Biobased Polycarbonate Market Share, Size, Trends, Industry Analysis Report

By Grade (General Purpose Grade, Optical Grade); By End-Use Industry; By Region; Segment Forecast, 2023- 2032

- Published Date:Nov-2023

- Pages: 118

- Format: PDF

- Report ID: PM3925

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

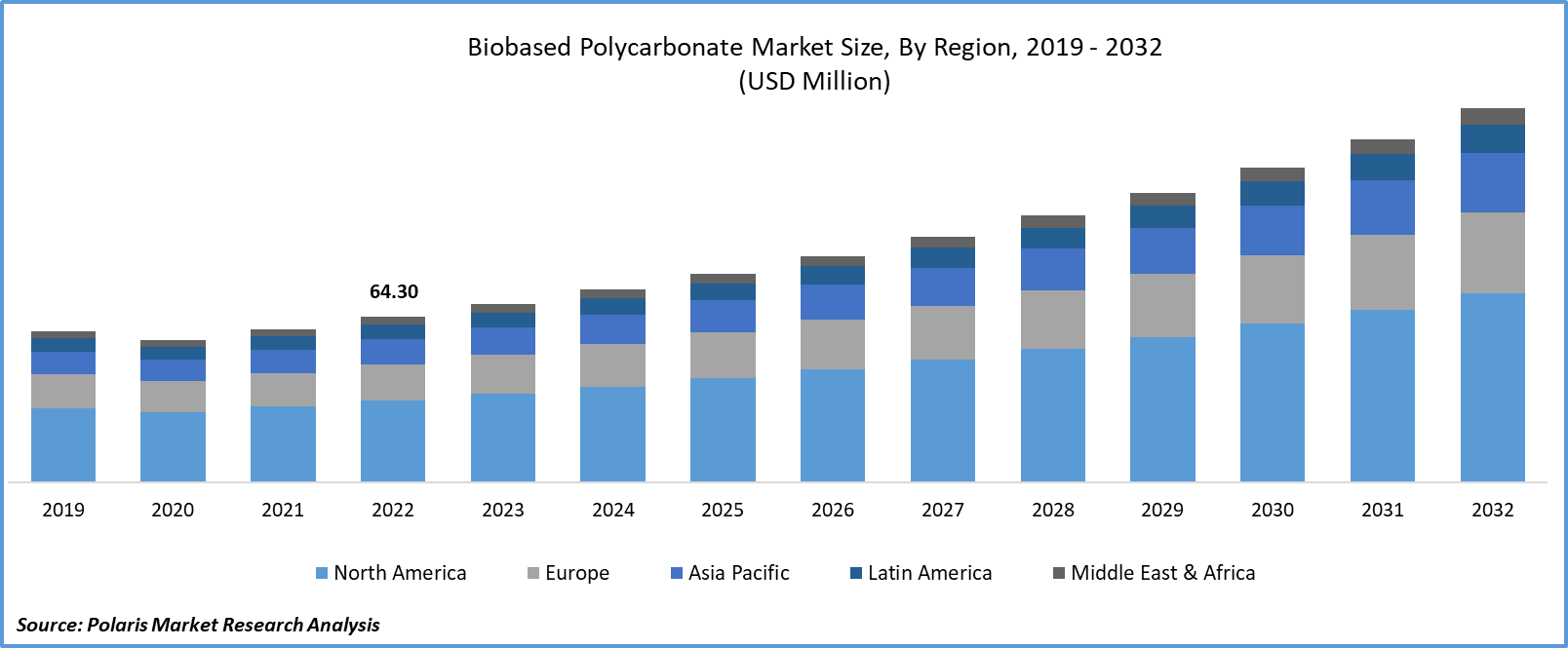

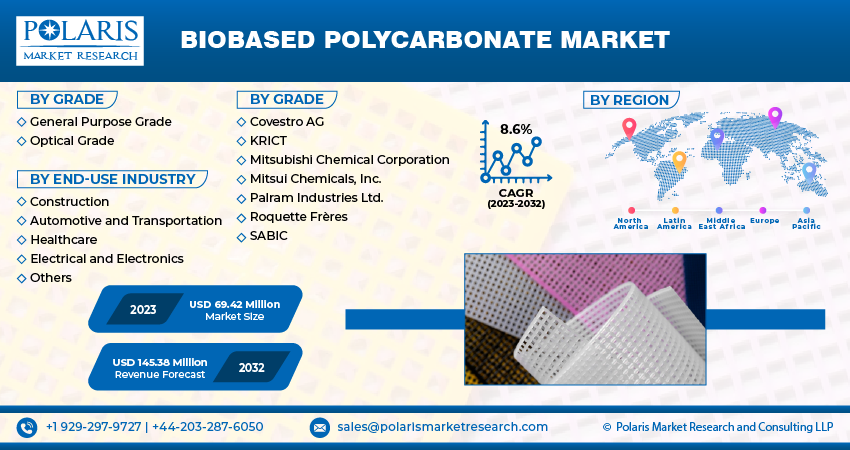

The global biobased polycarbonate market was valued at USD 64.30 million in 2022 and is expected to grow at a CAGR of 8.6% during the forecast period.

Bio-based polycarbonate, sourced from renewable feedstocks like plant-derived materials, has emerged as an eco-conscious choice. This sustainability factor aligns with the growing global emphasis on environmental responsibility and reducing carbon footprints. Bio-based polycarbonate diminishes the reliance on finite fossil fuel resources, rendering it an appealing option for industries seeking to diversify their material sources and reduce vulnerability to fluctuating oil prices.

To Understand More About this Research: Request a Free Sample Report

With the surge in electric vehicles, bio-based polycarbonate is being employed in the production of battery housings, charging ports, and other EV parts. Its lightweight properties are particularly advantageous for EVs, which aim to optimize energy efficiency.

Collaborations and partnerships between organizations and companies foster the development and acceptance of bio-based materials. These cooperative ventures contribute to research advancements, product innovation, and broader market penetration.

- For instance, in August 2022, Mitsui Chemicals, Inc., along with Teijin Limited together, announced the development of biomass-derived polycarbonate (PC) resins, which are aimed at driving support to achieve carbon neutrality.

Government policies and regulations that incentivize the use of sustainable and renewable materials play a substantial role in promoting bio-based polycarbonate. These regulatory frameworks offer financial incentives, subsidies, and even mandates, encouraging the development and utilization of eco-friendly materials.

For Specific Research Requirements: Request for Customized Report

The COVID-19 pandemic disrupted the bio-based polycarbonate industry through supply chain disruptions, reduced demand, production halts, financial constraints, research delays, economic uncertainties, and a shift in priorities. However, the industry is expected to recover as economies stabilize and sustainability goals regain prominence in a post-pandemic world. Adaptation, resilience, and government support play pivotal roles in the industry's recovery and growth. Government initiatives and stimulus packages aimed at economic recovery may provide opportunities for the bio-based polycarbonate industry. Support for sustainable and green technologies could further benefit the sector.

Growth Drivers

- Increased environmental concerns and growing consumer awareness is projected to spur the market demand

The rising awareness of environmental concerns and a commitment to reduce carbon footprints are pivotal drivers behind the uptake of bio-based polycarbonate. Derived from renewable sources like plant-based materials, it presents an eco-conscious alternative to traditional polycarbonate sourced from non-renewable fossil fuels.

Growing consumer consciousness about sustainability and a preference for products with environmentally friendly attributes have spurred the demand for bio-based polycarbonate. Manufacturers are responding to this consumer sentiment by incorporating bio-based materials into their product lines.

Report Segmentation

The market is primarily segmented based on grade, end use industry, and region.

|

By Grade |

By End-Use Industry |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Grade Analysis

- Optical grade biobased polycarbonate emerged as the largest segment in 2022

The optical grade biobased polycarbonate segment held the major share in the biobased polycarbonate market and will constantly grow throughout the forecast period. Optical grade bio-based polycarbonate merges the advantages of optical precision with the sustainability and eco-friendliness of bio-based materials. Optical grade bio-based polycarbonate offers exceptional transparency and optical lucidity, ensuring minimal distortion while facilitating the unhampered transmission of light. It is the preferred choice for scenarios where visual excellence is essential. Optical grade bio-based polycarbonate finds application in crafting optical lenses for cameras, eyewear, or scientific instruments. Its ability to seamlessly combine optical clarity with impact resistance renders it an exemplary choice for such purposes.

General-purpose grade bio-based polycarbonate represents a versatile and adaptable variant of polycarbonate derived from sustainable and renewable sources. It is increasingly being used in consumer goods, packaging solutions, automotive components, construction materials, and medical devices, among others. General-purpose grade bio-based polycarbonate is harnessed for crafting sustainable packaging materials, encompassing bottles, containers, and films. Its utility extends to the creation of diverse consumer goods, including household items, toys, and casings for electronic devices.

By End-Use Industry Analysis

- Automotive and transportation segment held the significant market revenue share in 2022

The automotive and transportation segment held a significant market share in revenue share in 2022. Bio-based polycarbonate is finding increasing utility within the automotive and transportation sector due to its ecological credentials, lightweight characteristics, and robustness. Manufacturers are incorporating bio-based polycarbonate into the creation of interior elements like dashboards, door panels, and trim. This material's lightweight nature contributes to enhanced fuel efficiency and reduced greenhouse gas emissions. Instrument panels and central consoles often benefit from the integration of bio-based polycarbonate due to its exceptional impact resistance and capacity to withstand temperature fluctuations. Numerous automotive manufacturers are embracing bio-based polycarbonate as part of their sustainability endeavors. This material aligns with their mission to curtail the ecological footprint of vehicle manufacturing.

The application of biobased polycarbonate is expected to increase in the electrical and electronics sectors during the forecast period. Transparent bio-based polycarbonate films serve as screen protectors for electronic gadgets. These films offer superior optical clarity, resistance to scratches, and guard against smudges and fingerprint marks. The durability and weather-resistant qualities of bio-based polycarbonate render it suitable for environmental sensors and sensor housings, even in outdoor environments with harsh conditions.

Regional Insights

- Asia-Pacific region dominated the global market in 2022

The Asia-Pacific bio-based polycarbonate market is flourishing, driven by a confluence of factors that include heightened environmental awareness, government backing, diverse industrial applications, substantial research investment, eco-conscious consumer preferences, collaborative initiatives, global market integration, and technological breakthroughs. Bio-based polycarbonate boasts versatile applications across a spectrum of industries, encompassing automotive, electronics, packaging, and construction. The region's burgeoning industrial sectors are driving the need for sustainable alternatives like bio-based polycarbonate. Governments in various Asia-Pacific countries have rolled out supportive policies and regulations aimed at reducing reliance on traditional plastics and promoting the adoption of sustainable materials. This regulatory backing creates a conducive environment for the bio-based polycarbonate industry's development.

The North America region is anticipated to experience significant growth during the projected period. The adoption of bio-based polycarbonate in the region is in sync with the growing focus on sustainability and environmental awareness. Its versatility, endurance, and eco-friendly characteristics position it as a preferred material in a myriad of applications. Bio-based polycarbonate finds its way into various electronic devices and household appliances, including laptops, smartphones, and white goods. Its durability and resistance to heat and chemicals make it an apt choice for these applications. The medical industry leverages bio-based polycarbonate for crafting a wide range of medical devices and equipment. Its biocompatibility and chemical resistance ensure the safety of medical applications.

Key Market Players & Competitive Insights

The biobased polycarbonate market exhibits fragmentation and is poised to experience competitive dynamics owing to the presence of numerous players. Key market participants continually introduce novel products to fortify their market standing. These industry leaders concentrate on forging partnerships, enhancing product offerings, and fostering collaborations to gain a competitive advantage over their counterparts and secure a substantial market foothold.

Some of the major players operating in the global market include:

- Covestro AG

- KRICT

- Mitsubishi Chemical Corporation

- Mitsui Chemicals, Inc.

- Palram Industries Ltd.

- Roquette Frères

- SABIC

Recent Developments

- In June 2020, Covestro launched its new polycarbonate film, Makrofol EC. It is a partially bio-based film that reduces CO2 footprint considerably. The film offers enhanced weather and chemical resistance, along with increased abrasion resistance.

- In January 2022, SABIC launched its first bio-based polycarbonate (PC) copolymer, LNP ELCRIN EXL7414B. The product is aimed at enabling the consumer electronics industry to reduce carbon emissions.

Biobased Polycarbonate Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 69.42 million |

|

Revenue forecast in 2032 |

USD 145.38 million |

|

CAGR |

8.6% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019-2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Grade, By End-Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |