Automotive Charge Air Cooler Market Size, Share, Trends, Industry Analysis Report

: By Product Type (Air-Cooled and Liquid-Cooled), By Vehicle Type, By Design Type, By Position Type, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM2965

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

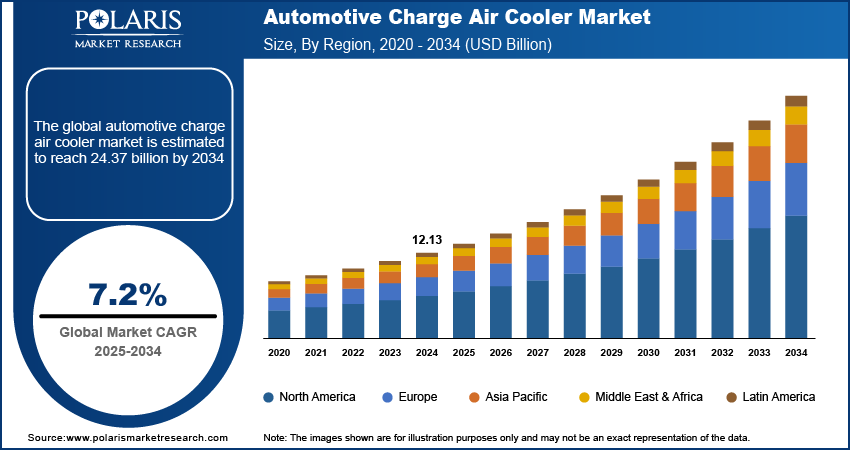

The automotive charge air cooler market size was valued at USD 12.13 billion in 2024. It is projected to grow from USD 12.98 billion in 2025 to USD 24.37 billion by 2034, exhibiting a CAGR of 7.2% during 2025–2034. The usage of charged air coolers improves fuel economy and assists in meeting strict emission norms by governments globally, thus boosting the market demand.

Key Insights

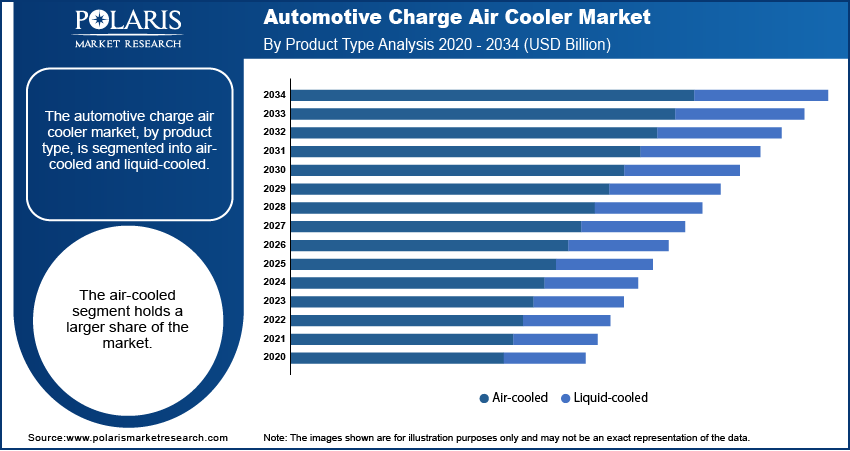

- The air-cooled segment dominated the market share in 2024.

- The passenger vehicles segment accounted for a larger share of the market, driven by the high volume of passenger car production and sales worldwide.

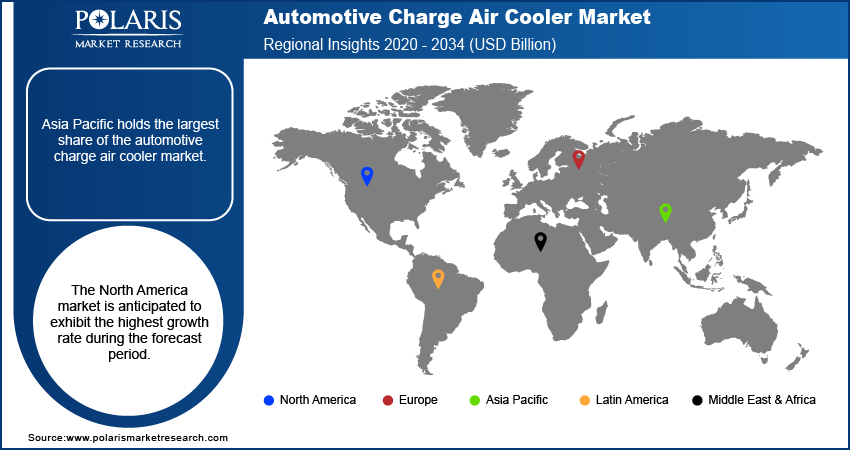

- Asia Pacific automotive charge air cooler market holds the largest market share due to the region's extensive capacity of vehicle production, especially in nations such as China and India, which are prominent automotive manufacturing hubs.

- North America is projected to exhibit the highest growth rate in the market due to rapid industrialization and urbanization in the US and Canada.

Industry Dynamics

- The rising adoption of turbocharger engines to reduce emissions and enhance fuel efficiency is one of the key market drivers.

- The introduction of increasingly stringent emissions directives covering the globe is another prominent driver for the market, as governments worldwide are demanding lower levels of harmful emissions from vehicles to combat air contamination and climate change.

- Strict emissions directives and a worldwide shift towards green transportation are present opportunities for the market.

- Surge in demand for electric vehicles may present challenges to market growth.

Market Statistics

2024 Market Size: USD 12.13 billion

2034 Projected Market Size: USD 24.37 billion

CAGR (2025-2034): 7.2%

Asia Pacific: Largest Market in 2024

To Understand More About this Research:Request a Free Sample Report

The automotive charge air cooler (CAC) market revolves around heat exchangers designed to reduce the temperature of air compressed by turbochargers before it enters the engine. This cooling process increases the density of the air, leading to more efficient combustion, improved engine performance, and reduced emissions. The use of CACs contributes to enhanced fuel economy and helps in meeting stringent emission standards implemented by governments worldwide.

The increasing adoption of turbocharged engines in vehicles to improve fuel efficiency and reduce emissions is one of the primary drivers. Stringent emission regulations and the global push towards sustainable transportation are also fueling industry expansion. Furthermore, the rising demand for passenger and electric commercial vehicles, along with the increasing production of automobiles worldwide, contributes to the demand for CACs.

Market Dynamics

Rising Adoption of Turbocharged Engines

Turbochargers enhance engine power and efficiency by forcing more air into the combustion chamber. This process also increases the temperature of the intake air, which reduces its density and thus the effectiveness of combustion. Charge air coolers are essential in mitigating this issue by cooling the compressed air, thereby improving engine performance and fuel economy. Therefore, the rising adoption of turbocharged engines is significantly driving the demand for automotive charge air coolers.

Stringent Emission Regulations

The implementation of increasingly strict emission regulations across the globe is another major driver for the market. Governments worldwide are mandating lower levels of harmful emissions from vehicles to combat air pollution and climate change. Charge air coolers play a vital role in helping vehicles meet these regulations by ensuring more efficient combustion, which leads to reduced emissions of pollutants such as nitrogen oxides and particulate matter. Thus, as emission standards become more rigorous, the demand for advanced and efficient charge air cooler systems will continue to rise.

Growing Vehicle Production and Sales

The consistent growth in global vehicle production and sales directly contributes to the adoption of CACs. The Society of Indian Automobile Manufacturers (SIAM) reported that the total production of vehicles in India alone reached 2.84 crore units in the fiscal year 2023-24, an increase from 2.59 crore units in the previous fiscal year. This upward trend in vehicle production signifies a greater need for automotive components such as charge air coolers. Furthermore, increasing consumer preference for vehicles with enhanced engine performance and fuel efficiency, often achieved through turbocharging and intercooling, further fuels the demand for charge air coolers. Therefore, the continuous rise in vehicle production and sales acts as a catalyst for the automotive charge air cooler market revenue.

Segment Insights

Market Assessment By Product Type

The automotive charge air cooler market, by product type, is bifurcated into air-cooled and liquid-cooled. The air-cooled segment holds a larger share, owing to the widespread adoption of air-cooled CACs across various vehicle types, particularly in passenger cars and light commercial vehicles. The established manufacturing processes and relatively lower cost compared to liquid-cooled systems have contributed to the significant penetration of the air-cooled CACs. Furthermore, continuous advancements in the design and materials used in air-cooled CACs have enhanced their efficiency and durability, allowing them to remain a preferred choice for many automotive manufacturers globally.

The liquid-cooled segment is anticipated to exhibit a higher growth rate during the forecast period. This growth is primarily driven by the increasing demand for high-performance vehicles and stringent emission regulations, which necessitate more efficient cooling solutions. Liquid-cooled CACs offer superior cooling performance, especially in high-boost applications and compact engine designs where space is limited. The ability of liquid-cooled systems to maintain lower intake air temperatures consistently contributes to enhanced engine efficiency and reduced emissions. Therefore, as vehicle manufacturers continue to focus on developing more powerful yet environmentally friendly engines, the adoption of liquid-cooled charge air coolers is expected to increase significantly during the forecast period.

Market Evaluation By Vehicle Type

Based on vehicle type, the automotive charge air cooler market is segmented into passenger vehicles, light commercial vehicles, heavy commercial vehicles, and others. The passenger vehicles segment accounts for the largest share, primarily due to the high volume of passenger car production and sales globally. The widespread adoption of turbocharged engines across various passenger vehicle models to enhance fuel efficiency and performance has further propelled the demand for charge air coolers in the segment. The high number of passenger vehicles on the road and the increasing trend of incorporating advanced engine technologies contribute substantially to the dominance of the segment.

The heavy commercial vehicles segment is projected to experience the highest growth rate during the forecast period. This anticipated growth is driven by the increasing demand for efficient and powerful engines in trucks and buses, coupled with stringent emission regulations for heavy-duty vehicles. Turbocharging is becoming increasingly common in heavy commercial vehicles to achieve better fuel economy and reduce emissions, thereby necessitating the use of robust and efficient charge air coolers. The expanding logistics and transportation sectors globally, along with the growing focus on reducing the environmental impact of commercial fleets, are expected to fuel the segment's growth.

Market Assessment By Design Type

The automotive charge air cooler market, by design type, is segmented into fin & tube and bar & plate. The fin & tube segment holds a larger market share. This is primarily due to its established manufacturing processes, cost-effectiveness, and suitability for a wide range of vehicle applications, particularly in passenger cars and light commercial vehicles. The fin & tube design offers a good balance between heat transfer efficiency and weight, making it a preferred choice for many original equipment manufacturers (OEMs) seeking reliable and economical cooling solutions. Its long-standing presence and continuous improvements in design and materials have contributed to its leading position in the industry.

The bar & plate segment is anticipated to register a higher growth rate in the market. This growth is attributed to the increasing demand for high-performance vehicles and heavy-duty applications where superior cooling efficiency and durability are crucial. The bar & plate design offers enhanced heat transfer capabilities and withstands higher pressures compared to fin & tube designs, making it ideal for turbocharged engines in heavy commercial vehicles and performance-oriented passenger cars. Therefore, as the demand tends toward more powerful and efficient engines, the bar & plate design segment is expected to witness increased adoption during the forecast period.

Market Assessment By Position Type

The market, by position type, is segmented into integrated and standalone. The standalone segment holds a larger share. This dominance stems from the traditional design and packaging of many vehicles, where the charge air cooler is a distinct and separate component located in the engine bay. Standalone CACs offer flexibility in terms of placement and design, allowing for optimization based on specific vehicle architectures and engine configurations. Their established presence in the automotive industry and ease of maintenance have contributed to their significant market penetration and share.

The integrated segment is expected to demonstrate the highest growth rate during the forecast period. This growth is driven by the automotive sector's increasing focus on compact engine designs, improved packaging efficiency, and enhanced thermal management. Integrated CACs, which are often incorporated into the intake manifold or other engine components, offer advantages in terms of reduced airflow distance and improved responsiveness. Thus, as vehicle manufacturers strive for more streamlined and efficient engine layouts, the adoption of integrated charge air cooler solutions is anticipated to rise in the coming years.

Regional Outlook

By region, the automotive charge air cooler market report provides insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific holds the largest share of the market, owing to the region's high volume of vehicle production, particularly in countries such as China and India, which are major automotive manufacturing hubs. The increasing adoption of turbocharging in vehicles across Asia Pacific, driven by a growing demand for fuel-efficient vehicles and evolving emission standards, further fuels the CACs demand. The wide size of the automotive sector in this region and the continuous expansion of vehicle ownership contributed to Asia Pacific's leading position.

The North America automotive charge air cooler market is anticipated to exhibit the highest growth rate in the market during the forecast period. The rapid industrialization and urbanization in the US and Canada are driving increased vehicle sales and production. Furthermore, the growing stringency of emission regulations and the increasing focus on fuel efficiency are compelling automotive manufacturers in the region to incorporate advanced technologies such as turbocharging and efficient charge air coolers in their vehicles. The increasing investments in automotive manufacturing and technological advancements position North America as the region with the most promising market development.

Key Players and Competitive Analysis

A few key players actively operating in the automotive charge air cooler market include MAHLE GmbH; Modine Manufacturing Company; Dana Incorporated; Valeo; BorgWarner Inc.; T.RAD Co., Ltd.; Hanon Systems; Calsonic Kansei Corporation (now Marelli Corporation); Denso Corporation; Delphi Technologies (now BorgWarner Inc.); and Behr Hella Service GmbH (part of MAHLE GmbH). These companies offer a diverse range of charge air coolers for various vehicle types and applications, contributing significantly to the market dynamics.

The competitive landscape of the automotive charge air cooler market is characterized by the presence of both global players and regional manufacturers. Competition is driven by factors such as product innovation, technological advancements in cooling efficiency and material usage, pricing strategies, and the ability to meet the requirements of different vehicle manufacturers. Market insights suggest a continuous focus on developing more compact, lightweight, and efficient charge air coolers to cater to the evolving demands of the automotive sector, including the increasing adoption of electric vehicles and hybrid vehicles, which may require specialized thermal management solutions. Market penetration strategies often involve close collaboration with OEMs to integrate charge air coolers into new vehicle platforms.

MAHLE GmbH, located in Stuttgart, Germany, offers a comprehensive portfolio of automotive components, including a wide range of charge air coolers for passenger cars, commercial vehicles, and off-highway applications. Their offerings include both air-cooled and liquid-cooled charge air coolers, utilizing various designs and materials to optimize performance and efficiency for different engine types and sizes. MAHLE's focus on innovation and close partnerships with automotive manufacturers makes them a relevant player in addressing the demand for advanced thermal management solutions.

BorgWarner Inc., headquartered in Auburn Hills, Michigan, USA, provides a broad spectrum of powertrain solutions, including turbochargers and charge air coolers. Their charge air cooler offerings encompass both air-cooled and liquid-cooled technologies, designed to enhance engine performance, improve fuel economy, and reduce emissions. With a strong emphasis on developing advanced technologies and serving a global customer base, BorgWarner plays a significant role in the industry by supplying critical components for various vehicle platforms.

List of Key Companies

- Behr Hella Service GmbH

- BorgWarner Inc.

- Calsonic Kansei Corporation

- Dana Incorporated

- Delphi Technologies

- Denso Corporation

- Hanon Systems

- MAHLE GmbH

- Modine Manufacturing Company

- T.RAD Co., Ltd.

- Valeo

Automotive Charge Air Cooler Industry Developments

- September 2023: Modine Manufacturing Company announced that it signed a definitive agreement to sell three of its Germany-based automotive businesses to affiliates of Regent LP. These businesses manufactured exhaust gas recirculation coolers, radiators, and charge air cooler modules for internal combustion engine applications in the European automotive sector.

- January 2020: MAHLE GmbH completed the acquisition of Behr Hella Service GmbH (BHS). This acquisition expanded MAHLE's aftermarket product range in thermal management systems, including charge air coolers, strengthening its position in the automotive components sector.

Automotive Charge Air Cooler Market Segmentation

By Product Type Outlook (Revenue – USD Billion, 2020–2034)

- Air-Cooled

- Liquid-Cooled

By Vehicle Type Outlook (Revenue – USD Billion, 2020–2034)

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Others

By Design Type Outlook (Revenue – USD Billion, 2020–2034)

- Fin & Tube

- Bar & Tube

By Position Type Outlook (Revenue – USD Billion, 2020–2034)

- Integrated

- Standalone

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.13 billion |

|

Market Size Value in 2025 |

USD 12.98 billion |

|

Revenue Forecast by 2034 |

USD 24.37 billion |

|

CAGR |

7.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The automotive charge air cooler market has been segmented into detailed segments of product type, vehicle type, design type, and position type. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies: A key growth strategy in the market involves focusing on technological innovation to develop more efficient and compact cooling solutions that meet stringent emission standards and the demands of next-generation vehicles, including electric and hybrid models. Market penetration can be enhanced through strategic collaborations with automotive manufacturers to integrate advanced charge air coolers into new vehicle platforms. Emphasizing the benefits of enhanced engine performance and fuel efficiency through targeted marketing efforts can further drive demand trends. Exploring opportunities in emerging economies with increasing vehicle production and a growing focus on emission control presents significant industry potential. Additionally, aftermarket services and the development of durable, long-lasting products can contribute to sustained growth and customer loyalty.

FAQ's

The market size was valued at USD 12.13 billion in 2024 and is projected to grow to USD 24.37 billion by 2034.

The market is projected to register a CAGR of 7.2% during the forecast period.

Asia Pacific held the largest share of the market in 2024.

A few key players actively operating include MAHLE GmbH; Modine Manufacturing Company; Dana Incorporated; Valeo; BorgWarner Inc.; T.RAD Co., Ltd.; Hanon Systems; Calsonic Kansei Corporation (now Marelli Corporation); Denso Corporation; Delphi Technologies (now BorgWarner Inc.); and Behr Hella Service GmbH (part of MAHLE GmbH).

The air-cooled segment accounted for a larger share in 2024.

Following are a few of the market trends: ? Increasing Adoption of Automotive Turbocharger Engines: The continuous rise in the use of turbocharged engines across various vehicle segments to improve fuel efficiency and reduce emissions is a significant trend driving the demand for charge air coolers. ? Stringent Emission Regulations: The implementation of increasingly strict emission standards globally necessitates the use of efficient charge air coolers to help vehicles meet these requirements by optimizing combustion. ? Focus on Lightweighting: There is a growing trend toward using lightweight materials such as aluminum and composites in the manufacturing of charge air coolers to improve heat dissipation and overall vehicle efficiency.

An automotive charge air cooler (CAC), often referred to as an intercooler or aftercooler, is a heat exchange device used in turbocharged and supercharged internal combustion engines. Its primary function is to cool the compressed air coming from the turbocharger or supercharger before it enters the engine's intake manifold.