Base Oil Market Size, Share & Trends Analysis Report

By Type (Mineral Oil, Synthetic Oil, and Bio-Based Oil), By Grade, Application, and By Region – Market Forecast, 2025– 2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM3094

- Base Year: 2024

- Historical Data: 2020-2023

Base Oil Market Overview

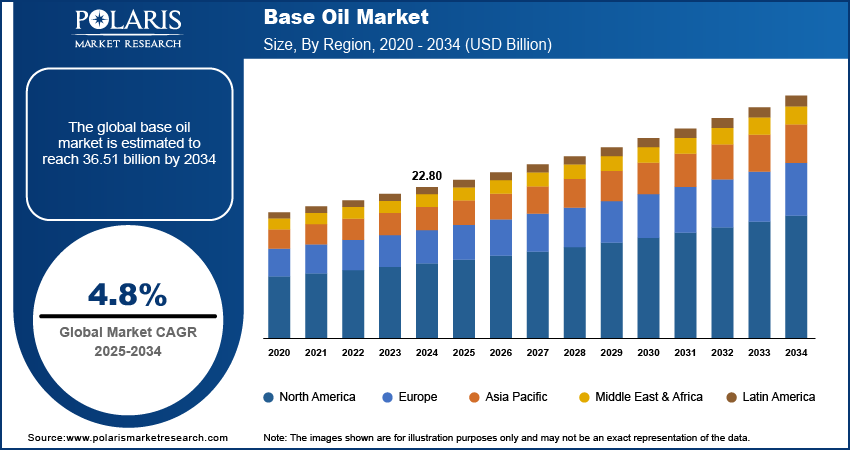

The global base oil market was valued at USD 22.80 billion in 2024 and is expected to exhibit a CAGR of 4.8% from 2025 to 2034. Base oil drives the production and distribution of lubricants for industrial and automotive applications, supported by governmental strategies that facilitate the shift toward advanced engine designs. A report by the ICCT, published in August 2021, highlighted that governments worldwide have started making long-term commitments for a 100% phase out of internal combustion engine medium and heavy-duty commercial vehicle; globally, which further supports the transition to advanced engine designs.

Base oils are the primary ingredients used in the production of lubricants, derived from crude oil, synthetic sources, or bio-based materials. These oils play a crucial role in determining the performance characteristics of the lubricant.

To Understand More About this Research: Request a Free Sample Report

One of the key drivers is the increasing demand for high-performance lubricants in the automotive sector, demonstrating governmental recognition of technological shifts in automotive lubrication. For example, nanotechnology is transforming automobile lubricants by incorporating nanomaterial measuring less than 100 nanometers, which reduce friction and enhance engine efficiency, leading to improved performance and fuel economy. The transition to advanced engine designs, including hybrid and electric vehicles (EVs), necessitates low-viscosity lubricants that improve fuel efficiency and meet strict emission standards. This trend has amplified the demand for Group III and Group IV base oils, known for their superior thermal and oxidative stability. Additionally, rapid industrialization and infrastructure development globally continue to boost base oil demand, highlighting the critical role of advanced lubricant technologies in supporting industrial innovation.

Base Oil Market Dynamics

Rising Industrial Growth and Energy Efficiency Needs

Rising Industrial Growth and Energy Efficiency Needs

Industrialization across emerging economies, particularly in Asia Pacific, is driving the demand for advanced lubricants derived from high-quality base oils, with the automotive sector being a key consumer. According to the Society of Indian Automobile Manufacturers (SIAM), vehicle production in India increased from 23,040,066 units between April 2021 and March 2022 to 25,931,867 units between April 2022 and March 2023, further boosting base oil demand. Additionally, manufacturing sectors such as heavy machinery, metalworking, and power generation rely on lubricants to enhance operational efficiency, reduce downtime, and ensure machinery protection by minimizing friction, dissipating heat, and preventing contamination. In line with sustainability efforts, companies are innovating to reduce dependence on crude oil. For instance, in February 2023, Neste introduced ReNew lubricant, produced using renewable or re-refined base oils. The growing emphasis on energy efficiency continues to drive the adoption of base oils with high viscosity indices and improved thermal stability, aligning with the global push for sustainable industrial solutions.

Shift Towards Synthetic and Bio-Based Oils

Synthetic oils, such as Group IV (PAO), offer exceptional thermal stability, oxidation resistance, and extended drain intervals, making them ideal for high-performance automotive and industrial applications. Simultaneously, bio-based oils derived from renewable sources are gaining traction due to increasing environmental awareness and stringent regulations aimed at reducing carbon emissions. Government initiatives, such as the European Green Deal, are accelerating the adoption of these sustainable alternatives. Additionally, industries such as food processing and pharmaceuticals are favoring bio-based oils for their compliance with health and safety standards. For instance, in January 2024, S-OIL launched an innovative bio-based production strategy in Korea, converting used cooking oil and palm oil byproducts into sustainable aviation fuel and eco-friendly chemicals. This dual focus on performance enhancement and sustainability is reshaping industry dynamics as end-users increasingly prioritize long-term efficiency and reduced ecological impact.

Base Oil Market Segment Insights

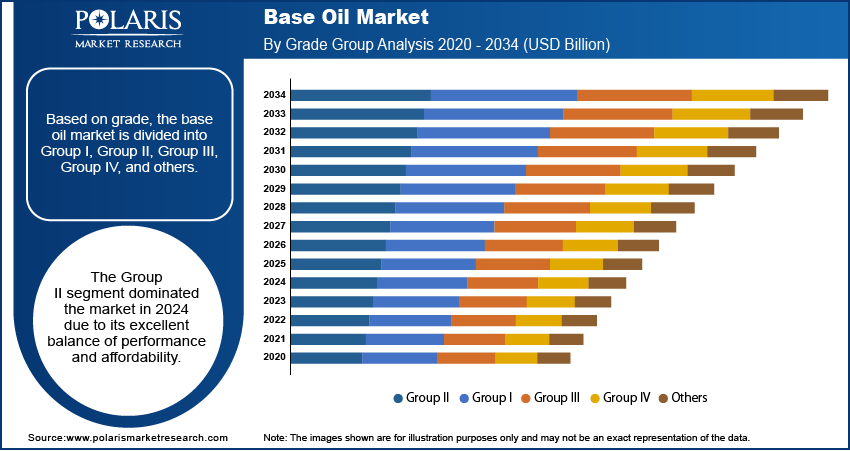

Base Oil Market Assessment by Grade Outlook

The global market assessment, based on grade, includes Group I, Group II, Group III, Group IV, and others. The Group II segment dominated in 2024 due to its excellent balance of performance and affordability. Group II oils offer superior oxidation stability and have lower sulfur content compared to Group I oils, making them ideal for automotive and industrial lubricants. Their extensive use in the manufacturing of engine oils that comply with emission norms, such as Bharat Stage (BS) VI and Corporate Average Fuel Efficiency (CAFÉ), further strengthens their position. In the automotive sector, Group II oils are essential for producing multigrade lubricants used in passenger vehicles and light-duty trucks. Additionally, the global shift from Group I to Group II oils, driven by stricter regulations on sulfur content and a focus on improved efficiency, supports their dominance.

Base Oil Market Evaluation by Type Outlook

The global market segmentation, based on type, includes mineral oil, synthetic oil, and bio-based oil. The synthetic oil segment is expected to witness the fastest growth during the forecast period, driven by the demand for superior lubrication in modern high-performance engines operating under extreme conditions. The rise of electric and hybrid vehicles further contributes to the growing demand for base oils, as these vehicles require low-viscosity lubricants to ensure optimal efficiency. The US and Europe have witnessed increased adoption of synthetic oils due to strict carbon emission targets. This trend highlights the growing preference for synthetic solutions over conventional mineral-based products.

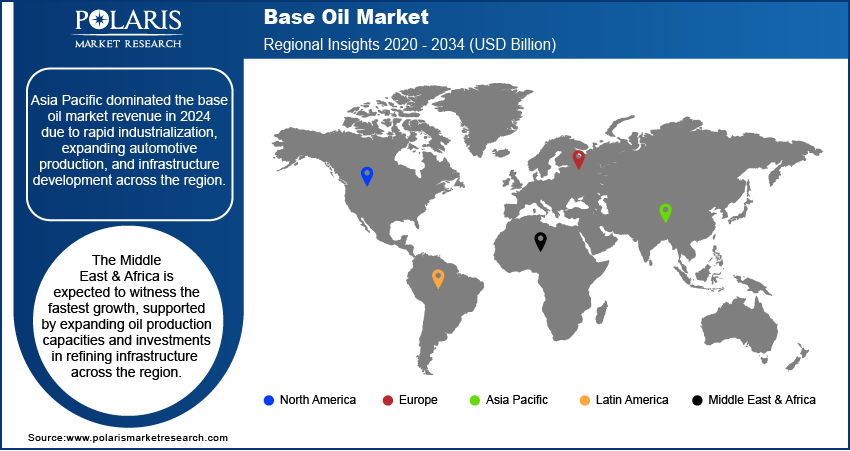

Base Oil Market Regional Analysis

By region, the report provides the insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific base oil market dominated the revenue in 2024 due to rapid industrialization, expanding automotive production, and infrastructure development across the region. Countries such as China, India, and Japan have witnessed significant demand for lubricants in manufacturing, transportation, and heavy machinery. China, the world’s largest automotive producer, has witnessed a high consumption of advanced base oils to meet stringent emission standards and fuel efficiency requirements. According to a June 2024 report by China SICO, crude oil production in the country has remained stable at 200 million tons annually. Additionally, government initiatives, including India's "Make in India" program, have supported industrial growth, further boosting the demand for industrial oils and hydraulic fluids. For instance, in September 2023, India’s Ministry of Environment, Forest and Climate Change announced the Hazardous and Other Waste (Management and Transboundary Movement) Second Amendment Rules, 2023. Effective from April 2024, these rules mandate producers and importers of used oil to register with the Central Pollution Control Board via a new online portal within six months. The region's strong refining capabilities, coupled with investments in upgrading production facilities for high-quality base oils such as Group II and Group III, have reinforced its leadership.

The Middle East & Africa base oil market is expected to witness the fastest growth, supported by expanding oil production capacities and investments in refining infrastructure. Countries such as Saudi Arabia are strengthening their presence by increasing Group III and IV production capacities. For instance, in January 2024, Aramco reported an average hydrocarbon output of 13.6 million barrels per day (mmbpd), which includes 11.5 mmbpd of crude oil. The company also claims to produce the industry's lowest-carbon barrel of oil and has pledged to reach net-zero emissions by 2050, surpassing the Saudi government's target of achieving net-zero emissions by 2060.

Key Players and Competitive Insights

Major players are investing heavily in research and development in order to expand their offerings, which will help the base oil industry grow even more. The base oil industry is highly competitive, with leading players prioritizing innovation, sustainability, and strategic partnerships to maintain their positions. ExxonMobil and Shell are driving advancements with high-performance base oil technologies and investments in eco-friendly solutions, while SK Lubricants is expanding its premium Group III production to meet growing global demand. Companies like Chevron and TotalEnergies focus on tailored solutions, leveraging advanced refining technologies to cater to diverse end-user requirements. Collectively, these players dominate through extensive R&D efforts, regional expansions, and collaborations to address evolving customer needs and stringent regulatory standards.

Exxon Mobil Corporation is a multinational oil and gas corporation. It was formed in 1999 through the merger of Exxon Corporation and Mobil Corporation, two of the most prominent oil companies in the US. Headquartered in Irving, Texas, Exxon Mobil is primarily engaged in the exploration, production, refining, and marketing of oil and natural gas, as well as the manufacturing and marketing of petrochemicals and other chemical products. Its core operations span the entire energy value chain. Exxon Mobil is a global energy company with operations in over 70 countries. It has a significant presence in both upstream (exploration and production) and downstream (refining and marketing) activities worldwide. The company explores and produces crude oil and natural gas in various regions, including the US, Europe, Africa, Asia, and the Middle East. It operates in both onshore and offshore environments and is involved in conventional and unconventional energy resources. Exxon Mobil Corporation offers high-performance base oils, including Group I, II, and III variants, under the EHC and SpectraSyn brands. These enhance lubricant efficiency, providing superior viscosity, oxidation stability, and fuel economy benefits.

TotalEnergies Corbion is a producer in Poly Lactic Acid (PLA) production, a renewable and biodegradable polymer. Their Luminy PLA line includes recycled content, offering versatility for applications in fresh food packaging, consumer goods, automotive, and 3D printing. PLA reduces carbon emissions, making it an eco-friendly alternative in various industries. The company offers their solutions for various application such as rigid food packaging, flexible packaging, food serviceware, durable goods, non-wovens, and 3D-printing. Total and Corbion established a 50/50 joint venture to produce and sell polylactic (PLA) polymers, constructing a plant in Thailand, operational from 2017. TotalEnergies is a global energy company, employing 100,000 people, dedicated to providing affordable, reliable, and clean energy solutions across 130+ countries. Their focus is on accessible and responsible energy production, emphasizing low-carbon electricity, fuels, and natural gas. Corbion, market player, specializes in lactic acid derivatives, emulsifiers, enzymes, and algae ingredients. Utilizing fermentation expertise, Corbion delivers sustainable solutions for food preservation, health, and bioplastics, contributing significantly to various industries. TotalEnergies Corbion specializes in sustainable base oils derived from renewable sources. Their innovative biopolymer-based solutions enhance lubricant performance, offering high oxidation stability, biodegradability, and reduced environmental impact for industrial and automotive applications.

List of Key Companies in Base Oil Market

- BP plc

- Calumet, Inc.,

- Chevron Corporation

- ExxonMobil

- FUCHS

- H&R Group

- Lukoil

- Motiva Enterprises LLC

- Neste

- Petro‐Canada Lubricants Inc.,

- Phillips 66 Company.

- Shell

- Sinopec

- SK Enmove Co., Ltd.

- TotalEnergies

Base Oil Industry Developments

June 2024 TotalEnergies Lubrifiants launched its lubricant ranges, Quartz EV3R for passenger cars and Rubia EV3R for trucks. The company stated that these products are formulated using high-quality regenerated base oils and have received approval from numerous vehicle manufacturers.

September 2024: Pentas Flora, a manufacturer of sustainable base oil solutions, launched its Re-refined Base Oil (RRBO) Group II+ N150. According to Pentas Flora, this product marks a noteworthy milestone towards a cleaner, greener future.

In March 2022, ADNOC Distribution introduced a new Voyager Green Series line of lubricant products designed for both petrol and diesel engines, utilizing 100% plant-based base oil.

Base Oil Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Mineral Oil

- Synthetic Oil

- Bio-Based Oil

By Grade Outlook (Revenue – USD Billion, 2020–2034)

- Group I

- Group II

- Group III

- Group IV

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Automotive Oil

- Industrial Oil

- Metalworking Fluids

- Hydraulic Oil

- Greases

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Base Oil Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 22.80 billion |

|

Market Size Value in 2025 |

USD 23.87 billion |

|

Revenue Forecast by 2034 |

USD 36.51 billion |

|

CAGR |

4.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global base oil market size was valued at USD 22.80 billion in 2024 and is projected to grow to USD 36.51 billion by 2034.

• The global market is projected to register a CAGR of 4.8% during the forecast period.

• Asia Pacific dominated the base oil market revenue in 2024.

• A few of the key players in the market are BP plc; Calumet, Inc.; Chevron Corporation; ExxonMobil; FUCHS; H&R Group; Lukoil; Motiva Enterprises LLC; Neste; Petro-Canada Lubricants Inc.; Phillips 66 Company; Shell; Sinopec; SK Enmove Co., Ltd.; and TotalEnergies.

• The Group II segment dominated the market in 2024.