Automotive eCall Market Size, Share, & Trends, Analysis Report

By Propulsion (ICE and Electric Motor), By Trigger Type, By Vehicle Type, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5771

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

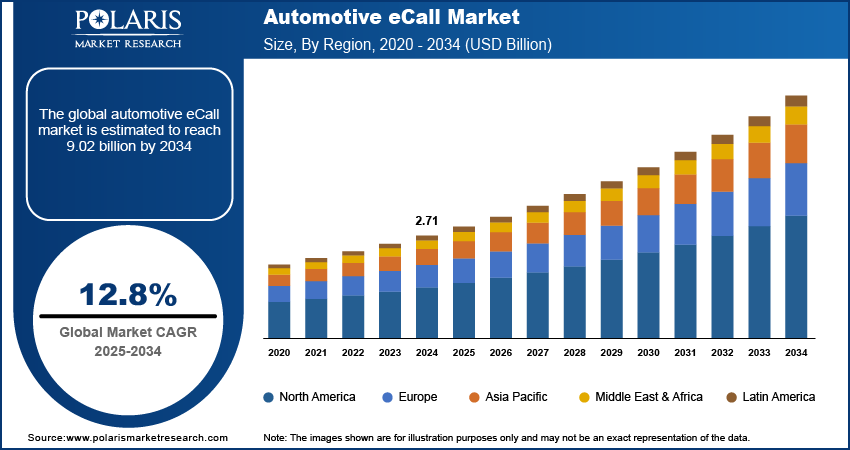

The global automotive eCall market size was valued at USD 2.71 billion in 2024, growing at a CAGR of 12.8% during 2025–2034. The growth is driven by government regulations on road safety and growth of automotive industry.

The automotive eCall is an emergency call system that automatically dials the emergency number in the event of a serious road accident, transmitting crucial data such as location and vehicle information to emergency services. It aims to reduce response times and improve road safety by ensuring faster assistance to those in need.

Consumers prefer vehicles with advanced safety and convenience features. This change in preference is driven by rising disposable income, awareness regarding road safety, and a desire for a smoother and more enjoyable driving experience. eCall is one of the major features that improve driver and passenger safety, as it automatically notifies emergency services in the event of a serious accident. To meet this demand, automakers are adding eCall to attract safety-conscious buyers, thereby driving growth.

The global rollout of better mobile and internet networks is improving the functioning of eCall systems. Most of the regions worldwide are equipped with 5G infrastructure and advanced communication infrastructure. According to 5G Americas, North America alone has 264 million 5G connections, which covers 70% of the region's population. Reliable connectivity ensures that emergency calls are made without delay, even in remote areas. The performance and reach of eCall systems are improving as telecom infrastructure has improved worldwide, boosting the growth.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Government Regulations on Road Safety

Governments worldwide are mandating advanced safety features in vehicles. This government regulation of road safety and vehicle features is driven by rising road accidents and fatalities, improving public health and promoting financial stability. According to the US Department of Transport, in 2024, the US alone recorded 39,345 traffic fatalities. These rising road accidents and fatalities are driving the demand for safety features such as eCall as automakers are aiming to meet stringent government regulations, thereby driving the market growth.

Growth of Automotive Industry

The automotive industry is growing worldwide, driven by rising disposable income, technological advancements, and the increasing importance of sustainable mobility. According to the European Automobile Manufacturers Association, in Europe alone, vehicle sales increased by 10.6 million units in 2024, an increase of 0.8% compared to 2023. This growth in the automotive industry is driving the demand for advanced safety features such as eCall. Additionally, the rising trend of electric vehicles (EVs) is driving the demand for emergency call systems, as EV manufacturers are aiming to provide advanced features to maintain a competitive edge, further driving the eCall system demand.

Segmental Insights

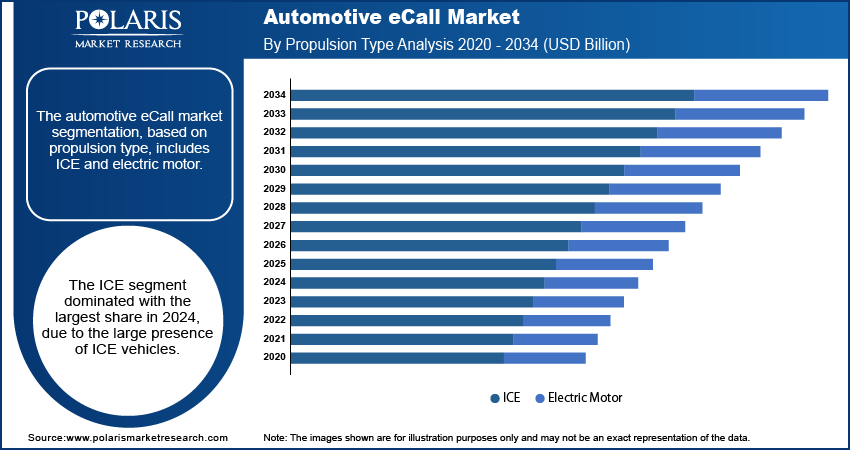

By Propulsion type Analysis

The segmentation, based on propulsion type, includes ICE and electric motor. The ICE segment dominated with a larger share in 2024, due to the large presence of ICE vehicles. Traditional gasoline and diesel vehicles represent the vast majority of cars on roads worldwide, making them the primary platform for eCall system deployment. ICE vehicles have established manufacturing processes, supply chains, and consumer familiarity that facilitate seamless eCall integration. The existing automotive infrastructure strongly supports ICE vehicle production, allowing manufacturers to incorporate eCall systems without major technological advancements, thereby driving segment growth.

By Trigger Type Analysis

The segmentation, based on trigger type, includes manually initiated eCall (MIeC) and automatically initiated eCall (AIeC). The automatically initiated eCall segment dominated with a larger share in 2024, as it provides the most critical safety benefits without requiring human intervention during emergencies. These systems activate instantly when crash sensors detect severe impacts and contact emergency services when occupants are unconscious or unable to communicate. Advanced crash detection algorithms analyze vehicle deceleration patterns, airbag deployment, and other safety system activations to determine when an emergency response is needed. Automakers are actively integrating advanced safety features, due to which the demand for automatically initiated eCall is rising, thereby driving the segment growth.

The manually initiated eCall (MIeC) segment is expected to witness significant growth due to its cost effectiveness and flexibility. Compared to automatically initiated eCall, the manually initiated call is cheaper and is expected to be integrated into every type of budget vehicle. This integration is expected to boost the demand for MieC as the number of budget vehicles is larger than the high-end vehicles globally, thereby driving the segment growth.

By Vehicle Type Analysis

The segmentation, based on vehicle type, includes passenger vehicles and commercial vehicles. The commercial vehicles segment is expected to record significant growth due to unique operational requirements and safety considerations. Fleet operators increasingly recognize eCall systems' value for protecting drivers, reducing liability exposure, and improving operational efficiency during emergencies. Commercial vehicle accidents often involve higher stakes due to cargo value, multiple parties, and complex insurance implications, making rapid emergency response particularly valuable, which is driving the demand for eCall systems in commercial vehicles.

Regional Analysis

Automotive eCall Market in Europe

The Europe automotive eCall market dominated with the largest share in 2024, due to strict regulations mandating eCall systems in all new vehicles since 2018. The region’s strong focus on road safety and advanced automotive infrastructure drives adoption. Countries such as Germany, France, and the UK are major contributors, with high awareness and government support. The presence of major automakers and tech providers further boosts the market growth in the region.

Automotive eCall Market in Germany

The Germany automotive eCall market is expected to witness significant growth due to its strong automotive industry and emphasis on vehicle safety. Leading car manufacturers such as BMW, Mercedes, and Volkswagen integrate eCall systems in their models, supporting the growth in demand. Government policies and high consumer awareness further accelerate adoption. Germany’s advanced telematics and 5G infrastructure are also enhancing eCall efficiency. The rising demand for connected and autonomous cars is further boosting the demand for these systems, thereby driving the industry growth in Germany.

Automotive eCall Market in North America

The North America automotive eCall market is projected to witness substantial growth during the forecast period, due to increasing road safety concerns and government initiatives. Automakers are voluntarily adopting eCall to enhance vehicle security. The US and Canada are leading this trend, supported by advanced telecommunication networks and rising demand for connected cars. Insurance companies also promote eCall by offering discounts for vehicles with emergency response systems. eCall adoption is expected to increase as autonomous and electric vehicles gain traction, thereby driving the growth in the region.

Automotive eCall Market in US

The US automotive eCall market is expected to experience significant growth driven by rising road accidents and the need for faster emergency response. Major automakers such as GM, Ford, and Tesla are integrating eCall systems to improve passenger safety. While regulations are less strict than in Europe, partnerships between car manufacturers and telematics providers are boosting adoption. The expansion of 5G networks and smart city initiatives further supports eCall integration. Additionally, the increasing consumer awareness and technological advancements in the US propel the adoption of eCall in the country.

Automotive eCall Market in Asia Pacific

The Asia Pacific automotive eCall market is expected to experience significant growth during the forecast period, due to increasing vehicle sales, rising road safety concerns, and government initiatives. Countries such as Japan, South Korea, and India are adopting eCall systems to reduce emergency response times. Automakers in the region are integrating eCall in premium and mid-range vehicles. Expanding 5G networks and smart city projects further support this growth. Additionally, the booming automotive industry and growing awareness of connected car technologies are driving the demand for eCall systems in the region.

Automotive eCall Market in China

The China automotive eCall market is expected to experience significant growth driven by strict safety regulations and the world’s largest automotive market. The government promotes intelligent transportation systems, including mandatory eCall-like features in new energy vehicles (NEVs). Domestic automakers such as BYD and Geely, along with global brands, are integrating advanced emergency response systems. Strong 5G infrastructure and smart city developments are improving eCall efficiency. Additionally, China’s push for smarter, safer mobility is fueling the adoption of eCall technology in the country.

Key Players and Competitive Analysis Report

The market features intense competition among established technology leaders across different specialization areas. Continental AG and Robert Bosch GmbH dominate as comprehensive Tier 1 suppliers, leveraging extensive OEM relationships and integrated system capabilities. DENSO Corporation competes through advanced telematics expertise and automotive electronics heritage. Valeo and Visteon Corporation focus on connected vehicle technologies and human-machine interface solutions. Infineon Technologies AG and STMicroelectronics are competing for critical processing units and connectivity chipsets powering eCall systems. Connectivity specialists Telit Cinterion and u-blox fight for cellular module market share, essential for emergency communication functionality. Thales differentiates through cybersecurity expertise and secure communication solutions, addressing growing data protection concerns.

Key Players

- Continental AG

- DENSO CORPORATION

- Infineon Technologies AG

- Robert Bosch GmbH

- STMicroelectronics

- Telit Cinterion

- Thales

- u-blox

- Valeo

- Visteon Corporation

Industry Developments

In December 2023, Deutsche Telekom launched a pilot project with Qualcomm and cetecom advanced, enabling vehicle manufacturers and emergency call centers to test Next Generation eCall over 4G networks. The initiative modernized emergency response by supporting faster data and voice connections in vehicles.

In January 2021, Qorvo launched its integrated broadband antenna routing switch for automotive eCall, delivering reliable emergency connectivity with up to 50% board space savings. The switch enabled robust, simple antenna systems for automatic crash notification in connected cars, supporting 4G and 5G TCU requirements.

Automotive eCall Market Segmentation

By Propulsion Type Outlook (Revenue, USD Billion, 2020–2034)

- ICE

- Electric Motor

By Trigger Type Outlook (Revenue, USD Billion, 2020–2034)

- Manually Initiated eCall (MIeC)

- Automatically Initiated eCall (AIeC)

By Vehicle Type Outlook (Revenue, USD Billion, 2020–2034)

- Passenger Cars

- Commercial Vehicles

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Netherlands

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Malaysia

- Latin America

- Argentina

- Brazil

- Mexico

- Middle East & Africa

- UAE

- Saudi Arabia

- Israel

- South Africa

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2.71 Billion |

|

Market Size Value in 2025 |

USD 3.05 Billion |

|

Revenue Forecast by 2034 |

USD 9.02 Billion |

|

CAGR |

12.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.71 billion in 2024 and is projected to grow to USD 9.02 billion by 2034.

The global market is projected to register a CAGR of 12.8% during the forecast period.

Europe dominated the market share in 2024.

A few of the key players in the market are Continental AG, DENSO CORPORATION, Infineon Technologies AG, Robert Bosch GmbH, STMicroelectronics, Telit Cinterion, Thales, u-blox, Valeo, and Visteon Corporation.

The ICE segment dominated the market share in 2024.

The commercial vehicles segment is expected to witness the significant growth during the forecast period.