Bearing Steel Market Share, Size, Trends, Industry Analysis Report

By Type (Carbon Steel, Stainless Steel); By End Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM3532

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

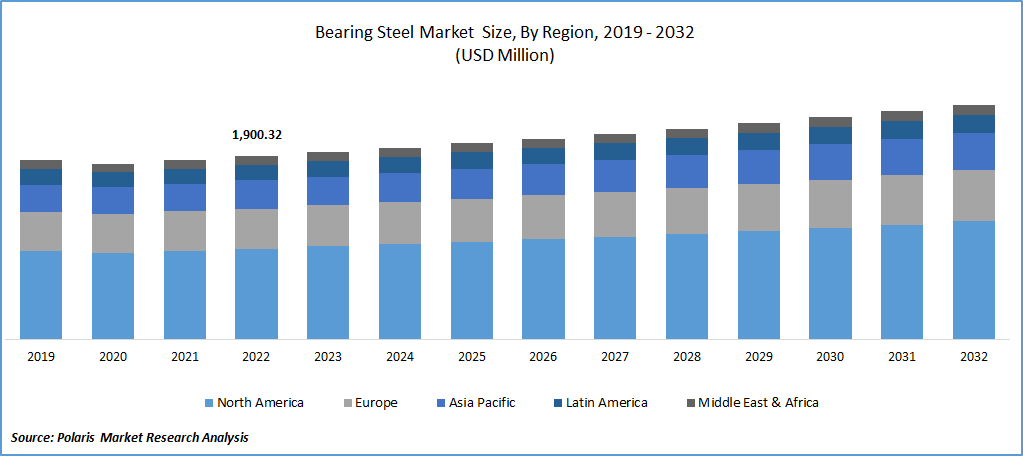

The global bearing steel market was valued at USD 1942.32 million in 2023 and is expected to grow at a CAGR of 2.50% during the forecast period. The growth of the wind energy sector has increased the demand for large bearings used in wind turbines. Bearing steel is used to manufacture these bearings, and as wind energy becomes a more significant contributor to the global energy mix, the demand for bearing steel is expected to increase. The largest growth of all power production technologies, the amount of electricity produced by wind increased by about 273 TWh in 2021 (up 17%), a growth of 55% more than that seen in 2020. In 2021, wind will continue to be the most important non-hydro renewable technology, producing 1 870 TWh, almost as much as all the others combined.

To Understand More About this Research: Request a Free Sample Report

Wind turbines are complex machines with several critical components, including the gearbox, generator, and rotor. These components require bearings to ensure smooth operation, and the bearings used in wind turbines must withstand harsh operating conditions, including high winds and extreme temperatures. The growing production of wind energy is a major driver of the bearing steel market, as wind turbines require a significant number of bearings, and these bearings require high-quality bearing steel to ensure their durability and reliability.

Industry Dynamics

Growth Drivers

The bearing steel market is primarily driven by the demand from various end-use industries such as automotive, aerospace, energy, and power generation. The growth of these industries is creating new opportunities for the bearing steel market. The growing construction and mining equipment sector is fuelling the development of the bearing steel market.

The construction and mining equipment sector uses many bearings in various components, such as excavators, loaders, and conveyor systems, driving the demand for high-quality bearings made of bearing steel. Construction and mining equipment operate in harsh environments that place much stress on bearings. These machines require bearings that withstand heavy loads, high speeds, and extreme temperatures. The unique performance requirements of these machines are driving the development of new bearing steel alloys that can meet these demands.

Report Segmentation

The market is primarily segmented based on type, end use industry and region.

|

By Type |

By End Use Industry |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Stainless Steel segment is expected to witness fastest growth during forecast period

Stainless steel is driving the growth of the bearing steel market primarily because of its superior properties compared to carbon steel. Stainless steel is an alloy that contains a minimum of 10.5% chromium, which gives it its characteristic corrosion resistance. This makes stainless steel bearings more durable and corrosion-resistant, which is especially important in harsh environments such as marine or chemical processing industries. In addition to its corrosion resistance, stainless steel bearings perform better in high-temperature applications due to their high melting point and strength at elevated temperatures.

They also have a higher load-bearing capacity, making them ideal for heavy-duty applications. Furthermore, the demand for stainless steel bearings is expected to increase due to the growth of industries such as automotive, aerospace, and food processing, where high-performance bearings are critical. This is expected to drive the development of the bearing steel market in the coming years.

Automotive segment accounted for the largest market share in the study period

The automotive segment registered the largest market share in the projection period. The automotive industry is driving the growth of the bearing steel market due to the high demand for bearings in various automotive applications. Bearings are critical components in automotive applications such as engines, transmissions, and chassis systems. They support rotating shafts and reduce friction, enabling efficient and reliable operation of the vehicle. The need for bearings is driven by the automobile industry, which is expanding significantly, particularly in rising economies like China and India. In addition, the increasing demand for electric vehicles (EVs) is also driving the growth of the bearing steel market.

EVs require more bearings than traditional internal combustion engine vehicles, mainly due to electric motors requiring several bearings to support their rotating shafts. Furthermore, the automotive industry's focus on lightweight, fuel efficiency, and reducing emissions drive the demand for high-performance bearings made from advanced materials such as bearing steel. Bearing steel offers superior mechanical properties such as high strength, durability, and fatigue resistance, making it an ideal choice for demanding automotive applications.

APAC is expected to hold larger revenue share and higher growth rate in the study period

APAC is projected to have a higher growth rate and larger revenue share for the bearing steel market. Firstly, the region is experiencing rapid industrialization and urbanization, leading to increased demand for bearings and other related products. The growing manufacturing activities, particularly in countries such as China and India, drive the demand for bearings in various industries such as automotive, aerospace, energy, and power generation.

China invested USD 164 billion in new solar farms and USD 109 billion in new wind farms, accounting for 55% of all renewable energy investments worldwide. China has been one of the fastest-growing markets for renewable energy, with the country investing heavily in wind, solar, and hydropower projects. The growth of renewable energy projects in China has increased the demand for bearings, which are used in wind turbines, solar panels, and hydropower plants. This will further fuel the growth of the market in the coming years.

Europe garnered with the second largest growth rate in the forecast period

Europe is expected to have the second-largest growth for the bearing steel market after the Asia Pacific. The region has a well-established automotive industry and a significant presence of aerospace and defense manufacturers, major end-users of bearing steel.

Furthermore, the region invests heavily in renewable energy and power generation, driving the demand for bearings and related products. The presence of key market players in the region is also contributing to the growth of the bearing steel market.

The growing production of solar and wind energy, surpassing traditional fuels, is driving the growth of the bearing steel market in Europe. As the demand for renewable energy continues to grow in Europe, so does the need for bearings and bearing steel used in renewable energy equipment.

Competitive Insight

Some of the major players operating in the global market include AB SKF, Sanyo Special Steel, Timken Company, Schaeffler Group, ZWZ Bearing, Baosteel, Cartech, Dongbei Special Steel, Aichi Steel, Suzhou Steel, Dongil Industries, Kobe Steel, & Benxi Iron and Steel.

Recent Developments

- In March 2023, the UP-state government inaugurated an integrated steel mill worth Rs 550 crore. Ankur Industries and the UP government have agreed to an MOU worth Rs. 700 crores for the expansion of this plant.

- In November 2022, Aaress Iron and Steel, a Baldota Group and a subsidiary of the MSPL inked an agreement with the Karnataka government to construct and run an integrated steel factory.

Bearing Steel Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1986.41 million |

|

Revenue forecast in 2032 |

USD 2,427.80 million |

|

CAGR |

2.50% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By End Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

AB SKF, Sanyo Special Steel, Timken Company, Schaeffler Group, ZWZ Bearing, Baosteel, Cartech, Dongbei Special Steel, Aichi Steel, Suzhou Steel, Dongil Industries, Kobe Steel, & Benxi Iron and Steel |

FAQ's

key companies in Bearing Steel Market are AB SKF, Sanyo Special Steel, Timken Company, Schaeffler Group, ZWZ Bearing, Baosteel, Cartech.

The global bearing steel market expected to grow at a CAGR of 2.5% during the forecast period.

The Bearing Steel Market report covering key are type, end use industry and region.

key driving factors in Bearing Steel Market are Growing Demand for Bearings from Automotive Industry.

The global bearing steel market size is expected to reach USD 2,427.80 million by 2032.