Bacterial Antigens Market Share, Size, Trends, Industry Analysis Report

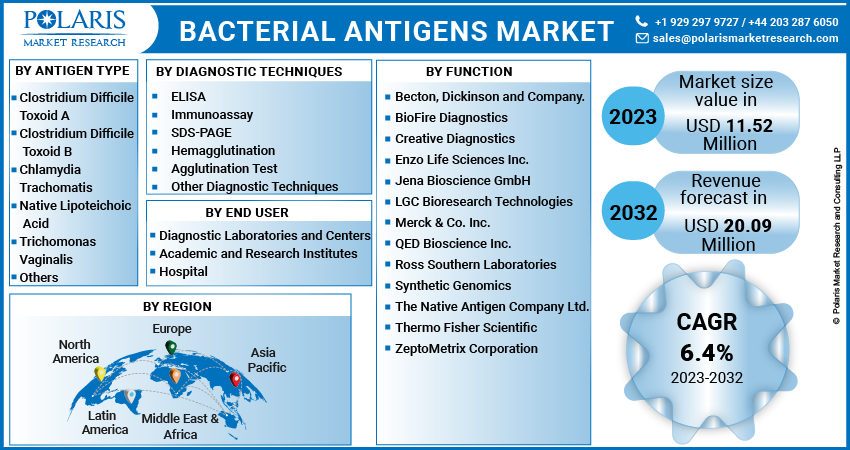

By Antigen Type (Clostridium Difficile Toxoid A, Clostridium Difficile B, Chlamydia Trachomatis, Native Lipoteichoic Acid, Trichomonas Vaginalis, and Others); By Diagnostic Techniques; By End User; By Region; Segment Forecast, 2023 – 2032

- Published Date:Sep-2023

- Pages: 116

- Format: PDF

- Report ID: PM3746

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

The global bacterial antigens market was valued at USD 10.85 million in 2022 and is expected to grow at a CAGR of 6.4% during the forecast period. The growing emphasis on preventive healthcare measures and the continuously surging need for vaccine development to combat both emerging and established bacterial antigens, coupled with the increasing demand for bacterial antigens that are capable of eliciting a protective immune response against the different infectious diseases, are driving the global bacterial antigens market growth exponentially. In addition, the rise in the number of diagnostic tests being performed in humans and the rising prevalence of new bacterial antigen launches and product approval by major research organizations and institutions are propelling the need and demand for antigens over the coming years.

For instance, in March 2023, The National Institutes of Health announced the 5-year USD 7.85 Mn grant provided to the Vanderbilt University Medical Center for the launch of Vanderbilt Antibody and Antigen Discovery for the clostridioides difficile vaccines. The grant will be supporting a team of more than 25 VU & VUMC multidisciplinary researchers in discovering C. diff antigens.

Moreover, there has been a growing focus among major healthcare institutions globally towards expanding the applications of bacterial antigens. As a result, bacterial antigens are being utilized in immunotherapies for stimulating the immune system against bacterial infection and have been showing promising results in treating certain diseases, thereby fueling the market’s growth.

However, several stringent regulatory standards for the development and commercialization of bacterial antigens, mainly for vaccines and diagnostic arrays, and a time-consuming and expensive approval process are among the factors expected to restrain the growth of the market in the near future.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the bacterial antigens market. The rapid spread of the pandemic worldwide has largely disrupted global supply chains, affecting the availability of raw materials, reagents, and laboratory equipment necessary for research and production of bacterial antigens, which could have impacted the production and distribution of bacterial antigens all over the world.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Increasing use of different types of bacterial antigens

The growing use of different types of bacterial antigens to develop new and advanced antibodies in research laboratories in order to improve the overall immune system and are also being used in different diagnostic techniques, including ELISA, SDS-PAGE, Agglutination, and Immunoassay, among others coupled with the surging proliferation for new types of bacterial infections globally, are among the primary factors driving the demand and growth of the market at a rapid pace.

Furthermore, the increasing awareness regarding the importance of vaccinations and preventive healthcare measures around the world encourages the development and use of bacterial antigen-based products such as diagnostic kits, vaccines, and research tools, along with the greater emergence of antibiotic-resistant bacterial strains emphasizing the need for innovative alternative approaches in order to combat bacterial infections, are further anticipated to boost the market growth.

Report Segmentation

The market is primarily segmented based on antigen type, diagnostic techniques, end user, and region.

|

By Antigen Type |

By Diagnostic Techniques |

By End User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Antigen Type Analysis

Clostridium difficile toxoid A segment accounted for largest market share in 2022

The Clostridium difficile toxoid A segment accounted for a significant global market share. The growth of the segment market can be mainly attributed to a rapid surge in the prevalence of these infections in various healthcare settings, including hospitals and nursing homes, and growing awareness among hospitals, patients, and the general public regarding the effects of these infections on the body.

The trichomonas vaginalis segment is expected to gain a substantial growth rate over the study period on account of increasing knowledge among the people about the risks associated with STIs, including trichomoniasis, that leads to an increased number of patients globally seeking treatment and testing.

By Diagnosis Technique

Immunoassay segment held the significant market share in 2022

The immunoassay segment held the maximum market share both in terms of revenue and volume in 2022, which is mainly driven by the exponential rise in the number of bacterial infections, which largely requires immunoassays targeting bacterial antigens for the treatment and diagnosis coupled with the growing advancements in immunoassay technologies that led to the development of improved sensitivity, specificity, and enhanced bacterial antigen detection, that makes it a very crucial tool in clinical laboratories for effectively diagnosing infections.

For instance, according to a report published in December 2022, around 7.7 million deaths all over the world are estimated to be linked to bacterial infection, which means approx. 13.6% of total deaths, or every 1 in 8 deaths globally, are caused by bacterial infection.

The ELISA segment is projected to register the highest growth rate during the anticipated period, which is mainly accelerated by its widespread use in the research and diagnostic laboratories in order to easily detect and quantify specific antigens, antibodies, and many other biomolecules and increasing funding for life sciences research that supports the development of various new assays.

By End User

Academic and research institutes segment is expected to witness highest growth during forecast period

The academic and research institutes segment is expected to grow at the highest growth rate over the forecast period, mainly due to a rapid increase in scientific advancements and a growing number of research institutions requiring numerous types of antigens for studying various aspects of bacteria, including the function, interaction, and structure along with the constantly rising focus and investment on the research and development of novel vaccines based on bacterial antigens.

The hospitals segment led the industry market with substantial revenue share in 2022 on account of growing awareness about the importance of early and accurate diagnosis of various bacterial antigens and continuous surge in hospital expenditure in many leading or emerging countries in the world to better understand the bacterial pathogens and develop new vaccines more efficiently.

Regional Analysis

North America region dominated the global market in 2022

The North American region dominated the global market with a considerable share in 2022 and is projected to maintain its dominance throughout the study period. The regional market growth is mainly attributable to the region’s increasing research development activities related to bacterial antigens, along with the growth in the number of favorable government initiatives and public awareness campaigns specifically aimed at preventing infectious diseases with the help of vaccination while boosting the demand for bacterial antigens to be used in vaccine formulation.

APAC region will grow at the fastest pace, owing to a rapid increase in infectious disease burden in densely populated countries like India and China and the significant emergence of various antibiotic-resistant strains and new infectious diseases across the region.

Competitive Insight

The bacterial antigen market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Becton, Dickinson and Company.

- BioFire Diagnostics

- Creative Diagnostics

- Enzo Life Sciences Inc.

- Jena Bioscience GmbH

- LGC Bioresearch Technologies

- Merck & Co. Inc.

- QED Bioscience Inc.

- Ross Southern Laboratories

- Synthetic Genomics

- The Native Antigen Company Ltd.

- Thermo Fisher Scientific

- ZeptoMetrix Corporation

Recent Developments

- In November 2022, The Native Antigen Company introduced new influenza antigens for the southern hemisphere flu season in 2023. The newly developed antigens will support the development of new vaccines and diagnostics as a part of their vaccine reformulation program.

- In December 2021, BioGenex, a global pioneer in the automated staining solution provider for cancer diagnostics, introduces its three new primary immunohistochemistry antibodies for cancer diagnostics that include CD8A, CD56, and CD163, with all of these having different characteristics and properties.

Bacterial Antigens Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 11.52 million |

|

Revenue forecast in 2032 |

USD 20.09 million |

|

CAGR |

6.4% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Antigen Type, By Diagnostic Techniques, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global bacterial antigens market size is expected to reach USD 20.09 million by 2032.

Key players in the bacterial antigens market are Ross Southern Laboratories, Thermo Fisher Scientific, The Native Antigen Company.

North American contribute notably towards the global bacterial antigens market.

The global bacterial antigens market is expected to grow at a CAGR of 6.4% during the forecast period.

The bacterial antigens market report covering key segments are antigen type, diagnostic techniques, end user, and region.