Bioethanol Market Share, Size, Trends, Industry Analysis Report

By Feedstock (Cereals & Starch, Wheat, Maize, Beet, Sugarcane, Others); By Industry; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 114

- Format: PDF

- Report ID: PM2484

- Base Year: 2024

- Historical Data: 2020-2023

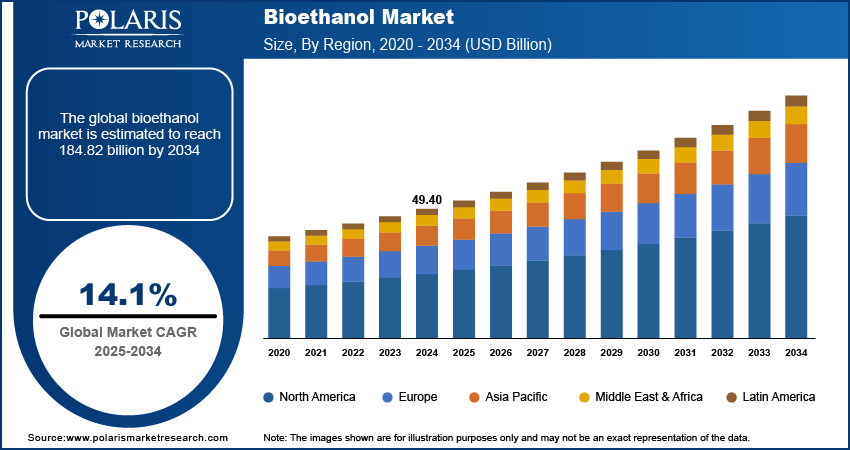

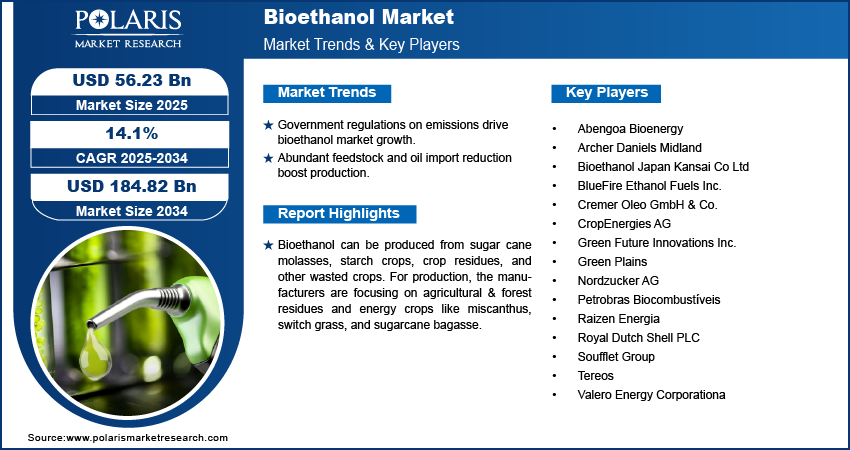

The global bioethanol market was valued at USD 49.40 billion in 2024 and is expected to grow at a CAGR of 14.1% during the forecast period. The bioethanol market dynamics help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Key Insights

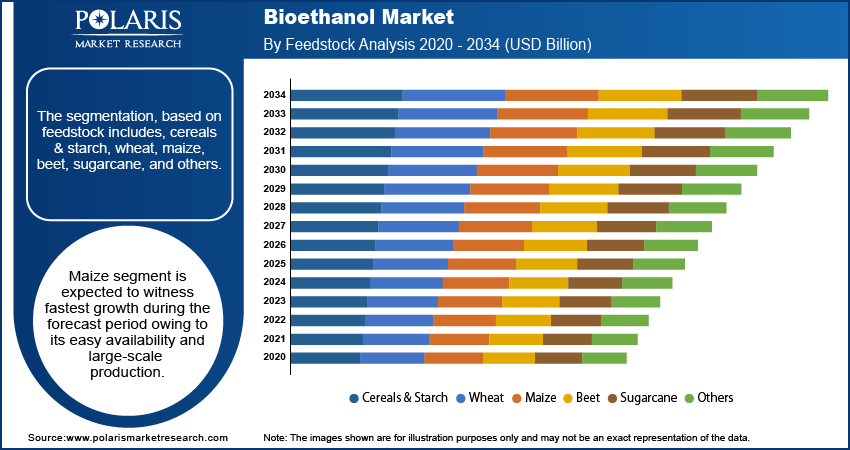

- The maize segment is expected to witness rapid growth during the forecast period. This is due to its easy availability and large-scale production.

- The transportation segment dominated the market share in 2024. This is due to the utilization of bio-ethanol as a fuel and fuel additive in the automotive and transportation industries.

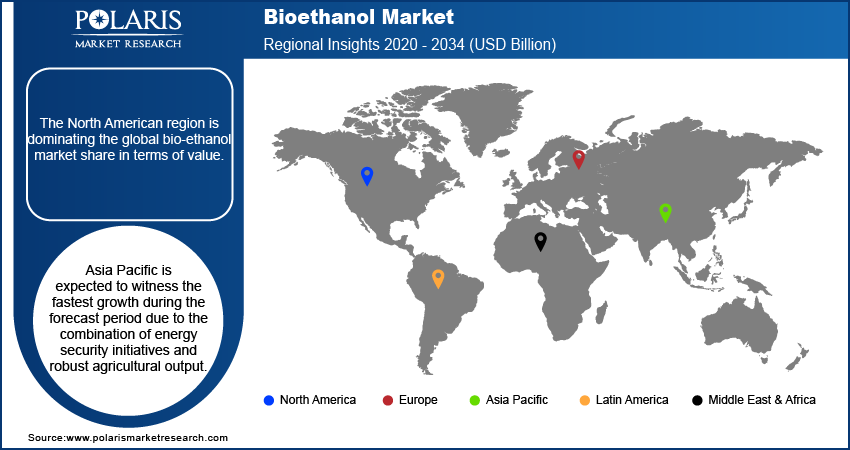

- North America dominated the market in 2024 due to the increasing approvals and government backing for developing eco-friendly and sustainable fuels.

- Asia Pacific is expected to witness rapid growth during the forecast period. This is due to government-led energy security policies and strong agricultural production capabilities.

Industry Dynamics

- Strict government mandates and regulations for reducing emissions are driving the expansion opportunities.

- The feedstock availability and the need to reduce dependence on crude oil imports are accelerating the production of bioethanol and reducing energy dependence.

- The reliance on food-grade feedstock such as corn and sugarcane has created price unpredictability and concerns over resource allocation.

- Advances in cellulosic ethanol technology allows the use of unlocking sustainable production, non-food agricultural waste, and expansion into new feedstock sources.

Market Statistics

- 2024 Market Size: USD 49.40 billion

- 2034 Projected Market Size: USD 184.82 billion

- CAGR (2025-2034): 14.1%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Bioethanol can be produced from sugar cane molasses, starch crops, crop residues, and other wasted crops. For production, the manufacturers are focusing on agricultural & forest residues and energy crops like miscanthus, switch grass, and sugarcane bagasse. It can be used as a fuel in isolation and in mixtures with other fossil fuels. Bioethanol is a biodegradable, renewable energy resource produced from biomass through sugar fermentation and chemical process. Bioethanol is an attractive substitute for conventional fuel sources due to its high octane value and lower greenhouse gas emissions.

Production involves different manufacturing steps, such as fermentation, distillation technologies, dehydration, etc. Bioethanol has various properties, such as homogeneity, physical stability, low viscosity, weak lubricity, anti-corrosiveness, and better antiknock characteristics. The versatility of bioethanol is used as feedstock in the chemical market, fuel for power generation, a substitute for petrol in road transport vehicles, etc.

Additionally, Sustainable Development Goals (SDG) is one of the primary goals of the United Nations, which slows down climate change and reduce global warming. Biofuels play an essential role in this. Also, depleting energy resources and increasing focus on renewable energy sources are expected to boost the market growth. Technological advances and increased R&D to produce ethanol from algae are expected to increase market demand due to its rapid production rate and natural occurrence in the sea, lowering production costs. Furthermore, consumption will rise due to low prices compared to diesel and petrol.

The COVID-19 pandemic has disrupted the daily lives of the world's population and altered the ethanol market requirements for manufacturing use in many countries. Fuel ethanol standards remain a viable alternative for future development despite these short-term consequences, and regional councils are operating hard to develop market access in specific countries. As the coronavirus pandemic reduces gasoline consumption and pushes corn-based fuel off the market, several ethanol plants in the United States have lowered or decreased production. Fuel requirements have been reduced as governments encourage people to stay at home to combat the COVID-19 pandemic.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The primary driver for the global bioethanol market is government regulatory bodies encouraging production. Growing demand for blending in gasoline and increased government initiatives to produce and use greener fuels such as bio-ethanol are driving the market growth. Implementing stringent regulations has encouraged companies to focus on building better, cleaner, and less expensive energy. Technological advancements in the market have resulted in the development of second and third-generation bioethanol, which is expected to remain a viable prospect in the global market.

The factors driving the global bioethanol market are rising environmental concerns, which encourage manufacturers to produce bioethanol, blending mandates from regulatory bodies such as the EPA (Environmental Protection Agency), and abundant raw material availability.

Countries are focusing on energy security as demand for energy has increased significantly due to economic expansion, population growth, increased consumer income, and the discovery of new energy use. Many countries continue to import massive amounts of crude oil and could use it as a substitute for crude oil, thus, reducing their dependence. As a result, the increased focus on improving energy security is expected to provide lucrative opportunities for the global bioethanol oil market.

Report Segmentation

The market is primarily segmented based on feedstock, end-use, and region.

|

By Feedstock |

By End-Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

Feedstock Analysis

The segmentation, based on feedstock includes, cereals & starch, wheat, maize, beet, sugarcane, and others. Maize segment is expected to witness fastest growth during the forecast period owing to its easy availability and large-scale production. Most of the bioethanol generated in the United States is derived from starch-based crops and processed in a dry or wet mill. A dry milling process is created when maize is crushed into flour, fermented to make ethanol, and coupled with co-products such as distillers’ grains and carbon dioxide. Wet mills have maize sweeteners and ethanol, and a variety of by-products. Maize is separated into starch, protein, and fiber, then processed into products. Usage of maize mills is expected to grow globally, which will boost the bioethanol market's growth.

End Use Analysis

Based on end use, the segmentation, includes food & beverages, power generation, transportation, industrial, medical, and others. The transportation segment accounted for the largest market share in 2024.

The automotive and transportation industries utilize bio-ethanol as a fuel and fuel additive. It is used in conjunction with conventional petrol to fuel petrol engines in automotive. Bioethanol is less expensive and more environmentally friendly than petroleum. A small amount of bioethanol is mixed with pure gasoline to create blends, which burn more efficiently and emit no carbon dioxide. As a result, bioethanol fuel blends are required in many countries worldwide. This rising use of bioethanol in the transportation end-use market is thus driving its market towards growth.

Regional Analysis

North America Bioethanol Market Assessment

The North American region is dominating the global bio-ethanol market share in terms of value. North America is one of the largest consumers of fuel in the world and uses different ethanol fuel blends. The United States is the largest producer and consumer of bioethanol worldwide, followed by Brazil, China, India, and Canada.

North America accounts for a significant share owing to increasing approvals and government backing for developing eco-friendly and sustainable fuels. Countries in this region have mandated using higher blends in vehicles. Bio-ethanol production has increased due to higher renewable fuel standard targets and growth in domestic motor gasoline consumption, which is now blended with 10% ethanol by volume. The enormous quantity of maize growing in North America has created an enticing and fertile economic environment for the region's bioethanol market.

Asia Pacific Bioethanol Market Insight

Asia Pacific is expected to witness the fastest growth during the forecast period due to the combination of energy security initiatives and robust agricultural output. The government in this region is establishing biofuel blending policies and initiatives with an aim to reduce dependence on imported fossil fuels to enhance energy independence and build strategic fuel reserves. This push creates a stable environment demand, with boosted investments in production capacity. Moreover, this region has an advantage due to the vast agricultural base, which provides cost-effective feedstock from sugarcane in tropical climates.

Key Players & Competitive Analysis Report

The competitive environment is characterized by focused investments in advanced feedstock processing to enhance yields and lessen reliance on food-grade products such as maize and sugarcane. Major vendor strategies focus on expansion opportunities in developing markets, across the Asia Pacific and Latin America where local government policies actually promote expansion to areas that have high agricultural residue to sell into value chains with large unfulfilled demand and opportunities. Insights and perspectives from industry leading firms suggest that technological advancement in both cellulosic and waste to energy conversion is a primary consideration for future supply chain alignment to competitive positioning and finding opportunities for joint ventures with energy majors and agribusiness firms. However, small to medium firms are having difficulty scaling due in part to high costs of capital and the disruption to supply chains because of feedstock price volatility.

Some of the key market players in the bioethanol market are Abengoa Bioenergy, Archer Daniels Midland, Bioethanol Japan Kansai Co Ltd, BlueFire Ethanol Fuels Inc., Cremer Oleo GmbH & Co., CropEnergies AG, Green Future Innovations Inc., Green Plains, Nordzucker AG, Petrobras Biocombustíveis, Raizen Energia, Royal Dutch Shell PLC, Soufflet Group, Tereos, and Valero Energy Corporation. These players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their presence in the market. The companies are also introducing new innovative products to cater to the growing consumer demands.

Industry Developments

February 2025: Nippon Paper Industries Co., Ltd., Sumitomo Corporation, and Green Earth Institute Co., Ltd. collaborated to establish a joint venture company, Morisora Bio Refinery LLC, to focus on the production and sale of bioethanol and biochemicals derived from woody biomass.

October 2021: the Coca-Cola Company announced its first-ever beverage bottle made entirely of plant-based plastic. Coca-Cola's technology, which it co-owns with Changchun Meihe Science & Technology, speeds up the bMEG production process while allowing a larger spectrum of renewable materials. bMEG is made by converting sugarcane or corn into bioethanol, then converted to bio ethylene glycol.

January 2021: Argentina's energy division and corn bioethanol producers collaborated to manufacture biofuels and improve oil firms' prices. This agreement aims to reverse the industry's semi-stagnation.

Bioethanol Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 49.40 billion |

| Market size value in 2025 | USD 56.23 billion |

|

Revenue forecast in 2034 |

USD 184.82 billion |

|

CAGR |

14.1% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Feedstock, By End Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Abengoa Bioenergy, Archer Daniels Midland, Bioethanol Japan Kansai Co Ltd, BlueFire Ethanol Fuels Inc., Cremer Oleo GmbH & Co., CropEnergies AG, Green Future Innovations Inc., Green Plains, Nordzucker AG, Petrobras Biocombustíveis, Raizen Energia, Royal Dutch Shell PLC, Soufflet Group, Tereos, and Valero Energy Corporation |

Want to check out the bioethanol market report before buying it? Then, our sample report has got you covered. It includes key market data points, ranging from trend analyses to industry estimates and forecasts. See for yourself by downloading the sample report.

FAQ's

• The global market size was valued at USD 49.40 billion in 2024 and is projected to grow to USD 184.82 billion by 2034.

• The global market is projected to register a CAGR of 14.1% during the forecast period.

• North America dominated the global market share in 2024.

• A few market players are Abengoa Bioenergy, Archer Daniels Midland, Bioethanol Japan Kansai Co Ltd, BlueFire Ethanol Fuels Inc., Cremer Oleo GmbH & Co., CropEnergies AG, Green Future Innovations Inc., Green Plains, Nordzucker AG, Petrobras Biocombustíveis, Raizen Energia, Royal Dutch Shell PLC, Soufflet Group, Tereos, and Valero Energy Corporation.

• The transportation segment dominated the market share in 2024.

• The maize segment is expected to witness rapid growth during the forecast period.