Europe Clinical Laboratory Tests Market Size, Share, Trends, & Industry Analysis Report

By Type (Clinical Chemistry Testing, Hematology Testing), By End Use, and By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM6369

- Base Year: 2024

- Historical Data: 2020-2023

Overview

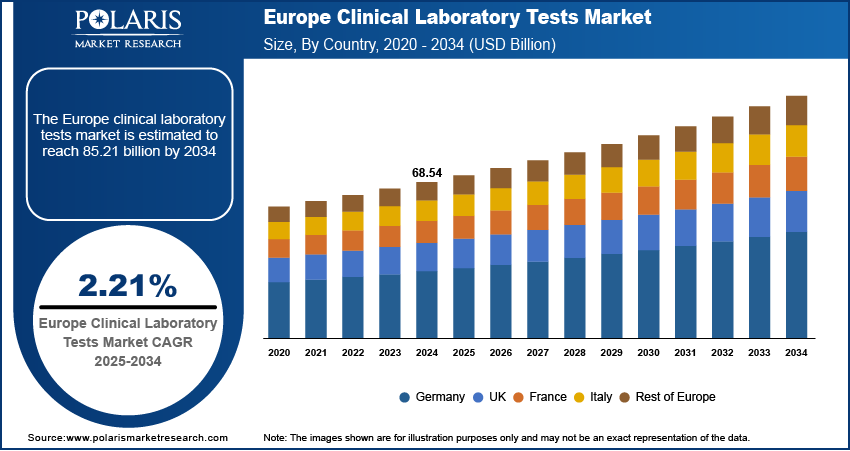

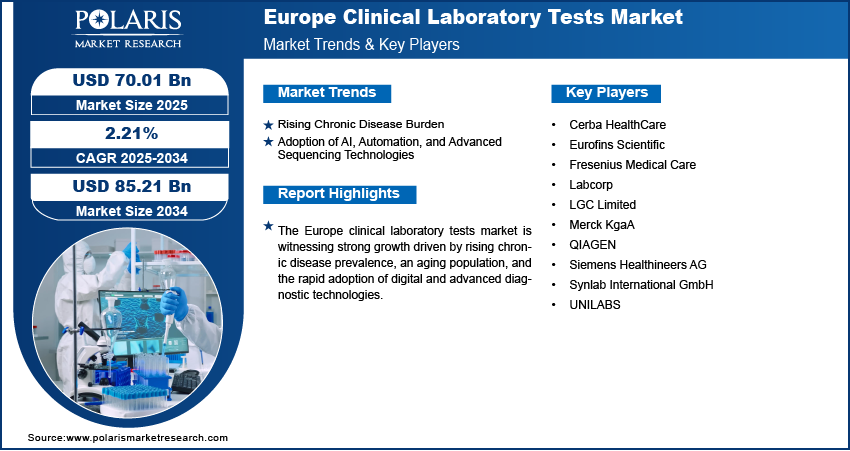

The Europe clinical laboratory tests market size was valued at USD 68.54 billion in 2024, growing at a CAGR of 2.21% from 2025–2034. Key factors driving demand include rapidly aging population, EU-Wide regulatory harmonization, rising chronic disease burden, and adoption of AI, automation, and advanced sequencing technologies.

Key Insights

- Clinical chemistry testing segment dominated the market in 2024, attributted to its role in routine management of patients.

- The primary clinics segment is forecast to grow at an 8.2% CAGR, fueled by greater patient access to convenient, community-level diagnostic services.

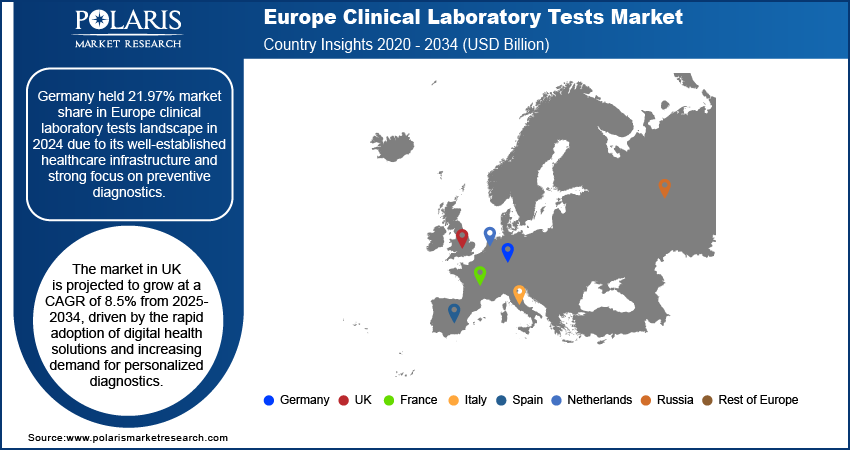

- Germany captured a 21.97% share of the European market in 2024, attributed to its advanced healthcare infrastructure and emphasis on preventive care diagnostics.

- The UK market is anticipated to grow at an 8.5% CAGR from 2025-2034, driven by the adoption of digital health tools and rising demand for personalized medicine.

Industry Dynamics

- The growing prevalence of chronic diseases like diabetes and cancer is increasing demand for continuous monitoring and diagnostic testing across Europe.

- Adoption of AI and automation is enhancing diagnostic accuracy and operational efficiency, enabling faster and more reliable laboratory testing services.

- Strict and evolving EU regulations, such as the IVDR, increase compliance costs and complexity, creating substantial barriers for laboratory operations and new test introductions.

- Europe's aging population and high chronic disease rates present a major growth opportunity for expanded routine testing and specialized monitoring services.

Market Statistics

- 2024 Market Size: USD 68.54 billion

- 2034 Projected Market Size: USD 85.21 billion

- CAGR (2025-2034): 2.21%

- Germany: Largest market in 2024

AI Impact on Europe Clinical Laboratory Tests Market

- AI improves accuracy in detecting diseases like cancer by analyzing complex genomic and imaging data, reducing diagnostic errors and supporting personalized treatment plans.

- AI-driven automation streamlines workflows, from sample sorting to result analysis, significantly cutting turnaround times and reducing laboratory operational costs.

- AI identifies population health trends and predicts disease outbreaks or high-risk patients, enabling proactive public health strategies and preventive care interventions.

- AI synthesizes vast clinical, genetic, and patient data to provide clinicians with actionable insights, improving diagnostic confidence and therapeutic decision-making.

Clinical laboratory tests are medical diagnostic procedures conducted on patient samples to detect, monitor, and manage health conditions, and form a critical component of Europe’s healthcare landscape.

The market is driven by the rapidly aging population across the region. According to a World Health Organization report, the European region's population aged 60 and above is projected to grow, from 215 million in 2021 to 247 million by 2030, and exceed 300 million by 2050. The demand for laboratory tests has increased substantially due to the higher prevalence of age-related diseases such as cardiovascular disorders, diabetes, and cancer, with Europe witnessing one of the highest proportions of elderly citizens globally. The aging demographic not only elevates the need for routine health screenings but also highlights the importance of early detection and continuous monitoring to reduce healthcare burdens. Consequently, the growing geriatric population is acting as a strong catalyst in shaping the demand for advanced and diverse clinical laboratory testing services across Europe.

The Europe clinical laboratory tests market is further driven by EU-wide regulatory harmonization, which plays a major role in standardizing diagnostic practices and ensuring high-quality patient outcomes. The implementation of frameworks such as the In Vitro Diagnostic Regulation (IVDR) has reinforced consistent quality benchmarks and compliance requirements for laboratory testing across member states. This harmonization facilitates cross-border collaboration in healthcare and also promotes innovation by enabling manufacturers and laboratories to operate under a suitable regulatory environment. Moreover, streamlined regulations enhance patient trust and promote the adoption of advanced diagnostic solutions, creating a more integrated healthcare system. As a result, EU-wide harmonization continues to drive growth by ensuring reliability, safety, and efficiency within Europe’s clinical laboratory testing ecosystem.

Drivers & Opportunities

Rising Chronic Disease Burden: The rising chronic disease burden is driving the growth opportunities, as conditions such as cardiovascular disorders, diabetes, cancer, and autoimmune diseases are increasingly prevalent across the region. A July 2025 European Union report stated that in 2024, over one-third (35.3%) of Europe's population reported having a longstanding chronic health condition. These long-term illnesses demand continuous monitoring, early detection, and regular diagnostic evaluations, all of which are heavily reliant on laboratory testing. The need for comprehensive diagnostic services has grown immensely, with lifestyle-related risk factors and aging populations contributing to higher incidences of chronic conditions. Clinical laboratory tests provide critical insights that guide treatment pathways, enable personalized care, and reduce complications, making them essential within Europe’s healthcare systems.

Adoption of AI, Automation, and Advanced Sequencing Technologies: The adoption of AI, automation, and advanced sequencing technologies is also reshaping the Europe clinical laboratory tests market by enhancing accuracy, speed, and efficiency in diagnostics. AI-driven tools are increasingly being used to analyze complex datasets, identify patterns, and improve predictive diagnostics, while automation reduces manual errors and improves laboratory throughput. Advanced sequencing technologies, particularly next-generation sequencing, enable deeper insights into genetic disorders and cancer diagnostics, supporting the shift towards personalized medicine. In Europe, where regulatory frameworks encourage innovation and healthcare providers focus on precision-based approaches, the integration of these technologies is improving diagnostic outcomes and streamlining workflows. For instance, in April 2025, NEC Laboratories Europe and Data-Driven.AI collaborated to enhance lab diagnostics and preventive health using AI. The collaboration aims to enable earlier disease detection and intervention before symptoms advance. This technological shift is driving market growth by addressing the growing demand for high-quality and timely clinical testing services.

Segmental Insights

Type Analysis

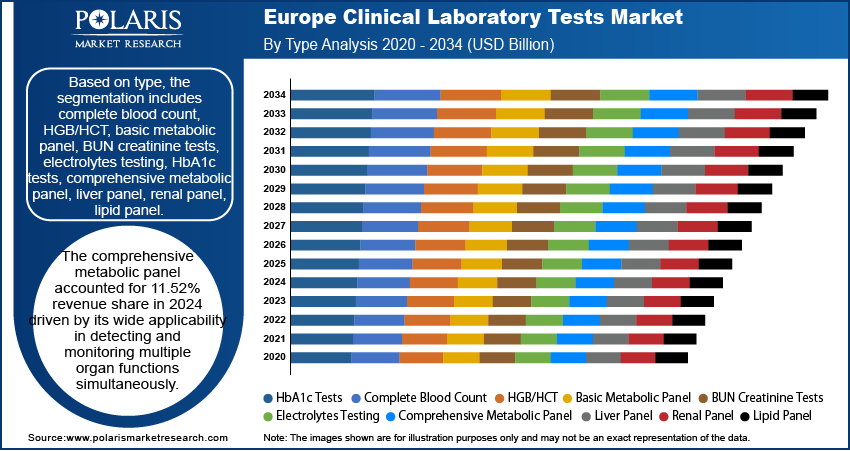

Based on type, the segmentation includes clinical chemistry testing, hematology testing, immunology & serology testing, molecular diagnostics, others. In 2024, clinical chemistry testing segment dominated the market. This is due to its role in routine patient management. These tests provide crucial data for screening, diagnosis, and monitoring a wide range of diseases, such as kidney and liver disorders, diabetes, and cardiovascular disease, by forming the basis of primary care diagnostics. The nature and high volume of these tests, with essential panels such as metabolic panels, ensure widespread and consistent utilization across hospitals and laboratories. Moreover, the established infrastructure, with the rise in demand for basic biochemical analysis in every medical environment, supports the dominant position in the market.

End Use Analysis

In terms of application, the segmentation includes central laboratories, primary clinics. The primary clinics segment is expected to witness robust growth with 8.2% CAGR during the forecast period driven by increasing accessibility of diagnostic services at the community level. Across Europe, there has been a strong shift toward decentralizing healthcare delivery, enabling patients to experience routine and preventive tests closer to home. Primary clinics are increasingly equipped with advanced diagnostic technologies, making them critical touchpoints for early detection and disease management. This trend improves patient convenience and engagement, while also reducing the pressure on central laboratories. As a result, the growing adoption of point-of-care and routine testing at primary clinics is fueling their expanding role in the clinical laboratory tests market across the region.

Country Analysis

Germany Clinical Laboratory Tests Market Insight

Germany held 21.97% market share in Europe clinical laboratory tests landscape in 2024 due to its well-established healthcare infrastructure and strong focus on preventive diagnostics. The country’s advanced network of laboratories, with continuous investment in innovative diagnostic technologies, has supported widespread access to testing services. Furthermore, Germany’s focus on early disease detection and its structured insurance coverage for diagnostic procedures have reinforced its leading position in the regional market.

UK Clinical Laboratory Tests Market

The market in UK is projected to grow at a CAGR of 8.5% from 2025-2034, driven by the rapid adoption of digital health solutions and increasing demand for personalized diagnostics. The UK’s healthcare system is progressively integrating AI-driven tools and automation into laboratory processes, enhancing efficiency and accuracy. In addition, government initiatives to strengthen precision medicine and expand genomic testing are further accelerating growth. This focus on innovation and patient-centric diagnostics is positioning the UK as a major growth hub within the European clinical laboratory tests market.

Key Players & Competitive Analysis Report

The European clinical laboratory testing landscape is characterized by consolidation, with major players such as SYNLAB, Cerba HealthCare, and Eurofins pursuing strategic investments and acquisitions to build sustainable value chains and expand geographic reach. Competitive intelligence and strategy focus on technological advancement in AI and automation to boost diagnostic accuracy and operational efficiency. A revenue opportunity exists in serving the aging demographic and rising chronic disease burden, which creates substantial latent demand and opportunities for specialized testing. Expert's insight confirms that future development strategies must navigate the complex EU IVD Regulation (IVDR), which acts as both a barrier and a driver for quality standardization. Economic and geopolitical shifts, such as supply chain vulnerabilities and reimbursement pressures, particularly impact growth projections. Moreover, success relies on developing expansion opportunities through partnerships with biopharma firms for companion diagnostics and advancing predictive, data-driven medicine.

Major companies operating in the clinical laboratory tests industry include Cerba HealthCare, Eurofins Scientific, Fresenius Medical Care, Labcorp, LGC Limited, Merck KgaA, QIAGEN, Siemens Healthineers AG, Synlab International GmbH, and UNILABS.

Key Players

- Cerba HealthCare

- Eurofins Scientific

- Fresenius Medical Care

- Labcorp

- LGC Limited

- Merck KgaA

- QIAGEN

- Siemens Healthineers AG

- Synlab International GmbH

- UNILABS

Industry Developments

- April 2024: Unilabs adopted SOPHiA GENETICS' AI platform to expedite genomic analysis for solid tumor testing, specifically for HRD-status, across its diagnostic network in Switzerland to enhance precision medicine outcomes.

- December 2023: ARUP Laboratories and Medicover collaborated to provide the AAV5 DetectCDx companion diagnostic in Europe. The test identifies hemophilia A patients eligible for a specific gene therapy, with testing centralized in Germany.

Europe Clinical Laboratory Tests Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Clinical Chemistry Testing

- Routine Chemistry Testing

- Specialized Chemistry Testing

- Hematology Testing

- Immunology & Serology Testing

- Molecular Diagnostics

- Infectious Disease Testing

- Genetic Testing

- Molecular Microbiology

- Transplant Diagnostics

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Central Laboratories

- Primary Clinics

By Country Outlook (Revenue, USD Billion, 2020–2034)

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Clinical Laboratory Tests Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 68.54 Billion |

|

Market Size in 2025 |

USD 70.01 Billion |

|

Revenue Forecast by 2034 |

USD 85.21 Billion |

|

CAGR |

2.21% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 68.54 billion in 2024 and is projected to grow to USD 85.21 billion by 2034.

The market is projected to register a CAGR of 2.21% during the forecast period.

Germany held 21.97% market share in Europe clinical laboratory tests landscape in 2024.

A few of the key players in the market are Cerba HealthCare, Eurofins Scientific, Fresenius Medical Care, Labcorp, LGC Limited, Merck KgaA, QIAGEN, Siemens Healthineers AG, Synlab International GmbH, and UNILABS.

Clinical chemistry testing segment dominated the market in 2024.

The primary clinics segment is expected to witness robust growth with 8.2% CAGR during the forecast period.