BPaaS Market Share, Size, Trends, Industry Analysis Report

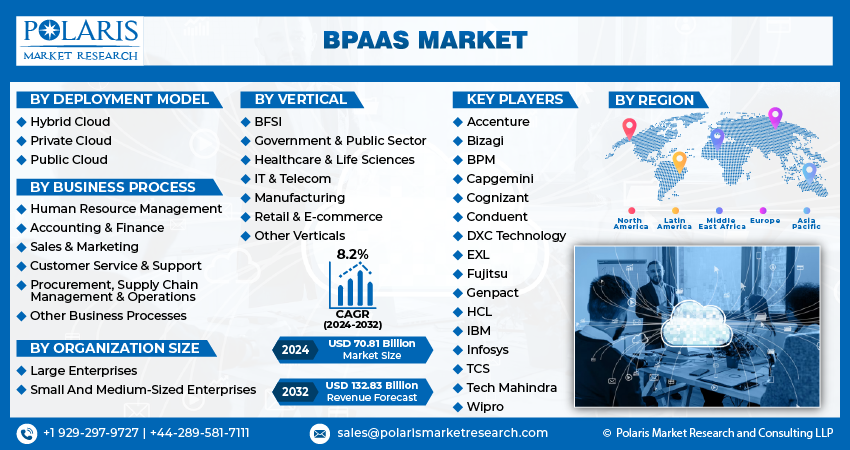

By Deployment Model (Hybrid Cloud, Private Cloud, Public Cloud); By Business Process; By Organization Size; By Vertical; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 117

- Format: PDF

- Report ID: PM4713

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

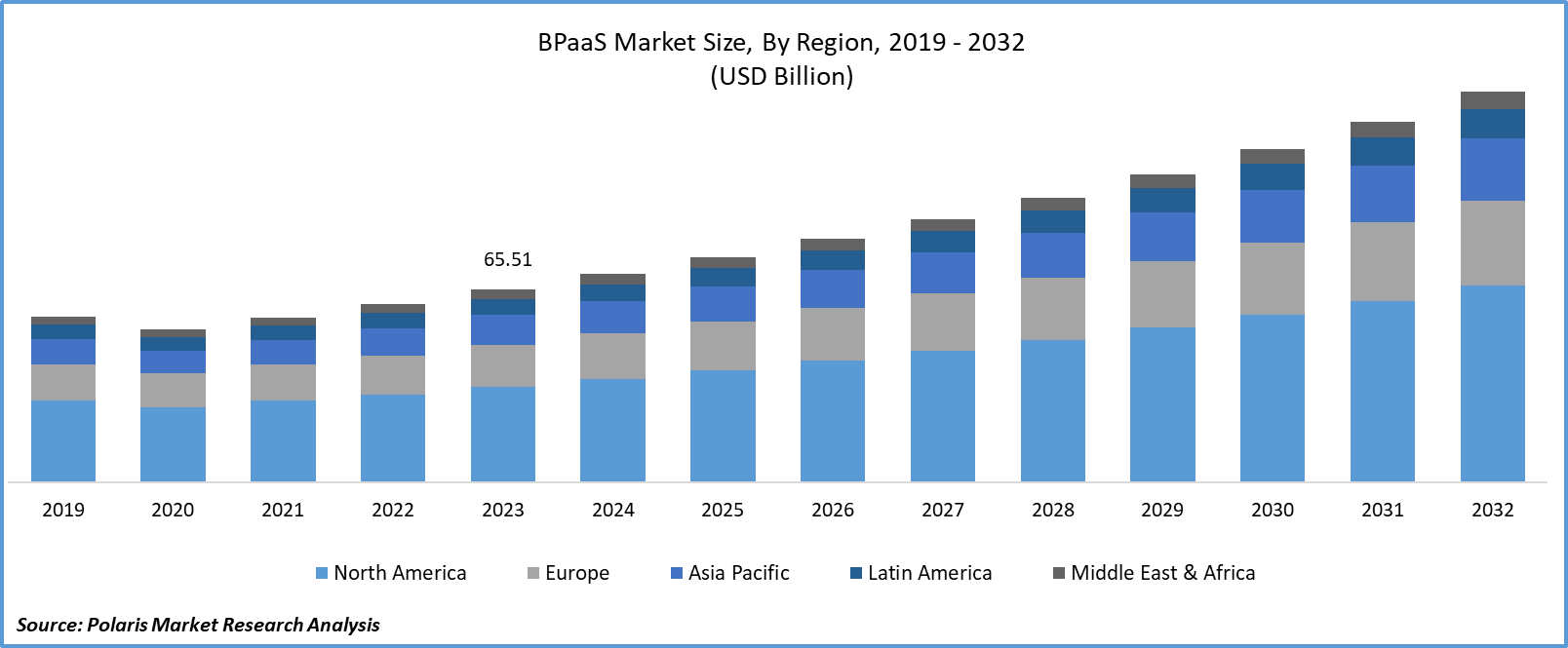

Global BPaaS market size was valued at USD 65.51 billion in 2023. The market is anticipated to grow from USD 70.81 billion in 2024 to USD 132.83 billion by 2032, exhibiting a CAGR of 8.2% during the forecast period.

Industry Trend

The BPaaS (Business Process as a Service) market segment falls within the broader cloud computing and business process outsourcing (BPO) landscape, wherein enterprises engage third-party service providers to deliver specific business processes or functions remotely over the Internet. This entails outsourcing diverse operations like human resources, finance, accounting, customer service, and supply chain management to expert providers via cloud-based platforms.

By adopting BPaaS, businesses gain access to specialized knowledge, scalable resources, and cutting-edge technologies without significant upfront investments in infrastructure or workforce. BPaaS vendors typically offer tailored solutions that can be customized to suit the unique requirements of each client, allowing organizations to concentrate on their core competencies while effectively managing their business processes. Hence, it is estimated that the BPaaS market share to rise tremendously in the upcoming years.

To Understand More About this Research:Request a Free Sample Report

The increasing demand for flexible and scalable business solutions is fueling the dynamic growth of the Business Process as a Service (BPAAS) market. Businesses are increasingly leveraging BPAAS to enhance productivity, streamline workflows, and harness emerging technologies such as robotic process automation and artificial intelligence. BPAAS emerges as a crucial player as organizations prioritize digital transformation, offering a versatile approach to address the ever-changing requirements of modern businesses. Rising demand shows the BPaaS market share to increase during the forecast period.

AI-related innovation and collaboration aimed at expanding the BPaaS (Business Process as a Service) market, there is a dynamic convergence of cutting-edge technologies and strategic partnerships. With the rise of artificial intelligence (AI), businesses are increasingly leveraging AI-driven solutions to enhance the efficiency, scalability, and flexibility of BPaaS offerings. Collaborations between BPaaS providers and AI technology firms are fostering the development of advanced algorithms, predictive analytics, and intelligent automation capabilities, enabling organizations to optimize their business processes and drive greater value.

For instance, In November 2023, Accenture introduced the Accenture Gen AI Services suite, tailored to aid businesses in optimizing the potential of generative AI. Among its offerings is a unique "switchboard" capability, empowering users to choose AI models that best align with their priorities, be it cost-effectiveness, accuracy, or specific business requirements. Additionally, the suite encompasses managed services designed for continuous enhancement and training.

The expansion of the customer service and support segment can be credited to a growing number of organizations seeking to overhaul their customer service operations. The emphasis is on reducing operational expenses while flexibly expanding operations and processes, particularly in response to shorter product life cycles. Customer service and support platforms play a pivotal role in overseeing the entire customer service lifecycle, encompassing customer care, asset and warranty management, contract management, field force management, and service performance management. This results in BPaaS market share to rise during the forecast period.

Key Takeaway

- North America dominated the largest market and contributed to more than 40% of the share in 2023.

- Asia Pacific accounted for the market to be the fastest growing CAGR during the forecast period.

- By vertical category, BFSI segment accounted for the largest BPaaS market share in 2023.

- By Business Process category, the customer service & support segment is projected to grow at a high CAGR during the projected period.

What are the Market Drivers Driving the Demand for the Bpaas Market?

The Ability to Offer Cost-Effective and Scalable Solutions to Businesses Is Projected to Spur Product Demand

Traditionally, companies had to invest heavily in establishing and maintaining their infrastructure and personnel to handle various business processes such as HR, finance, customer service, and more. However, with the advent of BPaaS, businesses can now outsource these processes to specialized service providers who offer them as a service over the Internet. This shift eliminates the need for upfront capital investments in hardware, software, and skilled personnel, allowing businesses to operate with greater flexibility and agility. Instead of managing complex systems internally, organizations can rely on BPaaS providers to handle their business processes efficiently and cost-effectively.

Moreover, BPaaS solutions are typically offered on a subscription or pay-per-use basis, allowing businesses to scale their usage according to their needs without being tied down by long-term commitments. This scalability is particularly beneficial for businesses experiencing fluctuations in demand or undergoing rapid growth, as they can easily adjust their service levels without incurring significant additional costs.

However, the cost-effectiveness and scalability offered by BPaaS solutions make them an attractive option for businesses seeking to streamline their operations, drive efficiency, and focus on their core competencies, thereby contributing significantly to the growth of the BPaaS market size.

Which Factor is Restraining the Demand for the Bpaas Market?

Rising Concerns Regarding Data Security and Privacy Are Likely to Impede the Bpaas Market Growth

Businesses often handle sensitive and confidential information as part of their operations, including customer data, financial records, and proprietary business processes. When outsourcing these processes to BPaaS providers, there is a natural apprehension about the security and privacy of this data. In today's regulatory environment, companies are subject to stringent data protection laws and regulations, such as GDPR in Europe and CCPA in California, which impose strict requirements on the handling and storage of personal and sensitive data. Any breach of these regulations can result in severe penalties, legal liabilities, and damage to reputation.

As a result, many businesses hesitate to adopt BPaaS solutions due to concerns about the security measures implemented by service providers to safeguard their data. They may fear unauthorized access, data breaches, or data misuse, especially when data is transferred or stored on remote servers managed by third-party vendors. Moreover, businesses may also face challenges in ensuring compliance with industry-specific regulations and standards when outsourcing critical business processes to BPaaS providers. Industries such as healthcare, finance, and government have stringent compliance requirements that must be adhered to, making it essential for BPaaS providers to demonstrate robust compliance measures.

Additionally, transparent communication and collaboration between BPaaS providers and their clients can help establish confidence and foster greater adoption of BPaaS solutions in the market.

Report Segmentation

The market is primarily segmented based on deployment model, business process, organization size, vertical, and region.

|

By Deployment Model |

By Business Process |

By Organization Size |

By Vertical |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Vertical Insights

Based on Vertical analysis, the market is segmented into the BFSI, government & public sector, healthcare & life sciences, IT & telecom, manufacturing, retail & e-commerce, and other verticals. The BFSI Segment held the largest market in 2023. The Banking, Financial Services, and Insurance (BFSI) sector involves a diverse array of intricate processes, ranging from transaction processing and risk management to compliance and customer service. By outsourcing these functions to BPaaS providers, BFSI enterprises can streamline their operations, lower operational expenses, and boost productivity. With the heavily regulated nature of the BFSI industry, organizations face stringent compliance standards set forth by regulatory authorities. Tailored BPaaS solutions for BFSI entities often incorporate robust compliance features, enabling firms to meet regulatory requirements while concentrating on core business goals. In today's dynamic financial landscape, BFSI companies are in constant pursuit of innovative strategies to maintain competitiveness.

By Business Process Insights

Based on Business Process analysis, the market has been segmented based on human resource management, accounting & finance, sales & marketing, customer service & support, procurement, supply chain management & operations, procurement, supply chain management & operations, and other business processes. The customer service & support segment is expected to be the fastest-growing CAGR during the forecast period. With the surge of digitalization and online interactions, businesses are increasingly prioritizing the delivery of exceptional customer experiences. This shift has led to a rising demand for advanced customer service and support solutions capable of promptly and effectively addressing customer inquiries, issues, and requests. In today's landscape, consumers expect seamless support across various channels, spanning phone, email, chat, social media, and self-service portals. To meet this expectation, companies are investing in omnichannel customer service solutions that seamlessly integrate these channels, offering a unified and consistent support experience. To meet these demands, businesses are turning to advanced analytics, AI-powered chatbots, and automation tools to anticipate customer needs, swiftly resolve issues, and deliver tailored support experiences.

Regional Insights

North America

North America accounted for the largest BPaaS market share in 2023. A convergence of factors underpins North America's dominance in the global BPaaS market. Firstly, the region hosts several major BPaaS service providers renowned for their comprehensive solutions across diverse industries, earning them substantial BPaaS market share. North America exhibits a consistent pattern of embracing cloud computing technologies across businesses of all scales and sectors. Cloud computing forms the bedrock for BPaaS solutions, delivering scalability, flexibility, and cost-efficiency. The region's advanced infrastructure, robust internet connectivity, and favorable regulatory climate further propel the uptake of cloud-based services.

Moreover, North America stands at the forefront of technological innovation, propelling the development and adoption of cutting-edge BPaaS solutions. With a vibrant ecosystem comprising technology startups, research institutions, and industry leaders, the region fosters a culture of innovation focused on enhancing BPaaS platforms' capabilities. This relentless pursuit of advancement ensures the continuous evolution and refinement of BPaaS offerings in North America. As organizations globally prioritize digital transformation and seek innovative operational solutions, North America's leadership in the BPaaS market is anticipated to persist into the foreseeable future.

Asia Pacific

Asia Pacific region is expected to grow at the fastest CAGR during the forecast period. The region's burgeoning population, rapid urbanization, and expanding middle class are driving significant economic growth and fostering a conducive environment for business expansion and innovation. As a result, there is a growing demand for advanced technologies and digital solutions to meet the evolving needs of businesses and consumers alike. Asia Pacific countries are increasingly embracing digital transformation initiatives spurred by government policies, investments in infrastructure, and a burgeoning startup ecosystem. This digital revolution is fueling the adoption of cloud computing, artificial intelligence, and other transformative technologies, creating opportunities for Business Process as a Service (BPaaS) solutions to thrive.

Additionally, the region's diverse and dynamic business landscape, spanning industries such as manufacturing, finance, healthcare, and retail, presents ample opportunities for BPaaS providers to offer tailored solutions to address specific market needs. As businesses in Asia Pacific seek to enhance efficiency, agility, and competitiveness, they are turning to BPaaS offerings to streamline operations, optimize workflows, and drive innovation. Moreover, the increasing globalization of businesses and the rise of cross-border trade are prompting companies in the Asia Pacific to seek scalable and cost-effective solutions to manage their operations efficiently.

Competitive Landscape

The BPaaS market displays fragmentation, characterized by competition among numerous players. Leading service providers in this sector consistently upgrade their technologies to stay ahead of the competition, prioritizing efficiency, reliability, and safety. Seeking a strong market foothold, these companies underscore the importance of strategic partnerships, continuous product improvements, and collaborative initiatives to outperform industry peers.

Some of the major players operating in the global market include:

- Accenture

- Bizagi

- BPM

- Capgemini

- Cognizant

- Conduent

- DXC Technology

- EXL

- Fujitsu

- Genpact

- HCL

- IBM

- Infosys

- TCS

- Tech Mahindra

- Wipro

Recent Developments

- In July 2023, Capgemini and Microsoft have teamed up to launch the Azure Intelligent App Factory, aimed at expediting the adoption of generative AI solutions across diverse industries. Leveraging industry-tailored digital platforms and Microsoft Cloud technologies, this collaboration seeks to responsibly and sustainably scale AI capabilities. The solution, consisting of Digital Industry Platforms, Industry Assistants, and Intelligent App Delivery Teams, is geared towards optimizing AI investments, achieving measurable business results, and upholding security and industry compliance standards.

- In January 2023, Accenture announced its acquisition of SKS Group, a consulting firm specializing in assisting banks throughout Germany, Austria, and Switzerland in modernizing their technology infrastructure and meeting regulatory mandates through SAP S/4HANA solutions.

Report Coverage

The BPaaS Market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis of various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive deployment model, business process, organization size, and vertical and futuristic growth opportunities.

BPaaS Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 70.81 billion |

|

Revenue Forecast in 2032 |

USD 132.83 billion |

|

CAGR |

8.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Deployment Model, By Business Process, By Organization Size, By Vertical, And By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global BPaaS Market size is expected to reach USD 132.83 billion by 2032

Key players in the market are Accenture, Bizagi, BPM, Capgemini, Cognizant, Conduent, DXC Technology, EXL

North America contribute notably towards the global BPaaS Market

BPaaS Market exhibiting a CAGR of 8.2% during the forecast period.

The BPaaS Market report covering key segments are deployment model, business process, organization size, vertical, and region.