Breast Conserving Surgery Market Size, Share, Trends, Industry Analysis Report

By Product Type (Lumpectomy Devices, Radiofrequency Ablation Devices), By Surgery Type, By End User, By Technology, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6013

- Base Year: 2024

- Historical Data: 2020-2023

Overview

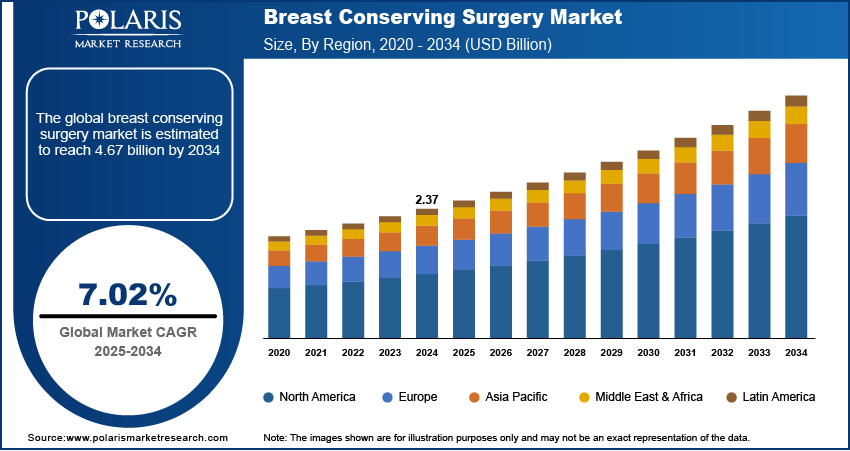

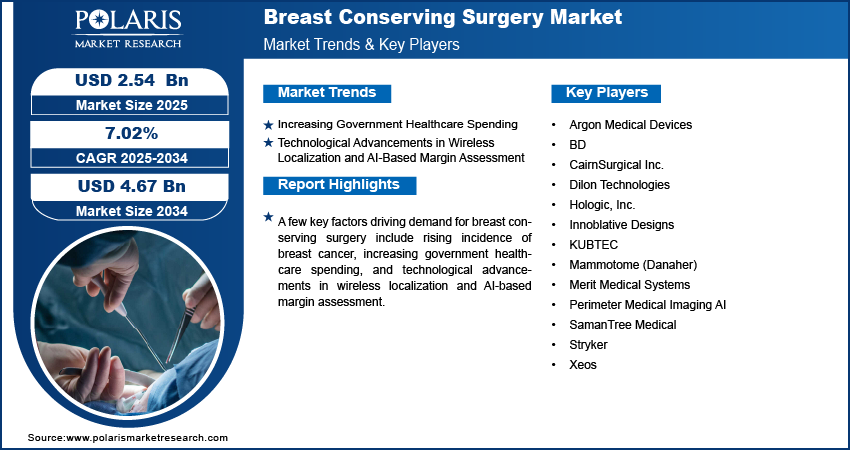

The global breast conserving surgery (BCS) market size was valued at USD 2.37 billion in 2024, growing at a CAGR of 7.02% from 2025 to 2034. A few key factors driving demand for breast conserving surgery are the rising prevalence of breast cancer, increasing government healthcare spending, and technological advancements in wireless localization and AI-based margin assessment.

Key Insights

- The lumpectomy devices segment accounted for a major revenue share in 2024.

- The tumor lumpectomy segment dominated the revenue share in 2024.

- North America accounted for 36.16% of the global market share in 2024.

- The U.S. held the largest revenue share in the North America industry in 2024.

- Breast conserving surgery landscape in Asia Pacific is being driven by increasing breast cancer awareness, improving healthcare access, and rising screening rates.

- A few countries such as Japan, Australia, and South Korea are leading in the adoption of breast conserving surgeries, supported by advanced medical infrastructure.

Breast conserving surgery (BCS), also known as lumpectomy, wide local excision, or partial mastectomy, is a surgical procedure designed to remove breast cancer while preserving as much normal breast tissue as possible. The primary goal of BCS is to excise the tumor along with a margin of surrounding healthy tissue, ensuring that all cancerous cells are removed, while maintaining the natural appearance and shape of the breast. This approach is commonly recommended for patients with early-stage breast cancer, where the tumor is small relative to the size of the breast, located in a single area, and the patient is able and willing to undergo postoperative radiotherapy.

Studies have demonstrated that women who undergo BCS followed by radiation have similar long-term survival rates compared to those who have a mastectomy, which involves removing the entire breast. BCS offers the advantage of preserving the breast’s appearance, which can be important for a patient’s psychological well-being and body image. However, the procedure is not suitable for everyone; factors such as tumor size, location, multiple cancer sites within the breast, previous radiation to the breast, certain genetic mutations, or connective tissue diseases may make BCS inappropriate. During the procedure, the surgeon may also remove some lymph nodes from under the arm to check for cancer spread.

The breast conserving surgery market demand is driven by the rising prevalence of breast cancer globally. The World Health Organization (WHO), in its report stated that breast cancer was the most common cancer in women in 157 countries out of 185 in 2022. Breast cancer patients opt for breast conserving surgery as it offers comparable survival rates with better cosmetic and psychological outcomes by removing the tumor while maintaining most of the breast tissue. Therefore, as the incidence of breast cancer increases globally, the demand for breast conserving surgery surges.

Industry Dynamics

- Increasing government healthcare spending is propelling market growth by enabling healthcare providers to offer more screenings and early diagnoses, leading to more breast cancer cases where BCS becomes a recommended treatment.

- Technological advancements in wireless localization and AI-based margin assessment boost the adoption of breast conserving surgery by addressing key concerns such as surgical accuracy and recurrence risks.

- The growing preference for preservation of the breast's appearance and body image among women is creating a lucrative market opportunity.

- The rising risk of local cancer recurrence compared to mastectomy treatment is hindering the demand for breast conserving surgery.

Increasing Government Healthcare Spending: Governments around the world are allocating more funds to healthcare infrastructure such as hospitals and clinics. These funds encourage healthcare organizations to invest in better equipment, training, and infrastructure, improving the availability of BCS, leading to market growth. The spending by the Government of India on healthcare has increased significantly over the years. The share of Government Health Expenditure (GHE) in the GDP increased from 1.13% in 2014-15 to 1.84% in 2021-22. Subsidies or insurance coverage expansions by government globally is reducing costs for patients, encouraging more women to opt for BCS over mastectomies. Additionally, higher funding is enabling healthcare providers to offer more screenings and early diagnoses, leading to more breast cancer cases where BCS becomes a recommended treatment, further driving demand.

Technological Advancements in Wireless Localization and AI-Based Margin Assessment: Wireless localization systems, such as RFID tags or radar-based tools, allow surgeons to accurately locate tumors in real-time, reducing the need for invasive procedures and improving patient outcomes. AI-based margin assessment tools analyze excised tissue during surgery, ensuring complete tumor removal while minimizing healthy tissue loss, which boosts confidence in the procedure's success. These innovations address key concerns such as surgical accuracy and recurrence risks, making breast conserving surgery a more appealing option for patients and surgeons.

Segmental Insights

Product Type Analysis

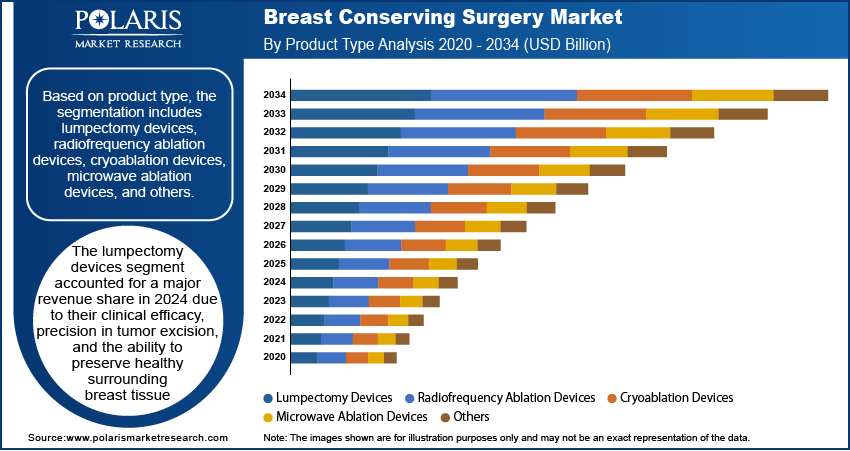

Based on product type, the segmentation includes lumpectomy devices, radiofrequency ablation devices, cryoablation devices, microwave ablation devices, and others. The lumpectomy devices segment accounted for a major revenue share in 2024 due to their clinical efficacy, precision in tumor excision, and the ability to preserve healthy surrounding breast tissue. Increasing awareness of early breast cancer detection, coupled with the rising preference for minimally invasive surgery, fueled demand for lumpectomy over other radical treatments. Hospitals and ambulatory surgical centers favored lumpectomy devices as they offer shorter recovery times, reduced risk of complications, and improved cosmetic outcomes, which align well with patient-centric care models.

The radiofrequency ablation devices segment is projected to grow at a robust pace in the coming years, owing to their ability to target and destroy cancerous tissue with minimal damage to adjacent healthy cells. Advancements in imaging-guided RFA techniques and expanding clinical trials demonstrating comparable oncological outcomes to traditional surgery have strengthened physician confidence in adopting these technologies. Moreover, RFA devices support outpatient treatment models and are particularly beneficial for patients who are not ideal candidates for surgical excision, such as elderly individuals or those with comorbidities. The growing inclination toward nonsurgical and image-guided treatment alternatives is expected to accelerate the adoption of RFA in the coming years.

Surgery Type Analysis

In terms of surgery type, the segmentation includes segmental mastectomy, quadrantectomy, tumor lumpectomy, and oncoplastic surgery. The tumor lumpectomy segment dominated the revenue share in 2024 due to its effectiveness in removing malignant tissue while preserving the majority of the breast structure. The procedure’s relatively short duration, lower complication rates, and favorable cosmetic outcomes contributed significantly to its widespread use. Additionally, increased access to early breast cancer screening led to a higher number of localized tumors eligible for lumpectomy. Healthcare experts and patients favor this surgery type as it reduces psychological distress associated with more extensive surgeries and allows quicker postoperative recovery, often without requiring hospitalization.

The oncoplastic surgery segment is expected to grow at a rapid pace in the coming years, owing to the rising demand for techniques that combine cancer resection with aesthetic reconstruction. Oncoplastic surgery integrates plastic surgery principles into tumor removal, allowing wider excisions without compromising breast shape, making it ideal for larger tumors that would traditionally require mastectomy. Furthermore, the expansion of breast cancer screening programs has led to earlier diagnoses, enabling more patients to qualify for oncoplastic approaches. Hospitals and specialized centers are investing in multidisciplinary teams, including breast and plastic surgeons, to meet this demand, ensuring oncoplastic surgery becomes the standard procedure for balancing oncologic efficacy and cosmetic excellence.

End User Analysis

In terms of end user, the segmentation includes hospitals, ambulatory surgical centers (ASCs), specialty clinics, and cancer research institutes. The hospitals segment held the largest revenue share in 2024 due to their ability to offer comprehensive infrastructure, including advanced imaging systems, surgical suites, and multidisciplinary oncology teams. The availability of skilled surgical oncologists, immediate access to post-operative care, and integration with radiology and pathology departments enhanced the quality and safety of procedures performed in these settings, encouraging people to favor hospitals for breast conserving surgery. Additionally, growing government investments in improving hospital-based cancer care, particularly in developing economies, further propelled their market dominance.

Technology Analysis

In terms of technology, the segmentation includes traditional surgical techniques, image-guided surgery, robotic-assisted surgery, and minimally invasive techniques. The traditional surgical techniques segment accounted for a major revenue share in 2024 due to their long-established clinical outcomes, cost-effectiveness, and widespread availability in both public and private healthcare settings. Many hospitals and surgical centers, particularly in low- and middle-income regions, continued to use traditional approaches as they required less advanced infrastructure and involved lower equipment and training costs. Additionally, familiarity among surgical teams and the proven reliability of conventional excision methods contributed to the continued dominance of traditional techniques.

The image-guided surgery segment is estimated to grow at a robust pace during the forecast period owing to the growing emphasis on surgical precision, reduced recurrence rates, and preservation of healthy tissue. The integration of real-time imaging modalities such as 3D ultrasound, MRI, and 3D mammography enables surgeons to localize tumors with high accuracy, leading to better cosmetic outcomes and fewer reoperations. Moreover, continuous innovation in imaging technologies and their expanding availability in both urban and semi-urban surgical centers are expected to accelerate the adoption of image-guided surgery globally.

Regional Analysis

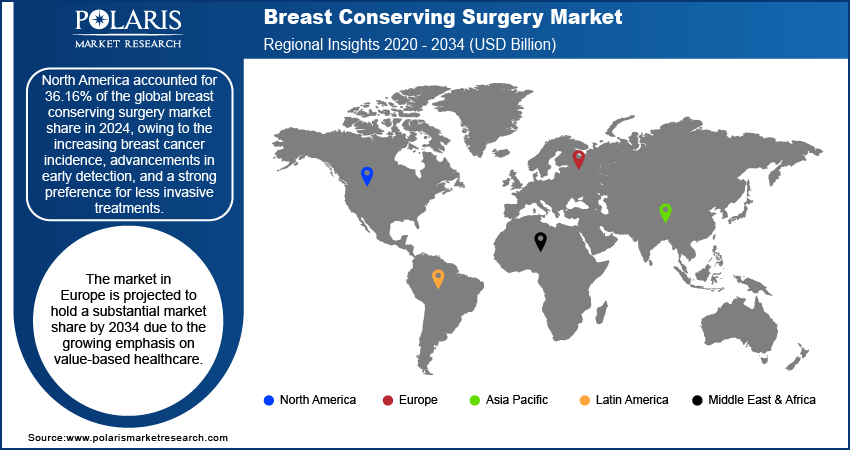

The North America breast conserving surgery market accounted for 36.16% of the global market share in 2024. This dominance is attributed to increasing breast cancer incidence, advancements in diagnostics for early detection, and a strong preference for less invasive treatments. Rising awareness of BCS benefits such as improved cosmetic outcomes and quality of life over mastectomy fueled its adoption. Additionally, well-established healthcare infrastructure, favorable reimbursement policies, and the availability of advanced radiation therapy techniques supported industry growth in North America. Patient advocacy and guidelines from organizations such as the American Society of Breast Surgeons further promoted breast conserving surgery as a standard of care for eligible patients in the region.

U.S. Breast Conserving Surgery Market Insights

The U.S. held the largest revenue share in North America in 2024 due to high breast cancer screening rates, leading to earlier-stage diagnoses where breast conserving surgery is most effective. The shift toward personalized cancer care and patient-centered treatment decisions in the country encouraged breast conserving surgery over mastectomy. Technological advancements, such as oncoplastic surgery and improved radiation therapy, enhanced BCS outcomes. Insurance coverage under Medicare and private insurers also facilitated breast conserving surgery access in the U.S.

Europe Breast Conserving Surgery Market Trends

The market in Europe is projected to hold a substantial share by 2034, due to growing emphasis on value-based healthcare. Many European countries are following national cancer guidelines that prioritize BCS for early-stage breast cancer when feasible. The availability of advanced radiotherapy and oncoplastic techniques is also supporting BCS growth in Europe. Additionally, patient awareness campaigns and government initiatives promoting breast cancer screening in many European countries contribute to early detection, increasing breast conserving surgery adoption and eligibility across the region.

France Breast Conserving Surgery Market Overview

The demand for breast conserving surgery in France is being driven by high breast cancer screening rates and strong government support for cancer research and treatment. Oncologists in the country favor BCS for early-stage cancer, supported by advanced radiotherapy access and oncoplastic surgery expertise. The French healthcare system’s universal coverage ensures broad patient access to BCS, leading to industry expansion. Additionally, cultural attitudes favoring less invasive treatments and aesthetic outcomes are further driving breast conserving surgery preference over mastectomy in France.

Asia Pacific Breast Conserving Surgery Market Analysis

The breast conserving surgery landscape in Asia Pacific is being driven by increasing breast cancer awareness, improving healthcare access, and rising screening rates. Countries such as Japan, Australia, and South Korea are leading in breast conserving surgery adoption, supported by advanced medical infrastructure. However, in developing nations, limited radiotherapy access and cultural preferences for mastectomy still hinder BCS growth. Economic development, government cancer initiatives, and training in oncoplastic techniques are expected to boost breast conserving surgery adoption in the region during the forecast period.

Key Players and Competitive Analysis

The competitive landscape of breast-conserving surgery (BCS) is characterized by a mix of established medical device companies and emerging innovators focused on improving precision, reducing re-excision rates, and enhancing patient outcomes. Major players such as Hologic, Inc. and Mammotome (Danaher) dominate the market with advanced biopsy and tumor localization technologies, including vacuum-assisted breast biopsy (VABB) systems and radiofrequency ablation tools. BD (Becton Dickinson) and Merit Medical Systems contribute with minimally invasive surgical instruments and biopsy devices, while Stryker leverages its expertise in surgical navigation and imaging for improved tumor margin assessment.

Emerging companies are introducing AI and advanced imaging to refine BCS. Perimeter Medical Imaging AI utilizes real-time intraoperative optical coherence tomography (OCT) to assess tumor margins, reducing the need for repeat surgeries. Similarly, SamanTree Medical employs high-resolution microscopy to provide rapid pathological feedback during operations. KUBTEC specializes in 3D specimen imaging, helping surgeons verify clear margins immediately after excision.

A few major companies operating in the breast conserving surgery industry include Argon Medical Devices; BD; CairnSurgical Inc.; Dilon Technologies; Hologic, Inc.; Innoblative Designs; KUBTEC; Mammotome (Danaher); Merit Medical Systems; Perimeter Medical Imaging AI; SamanTree Medical; Stryker; and Xeos.

Key Players

- Argon Medical Devices

- BD

- CairnSurgical Inc.

- Dilon Technologies

- Hologic, Inc.

- Innoblative Designs

- KUBTEC

- Mammotome (Danaher)

- Merit Medical Systems

- Perimeter Medical Imaging AI

- SamanTree Medical

- Stryker

- Xeos

Breast Conserving Surgery Industry Developments

July 2024: Innoblative Designs, Inc., a private medical device company, announced the use of its novel electrosurgical device in first-in-human clinical experience, treating a 64-year-old patients undergoing breast-conservation surgery.

July 2024: Hologic, Inc., a global company in women’s health, completed the acquisition of Endomagnetics Ltd, a privately held UK-based developer of breast cancer surgery technologies, for ~$310 million.

Breast Conserving Surgery Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Lumpectomy Devices

- Radiofrequency Ablation Devices

- Cryoablation Devices

- Microwave Ablation Devices

- Others

By Surgery Type Outlook (Revenue, USD Billion, 2020–2034)

- Segmental Mastectomy

- Quadrantectomy

- Tumor Lumpectomy

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Cancer Research Institutes

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Traditional Surgical Techniques

- Image-Guided Surgery

- Robotic-Assisted Surgery

- Minimally Invasive Techniques

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Breast Conserving Surgery Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.37 Billion |

|

Market Size in 2025 |

USD 2.54 Billion |

|

Revenue Forecast by 2034 |

USD 4.67 Billion |

|

CAGR |

7.02% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.37 billion in 2024 and is projected to grow to USD 4.67 billion by 2034.

The global market is projected to register a CAGR of 7.02% during the forecast period

North America dominated the market in 2024.

A few of the key players in the market are Argon Medical Devices; BD; CairnSurgical Inc.; Dilon Technologies; Hologic, Inc.; Innoblative Designs; KUBTEC; Mammotome (Danaher); Merit Medical Systems; Perimeter Medical Imaging AI; SamanTree Medical; Stryker; and Xeos.

The lumpectomy devices segment dominated the market in 2024.

The image-guided surgery segment is expected to witness the fastest growth during the forecast period.