U.S. Animal Wound Care Market Size, Share, Trends, Industry Analysis Report

By Animal Type (Companion Animals, Livestock Animals), By Product, By End Use, By Distribution Channel – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 125

- Format: PDF

- Report ID: PM6012

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

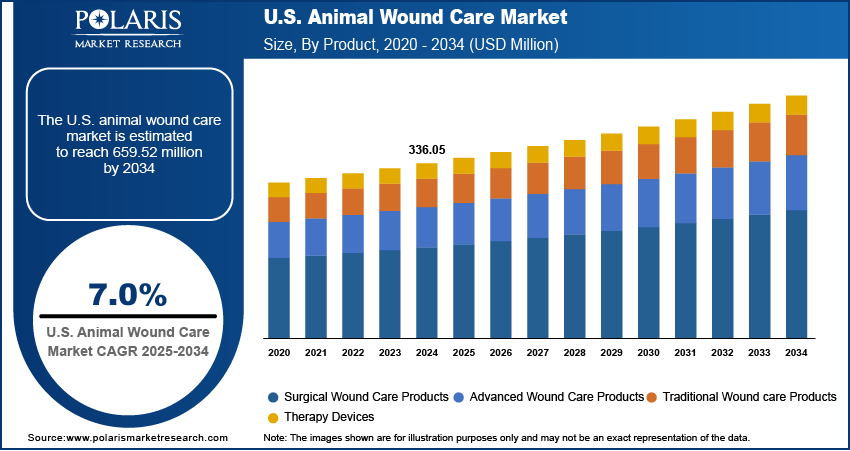

The U.S. animal wound care market size was valued at USD 336.05 million in 2024 and is anticipated to register a CAGR of 7.0% from 2025 to 2034. The industry is primarily driven by rising pet ownership and the increasing humanization of pets, leading to greater spending on their health.

Key Insights

- By product, the surgical wound care products segment held the largest share in 2024. These products, such as sutures and staples, are essential for treating numerous animal injuries and facilitating recovery after surgical procedures performed in veterinary settings across the country.

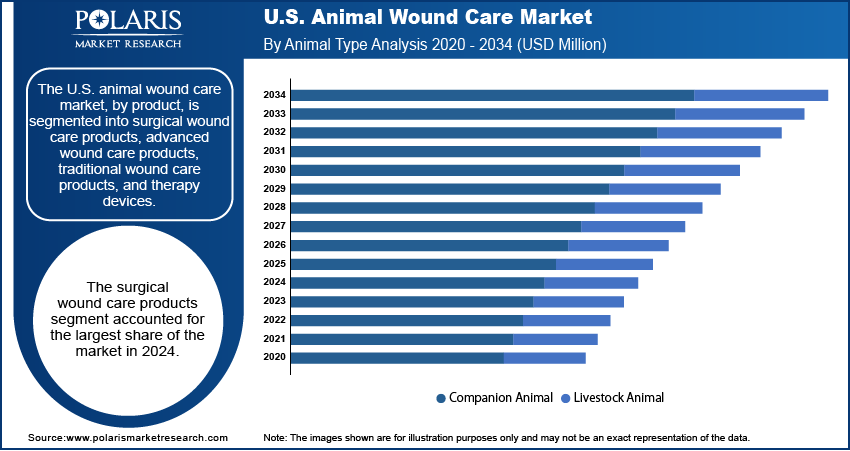

- By animal type, the companion animal segment, encompassing pets such as dogs and cats, held a larger share in 2024. This sustained dominance is fueled by the significant increase in pet ownership and the growing inclination of owners to spend more on their pets' health, including comprehensive wound management solutions.

- By end use, the veterinary hospitals and clinics segment held the largest share in 2024. These professional facilities are crucial for diagnosing and treating a wide range of animal wounds, providing specialized care and serving as the primary point of access for complex wound management.

- By distribution channel, the veterinary hospitals and clinics channel held the largest share in 2024. This is due to the direct provision of essential wound care products during animal visits for treatment, establishing these clinics as a primary source for immediate and professional wound care solutions.

The U.S. animal wound care market focuses on products and services used to treat injuries in pets and livestock, ranging from minor cuts to complex surgical wounds. These solutions help clean and protect injuries, as well as promote the healing process while preventing infections, supporting the overall well-being and recovery of animals.

The growing prevalence of chronic diseases and age-related health issues in companion and livestock animals is significantly boosting the U.S. animal wound care market demand. As veterinary medicine advances, animals are living longer, leading to a higher incidence of conditions such as diabetes, obesity, and various forms of arthritis. These conditions can often lead to persistent or recurring wounds, such as diabetic ulcers, pressure sores, and non-healing lesions, which require ongoing and specialized wound management. This demographic shift in the animal population creates a continuous need for effective wound care solutions to improve the quality of life and extend the lifespan of affected animals.

The rising awareness among pet owners about proactive animal healthcare and the increasing emphasis on animal welfare in the agricultural sector are key drivers for the U.S. animal wound care market. As more people view their pets as integral family members, there is a surging desire to provide the best possible care, including early intervention and diligent management of wounds. Similarly, in livestock farming, maintaining healthy animals is crucial for productivity and compliance with welfare standards, leading to greater adoption of advanced wound care practices.

Industry Dynamics

- The increasing prevalence of chronic diseases and age-related conditions in animals is significantly boosting the demand for animal wound care products. As animals live longer due to advancements in veterinary medicine, they are more prone to developing conditions such as diabetes and arthritis, which can lead to persistent or recurring wounds requiring ongoing specialized care.

- Greater awareness and education among both pet owners and farmers about animal healthcare and welfare are driving the U.S. animal wound care market. This increasing understanding encourages proactive measures and diligent management of animal injuries, leading to increased demand for effective wound care products and services.

Rising Pet Ownership and Humanization: The increasing number of households in the U.S. that own pets, coupled with the trend of treating these animals as family members, is a significant driver for the U.S. animal wound care market. As pets become more integrated into families, owners are more inclined to invest in their health and well-being, including advanced medical care for injuries and wound cleanser products. This shift in perception means that pet owners are seeking out more sophisticated and effective wound care solutions to ensure their beloved companions recover quickly and comfortably.

According to an article titled "Pet acquisition trends and veterinary care access in the U.S." published by the National Library of Medicine (NLM) in July 2025, the prevalence of pet ownership in the U.S. is high, with a large number of households keeping dogs and cats, and the majority of these owners consider their pets as family members. This strong human-animal bond directly contributes to increased spending on veterinary services, which fuels the demand for various wound care products and procedures across the country.

Advancements in Veterinary Medical Technology: Continuous innovation and technological advancements in veterinary medicine are significantly propelling the growth of the U.S. animal wound care market. New products and therapies, such as advanced wound dressings, regenerative medicine, and specialized equipment, are improving treatment outcomes and shortening recovery times for animals. These innovations make wound care more effective and accessible, encouraging veterinarians to adopt these newer methods.

A review article titled "Recent technological advances in the management of chronic wounds: A literature review" published in the National Center for Biotechnology Information (NCBI) in May 2022 highlights how a careful combination of recent research outputs can greatly change wound care technologies, leading to improved outcomes. The development of advanced techniques and products for animal wound healing, such as those that accelerate tissue repair and reduce infection, directly contributes to the expansion.

Segmental Insights

Product Analysis

Based on product, the segmentation includes surgical wound care products, advanced wound care products, traditional wound care products, and therapy devices. The surgical wound care products segment held the largest share in 2024. This dominance stems from the frequent need for surgical interventions in animals, driven by factors such as a high incidence of injuries, the growing number of pet surgeries, and the management of various diseases that require operative treatment. Products within this segment, such as sutures, staples, and tissue adhesives, are essential for closing wounds, providing stability, and promoting proper healing after surgical procedures or traumatic injuries. The consistent demand for these fundamental tools in veterinary practices and animal hospitals ensures this segment maintains its leading position.

The therapy devices segment is anticipated to register the highest growth rate during the forecast period. This projected rapid expansion is attributed to the increasing adoption of advanced technologies that offer noninvasive or minimally invasive surgery or solutions for wound healing. Therapy devices, which include products such as negative pressure wound therapy (NPWT) systems, laser therapy devices, and other electro-stimulation tools, are gaining popularity because they can significantly accelerate the healing process, reduce pain, and prevent complications. As veterinarians and pet owners seek more efficient and less stressful ways to manage wounds, the demand for these innovative devices is on the rise, positioning this segment for substantial growth in the coming years.

Animal Type Analysis

Based on animal type, the segmentation includes companion animal and livestock animal. The companion animal segment held the largest share in 2024. This dominance is primarily due to the significant number of pet-owning households in the U.S. and the strong bond between owners and their pets, often referred to as the "humanization" of pets. This trend leads to pet owners increasingly prioritizing the health and well-being of their animals, driving greater expenditure on veterinary care, including advanced wound management for injuries, surgeries, and chronic conditions. The sheer volume of companion animals, such as dogs and cats, and even companion animals vaccine, undergoing routine and emergency veterinary procedures creates a consistent and high demand for various wound care products and solutions.

The livestock animal segment is anticipated to grow at the highest growth rate during the forecast period. This anticipated growth is influenced by a rising demand for animal-derived products, which in turn leads to larger livestock populations and an increased focus on animal health and productivity in agricultural settings. As the scale of livestock farming expands, there is a natural increase in the incidence of injuries, infections, and other conditions that require effective wound care to maintain animal welfare and ensure economic viability. Farmers and veterinary professionals are becoming more aware of the benefits of advanced wound care in preventing losses and improving recovery times for livestock, thus fueling the demand for specialized products designed for these animals.

End Use Analysis

Based on end use, the segmentation includes veterinary hospitals/clinics, homecare, and research institutes. The veterinary hospitals/clinics segment held the largest share in 2024. These facilities serve as the primary point of contact for animal owners seeking professional medical attention for their injured or ill pets and livestock. The high volume of surgical procedures, emergency treatments, and routine wound management cases handled by these establishments consistently drives the demand for a wide array of wound care products. Veterinarians in these settings are equipped with specialized knowledge, diagnostic tools, and a comprehensive range of solutions, making them the preferred choice for complex wound issues. The trust and reliability associated with licensed veterinary professionals further solidify this segment's leading position, as animal owners rely on their expertise for optimal recovery outcomes.

The homecare segment is anticipated to register the highest growth rate during the forecast period. This surge is largely attributed to the increasing comfort and willingness of pet owners to administer certain aspects of wound care at home, often following initial treatment at a veterinary clinic. Factors such as the desire for convenience, reduced stress for animals in a familiar environment, and the potential for cost savings are contributing to this shift. The availability of user-friendly wound care products and clearer instructions from veterinarians enable owners to manage less severe wounds or provide ongoing care after professional intervention.

Distribution Channel Analysis

Based on distribution channel, the segmentation includes retail, e-commerce, and veterinary hospitals/clinics. The veterinary hospitals/clinics segment held the largest share in 2024, as these facilities serve as crucial hubs for comprehensive animal healthcare, where a vast majority of serious injuries, surgical procedures, and follow-up wound treatments take place. Veterinarians and their staff are directly involved in diagnosing, treating, and often dispensing the necessary wound care products, including specialized dressings, sutures, and medications. Animal owners typically rely on the professional advice and direct provision of products from these clinics for effective and safe wound management. The integral role of veterinary professionals in the animal health ecosystem, along with the immediate need for certain wound care items in a clinical setting, ensures that this channel remains dominant.

The e-commerce segment is anticipated to register the highest growth rate during the forecast period. The convenience, wider product selection, and competitive pricing offered by online platforms are increasingly appealing to pet owners. While complex or urgent wound care still necessitates a visit to a veterinarian, routine wound care products, maintenance supplies, and specialized items for ongoing homecare are readily available through e-commerce. The increasing digital literacy of pet owners and the shift toward online shopping for everyday needs, including pet supplies, are fueling this rapid expansion. The ability to easily compare products, read reviews, and have items delivered directly to their doorstep makes e-commerce a highly attractive option for managing animal wound care needs that do not require immediate veterinary intervention.

Key Players and Competitive Insights

The U.S. animal wound care industry features a competitive landscape with several key players striving for a larger share. These companies compete on factors such as product innovation, pricing strategies, distribution network strength, and the breadth of their product portfolios. Many players focus on developing advanced wound care solutions, while others emphasize traditional products or specialized therapy devices. Strategic alliances, partnerships with veterinary organizations, and investments in research and development are common tactics employed by these companies to gain a competitive edge and respond to evolving demands in animal healthcare.

A few key players in the market include Elanco Animal Health, 3M Company, Medtronic PLC, B. Braun, Virbac SA, NEOGEN Corporation, Dechra Pharmaceuticals PLC, Jorgensen Laboratories, Covetrus, Inc., Vetoquinol SA, and Boehringer Ingelheim.

Key Players

- 3M Company

- B. Braun

- Boehringer Ingelheim Animal Health

- Covetrus, Inc.

- Dechra Pharmaceuticals PLC

- Elanco Animal Health

- Jorgensen Laboratories

- Medtronic PLC

- NEOGEN Corporation

- Virbac SA

- Vetoquinol SA

U.S. Animal Wound Care Industry Developments

May 2024: Sonoma Pharmaceuticals, a global healthcare firm known for its stabilized hypochlorous acid (HOCl) solutions using proprietary Microcy technology, introduced its MicrocynAH animal health line across Menards, a major U.S. home improvement retail chain.

U.S. Animal Wound Care Market Segmentation

By Product Outlook (Revenue – USD Million, 2020–2034)

- Surgical Wound Care Products

- Advanced Wound Care Products

- Traditional Wound Care Products

- Therapy Devices

By Animal Type Outlook (Revenue – USD Million, 2020–2034)

- Companion Animal

- Livestock Animal

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Veterinary Hospitals/Clinics

- Homecare

- Research Institutes

By Distribution Channel Outlook (Revenue – USD Million, 2020–2034)

- Retail

- E-commerce

- Veterinary Hospitals/Clinics

U.S. Animal Wound Care Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 336.05 million |

|

Market Size in 2025 |

USD 358.74 million |

|

Revenue Forecast by 2034 |

USD 659.52 million |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 336.05 million in 2024 and is projected to grow to USD 659.52 million by 2034.

The market is projected to register a CAGR of 7.0% during the forecast period.

A few key players in the market include Elanco Animal Health, 3M Company, Medtronic PLC, B. Braun, Virbac SA, NEOGEN Corporation, Dechra Pharmaceuticals PLC, Jorgensen Laboratories, Covetrus, Inc., Vetoquinol SA, and Boehringer Ingelheim.

The surgical wound care products segment accounted for the largest share of the market in 2024.

The livestock animal segment is expected to witness the fastest growth during the forecast period.