Aviation Crew Management Market Share, Size, Trends, Industry Analysis Report

By Solution (Hardware, Software, and Services); By Application; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3171

- Base Year: 2023

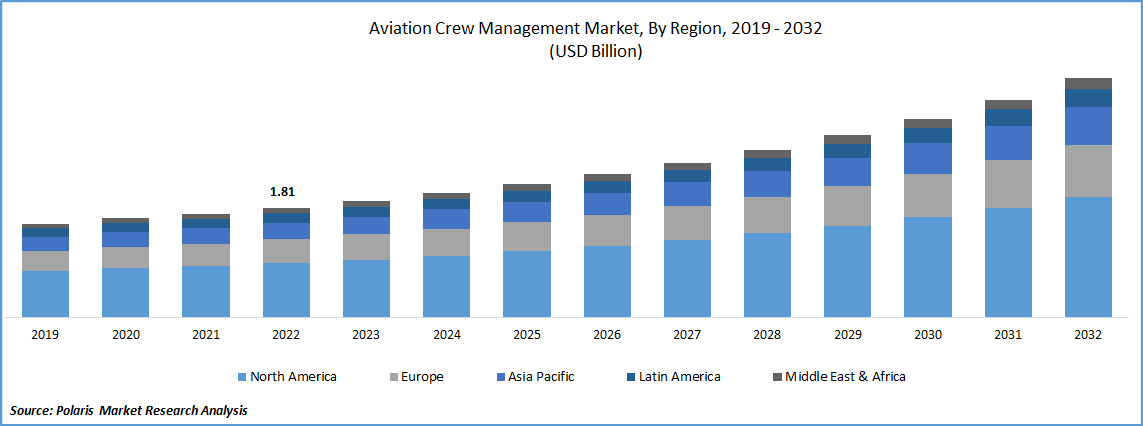

- Historical Data: 2019-2022

Report Outlook

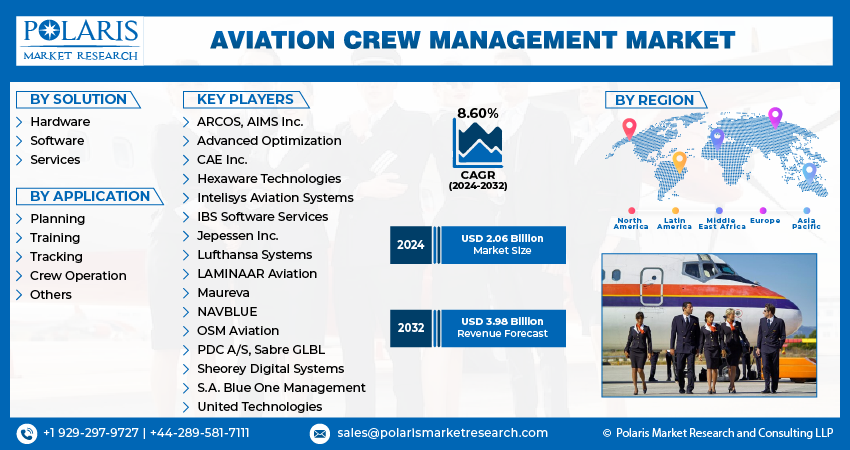

The global aviation crew management market was valued at USD 1.93 billion in 2023 and is expected to grow at a CAGR of 8.60% during the forecast period. In the aviation sector, managing employee issues is referred to as crew management. The primary responsibility of crew management is effective crew planning or scheduling, with pairing and rostering serving as the basic building blocks. Preparing covers staff scheduling, aircraft routing, and flight management, while recovery includes personnel recovery, hiring, and planning for erratic operations. Systems for crew management assist in streamlining and automating the aforementioned procedures. Additionally, it handles numerous tasks like crew manning, sick leave, vacation management, crew education, special capability and credentials management, and contractual rules management.

Know more about this report: Request for sample pages

Increased demand for flight safety is the major factor boosting the aviation crew management market growth over the forecast period. The rise in air travel fuels improvements in safety. A crucial factor in the market's expansion has also been the development of digital solutions, cloud-based services, enhanced electronics, and advanced navigational equipment. Big data's increased use in the aerospace sector will be a major factor in the industry's growth. Additionally, factors including the increase in capital expenditures by aviation businesses and the expanding use of cloud-based applications and services in the aviation industry are driving business.

The automatic enhancement of performance via machine learning is another key element that will moderate the growth of the business. A prominent player's focus is also on research and development for technologies like digital monitoring data. Market growth is being driven by visual recording technology.

Government limitations on commercial aviation, trade, and business operations were a result of the pandemic. The COVID-19 outbreak's influence on the aviation sector has had a huge global impact on the commercial aircraft crew management system. Additionally, the COVID-19 pandemic's decreased aviation passenger traffic has reduced the market for crew management systems. Up to 46 million jobs could be at risk as a result of the COVID-19 aviation slump, according to a report by Airports Council International (ACI). It covers responsibilities requiring a high level of aviation expertise, supply chains in the construction industry, catering supplies, professional services, and other similar tasks necessary in the aviation industry. Airlines have reduced their flight schedules as a result of border restrictions and reduced air traffic brought on by the pandemic. Therefore, the government restriction and stoppage of all activities during the COVID-19 pandemic have impacted market growth.

Industry Dynamics

Growth Drivers

The increasing need for more automated systems to increase operational efficiency as well as the collaboration among major players for the launches of automated systems is the main factor driving this aviation crew management market. For instance, In February 2022, Lynx Air (Lynx), a brand-new, incredibly economical airline in Canada, collaborated with IBS Software to handle its flight operation. IBS's iFlight digital platform will optimize Lynx's flight and crew operations. A significant factor driving the global market is the rise in demand for expert automated systems that enable prompt decision-making. The increase in air travel and growing airline fleets are driving up demand for these systems on a global scale.

Further, due to increasing demand from several airlines, airport authorities, government, and aviation service providers, this business is expanding due to ongoing investment. For instance, In the next four years, investments totaling USD 5 Bn is projected towards the India's aviation sector. By 2026, the Indian government (GOI) expects to have spent USD 1.8 Bn on the development of airport infrastructure & aviation services. These elements could fuel the market growth for airline crew management systems. Important firms have intensified their focus on spending on R&D operations to create better crew management systems as a result of the rising demand for the system, which is accelerate the growth of the aviation crew management market over the forecast period.

Report Segmentation

The market is primarily segmented based on solution, application, and region.

|

By Solution |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

The software segment is expected to witness the fastest growth during forecast period

It is anticipated that during the forecast period, the software segment will expand the fastest. The desire for cutting-edge on-cloud software solutions is what's driving this increase. With the use of this technology, customers can access data on any device, including tablets, laptops, and smartphones. Utilizing aviation crew management system apps, the crew is managed. Exchanges of technical information take place through the crew management software. A high rate of adoption of this program among airline authorities and aviation providers is because it handles the scheduling, training, and signing on and off of workers through centralized aviation crew management software.

The market's hardware segment had a sizable value share due to the significant growth in the usage of aviation crew management systems to boost the effectiveness of staff optimization is credited with this high proportion. Additionally, it is anticipated that the expanding smart airport projects will accelerate segment growth during the projection period.

The Crew Operation segment industry accounted for the highest market share in 2022

During the anticipated timeframe, the crew operation application segment experiences the largest compound annual market growth. Airline companies can rearrange plans and operations owing to signals from aviation crew management systems, which cuts down on AOG time and boosts operational effectiveness. The necessity to optimize pilot and crew operations to lower overall aircraft operating costs is associated with this growth. Airlines can reschedule crew operations owing to aviation crew management systems in the event of crises or flight delays. Airlines can efficiently manage crew activities, evaluate employee performance, and make use of resources due to aviation crew management systems.

The demand in North America is expected to witness significant growth during forecast period

The region's aviation market is propelled by the presence of a sizable aircraft fleet and a number of the world's top airline companies. Market expansion in the area is anticipated to be fueled by investments made by airlines in the adoption of these systems to streamline operations and improve crew productivity. The most alluring potential for the major participants in the aviation industry is the entry of new carriers in industrialized nations. In wealthy nations like the United States, the United Kingdom, Canada, and Germany, among others, the cost of work is high.

In these developed nations, numerous airlines are entering the aviation business. These airlines, therefore, need crew management systems to make sure that staff members are used as effectively as possible, lowering the cost associated with the crew. The European region has grown as a result of more people traveling by air, the acquisition of new aircraft, and the government's acceptance of new aviation regulations. Additionally, the European Aviation Safety Agency (EASA) amended and adopted the crew operating in high-risk zones rules in June 2020.

During the predicted period, Asia Pacific is expected to exhibit long-term growth possibilities. The expansion is credited to the strengthening economy and the substantial demand for travel from nations. Due to the presence of wealthy individuals in the area, an increase in travel and business prospects, and fresh procurement strategies, the Middle Eastern market is expected to experience significant growth in the next years. As a result, the rise of aviation crew management systems will be anticipated by the demand for commercial aircraft.

Competitive Insight

Some of the major players operating in the global aviation crew management market include ARCOS, AIMS Inc., Advanced Optimization, CAE Inc., Hexaware Technologies, Intelisys Aviation Systems, IBS Software Services, Jepessen Inc., Lufthansa Systems, LAMINAAR Aviation, Maureva, NAVBLUE, OSM Aviation, PDC A/S, Sabre GLBL, Sheorey Digital Systems, S.A. Blue One Management, & United Technologies.

Recent Developments

- In March 2022, NetLine/Crew Qualification & Training Management were introduced by Lufthansa Systems. The session gives a thorough overview of the planning and requirements for a crew member and ground personnel training on a single platform. The qualifications, recurrency, and training requirements of airline employees are managed by NetLine/Crew Qualification and Training Management.

- In September 2019, IBS Software (IBS) announced the successful completion of the acquisition of Canada-based AD OPT, a global leader in aircraft crew optimization tools, from Kronos Incorporated. With the acquisition, IBS Canada will be created, transforming the Montreal headquarters of AD OPT into a global Center of Excellence for crew optimization tools.

Aviation Crew Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.06 billion |

|

Revenue forecast in 2032 |

USD 3.98 billion |

|

CAGR |

8.60% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Solution, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

ARCOS LLC, AIMS Inc., Advanced Optimization System, Inc., CAE Inc., Hexaware Technologies Limited, Intelisys Aviation Systems Inc., IBS Software Services Pvt. Ltd., Jepessen Inc., Lufthansa Systems GmbH & Co. KG, LAMINAAR Aviation InfoTech Pte. Ltd., Maureva Ltd., NAVBLUE, OSM Aviation Group, PDC A/S, Sabre GLBL Inc., Sheorey Digital Systems Pvt. Ltd., S.A. Blue One Management N.V., and United Technologies Corporation |

FAQ's

The aviation crew management market report covering key segments are solution, application, and region.

The global aviation crew management market size is expected to reach USD 3.98 billion by 2032.

The global aviation crew management market expected to grow at a CAGR of 8.4% during the forecast period.

North America is leading the global market.

Key driving factors in aviation crew management market are increase in air travel and growing airline fleets.