Biosurgery Market Size, Share, Trends, Industry Analysis Report

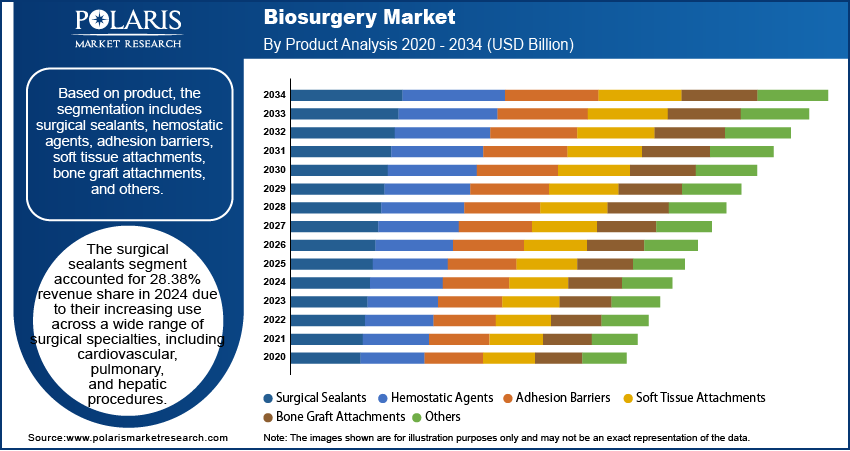

By Product (Surgical Sealants, Hemostatic Agents, Adhesion Barriers, Soft Tissue Attachments, Bone Graft Attachments, Others), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5930

- Base Year: 2024

- Historical Data: 2020-2023

Overview

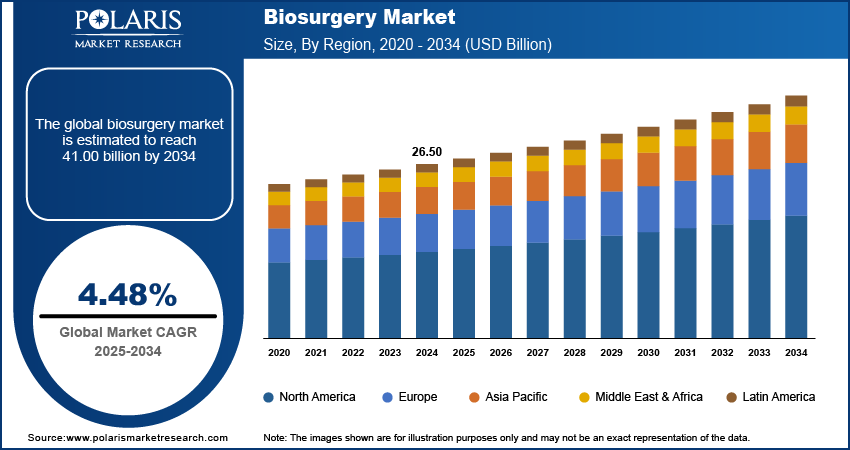

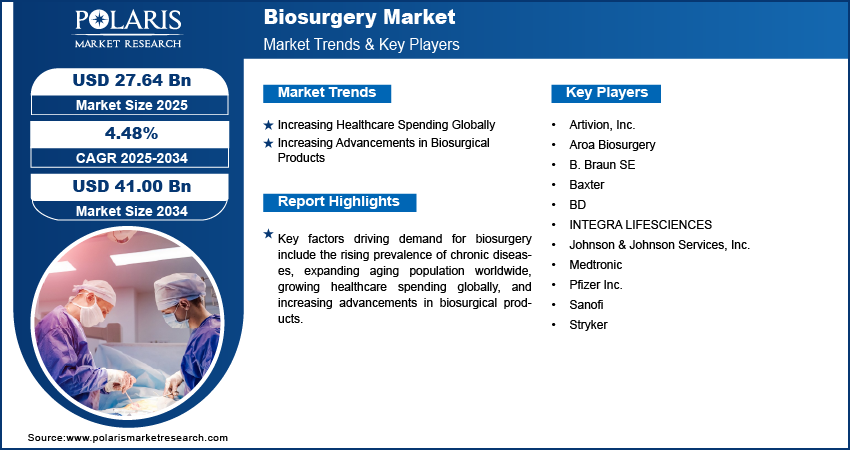

The global biosurgery market size was valued at USD 26.50 billion in 2024, growing at a CAGR of 4.48% from 2025 to 2034. Key factors driving demand for biosurgeries include rising prevalence of chronic diseases, expanding aging population worldwide, growing government healthcare spending, and increasing advancements in biosurgical products.

Key Insight

- The surgical sealants segment accounted for 28.38% market share in 2024.

- The cardiovascular surgery segment is projected to grow at a rapid pace in the coming years, driven by the increasing prevalence of heart diseases.

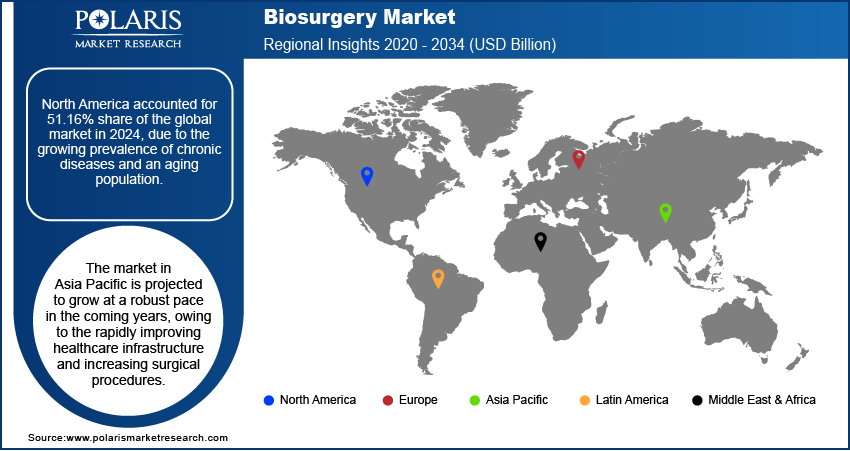

- North America accounted for 51.16% of the global market share in 2024.

- The U.S. biosurgery market held a 77.79% share of North America market in 2024 due to high healthcare spending and a strong focus on minimally invasive procedures.

- The market in Asia Pacific is projected to register a CAGR of 4.80% from 2025 to 2034, owing to the rapidly improving healthcare infrastructure and increasing surgical procedures.

- Countries such as China and Japan are investing heavily in advanced medical technologies, including biosurgical products, leading to industry expansion.

Biosurgery is a medical technique that uses living organisms or biologically compatible materials to treat disease, repair tissue, and promote healing. The technique encompasses the application of natural glues to seal wounds, lubricants for joints, and biotherapeutic techniques, such as gene and cellular therapies, for use in orthopedics, urology, and neurosurgery. It offers a promising path toward effective, less invasive, and harmonious medical treatments.

The rising prevalence of chronic diseases globally is driving the market growth. The World Health Organization, in its report, stated that at least 43 million deaths were reported due to noncommunicable diseases (NCDs) or chronic diseases in 2021. Chronic conditions often lead to complications, such as non-healing wounds, tissue damage, or organ dysfunction. It necessitates biosurgery and biosurgical products, including adhesives & sealants and soft-tissue reinforcements, to enhance healing and surgical outcomes. Therefore, the rising incidence of chronic diseases globally is driving the demand for biosurgery.

To Understand More About this Research: Request a Free Sample Report

The biosurgery demand is driven by the expanding aging population worldwide. World Health Organization, in its report, stated that by 2030, 1 in 6 people in the world will be aged 60 years and above. Geriatric population usually requires procedures such as joint replacements, wound care, and cancer surgeries, where biosurgical products such as hemostats, tissue adhesives, and mesh grafts play a critical role in improving recovery and reducing complications. Geriatric people also witness slower healing, which increases reliance on advanced biosurgery solutions to enhance surgical outcomes. Additionally, the growing preference for minimally invasive procedures among older adults further fuels demand for biosurgery and its associated products, designed to support safer and faster recovery. Hence, the expanding aging population is driving the biosurgery industry globally.

Industry Dynamics

- Increasing government healthcare spending globally is driving demand for biosurgery by fostering innovation in biosurgery solutions.

- Rising advancements in biosurgical products are driving the market growth by making biosurgery more appealing to surgeons and hospitals.

- Increasing volume of surgeries worldwide, including general, cardiovascular, orthopedic, and plastic surgeries, is expected to create a lucrative opportunity in the market during the forecast period.

- The high cost of biosurgery products and surgical procedures is limiting their accessibility and adoption, especially in emerging regions and among patients without adequate insurance coverage.

Increasing Government Healthcare Spending:

Governments and private healthcare providers worldwide are allocating larger budgets to modernize their medical infrastructure, making innovative biosurgery solutions, such as sealants, hemostats, and tissue scaffolds, more accessible. According to the Economic Survey, the share of government health expenditure in India's total health expenditure between FY15 and FY22 increased from 29.0% to 48.0%. This increase in spending supports training for surgeons in minimally invasive techniques, which often rely on biosurgery products for better outcomes.

Rising expenditures on chronic disease management and elective surgeries are further driving demand, as biosurgery plays a crucial role in enhancing surgical precision and post-operative healing in the management of chronic diseases. Therefore, the increasing healthcare spending globally is fueling the adoption of biosurgery.

Rising Advancement in Biosurgical Products:

Innovations such as next-generation tissue adhesives, smart hemostats, and bioactive scaffolds are enhancing surgical precision, reducing complications, and fueling recovery, making biosurgery more appealing to surgeons and hospitals. Advanced technologies such as 3D-printed grafts and stem cell-based therapies are expanding the range of treatable conditions, attracting more medical professionals to adopt biosurgery. Additionally, the growing awareness of these advancements is encouraging healthcare providers to invest in biosurgery, further driving adoption.

Segmental Insights

Product Analysis

Based on product, the segmentation includes surgical sealants, hemostatic agents, adhesion barriers, soft tissue attachments, bone graft attachments, and others. The surgical sealants segment accounted for 28.38% revenue share in 2024 due to their increasing use across a wide range of surgical specialties, including cardiovascular, pulmonary, and hepatic procedures. Surgeons preferred these products as they effectively prevent leakage of air, blood, and other bodily fluids, which improves surgical outcomes and minimizes postoperative complications. The demand rose further as hospitals aimed to reduce operative time and enhance healing processes. Technological advancements in biomaterials, combined with the introduction of synthetic and natural sealants that offer improved elasticity, strength, and biocompatibility, have also fueled their widespread adoption. The increasing volume of elective and complex surgeries, particularly among aging populations, has significantly propelled the demand for surgical sealants in healthcare systems.

The soft tissue attachments segment is projected to grow at a robust pace in the coming years. The surging number of sports injury cases propels demand for orthopedic reconstructions and soft tissue repair procedures, which drives segment growth. Increasing participation in physical activities and a rising number of musculoskeletal disorders among older adults are contributing to the rising demand for soft tissue surgeries, leading to high adoption of soft tissue attachments. Surgeons increasingly rely on advanced attachment products such as suture anchors, fixation devices, and mesh systems to enhance stability and promote tissue regeneration. Ongoing innovation in bioresorbable materials and minimally invasive fixation techniques is further strengthening the appeal of soft tissue attachment solutions.

Application Analysis

In terms of application, the segmentation includes general surgery, orthopedic surgery, cardiovascular surgery, neurological surgery, and others. The general surgery dominated the revenue share in 2024 due to the rising penetration of abdominal, gastrointestinal, and hepatobiliary procedures that require effective bleeding control and tissue sealing. Surgeons increasingly use advanced surgical sealants and hemostatic agents to manage intraoperative bleeding, minimize post-surgical leakage, and fuel wound healing. The global rise in elective and emergency procedures, such as hernia repairs, appendectomies, and colorectal surgeries, has increased the demand for biosurgical products that enhance surgical precision and reduce complications. Furthermore, the growing prevalence of lifestyle-related disorders, including obesity and gastrointestinal diseases, led to a higher volume of general surgical interventions, particularly in hospitals and ambulatory surgical centers.

The cardiovascular surgery segment is projected to grow at a rapid pace in the coming years, driven by the increasing prevalence of heart diseases and the rising number of open-heart and vascular procedures. Surgeons rely on specialized biosurgical products to achieve rapid hemostasis, particularly in high-risk heart operations where bleeding control is crucial. The aging global population, along with a surge in the prevalence of hypertension and diabetes, is contributing to a growing demand for coronary artery bypass grafts, valve replacements, and aortic repairs, leading to high adoption of biosurgery.

Regional Analysis

The North America biosurgery market accounted for 51.16% of the global share in 2024. This dominance is attributed to the growing prevalence of chronic diseases and an aging population. Surgeons in the region preferred biosurgery products for their ability to reduce complications and improve recovery times in the management of chronic diseases. Technological advancements, including innovative hemostats and sealants, have further propelled market growth in North America. Additionally, rising healthcare expenditure and strong support from regulatory bodies encouraged the use of biosurgery in complex procedures in the region.

U.S. Biosurgery Market Insight

The U.S. held 77.79% market share in North America biosurgery landscape in 2024, due to high healthcare spending and a strong focus on minimally invasive procedures. The American Medical Association, in its report, stated that the U.S. healthcare spending grew 7.5% in 2023, reaching $4.9 trillion, or $14,570 per person. Increasing surgical volumes, particularly in orthopedic and cardiovascular surgeries, drove demand for biosurgical products in the U.S. The presence of major players and continuous R&D investments fueled product innovation, contributing to dominance. Furthermore, patient preference for faster recovery and reduced hospital stays pushed hospitals in the U.S. to integrate advanced biosurgery solutions.

Asia Pacific Biosurgery Market

The market in Asia Pacific is projected to register a CAGR of 4.80% from 2025 to 2034, owing to the rapidly improving healthcare infrastructure and increasing surgical procedures. Countries such as China and Japan are investing heavily in advanced medical technologies, including biosurgical products, leading to industry expansion. Governments in the region are also supporting the adoption of biosurgery through expanding healthcare spending for modern surgical techniques. For instance, Vietnam's healthcare expenditure was approximately USD18.5 billion in 2022, representing 4.6% of the country's GDP.

India Biosurgery Market Overview

The market in India is expanding due to rising awareness of advanced wound care and surgical hemostats. An increase in the number of trauma cases, road accidents, and chronic wound cases is creating a strong demand for biosurgical products in India. The Ministry of Road Transport and Highways, in its Road Accident report, stated that the number of road accidents, the number of deaths, and the number of injury cases due to the accidents increased in 2022 compared to the previous year by 11.9%, 9.4%, and 15.3%, respectively. Additionally, the country's rising medical tourism is attracting international patients seeking cost-effective biosurgery treatments, further stimulating biosurgery demand.

Europe Biosurgery Market

The biosurgery landscape in Europe is projected to hold a substantial share in 2034 due to established healthcare systems and high surgical volumes. The rising aging population in the region is also driving industry growth, as this population requires more orthopedic and soft tissue repair procedures, thereby increasing the use of biosurgical products. Stringent regulatory standards further ensure product efficacy and safety, boosting surgeon confidence. Moreover, government initiatives promoting advanced surgical techniques and rising investments in healthcare innovation are supporting industry expansion.

Key Players and Competitive Analysis

The field of biosurgery is highly competitive, with key players such as Medtronic, Baxter, BD, Stryker, B. Braun SE, INTEGRA LIFESCIENCES, Artivion, Inc., Pfizer Inc., and Sanofi driving innovation and product expansion. These companies compete on product portfolios, technological advancements, and strategic collaborations to strengthen their positions in wound management, hemostats, surgical sealants, adhesion prevention, and soft tissue management. Medtronic dominates the biosurgery industry with extensive product lines, including advanced hemostatic agents and sealants. Baxter and BD focus on innovation in fibrin sealants and surgical hemostats, leveraging their strong R&D capabilities to address complex surgical needs. Meanwhile, Stryker has made significant advancements in biosurgery through acquisitions and the development of specialized products for orthopedic and trauma surgeries. The competitive landscape is further shaped by mergers and acquisitions, and partnerships, as companies seek to enhance their technological capabilities and geographic reach.

A few major companies include Artivion, Inc.; Aroa Biosurgery; B. Braun SE; Baxter; BD; INTEGRA LIFESCIENCES; Johnson & Johnson Services, Inc.; Medtronic; Pfizer Inc.; Sanofi; and Stryker.

Key Players

- Artivion, Inc.

- Aroa Biosurgery

- B. Braun SE

- Baxter

- BD

- INTEGRA LIFESCIENCES

- Johnson & Johnson Services, Inc.

- Medtronic

- Pfizer Inc.

- Sanofi

- Stryker

Industry Developments

September 2024: HCAH, a provider of out-of-hospital healthcare solutions, announced its partnership with Aroa Biosurgery to develop medical and surgical products for soft tissue regeneration and complex wound healing.

May 2024: Sanofi announced an investment of more than USD 1.08 billion to establish new bioproduction capacity at its French sites.

Biosurgery Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Surgical Sealants

- Hemostatic Agents

- Adhesion Barriers

- Soft Tissue Attachments

- Bone Graft Attachments

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- General Surgery

- Orthopedic Surgery

- Cardiovascular Surgery

- Neurological Surgery

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Biosurgery Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 26.50 Billion |

|

Market Size in 2025 |

USD 27.64 Billion |

|

Revenue Forecast by 2034 |

USD 41.00 Billion |

|

CAGR |

4.48% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 26.50 billion in 2024 and is projected to grow to USD 41.00 billion by 2034.

The global market is projected to register a CAGR of 4.48% during the forecast period.

North America dominated the market in 2024, holding 51.16% share.

A few of the key players in the market are Artivion, Inc; Aroa Biosurgery; B. Braun SE; Baxter; BD; INTEGRA LIFESCIENCES; Johnson & Johnson Services, Inc; Medtronic; Pfizer Inc; Sanofi; and Stryker.

The surgical sealants segment dominated the market in 2024, holding 28.38% share.

The cardiovascular surgery segment is expected to witness the fastest growth during the forecast period.