbear Software, Testim.io, Tricentis, Thinksys, and Worksoft among others.

Automation Testing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 34.64 Billion |

|

Market Size in 2025 |

USD 41.16 Billion |

|

Revenue Forecast by 2034 |

USD 197.12 Billion |

|

CAGR |

19.01% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global market size was valued at USD 34.64 billion in 2024 and is projected to grow to USD 197.12 billion by 2034.

• The global market is projected to register a CAGR of 19.01% during the forecast period.

• North America dominated the market in 2024

• A few of the key players in the market are Sauce Labs, AFour Technologies., Invensis, Keysight Technologies, Broadcom, Applitools, Cygnet Infotech Astegic, Mobisoft Infotech, Parasoft, ProdPerfect, Microsoft, Cigniti Technologies, Infostrecth, QA Source, Codoid, froglogic, Capgemini, Micro Focus, IBM, QA Mentor, Ranorex, Smartbear Software, Testim.io, Tricentis, Thinksys, and Worksoft, among others.

• The implementation service segment dominated the market revenue share in 2024.