Ballistic Protective Equipment Market Size, Share, Trends, Industry Analysis Report

By Product Type, By Material Type, By Threat Level, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6311

- Base Year: 2024

- Historical Data: 2020-2023

Overview

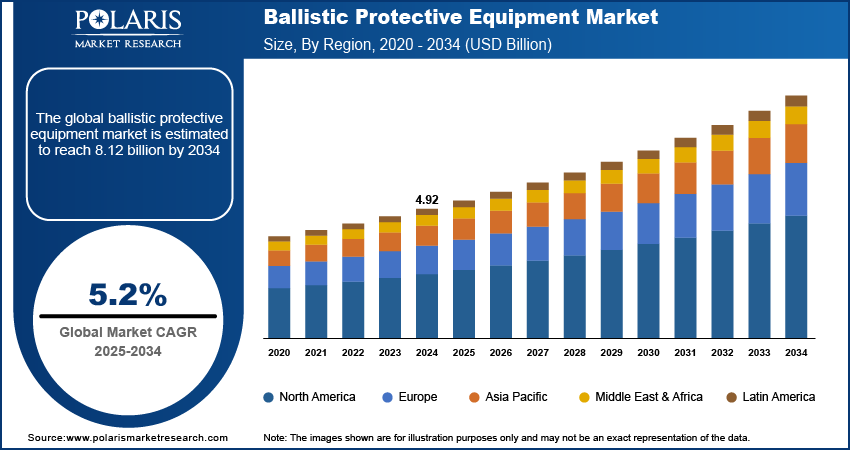

The ballistic protective equipment market size was valued at USD 4.92 billion in 2024, growing at a CAGR of 5.2% from 2025 to 2034. Key factors driving demand for ballistic protective equipment include the global rise in defense budget worldwide and increasing innovation in lightweight, high-strength materials.

Key Insights

- The soft armor segment dominated the market share in 2024.

- The UHMWPE segment is expected to grow due to strong impact resistance and wider use in body armor and helmets that improve mobility and safety.

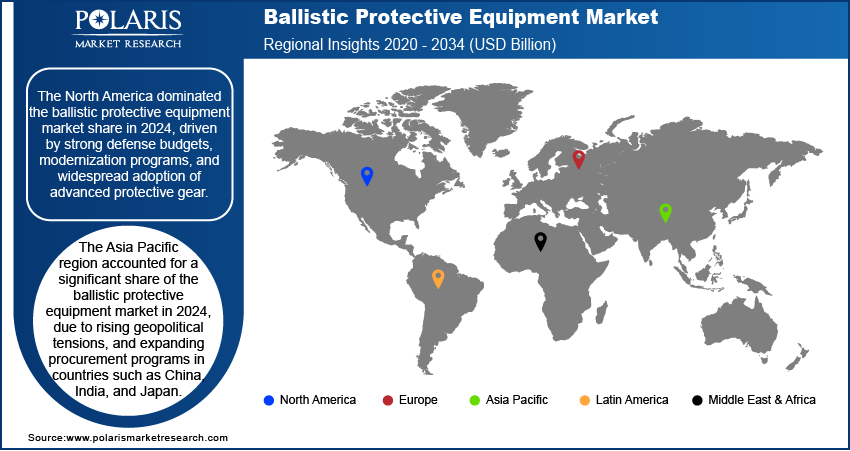

- North America ballistic protective equipment market dominated the global market share in 2024.

- The U.S. ballistic protective equipment market is growing due to high defense budgets and continuous modernization of defense systems.

- Asia Pacific market expected to grow significantly between 2025 and 2034 due to increasing geopolitical tensions and increased expenditure on advanced defense protection technologies.

- Countries such as China and Japan are driving regional growth with larger defense procurement programs and focus on lightweight, high-performance protective gear for their forces.

Industry Dynamics

- Rising defense expenditure worldwide is fueling the market growth due to the continuous procurement of modern protective gear and upgrades to existing equipment for military and security personnel.

- Increasing innovations in lightweight, high-strength materials is fueling the market growth due to its ability to enhance soldier mobility and improve overall battlefield performance without compromising safety.

- The rising demand for multipurpose equipment is expected to create lucrative opportunities during the forecast period.

- The steep manufacturing costs limits small player participation thereby hindering the market growth.

Market Statistics

- 2024 Market Size: USD 4.92 Billion

- 2034 Projected Market Size: USD 8.12 Billion

- CAGR (2025–2034): 5.2%

- North America: Largest Market Share

Ballistic protective gear covers helmets, vests, shields and entire-body armor used for protection of military, police and security personnel against bullets, shrapnel and explosions. The equipment is constructed with advanced materials and is light in weight, strong, and necessary for protection during combat and high-risk operations. The demand is growing with government procurement increasing to enhance soldier security and preparedness.

Increased armed violence across the globe is driving the demand for ballistic protective equipment as a result of increased threats to soldiers and civilians' safety. The Peace Research Institute Oslo noted 59 state-based conflicts in 2023. There was approximately 122,000 battle fatalities with more than 71,000 in Ukraine and around 23,000 in Gaza over the course of three months. This alarming escalation in global hostilities is driving the adoption of advanced ballistic protective equipment to safeguard military personnel and security forces in high-risk environments.

Increasing safety standards for military, law enforcement, and industrial roles drive the adoption of certified ballistic protective equipment due to the need for compliance with stringent regulations that ensure maximum protection in high-risk environments. Defense agencies and security forces require equipment tested against internationally recognized benchmarks, such as those set by the National Institute of Justice (NIJ) and NATO standards, to guarantee reliability against modern ballistic threats. These requirements are pushing procurement of certified solutions that enhance survivability in combat and policing operations and meet operational demands for mobility, comfort, and durability.

Drivers & Opportunities

Rise in Defense Budget Worldwide: Growing defense budgets across the globe are boosting demand for ballistic protective equipment. Military forces depend on advanced vests, helmets, and body armor to safeguard soldiers and improve survival in land, air and sea missions. According to the Stockholm International Peace Research Institute (SIPRI), worldwide military expenditure climbed to USD 2,718 billion in 2024, reflecting a 9.4% increase from 2023. This steady rise in defense allocations is accelerating the procurement of next-generation protective solutions, fueling the growth of the ballistic protective equipment market.

Increasing Innovations in Lightweight, High-Strength Materials: New materials such as polymers, ceramics, and composite fibers are making protective gear lighter while keeping it strong against high-velocity threats. These innovations improve comfort, mobility and safety that helps defense and law enforcement agencies equip personnel with advanced solutions for better performance and endurance.

Segmental Insights

Product Type Analysis

By product type the market is divided into head protection, soft armor, and hard armor. The soft armor segment held the largest share in 2024 due to its wide use in law enforcement and private security. Lightweight design, comfort, and flexibility make it suitable for patrols and tactical missions while demand for concealed vests and modular styles is rising in urban safety.

The hard armor segment is expected to grow the fastest by 2034, driven by defense and special unit needs. Hard plates in body gear and vehicles provide strong protection against rifles and armor-piercing rounds, propelled by defense modernization and soldier safety programs.

Material Type Analysis

Based on material type, the market is categorized into aramid, composites, UHMWPE, steel, and others. The aramid accounted for the largest share in 2024 due to its strength, light weight, and heat resistance. It is the most popular option due to its extensive application in vests, helmets, and shields. For example, DuPont launched Kevlar EXO during April 2023 a next-generation aramid fiber that offers superb protection, comfort, and light weight.

The UHMWPE segment is anticipated to increase at the highest rate due to its water resistance and ease of fitting into soft and hard armor. Rising investment in hybrid composites and advanced UHMWPE is expanding its role in next-generation protective gear.

Threat Level Analysis

By threat level the market is divided into Level II & Level IIA, Level III & Level IIIA and Level IV & above. The Level III & Level IIIA segment dominated the market in 2024, as these vests deliver protection against a wide range of handgun rounds while maintaining mobility for active-duty officers.

The Level IV & higher category is growing the steadily, providing excellent protection against high-velocity armor-piercing rounds for extreme combat. These vests are used by advanced tactical and military units that need maximum protection.

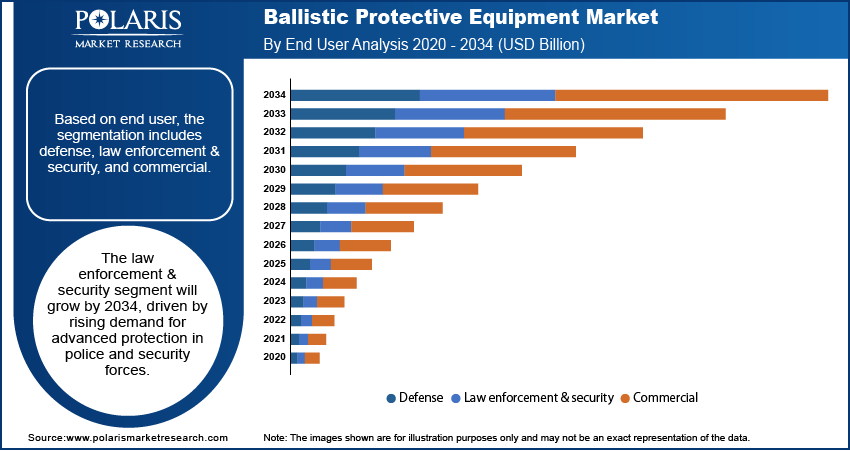

End User Analysis

Based on end user the market is divided into defense, law enforcement & security, and commercial. The defense segment occupied the highest share in 2024 on account of huge military procurement programs to ensure combat readiness. The governments are enhancing troops by arming them with helmets, body armor plates, and vehicle kits to protect soldiers in war zones.

The law enforcement & security segment expected to grow rapidly by 2034 as police and private security incorporate advanced vests, shields, and headgear. Rising demand for lightweight and adaptable protective gear backs better safety in urban operations and unpredictable environments.

Regional Analysis

North America led the ballistic protective equipment market in 2024, driven by high defense spending and major procurement programs. Advanced manufacturing and government focus on soldier safety drive the use of modern body armor, helmets, and shields. Additionally, growing investment in homeland security and terrorism is maintaining demand strong in military and civilian sectors.

U.S. Ballistic Protective Equipment Market Overview

The ballistic protective equipment market is driven by the rising defense expenditure in the U.S., due to the focus of military authorities on equipping personnel with advanced armor solutions to boost battlefield protection. The need for ballistic vests, helmets, and tactical gear is rising as defense forces upgrade to face new threats. The Stockholm International Peace Research Institute states that U.S. defense spending grew to USD 916.01 billion in 2023 from USD 734.34 billion in 2019. Such growth in defense spending drives the adoption of defense equipment offering better protection for defense personnel.

Europe Ballistic Protective Equipment Market Trends

Europe contributed the second highest share led by robust defense industries, NATO security measures, and modernization. European nations invest in ballistic protection to protect borders and update military equipment. Strict safety regulations and developments in light materials further enhance regional growth.

Asia Pacific Ballistic Protective Equipment Market Assessments

Asia Pacific is forecast to experience the most robust growth over the forecast period led by developing protective technology and expanding security demand. Geopolitical tensions, defense modernization and expanding demand from security agencies are driving robust regional growth.

India Ballistic Protective Equipment Market Insights

The Indian ballistic protection equipment market is growing with the evolution of new technologies for boosting soldier protection and reducing weight. For instance, DRDO and IIT Delhi developed lightweight bulletproof jackets named ABHED that is made with polymers and boron carbide. These jackets give full protection while weighing only 8.2 to 9.5 kg, making them lighter than existing options. The transfer of this technology to Indian industries shows the push for advanced homegrown solutions.

Key Players & Competitive Analysis

The ballistic protective equipment market is very competitive with key players including BAE Systems, 3M, Point Blank Enterprises, Safe Life Defense, Honeywell, ArmorSource, MSA Safety, and DuPont. These companies make advanced armor, helmets, shields, and vests using strong materials such as aramid fibers, UHMWPE, and composites. Defense procurement and strategic partnerships help them expand products and global reach. Additionally, rising R&D investments in modular armor, mobility gear, and sensor-enabled equipment are reshaping competition.

A few major companies operating in the ballistic protective equipment industry include BAE Systems plc, 3M Company, Point Blank Enterprises, Inc., Safe Life Defense, Honeywell International Inc., ArmorSource LLC, MSA Safety Incorporated, DuPont de Nemours, Inc., Seyntex N.V., Rheinmetall AG, Craig International Ballistics, and Delta Three Oscar.

Key Players

- 3M Company

- ArmorSource LLC

- BAE Systems plc

- Craig International Ballistics

- Delta Three Oscar

- DuPont de Nemours, Inc.

- Honeywell International Inc.

- MSA Safety Incorporated

- Point Blank Enterprises, Inc.

- Rheinmetall AG

- Safe Life Defense

- Seyntex N.V.

Ballistic Protective Equipment Industry Developments

October 2024: Delta Three Oscar launched its revolutionary D3O Ballistic foam designed to help body armor manufacturers meet the new, stricter NIJ Standard 0101.07, improving protection and wearer mobility.

January 2024: DuPont and Point Blank Enterprises have formed an exclusive partnership to deliver body armor made with DuPont Kevlar EXO aramid fiber. This collaboration aims to meet higher ballistic standards with flexible, comfortable armor that empowers officers to perform at their best.

Ballistic Protective Equipment Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Head protection

- Soft armor

- Hard armor

By Material Type Outlook (Revenue, USD Billion, 2020–2034)

- Aramid

- Composites

- UHMWPE

- Steel

- Others

By Threat Level Outlook (Revenue, USD Billion, 2020–2034)

- Level II & Level IIA

- Level III & Level IIIA

- Level IV & Above

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Defense

- Law enforcement & security

- Commercial

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Ballistic Protective Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.92 Billion |

|

Market Size in 2025 |

USD 5.17 Billion |

|

Revenue Forecast by 2034 |

USD 8.12 Billion |

|

CAGR |

5.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The ballistic protective equipment market size was valued at USD 4.92 billion in 2024 and is projected to grow to USD 8.12 billion by 2034.

The ballistic protective equipment market is projected to register a CAGR of 5.2% during the forecast period.

North America dominated the market in 2024 due to high defense spending, advanced technological integration in protective gear, and continuous demand from military and law enforcement agencies.

A few of the key players in the market are BAE Systems plc, 3M Company, Point Blank Enterprises, Inc., Safe Life Defense, Honeywell International Inc., ArmorSource LLC, MSA Safety Incorporated, DuPont de Nemours, Inc., Seyntex N.V., Rheinmetall AG, Craig International Ballistics, and Delta Three Oscar.

The soft armor segment dominated the market revenue share in 2024 due to its lightweight design, flexibility, and widespread use among law enforcement and security forces for enhanced mobility and comfort.

The Level IV & above segment is projected to witness the fastest growth during the forecast period due to rising demand for high-strength protection against armor-piercing rounds and advancements in composite material technologies.