Automotive Relay Market Share, Size, Trends, Industry Analysis Report

By Relay Type (PCB Relay, High-Voltage Relay, Plug-in Relay, Protective Relay, Time Relay, Signal Relay, Others); By Vehicle Type; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM1439

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

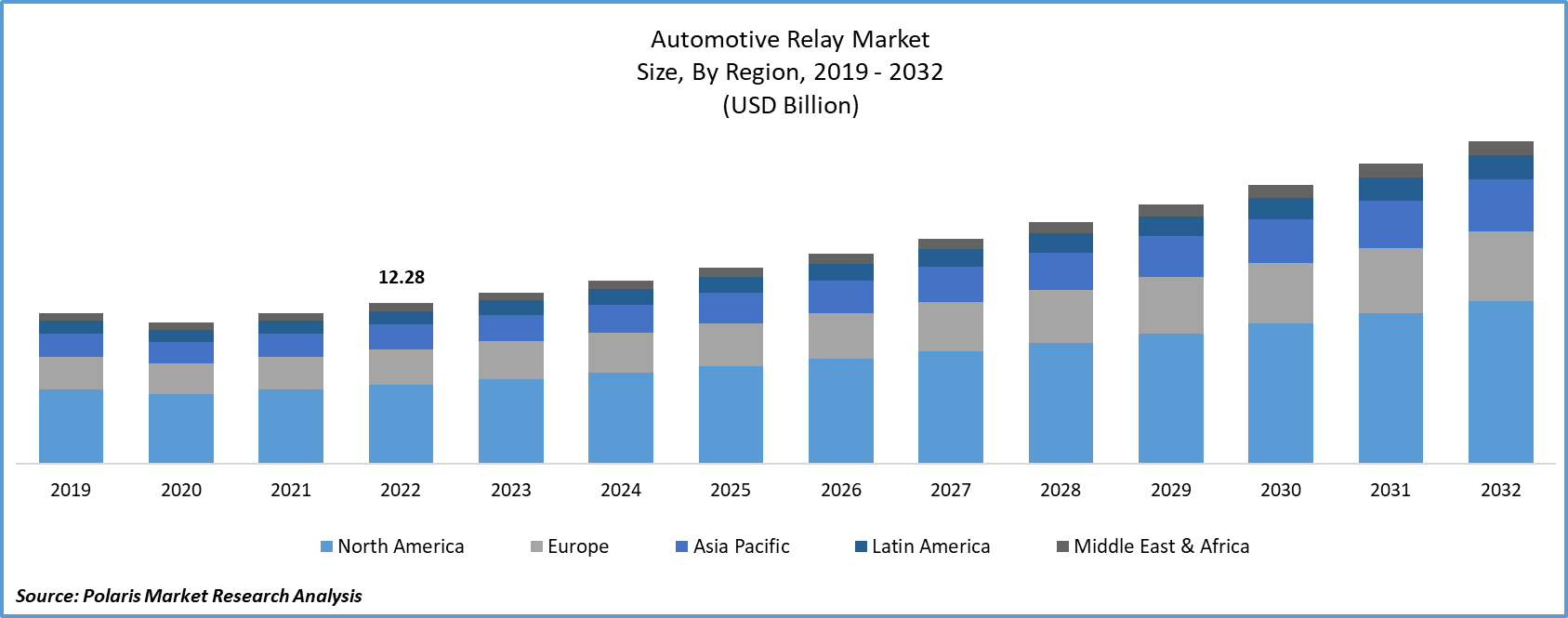

The global automotive relay market was valued at USD 13.12 billion in 2023 and is expected to grow at a CAGR of 7.3% during the forecast period.

Automotive relays are used in vehicles like cars, trucks, and buses to allow a low amperage circuit to switch on or off a higher amperage circuit. They are essential for permitting a small current flow circuit to control a higher current circuit throughout the electrical systems in vehicles. Automotive relays come in different types, including changeover, normally open, potted, flasher, skirted, time delay, and dual open contact, among others

To Understand More About this Research: Request a Free Sample Report

The demand for advanced safety and comfort features in modern automobiles, such as ADAS (Advance Driver Assistance System), infotainment systems, and HVAC (Heating, Ventilation, and Air Conditioning) systems, is increasing. Relays are essential for managing a vehicle's electrical systems, and as more people opt for these cutting-edge technologies, the demand for relays is anticipated to increase.

For instance, LG Magna e-Powertrain has announced the launch of its latest manufacturing plant in Ramos Arizpe, Mexico. The facility will specialize in producing inverters, motors, and onboard chargers, with the primary aim of supporting General Motors' electric vehicle (EV) manufacturing operations.

The market for automotive relays is anticipated to grow as autonomous vehicle use rises. Relays are important for managing the intricate network of electrical systems that autonomous vehicles require to operate. The need for automotive relays is anticipated to surge dramatically along with the demand for autonomous vehicles.

COVID-19 has significantly impacted the automotive relay market. Governments worldwide implemented strict import-export bans on raw materials used in the manufacturing of automotive components for a substantial portion of the pandemic year. This sudden restriction led to a sudden decrease in the availability of essential raw materials for automotive relays. The COVID-19 pandemic had a severe impact on aviation production and sales, causing detrimental effects on the automotive relay market. This, in turn, resulted in significant disruptions to supply chains and production schedules. Global governments imposed rigorous lockdowns and mandated social distancing measures to curb the spread of the virus. Thus, the automotive relay market is anticipated to experience rapid growth in the coming years.

Relays in electric automotive components require unique features for each one to meet Electric Control Unit (ECU) requirements. Advancements in miniaturization and high contact capability are essential to overcome space constraints. Highly reliable relays are essential for safety assurance. Components with attributes like latching, low noise, and ultra-miniaturization are necessary for advanced switching technology in vehicles.

For Specific Research Requirements: Request for Customized Report

Furthermore, the market is experiencing growth due to the increasing demand for small and lightweight relays. Automotive manufacturers are focused on reducing the weight and size of the components used in vehicles to enhance fuel efficiency and decrease emissions. As a consequence, there is a growing demand for compact and lightweight relays.

Industry Dynamics

Growth Drivers

Growing Demand of Hybrid and Electrical Vehicles will Drive the Growth of the Market

The market growth of automotive relay is primarily driven by the increasing demand of hybrid and electric vehicles. The rise in components used in electric vehicles has led to a higher demand for relays that are designed for switching purposes. Each relay must have unique characteristics that are tailored to its specific needs. Advancements in technology are especially necessary to achieve high contact capacity and miniaturization, particularly in the Electric Control Unit (ECU), where a cluster of relays limits the available mounting space. Reliability is paramount for safety reasons. As the need for switching technology to accommodate the latest electrical functions in vehicles increases, components that feature characteristics like low noise, ultra-miniaturization, and latching have become more popular.

More relays are anticipated to be fitted per car due to the increased use of electronic equipment and emphasis on safety. Additional relays are required for auxiliary devices. Advancements in PCB relays are anticipated to boost market growth by reducing vehicle weight and enhancing fuel economy.

The automotive relay market has experienced substantial growth due to the increasing demand for luxury vehicles, the rising adoption of electric vehicles, and the growing penetration of automotive safety technologies. This growth can be attributed to the increasing use of electronic components in vehicles and the preference of consumers for electronic relays over electromagnetic relays.

Report Segmentation

The market is primarily segmented based on relay type, vehicle type, application, and region.

|

By Relay Type |

By Vehicle Type |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Relay Type Analysis

The Pcb Relay Segment Accounted for the Largest Revenue Share in 2022

In 2022, the PCB relay segment accounted for the largest revenue share. Owing to their high switching reliability and capacity, which are important for automotive applications, PCB relays are anticipated to dominate the market in terms of revenue share. PCB relays are an ideal choice for the automobile industry, where reliability and space are essential factors. They are small in size, easy to mount on the circuit board, and have a powerful resistance to shock and vibration. The demand for PCB relays in the automotive industry is further fueled by their superior electrical insulating qualities and resistance to high temperatures.

On the other hand, the high-voltage relay segment is anticipated to witness fastest growth during the forecast period. The demand for high-voltage relays is on the rise, mainly driven by their extensive use in electric and hybrid electric vehicles. These relays are incorporated into the circuitry of vehicles by automotive manufacturers and OEMs, depending on their specific applications. Additionally, they enter into partnerships with service centers to ensure proper maintenance and replacement of components.

By Vehicle Type Analysis

The Passenger Vehicles Segment Accounted for the Highest Market Share During the Forecast Period

The passenger vehicles segment accounted for the highest market share during the forecast period. The automotive industry is experiencing growth due to a rising demand for electronic buses, which are preferred over electromagnetic alternatives. This segment is driven by the ongoing modernization of vehicles. With the continuous evolution of automotive technology, advanced electronic features and systems are being incorporated in passenger vehicles. As a result, modern passenger vehicles incorporate diverse electronic vehicle types, which require reliable and efficient power distribution.

On the other hand, electric vehicles segment is anticipated to experience fastest growth during the forecast period. Several European countries have implemented incentive-driven programs to promote the adoption of electric vehicles (EVs). For example, Germany and Austria have implemented tax exemptions and reductions, while France and the United Kingdom provide bonus payments to buyers of EVs, along with discounts on insurance. Governments actively present attractive offers to increase the sales and use of EVs, and tax benefits are extended to buyers during the process of purchasing.

Regional Insights

Asia Pacific Accounted for the Largest Market Share in 2022

In 2022, Asia Pacific accounted for largest market share in the automotive relay market. The Asia Pacific region is experiencing an increase in the need for passenger cars due to a growing middle class and expanding population. This has resulted in a rising demand for automotive relays, as safety features in vehicles become increasingly important. The presence of renowned automakers in the area is also contributing to market expansion. Furthermore, the expected growth in the Asia Pacific automotive relay market can be attributed to the surging demand for electric cars (EVs).

North America is accounted for the fastest growth in the forecast period. Increasing connection demand and vehicle digitalization will drive demand in the US, Canada, and Mexico. The north america region has growth potential due to space constraints, boosting the need for wiring harnesses. Government regulations mandate electronic safety systems such as ESP and ABS, creating opportunities for market expansion.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- ABB Group

- Delphi Automotive PLC

- Denso Corporation

- Eaton Corporation

- Fujitsu Limited

- Hella KGaA Hueck & Co.

- NEC Corporation

- Robert Bosch GmbH

- Siemens AG

- TE Connectivity Ltd.

Recent Developments

- In March 2023, Panasonic Industry Europe GmbH has launched its newest relay, the HE-R, after undergoing thorough testing to enhance its short-circuit performance. Specifically designed to offer a secure and dependable solution for customers in the electric vehicle (EV) charging industry, the HE-R relay has demonstrated its reliability by successfully passing the demanding IEC62955 test, which assesses short circuits at 10kA. Additionally, the HE-S relay, a smaller counterpart, adheres to the IEC62955 standard for 3kA short circuits.

- In May 2022, Texas Instruments launched new solid-state relays for EVs, providing isolated switches and drivers that meet auto standards. These relays are the most compact solution in the market, reducing BOM and powertrain expenses for 800-V battery-management systems.

- In January 2022, Toshiba Electronics Europe GmbH has launched a new photo relay, TLX9160T, for battery-powered and hybrid-electric vehicles. It's ideal for battery management systems, ground fault detection and identifying mechanical relay faults. The relay can operate with a 1000V supply voltage, making it compatible with most traction batteries commonly used in the industry.

Automotive Relay Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 14.03 billion |

|

Revenue forecast in 2032 |

USD 24.65 billion |

|

CAGR |

7.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Relay Type, By Vehicle Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation |

FAQ's

key companies in automotive relay market are

ABB Group, Delphi Automotive PLC, Denso Corporation, Eaton Corporation

The automotive relay market report covering key segments are relay type, vehicle type, application and region.

key driving factors in automotive relay market Rising demand for the secure and complacent vehicles will bolster the growth of the market

Automotive Relay Market Size Worth $24.65 Billion By 2032