Biorational Pesticides Market Share, Size, Trends, Industry Analysis Report

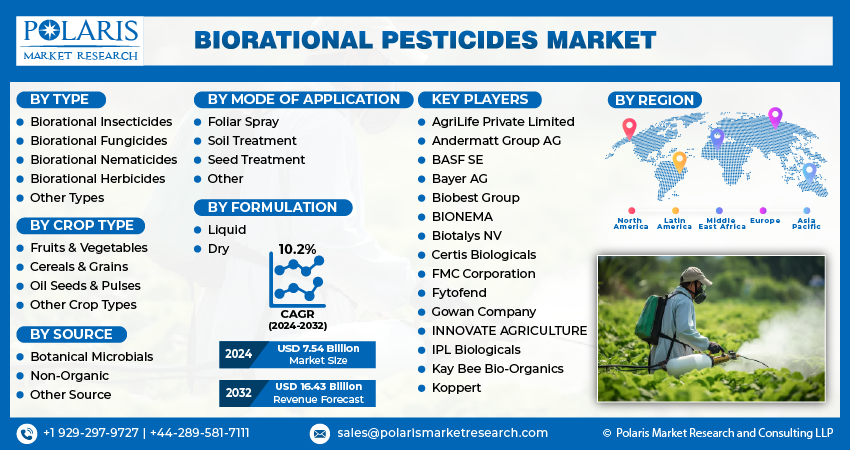

By Type (Biorational Insecticides, Biorational Fungicides, Biorational Nematicides, Biorational Herbicides, Other Types); By Crop Type; By Source; By Mode of Application; By Formulation; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 119

- Format: PDF

- Report ID: PM4442

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

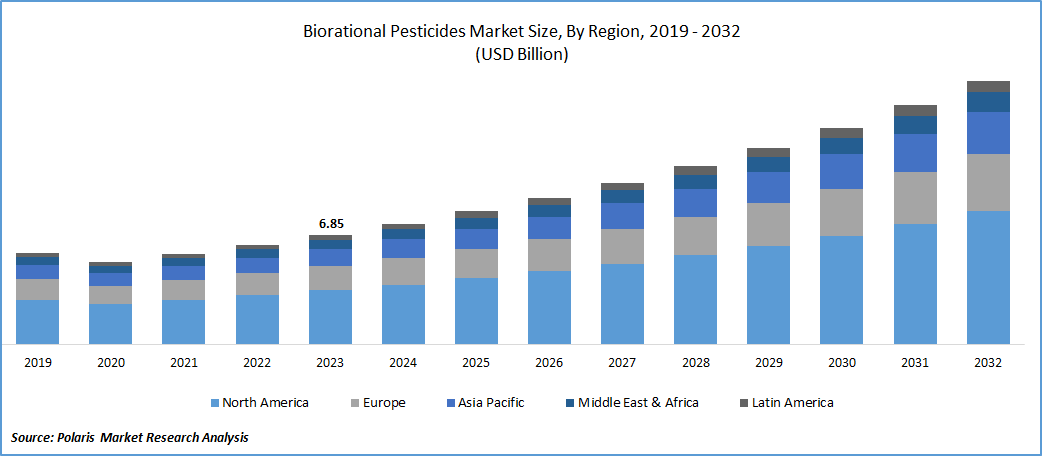

The global biorational pesticides market was valued at USD 6.85 billion in 2023 and is expected to grow at a CAGR of 10.2% during the forecast period.

The importance of sustainable food production is growing as more people show interest in organic and natural food over food produced by using traditional chemical pesticides. Biorational pesticides are comparatively non-toxic to nature with limited side effects, which is a driving force among people with an environmental safety mindset to use these pesticides in place of conventional ones.

The continuous rise in awareness programs by government and non-government organizations is enhancing the use of biopesticides in cultivation. In November 2023, Krishi Vigyan Kendra, Malyal, as a part of the Janjatiya Gaurav Diwas program, in Eshwaragudem, Kothaguda Mandal, Telangana, conducted an awareness program on natural farming. Additionally, the increasing evolution of new biorational pesticides in the global space is expected to stimulate demand for these products in the coming years.

To Understand More About this Research:Request a Free Sample Report

- For instance, in June 2023, Andermatt, a biopesticide solutions provider, unveiled a solution to control diamondback moths, Plutex. It has the potential to deal with these pests, along with the ability to promote resistance prevention.

Moreover, the frequent utilization of chemical pesticides is known to reduce microbe activity in the soil, which can lead to lower crop productivity and nutritional quality in the soil.

However, the lower awareness and accessibility of biorational pesticides among farmers are hindering the growth of the market. The higher familiarity with chemical pesticides and lower productivity are also expected to hamper the demand for biorational pesticides in the market

Growth Drivers

Rising demand for organic food by consumers

The rising literacy levels in the world are witnessing a demand for healthy food as people become more aware of the side effects associated with the chemical pesticides and fertilizers used. In addition, the increased accessibility of the internet is solving the asymmetry of information in the market, enabling demand for natural food products by health-conscious consumers. According to the report published by the International Federation of Organic Agriculture Movements (IFOAM) Germany & FiBL Switzerland in 2022, the global organic market is growing at an 8.7% CAGR in 2015–2020.

The population is willing to pay premium prices for natural and organic products; this support is driving farmers to produce organic products with the use of biopesticides. Research activities by agricultural scientists are revealing the potential limitations of pesticides. A 2022 study published in PubMed Central focused on reviewing the current status of side effects due to the incorporation of chemical pesticides into human health and the environment.

Report Segmentation

The market is primarily segmented based on type, crop type, source, mode of application, formulation and region.

|

By Type |

By Crop Type |

By Source |

By Mode of Application |

By Formulation |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Type Analysis

Biorational Insecticides segment is expected to witness the highest growth during the forecast period

The biorational insecticides segment will grow rapidly, mainly driven by its effectiveness to control pests without affecting other organisms. They are usually made up of natural components, including animals, plants, microbes, and minerals. The ongoing research activities focusing on reviewing the benefits and shortcomings related to biorational insecticide application are expected to have a positive effect on the growth of the market.

The biorational fungicides segment led the industry market with a substantial revenue share in 2022, largely attributable to its ability to offer plant growth. Fungicides can affect the plant, which is known as phytotoxicity. This is likely to stimulate the adoption of biorational pesticides among farmers.

By Crop Type Analysis

Cereals and Grains segment accounted for the largest market share in 2023

The cereals and grains segment accounted for the largest share and is likely to retain its biorational pesticides market position throughout the forecast period. Biorational pesticides are gaining momentum. The production of cereals and grains, such as corn, rice, barley, millet, rye, and buckwheat, is attributable to the establishment of organic e-commerce stores. The evolution of online retailers pertaining to natural food, including Conscious Food, Orgpick, and Qtrove, is motivating farmers to start their production with biorational pesticides.

The fruits and vegetables segment is expected to grow at the fastest rate over the next few years on account of the rapid increase in demand for residue-free products among consumers.

By Source Analysis

Botanical Microbials segment held the significant market revenue share in 2023

The botanical microbials segment held the largest share, due to the continuous rise in perception of lower limitations with the biorational pesticides composed of microbials. These microbes leave less residue on crops, making them the top choice among farmers in numerous applications, including crop control, integrated pest management, greenhouse management, and nursery management.

By Mode of Application Analysis

Foliar segment held the significant growth share in 2023

The foliar segment held a significant growth share in 2023, which is highly accelerated due to the numerous benefits of this in pest control applications. This method enables plants to absorb biorational pesticides quickly through the leaves. This embarks as an effective tool to protect foliage-related plant diseases.

By Formulation Analysis

Liquid segment held the significant revenue share in 2023

The liquid segment held a significant revenue share which is highly accelerated due to compatibility in foliar spraying activity on plants. Liquid biorational pesticide formulations are likely to show a faster response in integrated pest management, which will assist farmers in not losing more due to plant diseases.

Regional Insights

North America region registered the largest share of the global market in 2023

The North American region held the global market with the largest market share and is expected to continue its dominance over the study period. The increasing application of sustainable agriculture fertilizers and pesticides in farming and stringent regulations to protect consumers' health along with the soil are playing vital roles in the North American biorational pesticide market. For any pesticides to be used in the United States, the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) needs to be evaluated by the United States Environmental Protection Agency to assure lower potential environmental effects on humans and the environment.

The Asia Pacific region is expected to be the fastest growing region with a healthy CAGR during the projected period. The growth of the segment market can be largely attributed to the increasing government initiatives to promote sustainable agriculture practices in the region. For instance, the Asia Pesticide Residue Mitigation project aims to promote biopesticides and improve trade opportunities with the project period of 2020-2023. Furthermore, a 2023 study focused on finding the impact of Biopesticide Usage and challenges for Locust Management in China. This is expected to drive the growth of the market in the region.

Key Market Players & Competitive Insights

The biorational pesticide market is fairly fragmented and is expected to witness competition due to several players' presence. The ongoing partnerships, collaborations, mergers, and acquisitions activities are fueling the expansion of the biorational pesticide market. For instance, in January 2023, Sumitomo Chemical acquired FBSciences Holdings through its subsidiary, Valent Biosciences LLC.

Some of the major players operating in the global market include:

- AgriLife Private Limited

- Andermatt Group AG

- BASF SE

- Bayer AG

- Biobest Group

- BIONEMA

- Biotalys NV

- Certis Biologicals

- FMC Corporation

- Fytofend

- Gowan Company

- INNOVATE AGRICULTURE

- IPL Biologicals

- Kay Bee Bio-Organics

- Koppert

Recent Developments

- In October 2023, Bionema, a manufacturer of biostimulants, unveiled a biofertilizer, RootVita. This enhances the resistance of plants to abiotic stress factors such as heat, drought, and salt.

Biorational Pesticides Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.54 billion |

|

Revenue forecast in 2032 |

USD 16.43 billion |

|

CAGR |

10.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Crop Type, By Source, By Mode of Application, By Formulation, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Biorational Pesticides Market Size Worth $ 16.43 Billion By 2032.

The top market players in Biorational Pesticides Market include AgriLife Private Limited, Andermatt Group AG, BASF SE, Bayer AG, Biobest Group.

North America is contribute notably towards the Biorational Pesticides Market.

The global biorational pesticides market is expected to grow at a CAGR of 10.2% during the forecast period.

Biorational Pesticides Market report covering key segments are type, crop type, source, mode of application, formulation and region.