Bioactive Ingredients Market Size, Share, Trends, & Industry Analysis Report

By Type (Vitamin, Minerals), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 126

- Format: PDF

- Report ID: PM1556

- Base Year: 2024

- Historical Data: 2020-2023

What is the global bioactive ingredients market size?

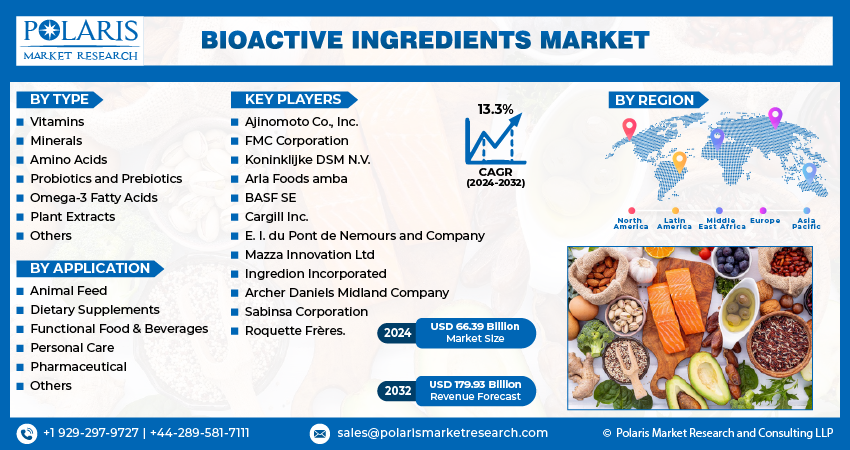

The global bioactive ingredients market size was valued at USD 65.16 billion in 2024, growing at a CAGR of 13.3% from 2025 to 2034. Key factors driving demand is growth of functional food industry, and the rise in the geriatric population.

Key Insights

- The vitamins segment is projected to grow at a CAGR of 15.6% over the forecast period, driven by rise in the demand for multivitamin supplements.

- The animal feed segment held a substantial revenue share in 2024, holding 9.64%, as these ingredients are used to improve animal health and disease resistance.

- Asia Pacific bioactive ingredient market recorded for 32.14% of revenue share in 2024, driven by large population based and improving awareness about healthy diet

- The industry in North America is expected to register a CAGR of 13.0% during the forecast period due to high demand for functional food in the region

- The demand in U.S. is rising driven by large retail infrastructure in urban and rural areas, which fuels the accessibility of the supplements.

Industry Dynamics

- Growth of functional food industry are driving the demand for bioactive ingredients.

- Rise in geriatric population is driving the bioactive ingredients market

- Advancement in the biotechnology practices and extraction method is fueling the growth.

- Limited clinical evidence and regulatory complexities for certain bioactive ingredients restrain the widespread adoption of bioactive ingredients.

Market Statistics

- 2024 Market Size: USD 65.16 Billion

- 2034 Projected Market Size: USD 227.19 Billion

- CAGR (2025-2034): 13.3%

- Asia Pacific: Largest Market Share

AI Impact on the Industry

- AI fuels discovery of new bioactive compounds and enable faster identification of ingredients.

- Machine learning models optimize bioactive formulation and reduce trial-and-error in R&D and shorten product development period.

- AI enables precision nutrition solutions by linking bioactive ingredients to individual health profiles using genetic, microbiome, and lifestyle data.

What Are Bioactive Ingredients, and Why Is Their Market Growing?

A bioactive ingredient is a compound that has an effect on living tissues and provides health benefits beyond basic nutrition. These ingredients influence biological processes, such as boosting immunity, improving digestion, or supporting mental health. Probiotics, peptides, polyphenols, and omega-3 fatty acids are common examples.

The awareness about health is rising among the general population. This rise is driven by growth in the number of chronic diseases such as obesity, diabetes, and heart disease, which are linked to poor diet. According to the World Health Organization, in 2022, 2.5 billion adults were overweight, and 890 people in 2.5 billion adults were living with obesity. This rise in cases is fueling the demand for the bioactive ingredients globally. These ingredients reduce the energy intake, increase the fat breakdown, and modulate the gene expression and inflammatory pathways related to obesity and chronic diseases. Moreover, rising educational campaigns and awareness camps hosted by the government are further fueling the growth of the industry.

Advancement in the biotechnology practices and extraction method is fueling the growth. These advancements are improving the appeal of this ingredient and making it more efficient, pure, and scalable. New technologies in the extraction method, such as ultrasound, microwave-assisted extraction, and supercritical fluid extraction, are scaling up the large-scale industrial applications. Moreover, advancements in nanotechnology are improving the delivery and protection of sensitive compounds, further fueling the adoption of new and sensitive applications and thereby driving the growth of the industry.

What are the drivers & opportunities in the bioactive ingredients market?

Growth of Functional Food Industry: The functional food industry is growing worldwide. This growth is driven by rising consumer health awareness, especially regarding lifestyle diseases and immunity. According to the New Zealand Government’s New Zealand Trade and Enterprise, the Australian functional food industry was worth USD 451 million at the start of 2022. This growth in the functional food industry is fueling the demand for bioactive ingredients. These ingredients are added into functional food to improve the health-promoting properties by improving the antioxidants, probiotics, and polyphenols content. Moreover, growing prevalence of chronic disease in adults further fuels the functional food demand, thereby fueling the bioactive ingredients demand.

Rise in Geriatric Population: The elderly population is growing worldwide. According to the Statistics Canada, in July 2024 7,820,121 people in Canada alone were 65 years and older. This rise in elderly population is due to increased life expectancy fuel by advances in health, and living conditions, and decreased birth rates. This growth in the elderly population is driving the demand for the bioactive ingredients. These ingredients are used in functional food that support healthy ageing, prevent chronic diseases, and improve cognitive and joint health. Moreover, rising prevalence of chronic disease among the elderly population further fuels the demand for the bioactive ingredients, thereby boosting the growth.

Segmental Insights

Type Analysis

Based on type, the segmentation includes vitamins, minerals, amino acids, probiotics and prebiotics, omega-3 fatty acids, plant extracts, and others. Vitamins segment is projected to grow at a CAGR of 15.6% over the forecast period due to rise in the demand for vitamin supplements. This growth in demand is driven by rising global cases of vitamin deficiency particularly among children and pregnant women. According to the World Health Organization, approx. half of the death in the children below 5 years are due to undernutrition. This rising cases of vitamins deficiency and undernutrition is fueling the demand for vitamin bioactive ingredients. This ingredient supports the immune system to fight infections, and ensure proper cognitive and physical development, thereby fueling the segment growth.

Minerals segment is expected to witness a significant share over the forecast period due to the rising prevalence of osteoporosis, anemia, and metabolic disorders. This Disease such as osteoporosis are emerged due to lack of calcium and other minerals in the diet which leads to bones lose density, and body to take minerals from bones to maintain other functions. This is fueling the demand for the mineral bioactive ingredients such as calcium, magnesium and other minerals. Mineral supplements provide essential building blocks and metabolic support for strong bones in case of osteoporosis and essential components the body needs to produce red blood cells and hemoglobin in case of anemia. Therefore, positively impacting the segment growth.

Application Analysis

In terms of application, the segmentation includes animal feed, dietary supplements, functional food & beverages, personal care, pharmaceutical, and others. The dietary supplements held 41.34% of revenue share in 2024 due to rising prevalence of lifestyle disease, rising focus on preventive healthcare, and rising demand for personalized healthcare solution. The prevalence of lifestyle disease is rising due unhealthy diets such as processed foods and sugary drinks, and a lack of physical activity from sedentary jobs and lifestyle. This has increased the demand for the dietary supplements worldwide. Bioactive ingredients are utilized in dietary supplements to improve basic nutrition by improving anti-inflammatory, antioxidant, and immunomodulatory effects, thereby fueling the segment growth.

The animal feed segment held significant revenue share in 2024, holding 9.64% as these ingredients are used to improve animal health and disease resistance. These ingredients modulate immune system, reduce oxidative stress, and exhibit direct antimicrobial and anti-inflammatory properties. Moreover, rising demand for high quality meat, milk and eggs are prompting the livestock farmer to spend on high quality animal feedstock which contains bioactive ingredients, thereby driving the segment growth.

Regional Analysis

Asia Pacific bioactive ingredient market accounted for 32.14% of global revenue share in 2024 due to large population based and improving awareness about healthy diet. The country has largest population of children below 5 years, due to which the demand for mineral and vitamins supplements is rising to address issues such as undernutrition and vitamin and mineral deficiency. Moreover, educational campaigns and government awareness campaigns about chronic diseases such as obesity, diabetes, and heart disease linked to poor diets is further fueling the growth of the industry in the region.

China Bioactive Ingredients Market Insight

The China held 31.62% of the revenue share within Asia Pacific in 2024, driven by high awareness about chronic conditions caused by poor diet. The country has one of the strongest retail infrastructures globally, which improves the accessibility of the dietary supplements and animal feed in rural and urban areas. Moreover, high prevalence of chronic conditions such as obesity, anemia further fuels the demand of bioactive ingredients for supplements used in day-to-day lifestyle. Demand for high quality meat and eggs in the country further fuels the adoption of the bioactive ingredients in the agriculture sector, thereby driving the growth in the country.

North America Bioactive Ingredients Market

The market in North America is expected to register a CAGR of 13.0% during the forecast period due to high demand for functional food in the region. Consumers in North America are adopting functional foods such as beverages, and supplements that promote specific health benefits such as gut health, immunity, energy, and cognitive support. Supportive regulatory environment in the region eases up entry of new players and new product launch which fuels the expansion of industry. Moreover, the rise in veganism and clean-label movement is driving the preference for natural and plant-derived bioactive with transparent sourcing and proven benefits.

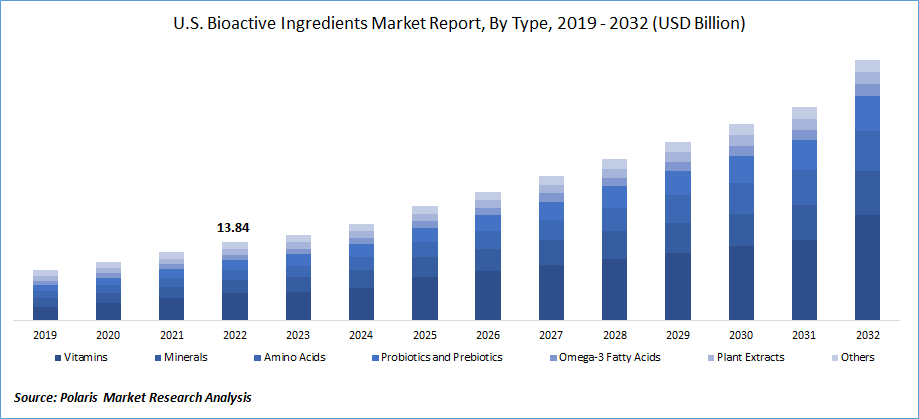

U.S. Bioactive Ingredients Market Overview

The demand in U.S. is rising driven by large retail infrastructure in urban and rural areas, which fuels the accessibility of the supplements. The high consumer awareness regarding healthy diet preventive healthcare is driving the demand for the bioactive ingredients. Additionally, the U.S. has large consumer base for supplements which fuels the demand for the bioactive such as omega-3s, probiotics, collagen, and adaptogens. Moreover, the demand for ingestible skincare with peptides, hyaluronic acid, and natural antioxidants is expanding the role of bioactives in the beauty industry, thereby boosting the growth in the country.

Europe Bioactive Ingredients Market

The industry in the Europe is projected to grow at a CAGR of 12.9% from 2025 to 2034, driven by high awareness of health and wellness. Consumers across Europe are increasingly choosing foods and supplements that help with immunity, digestion, aging, and energy. Large elderly population with age more than 65 year is fueling the demand for elderly nutritional supplements, further fueling the demand for the bioactive ingredients. Moreover, companies are focusing on ingredients such as probiotics, fibers, polyphenols, and omega-3s to meet the needs of health-conscious consumers in the region, thereby fueling the growth in the region.

Key Players & Competitive Analysis

The bioactive ingredient market is competitive as more consumers look for health-focused food, supplements, and personal care products. BASF SE, DSM, Cargill, and DuPont maintain a strong presence due to their wide product ranges, advanced R&D, and global reach. Ajinomoto, Ingredion, and ADM focus on innovations in plant-based actives, fibers, and amino acids. Sabinsa and Mazza specialize in botanical ingredients and Arla Foods develops dairy-based bioactives. Roquette works with plant-sourced compounds and FMC is known for marine- and fermentation-derived ingredients.

Key Players

- Ajinomoto Co., Inc.

- Archer Daniels Midland Company

- Arla Foods amba

- BASF SE

- Cargill Inc.

- E. I. du Pont de Nemours and Company

- FMC Corporation

- Ingredion Incorporated

- Koninklijke DSM N.V.

- Mazza Innovation Ltd

- Roquette Frères

- Sabinsa Corporation

Industry Developments

August 2025, Doré launched two innovative skincare products in partnership with Evolved By Nature, featuring bioactive peptides. The Peptides Essence and Firming Serum debuted on Ulta.com and in select Ulta stores, offering clinically proven, gentle, and effective skincare powered by biotechnology.

March 2025, Nutrition21 launched EverZen, a plant-based bioactive ingredient standardized to 6-MBOA, to support mood and stress relief. Clinically backed, EverZen promoted neurochemical balance and cortisol stabilization, offering supplement brands a novel alternative to traditional stress-relief ingredients like ashwagandha.

Bioactive Ingredients Market Segmentation

By Type Outlook (Revenue, USD Billion, 2021–2034)

- Vitamins

- Minerals

- Amino Acids

- Probiotics and Prebiotics

- Omega-3 Fatty Acids

- Plant Extracts

- Others

By Application Outlook (Revenue, USD Billion, 2021–2034)

- Animal Feed

- Dietary Supplements

- Functional Food & Beverages

- Personal Care

- Pharmaceutical

- Others

By Regional Outlook (Revenue, USD Billion, 2021–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Bioactive Ingredients Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 65.16 Billion |

|

Market Size in 2025 |

USD 73.64 Billion |

|

Revenue Forecast by 2034 |

USD 227.19 Billion |

|

CAGR |

13.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 65.16 billion in 2024 and is projected to grow to USD 227.19 billion by 2034.

The global market is projected to register a CAGR of 13.3% during the forecast period.

North America dominated the market in 2024

A few of the key players in the market are Ajinomoto Co., Inc.; Archer Daniels Midland Company; Arla Foods amba; BASF SE; Cargill Inc.; E. I. du Pont de Nemours and Company; FMC Corporation; Ingredion Incorporated; Koninklijke DSM N.V.; Mazza Innovation Ltd; Roquette Frères; Sabinsa Corporation.

The vitamins segment dominated the market revenue share in 2024.

The animal feed segment is projected to witness the fastest growth during the forecast period.