Barium Carbonate Market Share, Size, Trends, Industry Analysis Report

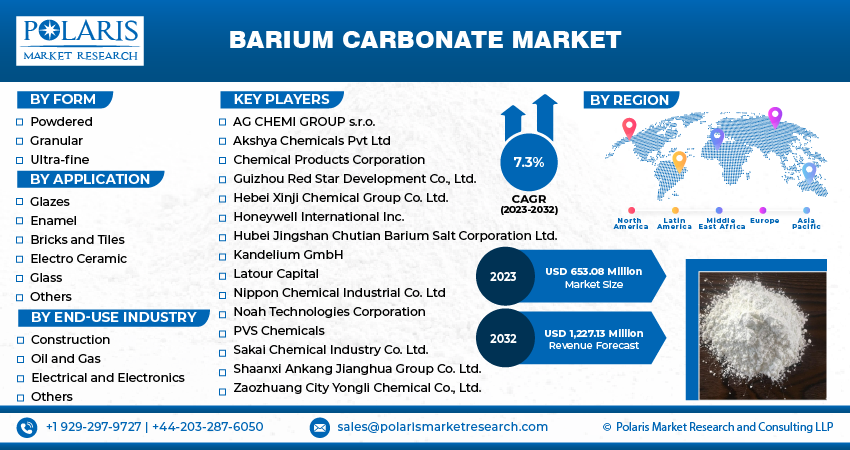

By Form (Powdered, Granular, Ultra-fine); By Application; By End-Use Industry; By Region; Segment Forecast, 2023- 2032

- Published Date:Nov-2023

- Pages: 116

- Format: PDF

- Report ID: PM3924

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

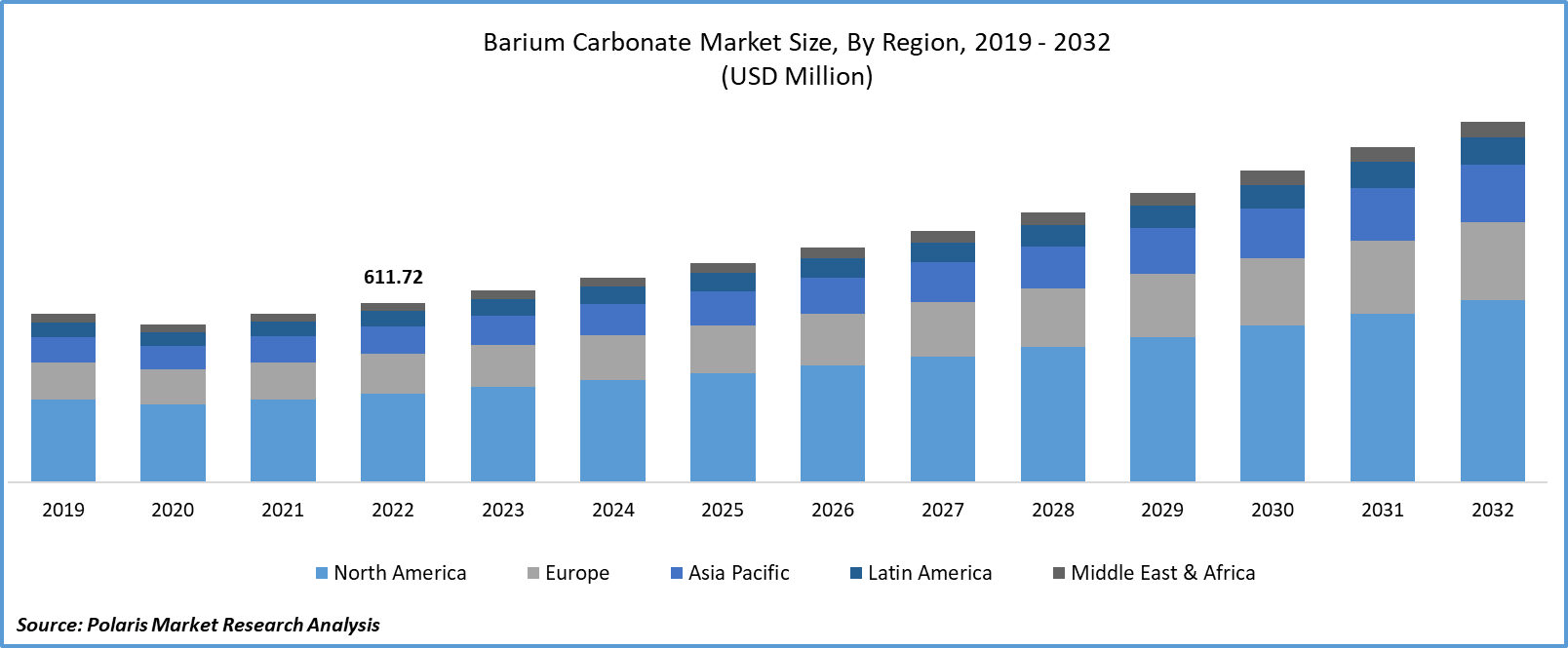

The global barium carbonate market was valued at USD 611.72 million in 2022 and is expected to grow at a CAGR of 7.3% during the forecast period.

The construction industry incorporates barium carbonate into materials such as bricks and tiles to improve color uniformity and mitigate efflorescence. The construction sector across the world is witnessing substantial growth, particularly in emerging markets. This surge in usage of barium carbonate is propelled by the industry's requirements for elevated quality and durability in construction materials. Barium carbonate is increasingly being used to enhance color consistency, diminish efflorescence, and increase material density. As a result, construction materials not only display vibrant, uniform colors but also exhibit superior resistance to environmental factors such as weathering and chemical exposure.

To Understand More About this Research: Request a Free Sample Report

In addition, companies operating in the market are acquiring other players to expand their regional presence and strengthen their market presence.

- For instance, in November 2020, Latour Capital acquired Solvay’s technical-grade barium and strontium business in Germany, Spain, and Mexico to strengthen its presence and expand its customer base.

Research into recycling and waste management processes for barium-containing products can help mitigate environmental concerns. Finding ways to reuse or safely dispose of barium carbonate waste is expected to lead to more sustainable practices in its production and use.

The market for barium carbonate was significantly impacted by the COVID-19 epidemic. The pandemic's early stages impacted manufacturing processes and supply chains, causing delays in production and shortages. Industries such as construction and ceramics, which rely on barium carbonate, experienced reduced demand due to lockdowns and economic uncertainties. However, post COVID-19, the construction industry, which heavily relies on barium carbonate, has witnessed a resurgence. Increased infrastructure projects and housing demands have created the demand for barium carbonate, particularly in construction materials like bricks and tiles.

For Specific Research Requirements: Request for Customized Report

Growth Drivers

- Increased utilization in production of glass, and strengthening construction sector across the world is projected to spur the market demand

A key propellant for the barium carbonate market is its significant use in the glass industry. Barium carbonate is an indispensable ingredient in the production of optical glass, which is crucial for lenses, prisms, and optical fibers. The growing need for high-quality optical glass in sectors such as telecommunications, aerospace, and healthcare is fueling the consumption of barium carbonate.

The ceramic industry extensively relies on barium carbonate to augment the properties of ceramics, including intensifying color and enhancing durability. As the construction and consumer goods sectors experience expansion, the requirement for ceramics like tiles, sanitary ware, and tableware surges, subsequently boosting the demand for barium carbonate.

Report Segmentation

The market is primarily segmented based on form, application, end use industry, and region.

|

By Form |

By Application |

By End-Use Industry |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Form Analysis

- Powdered form emerged as the largest segment in 2022

The powdered form segment accounted for the largest market share in 2022 and is likely to retain its market position throughout the forecast period. Fine barium carbonate powder is a finely milled variant of barium carbonate, typically composed of minute particles with a powdery texture with wide application across various industrial sectors. Fine barium carbonate powder serves as a fundamental raw material in the production of specialized glasses, optical glass, and glass ceramics. It functions as a flux, lowering the glass's melting point and aiding in the manufacturing process. The ceramics industry harnesses finely powdered barium carbonate to achieve vivid colors and improved resilience in ceramics, encompassing decorative tiles and tableware. Research laboratories often utilize finely powdered barium carbonate for a range of analytical and investigative purposes, including chemical analyses and experimental investigations.

By Application Analysis

- Bricks and tiles segment held significant market revenue share in 2022

The bricks and tiles segment held a significant market share in revenue share in 2022. Barium carbonate finds its role in brick and tile manufacturing by enhancing its color vibrancy and consistency. It also serves as a solution to combat efflorescence, the formation of unsightly white deposits on brick and tile surfaces caused by soluble salts. The utilization of barium carbonate can significantly bolster the durability of bricks and tiles. This enhancement results in greater resilience to environmental factors, including weathering and chemical exposure, leading to the creation of long-lasting and robust construction materials. Barium carbonate plays a pivotal role in minimizing water absorption by bricks and tiles, rendering them less susceptible to cracking, warping, or damage from freeze-thaw cycles. Some construction standards and regulatory mandates may necessitate the incorporation of barium carbonate or similar additives to meet specific performance and safety criteria, ensuring that bricks and tiles adhere to industry-approved norms.

By End-Use Industry Analysis

- Construction segment held the significant market revenue share in 2022

The construction segment held a significant market share in revenue share in 2022. The utilization of barium carbonate in construction is propelled by its advantages, encompassing increased durability, radiation shielding capabilities, aesthetic enhancements, and compliance with regulatory standards. Within construction, barium carbonate is utilized to develop ceramics used for decorative tiles, bathroom fixtures, and architectural embellishments. Its presence elevates both the aesthetics and robustness of these elements.

The construction sector is undergoing significant expansion, largely fueled by the ongoing trend of urbanization. The migration of populations to urban centers has created a surging demand for residential, commercial, and infrastructural developments, encompassing housing, office spaces, and retail complexes, driving the market growth.

Regional Insights

- Asia-Pacific region dominated the global market in 2022

The Asia-Pacific region, notably China, holds a prominent position within the global barium carbonate market. This status has been shaped by the region's industrialization, the continual growth of its chemical sectors, and the escalating demand for barium carbonate across various applications. Rapid industrialization and economic expansion in countries such as China, India, and Japan have driven a heightened need for barium carbonate across diverse industries, spanning ceramics, glass, and electronics.

Within the Asian landscape, the ceramic industry emerges as a significant consumer of barium carbonate, driven by the ever-increasing demand for ceramics in construction, tableware, and decorative tile production. Moreover, the utilization of barium carbonate extends to the manufacture of specialty glasses, phosphors for cathode-ray tubes, and its role as a flux in electronic component production, contributing to a consistent and enduring demand.

The Asia-Pacific market exhibits a robust competitive environment characterized by the presence of numerous local and international players. This competitive dynamic exerts a notable influence on pricing strategies and market share, fostering a landscape with adaptability and innovation.

The North America region is anticipated to experience considerable growth during the projected period. The industrial sector in the region is a substantial source of demand for barium carbonate, particularly in its role in the production of specialized glasses, ceramics, and various chemicals. Barium carbonate finds extensive application in the production of specialized glass in the region, enhancing the optical qualities, durability, and transparency of glass products. However, regulatory compliance and environmental considerations surrounding the management and disposal of barium carbonate constitute notable challenges for the industry in the region.

Key Market Players & Competitive Insights

The barium carbonate market demonstrates a fragmented nature with multitude of players involved. Leading participants in this market consistently unveil innovative products as part of their strategy to strengthen their market position. These industry leaders prioritize the establishment of partnerships, improvement of product portfolios, and the cultivation of collaborations to attain a competitive edge over their peers and establish a significant presence within the market.

Some of the major players operating in the global market include:

- AG CHEMI GROUP s.r.o.

- Akshya Chemicals Pvt Ltd

- Chemical Products Corporation

- Guizhou Red Star Development Co., Ltd.

- Hebei Xinji Chemical Group Co. Ltd.

- Honeywell International Inc.

- Hubei Jingshan Chutian Barium Salt Corporation Ltd.

- Kandelium GmbH

- Latour Capital

- Nippon Chemical Industrial Co. Ltd

- Noah Technologies Corporation

- PVS Chemicals

- Sakai Chemical Industry Co. Ltd.

- Shaanxi Ankang Jianghua Group Co. Ltd.

- Zaozhuang City Yongli Chemical Co., Ltd.

Recent Developments

- In July 2023, Vishnu Chemicals announced the acquisition of Ramadas Minerals Pvt Ltd. The acquisition would enable the company’s expansion in the barium carbonate industry.

Barium Carbonate Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 653.08 million |

|

Revenue forecast in 2032 |

USD 1,227.13 million |

|

CAGR |

7.3% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Form, By Application, By End-Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |