Autonomous Ships Market Size, Share, Trends, Industry Analysis Report

: By Autonomy (Partial Automation, Fully Autonomous, and Remotely Operated), Solution, Ship Type, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 116

- Format: PDF

- Report ID: PM3438

- Base Year: 2024

- Historical Data: 2020-2023

Autonomous Ships Market Overview

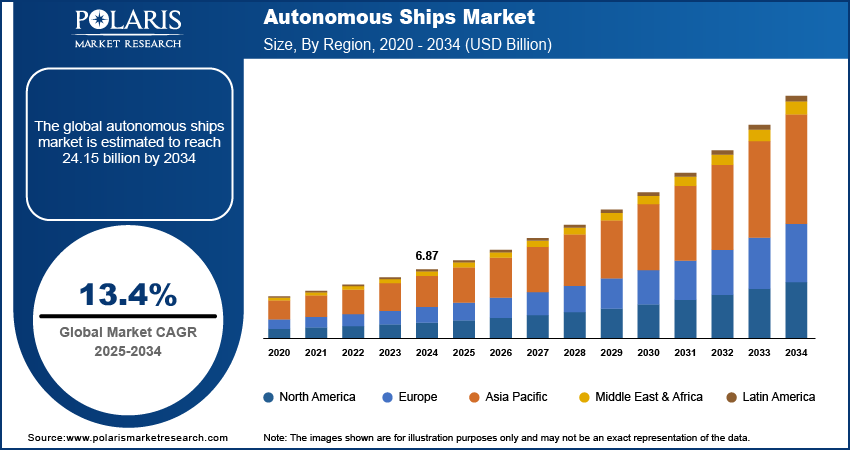

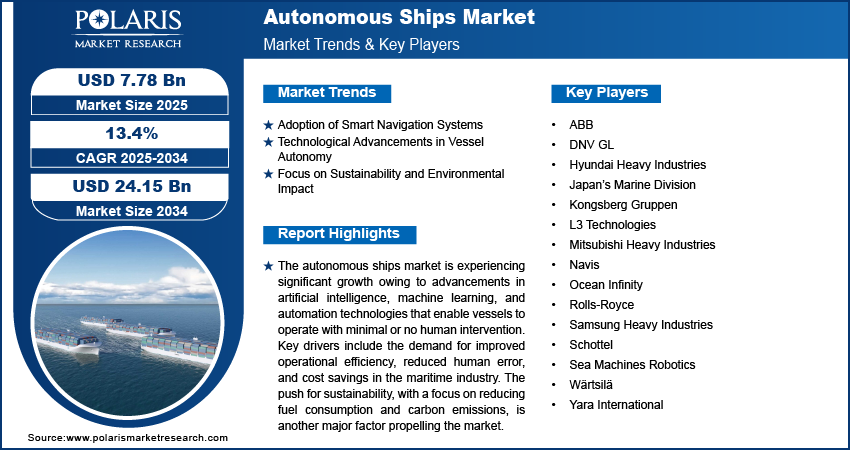

The autonomous ships market size was valued at USD 6.87 billion in 2024. The market is projected to grow from USD 7.78 billion in 2025 to USD 24.15 billion by 2034, exhibiting a CAGR of 13.4% during 2025–2034.

The autonomous ships market refers to the industry focused on the development and deployment of vessels that operate without direct human intervention, utilizing advanced technologies such as artificial intelligence, machine learning, sensors, and automation. The need for increased operational efficiency drives this market, reduced human error, and cost savings in the shipping and maritime industry. Key trends include the growing adoption of smart navigation systems, advancements in vessel autonomy, and regulatory developments that are shaping the future of autonomous shipping. The push toward sustainability and reduced carbon emissions is also a significant factor, as autonomous ships have the potential to optimize fuel consumption and minimize environmental impact. Additionally, the autonomous ships market demand is influenced by the increasing interest in unmanned vessels for commercial and military purposes.

To Understand More About this Research: Request a Free Sample Report

Autonomous Ships Market Dynamics

Adoption of Smart Navigation Systems

Smart navigation systems leverage advanced technologies such as radar, lidar, and cameras, along with artificial intelligence, to enable vessels to navigate autonomously in real time. The integration of these systems enhances safety by reducing human error and allows for more efficient route planning. According to a report by Rolls-Royce, by 2030, the company anticipates that up to 90% of shipping operations could be automated, with the majority of these relying on smart navigation technologies. In addition, regulatory bodies, such as the International Maritime Organization (IMO), are working on establishing standards for autonomous ships, making smart navigation systems a critical focus for the industry. Thus, the growing adoption of smart navigation systems is expected to become a key autonomous ships market trends during the forecast period.

Technological Advancements in Vessel Autonomy

Technological advancements in vessel autonomy are accelerating the development of autonomous ships. With innovations in artificial intelligence (AI), machine learning, and automation, autonomous ships are becoming increasingly capable of performing complex tasks such as obstacle avoidance, docking, and collision detection. These advancements are being propelled by collaborations between tech companies and maritime operators. For instance, in 2022, the Yara Birkeland, an electric autonomous container vessel, completed its maiden voyage in Norway, signaling significant progress in the field. The success of such projects highlights the growing capabilities of autonomous vessels and the increasing confidence in their ability to operate independently in diverse conditions. Moreover, data collected from trials and prototypes helps refine these technologies for broader use in commercial shipping. Hence, the technological advancements in vessel autonomy are expected to boost the autonomous ships market development in the coming years.

Focus on Sustainability and Environmental Impact

The rising focus on sustainability and reducing environmental impact is a significant driver for the autonomous ships market growth. With global shipping accounting for approximately 2–3% of total carbon emissions, there is a strong emphasis on developing technologies that can minimize emissions. Autonomous ships offer the potential for greater fuel efficiency, as they can optimize speed, route, and fuel consumption based on real-time conditions. The world’s first autonomous electric container ship, Yara Birkeland, is designed to reduce nitrogen oxide (NOx) emissions by up to 90% and carbon emissions by 1,000 tons annually. The growing emphasis on environmental regulations, such as the International Maritime Organization's (IMO) 2030 and 2050 decarbonization targets, further drives innovation and adoption of autonomous technologies that can contribute to achieving sustainability goals in the maritime industry.

Autonomous Ships Market Segment Insights

Autonomous Ships Market Outlook – Autonomy-Based Insights

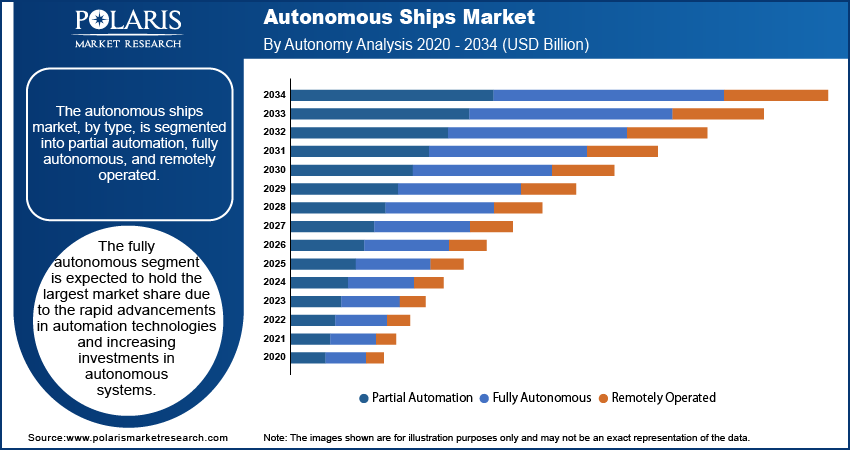

The autonomous ships market, by autonomy, is segmented into partial automation, fully autonomous, and remotely operated. The fully autonomous segment is expected to hold the largest share of the autonomous ships market revenue due to the rapid advancements in automation technologies and increasing investments in autonomous systems. As these vessels can operate without human intervention, they present significant advantages in terms of operational efficiency, cost savings, and safety. Fully autonomous ships are being prioritized in trials and demonstrations, with key players such as Rolls-Royce and Kongsberg already showcasing autonomous vessels for future commercial use. The growth in this segment is driven by technological innovations and regulatory support aimed at enhancing the safety and efficiency of maritime operations. Additionally, fully autonomous ships are seen as the future of the shipping industry, with several companies and countries targeting autonomous fleets for long-term sustainability and competitiveness in global trade.

The remotely operated and partial automation segments are experiencing growth at the slowest pace than fully autonomous vessels. Remotely operated ships, which are controlled from a shore-based station, offer a transitional step toward full autonomy, providing operators with a higher level of control during navigation. Partial automation, where certain functions are automated, but human oversight is still required, is also seeing increased adoption, particularly for vessels operating in restricted or high-traffic areas. However, the significant investments required for infrastructure and regulatory adjustments to support fully autonomous ships are expected to drive the autonomous ships market growth for the fully autonomous segment in the coming years. As of now, these segments serve as intermediate solutions, enabling smoother integration of autonomous technologies into the industry.

Autonomous Ships Market Assessment – Solution-Based Insights

The autonomous ships market, by solution, is segmented into hardware and software. The hardware segment holds a larger market share, driven by the need for advanced sensors, communication systems, and onboard processing equipment required for the operation of autonomous vessels. This includes technologies such as digital radar, lidar, cameras, GPS, and advanced computing systems that enable real-time decision making and navigation. As autonomous vessels require robust hardware to function without human intervention, the demand for high-performance hardware is growing rapidly. In particular, digital radar and lidar systems, which are integral for obstacle detection and collision avoidance, are seeing significant advancements, contributing to the autonomous ships market development for this segment. Investments in hardware are also driven by the development of unmanned ships that require more sophisticated and reliable components for safe and efficient operation across various marine environments.

The software segment is registering a higher growth rate, primarily due to the increasing reliance on artificial intelligence, deep learning algorithms, and data analytics for enhancing the operational efficiency of autonomous ships. Software solutions are critical for enabling autonomous navigation, route planning, and decision-making processes that are essential for the functioning of these vessels. The development of software platforms that support communication, monitoring, and system integration is accelerating as the industry moves toward more complex and autonomous operations. Furthermore, the regulatory landscape is pushing the need for advanced software that complies with international standards for autonomous shipping, adding further momentum to this segment’s growth. The integration of software solutions with hardware platforms ensures seamless operation and paves the way for further advancements in autonomous ship capabilities.

Autonomous Ships Market Evaluation – Ship Type-Based Insights

The autonomous ships market, by ship type, is bifurcated into commercial and defense. The commercial segment holds a larger share of the autonomous ships market revenue, primarily driven by the demand for cost-effective, efficient, and sustainable shipping solutions. Commercial vessels, including container ships, tankers, and bulk carriers, account for a significant portion of global trade and are increasingly adopting autonomous technologies to improve operational efficiency and reduce human error. The commercial sector's push toward reducing operational costs, fuel consumption, and carbon emissions is also propelling the adoption of autonomous ships. Additionally, advancements in smart navigation and route optimization technologies are enabling these ships to operate more efficiently, which is particularly critical in a highly competitive global shipping market.

The autonomous ships market for the defense segment is registering a higher growth rate, fueled by increasing interest from naval and military forces in autonomous vessels for surveillance, reconnaissance, and combat operations. Autonomous ships offer strategic advantages in defense applications, such as reducing human risk, enhancing operational flexibility, and increasing endurance in harsh or hostile environments. The growing focus on unmanned systems in military operations, alongside technological advancements that enable reliable autonomous behavior in complex maritime conditions, is driving growth in this segment. Defense forces are investing in autonomous technologies for surface and underwater vessels, with applications ranging from mine countermeasure vessels to autonomous patrol boats, further expanding the segment's potential.

Autonomous Ships Market Outlook – End User-Based Insights

The autonomous ships market, by end user, is segmented into line fit and retrofit. The line fit segment holds a larger market share, as it involves the integration of autonomous technologies into new vessels during the manufacturing process. Shipbuilders and maritime operators are increasingly incorporating advanced automation and smart technologies into their new fleets to meet the growing demand for efficient, cost-effective, and environmentally sustainable operations. This trend is particularly prominent among commercial shipping companies looking to capitalize on the benefits of reduced human error, improved fuel efficiency, and enhanced safety from the outset of vessel construction. Line fitting allows for the seamless integration of hardware and software systems designed specifically for autonomous navigation and operation, making it an attractive option for large-scale fleet operators.

The retrofit segment is registering a higher growth rate, driven by the need to upgrade existing vessels with autonomous technologies to stay competitive in a rapidly evolving maritime landscape. Retrofit solutions allow older ships to be equipped with modern autonomous systems, such as sensors, communication networks, and AI-based navigation software, without the need for complete vessel replacement. This segment is growing as operators seek cost-effective ways to improve the efficiency and safety of their fleets while adhering to stricter environmental regulations. The push toward retrofitting is also being fueled by increasing investments in technology upgrades for older ships, making it a key growth area in the market as companies adapt to the changing demands of the industry.

Autonomous Ships Market Regional Insights

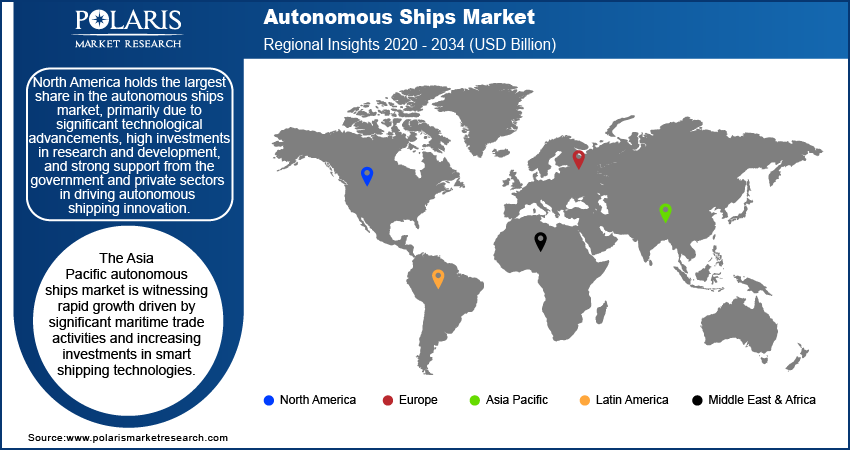

By region, the study provides autonomous ships market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the market, primarily due to significant technological advancements, high investments in research and development, and strong support from government and private sectors in driving autonomous shipping innovation. The US is a key player, with the presence of numerous maritime companies, including major shipping firms and defense contractors, investing in autonomous ship technologies. The region benefits from a well-established maritime infrastructure, a favorable regulatory environment, and ongoing trials and demonstrations, positioning it as a leader in the adoption of autonomous vessels. Additionally, the emphasis on sustainability and reducing carbon emissions, coupled with the region's commitment to modernizing its shipping fleets, further drives the autonomous ships market expansion in North America.

Europe is a significant player in the autonomous ships market, driven by strong regulatory frameworks, technological advancements, and a high level of collaboration between industry stakeholders. The European Union has been at the forefront of developing regulations to ensure the safe and efficient deployment of autonomous vessels. Countries such as Norway, the UK, and the Netherlands are leading the adoption of autonomous technologies, with several successful trials and pilot projects already in operation. Europe’s emphasis on sustainability, combined with its strategic location as a major global shipping hub, supports the growth of autonomous vessels, particularly in commercial shipping. The region’s established maritime industry and its focus on reducing emissions are key drivers for the development and implementation of autonomous technologies.

The Asia Pacific autonomous ships market is witnessing rapid growth, driven by significant maritime trade activities and increasing investments in smart shipping technologies. Countries such as Japan, South Korea, and China are making substantial strides in the development of autonomous vessels, with major shipping and technology companies leading the way. The region's large shipbuilding industry is also transitioning toward the integration of advanced automation systems in new builds and retrofitted vessels. Furthermore, the growing demand for more efficient, cost-effective shipping solutions and the focus on reducing environmental impact in highly congested trade routes are accelerating the adoption of autonomous technologies. The strategic importance of Asia Pacific in global shipping and trade, combined with technological innovations, positions it as a strong region in the market’s growth.

Autonomous Ships Market – Key Market Players and Competitive Insights

Key players in the autonomous ships market include major maritime companies and technology providers. A few of the prominent companies are Rolls-Royce, Kongsberg Gruppen, Wärtsilä, Mitsubishi Heavy Industries, and Samsung Heavy Industries. Additionally, companies such as Navis, Ocean Infinity, L3 Technologies, and ABB are contributing to the development of autonomous ship technologies, providing solutions ranging from sensors and navigation systems to artificial intelligence-based software. Other key players include Hyundai Heavy Industries, DNV GL, Japan’s Marine Division, Yara International, and Sea Machines Robotics. Many of these companies are actively engaged in autonomous ship trials and partnerships to push the boundaries of ship autonomy in commercial and defense applications.

The competitive landscape in the autonomous ships market is shaped by companies focused on different aspects of the technology, such as hardware development, software solutions, and system integration. Some firms are primarily concentrating on enhancing the automation of vessel operations, while others are focusing on developing comprehensive autonomous solutions combining software and hardware. Collaboration and partnerships play a significant role, as companies look to join forces with others that bring complementary strengths, such as those specializing in sensor technology or advanced AI systems. Additionally, established maritime companies are increasingly investing in startups or forming joint ventures to accelerate innovation and integrate autonomous systems into existing fleets.

As the market develops, the competitive dynamics are driven by the ability to offer reliable and cost-effective autonomous solutions. Companies that can provide a complete and integrated system, combining autonomous navigation with real-time data analytics, are well-positioned for growth. Moreover, a focus on meeting regulatory standards and ensuring safe operations will be critical, as governments and regulatory bodies are actively working on creating frameworks for autonomous ships. Market players are also prioritizing sustainability, with many companies focusing on how autonomous vessels can help reduce emissions and optimize fuel consumption. The increasing number of trials, proof-of-concept vessels, and government-backed initiatives are expected to intensify competition, as each player works to demonstrate their technology's potential.

Rolls-Royce is a key player in the autonomous ships market, known for its focus on developing technology to enable vessels to operate autonomously. The company has been involved in various research and development projects aimed at integrating automation into the maritime sector. Rolls-Royce has partnered with several maritime organizations and shipbuilders to advance autonomous ship capabilities, and its technology is being tested in a range of trials across different countries.

Wärtsilä is a significant player in the autonomous ships market, providing solutions related to engine technology, navigation, and automation systems for vessels. The company focuses on making maritime operations safer and more efficient by integrating smart technologies into ship designs. Wärtsilä has worked on a range of projects with shipbuilders and technology providers to develop autonomous solutions, particularly around optimizing fuel consumption and reducing emissions.

List of Key Companies in Autonomous Ships Market

- ABB

- DNV GL

- Hyundai Heavy Industries

- Japan’s Marine Division

- Kongsberg Gruppen

- L3 Technologies

- Mitsubishi Heavy Industries

- Navis

- Ocean Infinity

- Rolls-Royce

- Samsung Heavy Industries

- Schottel

- Sea Machines Robotics

- Wärtsilä

- Yara International

Autonomous Ships Industry Developments

- In June 2024, Rolls-Royce announced a successful trial of an autonomous vessel in collaboration with a European shipowner, marking a significant step toward commercial deployment of fully autonomous ships.

- In March 2024, Wärtsilä partnered with Qatar Shipyard Technology Solutions, focusing on technical capability and shipyard to provide a specialized suite of engine and propulsion solutions and services.

Autonomous Ships Market Segmentation

By Autonomy Outlook

- Partial Automation

- Fully Autonomous

- Remotely Operated

By Solution Outlook

- Hardware

- Software

By Ship Type Outlook

- Commercial

- Defense

By End User Outlook

- Line Fit

- Retrofit

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Autonomous Ships Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.87 billion |

|

Market Size Value in 2025 |

USD 7.78 billion |

|

Revenue Forecast by 2034 |

USD 24.15 billion |

|

CAGR |

13.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The autonomous ships market has been broadly segmented into detailed segments of autonomy, solution, ship type, and end user. Moreover, the study provides the reader with a detailed understanding of the different segments at the global and regional levels.

Growth/Marketing Strategy

The autonomous ships market growth strategy is centered around innovation, partnerships, and regulatory alignment. Companies are focusing on developing advanced technologies such as smart navigation systems, sensors, and AI-based software to enhance the safety and efficiency of autonomous vessels. Strategic partnerships between maritime operators, tech firms, and regulatory bodies are critical in accelerating adoption and testing. Additionally, market players are investing in research and development to stay competitive, while some are targeting specific regions with high shipping traffic to pilot their autonomous solutions. Increasing emphasis on sustainability and emission reduction also drives marketing efforts as companies promote the environmental benefits of autonomous ships

FAQ's

? The autonomous ships market size was valued at USD 6.87 billion in 2024 and is projected to grow to USD 24.15 billion by 2034.

? The market is projected to register a CAGR of 13.4% during the forecast period.

? North America accounted for the largest share of the market in 2024.

? Players in the autonomous ships market are major maritime companies and technology providers. A few of the prominent companies are Rolls-Royce, Kongsberg Gruppen, Wärtsilä, Mitsubishi Heavy Industries, and Samsung Heavy Industries.

? The fully autonomous segment accounted for the largest share of the market in 2024.

? The hardware segment accounted for a larger market share in 2024.

? Autonomous ships are vessels that operate without direct human control or intervention, using advanced technologies such as sensors, artificial intelligence (AI), machine learning, and automation systems. These ships can navigate, control speed, avoid obstacles, and perform other operational tasks autonomously. They rely on a combination of onboard systems, including radar, lidar, cameras, GPS, and real-time data processing, to make decisions and respond to environmental changes. Autonomous ships are designed to reduce human error, improve efficiency, lower operational costs, and enhance safety, particularly in commercial shipping and defense applications.

Below are a few key autonomous ships market trends: Advancement of Smart Navigation Systems: Increasing use of AI, sensors, and real-time data analytics for autonomous navigation and obstacle avoidance. Technological Advancements in Vessel Autonomy: Continuous improvements in AI, machine learning, and automation technologies enabling complex autonomous operations. Regulatory Developments: Governments and regulatory bodies, such as the IMO, are working on standards and regulations for autonomous shipping, creating a framework for safe operations. Sustainability Focus: Growing demand for autonomous vessels to reduce fuel consumption and carbon emissions, aligning with global sustainability goals

? A new company entering the autonomous ships market must focus on developing innovative, cost-effective solutions for smart navigation and real-time data analytics, which are crucial for autonomous vessel operation. Investing in AI-powered software and sensor technologies that improve vessel safety and operational efficiency could provide a competitive edge. Additionally, offering retrofit solutions for existing ships could tap into the growing demand for upgrading fleets with autonomous capabilities. Building strong partnerships with regulatory bodies and shipbuilders to ensure compliance with evolving regulations and standards is essential. Lastly, emphasizing sustainability through fuel-efficient, eco-friendly autonomous technologies could align with the industry's push for reduced environmental impact.

? Companies manufacturing, distributing, or purchasing autonomous ships and related products and other consulting firms must buy the report.