Automotive Robotics Market Share, Size, Trends & Industry Analysis Report

By Type (Articulated Robots, SCARA Robots, Cartesian Robots, Cylindrical Robots, Others); By Component; By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM1445

- Base Year: 2024

- Historical Data: 2020-2023

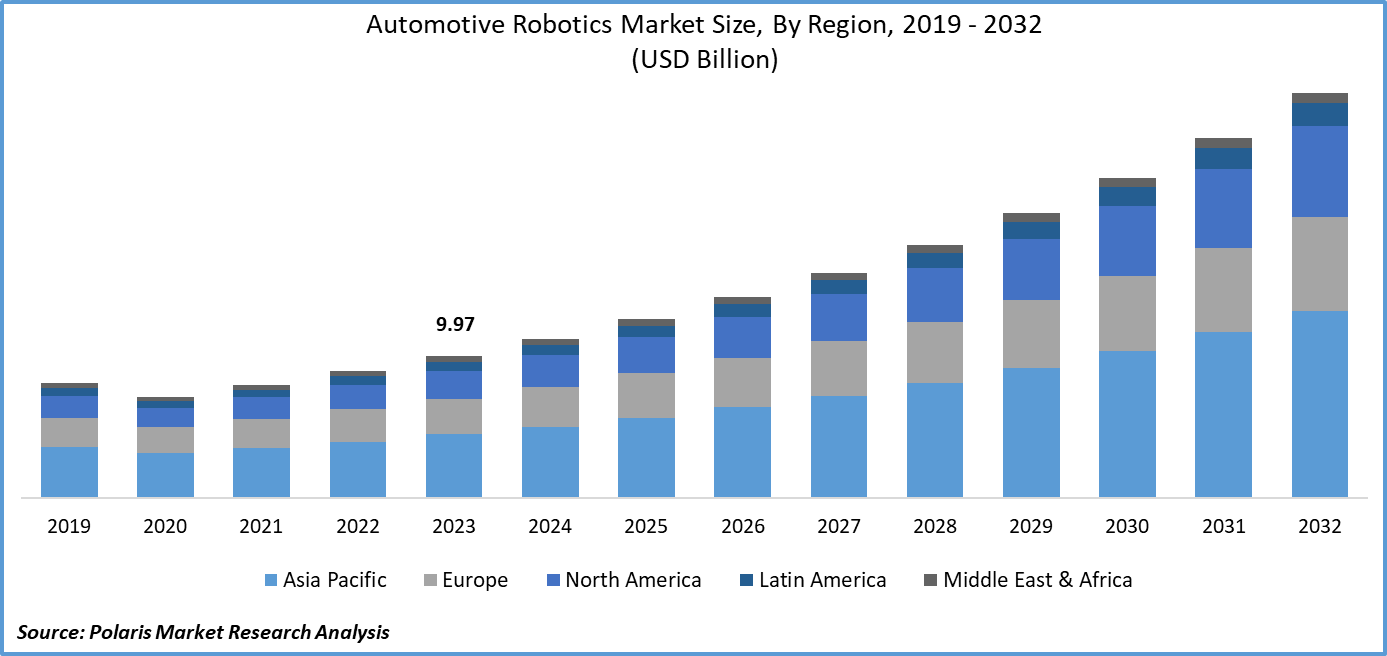

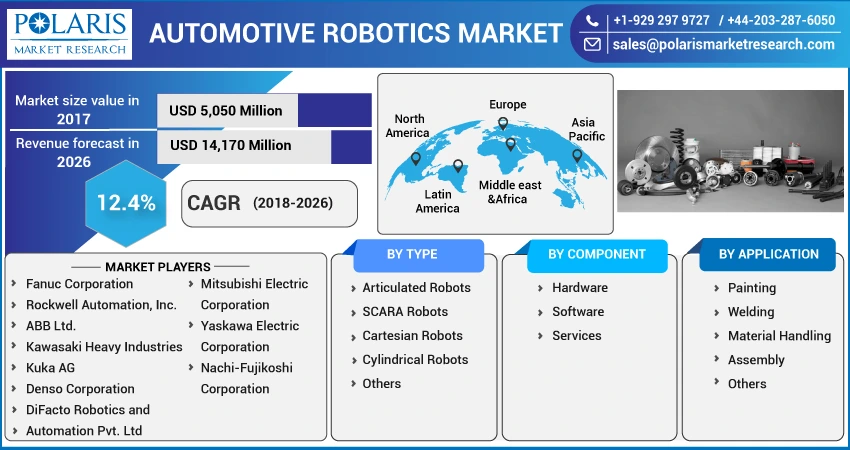

The global Automotive Robotics Market was valued at USD 8.7 billion in 2024 and is anticipated to grow at a CAGR of 10.50% from 2025 to 2034. Automation in manufacturing and precision assembly processes are key growth drivers.

Industry Trends

Automotive robotics refers to the use of robotic systems and automation technologies in the manufacturing and assembly processes within the automotive industry. These robotics systems are employed for various tasks, including welding, painting, assembly, material handling, and inspection, to streamline production, enhance efficiency, and improve quality in automotive manufacturing plants.

The Automotive Robotics Market has witnessed significant growth in recent years, driven by the increasing adoption of automation technologies in the automotive manufacturing sector. As the automotive industry continues to evolve, with a growing emphasis on electric vehicles (EVs), autonomous driving technology, and lightweight materials, the demand for advanced robotics solutions tailored to meet these evolving needs is expected to drive further the automotive robotics market growth.

To Understand More About this Research:Request a Free Sample Report

The market trends toward the growing demand for collaborative robots, or cobots, which work alongside human workers in automotive assembly lines, facilitating flexible and efficient production processes. Also, the integration of artificial intelligence (AI) and machine learning algorithms into automotive robotics systems is enabling predictive maintenance, adaptive control, and autonomous decision-making, further enhancing efficiency and productivity. There is increasing interest in modular robotics solutions that offer scalability, reconfigurability, and ease of integration, allowing automakers to adapt quickly to changing production requirements and market demands.

The global rise in demand for automobiles, especially in emerging markets, has led to a surge in investments in automotive manufacturing infrastructure and automation technologies. This is aimed at meeting the increasing production volumes and enhancing competitiveness. As a result, there is a growing need for automotive robotic solutions to cater to the rising demand and boost efficiency. However, the market growth is affected by the high initial investment required for deploying robotics systems in automotive manufacturing facilities, which prevents smaller manufacturers or those operating in cost-sensitive markets from adopting these solutions.

Key Takeaways

- Asia Pacific dominated the market and contributed over 41% market share of the automotive robotics market size in 2023

- By type category, the articulated robots segment is anticipated to grow with a significant CAGR over the automotive robotics market forecast period

- By application category, the welding segment dominated the global automotive robotics market size in 2024

What are the market drivers driving the demand for market?

The increasing demand for automobiles is driving the automotive robotics market growth.

The automotive industry is experiencing significant growth due to the increasing demand for vehicles across the world, especially in emerging economies with growing middle-class populations and rapid urbanization. Automakers are facing pressure to meet consumer needs by ramping up their production processes. To address this demand, automotive manufacturers are increasingly turning to robotics and automation technologies to streamline their production lines, enhance efficiency, and increase output while maintaining high-quality standards.

Robotic systems have proven to be capable of performing repetitive tasks faster and with greater precision, allowing automakers to optimize their manufacturing operations and meet the rising demand for vehicles. The use of automation has also enabled automakers to reduce labor costs, improve workplace safety, and achieve greater flexibility in production. These benefits have further contributed to the adoption of robotics solutions in the automotive industry. Overall, the increasing demand for automobiles is a critical driving force behind the automotive robotics market growth.

Which factor is restraining the demand for Automotive Robotics?

The high initial investment is hindering the automotive robotics market growth.

The high initial investment required for deploying robotics systems in automotive manufacturing facilities presents a significant barrier to the growth of the market. Implementing robotics solutions requires substantial upfront costs, including the purchase of robotic equipment, installation, integration with existing manufacturing processes, and employee training. For many automotive manufacturers, especially smaller players or those operating in cost-sensitive markets, this initial investment is expensive and discourages them from adopting robotics technologies. As a result, the high initial investment acts as a limiting factor, slowing down the pace of adoption and hindering the broader expansion of the automotive robotics market.

Report Segmentation

The market is primarily segmented based type, component, application, and region.

|

By Type |

By Component |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Type Insights

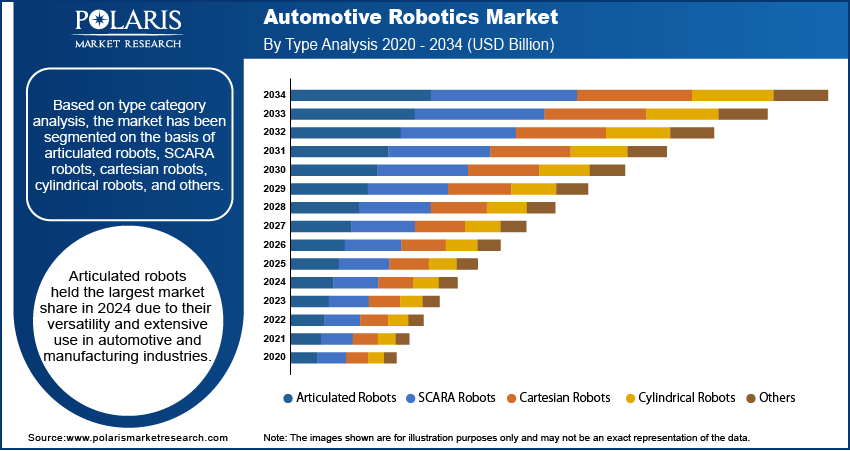

Based on type category analysis, the market has been segmented on the basis of articulated robots, SCARA robots, cartesian robots, cylindrical robots, and others. The articulated robots segment is poised for significant growth over the forecast period in the market since multiple joints and high flexibility characterize articulated robots, and they are well-suited for a wide range of automotive manufacturing tasks, including welding, painting, assembly, and material handling. These robots offer exceptional versatility, precision, and agility, allowing them to adapt to various production requirements and perform complex motions with ease.

Also, advancements in articulated robot technology, such as improved sensors, control algorithms, and programming capabilities, have enhanced their performance, reliability, and efficiency in automotive manufacturing applications. Similarly, the growing demand for electric vehicles (EVs) and lightweight materials in the automotive industry is driving the adoption of articulated robots optimized for battery assembly, lightweight component handling, and composite material processing. As automotive manufacturers seek to improve production efficiency, reduce costs, and maintain high-quality standards, the articulated robots segment is expected to experience robust growth as a preferred automation solution in the automotive manufacturing sector.

By Application Insights

Based on application category analysis, the market has been segmented on the basis of painting, welding, material handling, assembly, and others. The welding applications segment dominated the market in 2023. This is because welding is a crucial process in automotive manufacturing, as it is necessary to join various components, such as body panels, frames, and chassis, with precision and reliability. Robotic welding solutions are in high demand as automakers aim to improve production efficiency and product quality and meet the increasing demand for vehicles. Robotic welding systems offer several advantages over manual welding, including higher precision, consistency, productivity, and workplace safety.

Technological advancements in robotic welding, such as enhanced sensors, welding techniques, and programming capabilities, have further strengthened the performance and capabilities of robotic welding systems in automotive manufacturing applications. The welding segment's dominance in the automotive robotics market underscores its critical role in driving automation and efficiency in automotive manufacturing operations as the automotive industry continues to rely on welding processes for vehicle assembly.

Regional Insights

Asia Pacific

In 2023, the Asia Pacific region emerged as the dominant region in the global market because Asia Pacific is considered the world's largest automotive manufacturing hub, including China, Japan, South Korea, and India, which collectively account for a significant portion of global vehicle production. As these countries experience rapid industrialization, urbanization, and economic growth, there is increasing demand for automotive robotics solutions to meet production requirements efficiently and cost-effectively. Also, the presence of a robust ecosystem of robotics manufacturers, suppliers, and technology providers in the region fosters innovation, competition, and collaboration in the automotive robotics market.

North America

The North American region is anticipated to experience substantial growth in the market due to the region's strong automotive manufacturing sector, with major automakers and suppliers operating advanced production facilities across the region. As these companies seek to enhance productivity, improve quality, and meet evolving consumer demands, there is increasing adoption of robotics and automation technologies in automotive manufacturing processes. Also, the region's focus on innovation, technological advancements, and research and development in robotics further drives market growth.

Competitive Landscape

The competitive landscape in the automotive robotics market is identified by heavy competition among market key players striving to innovate and differentiate their offerings to acquire a competitive edge. Major players in the market include prominent robotics manufacturers such as FANUC America Corporation, Rockwell Automation, ABB, Kawasaki Heavy Industries, Ltd., and KUKA AG, which have established a strong presence with their diverse portfolio of robotic solutions tailored for automotive manufacturing applications. Also, there is a growing presence of niche players and startups specializing in specific segments of the automotive robotics market, offering innovative solutions to address emerging challenges and opportunities. Partnerships, collaborations, and strategic alliances are common strategies adopted by companies to expand their market reach, enhance technological capabilities, and capitalize on new market opportunities.

Some of the major players operating in the global market include:

- ABB

- Acieta

- DENSO Corporation

- DiFACTO

- FANUC America Corporation

- Kawasaki Heavy Industries, Ltd.

- KUKA AG

- Mitsubishi Electric Corporation

- NACHI-FUJIKOSHI CORP

- Rockwell Automation

- TECHMAN ROBOT INC.

- Universal Robots A/S

- YASKAWA ELECTRIC CORPORATION

Recent Developments

- In March 2025, Hexagon launched a Robotics division to advance autonomous solutions using AI, spatial intelligence, and measurement tech. Arnaud Robert was appointed President to lead innovation across manufacturing, automotive, aviation, and logistics sectors.

- In May 2023, ForwardX Robotics, a provider of autonomous mobile robots (AMRs) and manufacturing solutions worldwide, launched its latest AMR, Lynx. This new AMR is specifically designed as a "tugger" robot to tackle the challenges faced by the automotive industry.

- In January 2024, Figure, a California-based company specializing in autonomous humanoid robots, entered into a commercial agreement with US BMW Manufacturing Co. to deploy general-purpose robots in automotive manufacturing environments.

- In November 2023, ABB introduced the IRB 930 SCARA robot designed for automating pick-and-place and assembly tasks. This robot is specifically engineered to perform fast point-to-point operations and can handle high payloads and large work areas.

Report Coverage

The Automotive Robotics market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, component, application, and their futuristic growth opportunities.

Automotive Robotics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 9.6 billion |

|

Revenue forecast in 2034 |

USD 22.4 billion |

|

CAGR |

10.50% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Type, By Component, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global automotive robotics market size is expected to reach USD 22.4 Billion by 2034

Key players in the market are ABB, Acieta, DENSO Corporation, DiFACTO, FANUC America Corporation, Kawasaki Heavy Industries, Ltd., KUKA AG

North American contribute notably towards the global Automotive Robotics Market

Automotive Robotics Market exhibiting the CAGR of 10.50% during the forecast period

The Automotive Robotics Market report covering key segments are type, component, application, and region.