PTFE Tapes and Films Market Size, Share, Trends, Industry Analysis Report

By Technology (Skived, Cast, Extruded, Expanded, Others), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 120

- Format: PDF

- Report ID: PM6020

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

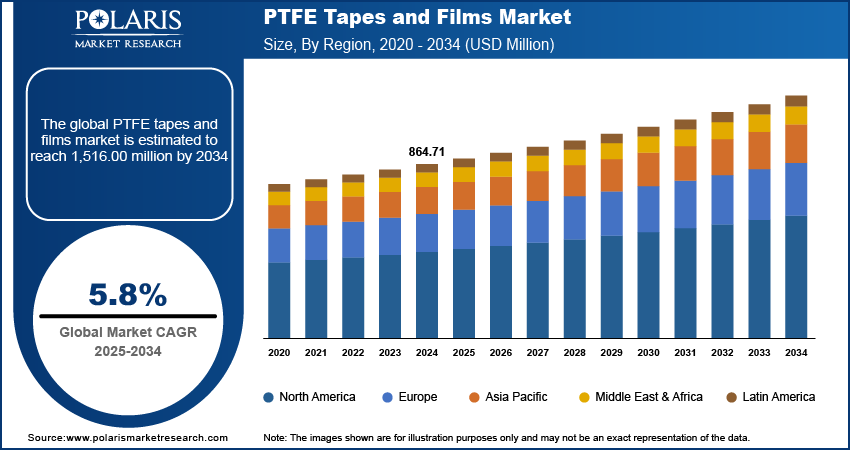

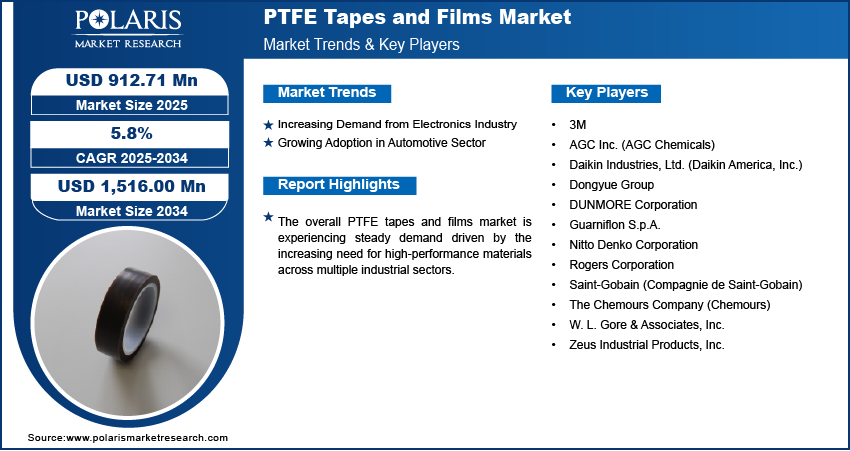

The global PTFE tapes and films market size was valued at USD 864.71 million in 2024 and is anticipated to register a CAGR of 5.8% from 2025 to 2034. The increasing demand for high-performance materials across various industries such as electronics, automotive, and aerospace boosts the growth of the PTFE tapes and films industry.

Key Insights

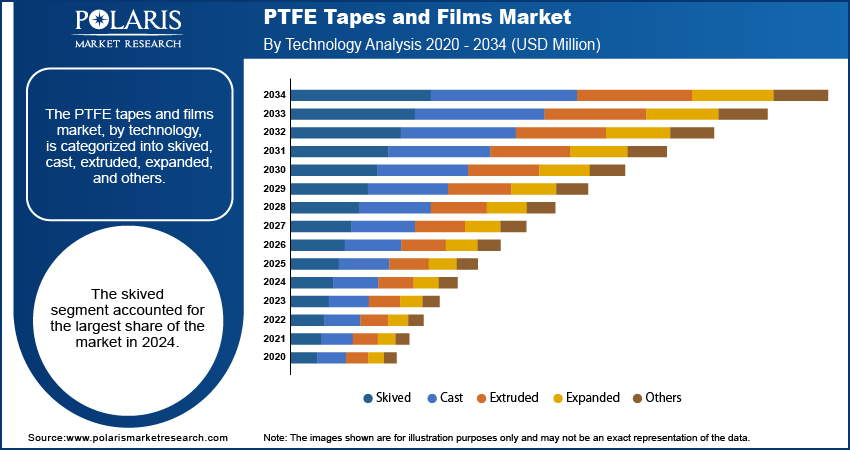

- By technology, the skived segment held the largest share in 2024. This is due to its efficiency in producing thin, uniform films that are essential for various electrical insulation and high-temperature sealing applications across industries.

- By application, the electrical and electronics application segment held the largest share in 2024. This is because PTFE's excellent dielectric strength, high thermal resistance, and chemical inertness are crucial for the insulation and protection of components in modern electronic devices and systems.

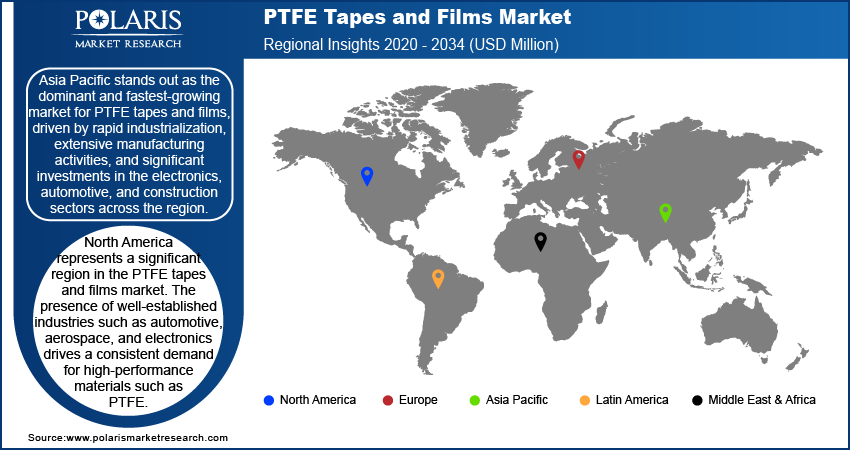

- By region, Asia Pacific held the largest share in 2024 and is fastest-growing regional market. This is driven by rapid industrialization, extensive manufacturing activities, and significant investments in the electronics, automotive, and construction sectors across the region.

The PTFE tapes and films market involves products made from polytetrafluoroethylene, a synthetic fluoropolymer, which are widely used due to their unique properties such as non-stick surfaces, high heat resistance, chemical inertness, and excellent electrical insulation. These products are available in various forms and thicknesses, serving diverse applications across many industries.

The chemical processing industry is a critical driver. This sector consistently requires materials that can withstand highly corrosive chemicals, extreme temperatures, and high pressures without degrading or contaminating the substances being processed. PTFE's exceptional chemical inertness and resistance to a wide range of aggressive chemicals make it an ideal choice for use in gaskets, seals, tank linings, pipes, and hose assemblies within chemical plants. The need for leak-proof connections and reliable fluid handling in hazardous environments significantly fuels the demand for PTFE products.

The growing global emphasis on energy efficiency and sustainable practices is a significant driver. Industries are increasingly seeking materials that can contribute to reducing energy consumption, minimizing waste, and extending the lifespan of equipment. PTFE's low friction properties help reduce energy loss in mechanical systems by decreasing wear and tear on moving parts, making machinery more efficient. Furthermore, its long lifespan and durability in harsh conditions result in less frequent replacement, contributing to reduced material waste.

Industry Dynamics

- The increasing demand from the electronics industry is a significant factor.

- Growing adoption in the automotive sector contributes to market expansion.

- The rising use in medical applications is driving demand.

- Expanding applications in the aerospace industry are fueling growth.

Increasing Demand from Electronics Industry: The electronics industry is a significant driver due to the material's exceptional electrical insulation properties, high-temperature resistance, and chemical inertness. As electronic devices become smaller, more powerful, and operate at higher frequencies, the need for reliable and efficient insulation materials intensifies. PTFE is used in wire and cable insulation, printed circuit boards, and various semiconductor components, ensuring optimal performance and safety in demanding electronic environments.

A study published in Polymers in 2024, titled "Study on the Electrical Insulation Properties of Modified PTFE at High Temperatures," highlighted that PTFE is widely used in aviation cable insulation materials as it can greatly improve the insulation performance of cables, even under extreme conditions such as high temperatures. The need for such robust materials is continuously growing with advancements in electronics. This ongoing expansion and miniaturization in the electronics sector, coupled with the need for reliable and durable components, continues to drive the demand for PTFE tapes and films.

Growing Adoption in Automotive Sector: The automotive industry's increasing shift toward electric vehicles (EVs) and advanced driver-assistance systems (ADAS) fuels the demand for PTFE tapes and films. These materials are crucial for various automotive applications due to their high-temperature resistance, chemical inertness, low friction, and excellent electrical insulation. They are used in gaskets, seals, bearings, fuel lines, and wiring insulation, where they contribute to vehicle performance, safety, and longevity, especially in the high-temperature and chemical-rich environments of modern vehicles.

"Investment Opportunities in Automobile," published by Invest India in February 2025, noted that domestic automobile production in India increased significantly in FY 2023-24, including passenger vehicles, electric commercial vehicles, and two-wheelers. The report also mentioned that electric vehicles (EVs) are projected to make up over 40% of the Indian automotive market by 2030. This growth in overall automotive manufacturing, particularly in the EV segment, directly increases the need for specialized materials such as PTFE tapes and films. The evolution of the automotive industry toward more efficient and safer vehicles continues to boost the demand for PTFE tapes and films.

Segmental Insights

Technology Analysis

Based on technology, the segmentation includes skived, cast, extruded, expanded, and others. The skived segment held the largest share in 2024. The dominance is primarily attributed to its versatility and ability to produce thin, precise films with consistent thickness and surface uniformity. The skiving process involves shaving thin layers from a molded PTFE block, allowing for excellent control over the material's properties and dimensions. These films are highly desirable for applications requiring high dielectric strength, non-stick surfaces, and chemical resistance, such as in electrical insulation, high-temperature gasketing, and various industrial lining applications. The established manufacturing processes and widespread acceptance of skived PTFE films across a broad range of end-use industries contribute significantly to its dominant position in the overall market.

The expanded PTFE, or ePTFE, technology segment is anticipated to register the highest growth rate during the forecast period. This growth is driven by the unique characteristics of ePTFE, which include a porous structure, high strength-to-weight ratio, and excellent biocompatibility, in addition to the inherent properties of regular PTFE. These enhanced features make ePTFE particularly suitable for advanced and specialized applications, especially in the medical and pharmaceutical sectors for implants, surgical patches, and filtration membranes. Furthermore, its use in high-performance apparel, filtration systems, and as a lightweight, durable sealing material in various industries further fuels its demand.

Application Analysis

Based on application, the segmentation includes medical & pharmaceuticals, chemical processing, automotive, aviation & aerospace, electrical & electronics, building & construction, and others. The electrical & electronics segment held the largest share in 2024. This is mainly due to PTFE's outstanding dielectric strength, high thermal stability, and chemical inertness, which are crucial for insulating and protecting sensitive electronic components. As electronic devices continue to miniaturize and demand higher performance, the need for reliable insulation in wires, cables, circuit boards, and various semiconductor applications remains consistently high. PTFE tapes and films are essential for ensuring the safe and efficient operation of these devices, especially in environments exposed to heat and chemicals.

The medical and pharmaceuticals segment is anticipated to register the highest growth rate during the forecast period. This growth is largely driven by the increasing demand for biocompatible, chemically inert, and sterilizable materials in the healthcare industry. PTFE's unique properties make it an ideal choice for a wide range of medical devices, including catheters, vascular grafts, implants, and surgical instruments. Its non-reactive nature ensures patient safety and the integrity of pharmaceutical products. As healthcare technologies advance and there is a rising focus on minimally invasive procedures and personalized medicine, the adoption of PTFE in medical applications continues to expand.

Regional Analysis

Asia Pacific PTFE Tapes and Films Market Overview

The Asia Pacific PTFE tapes and films market accounted for the largest share in 2024, fueled by rapid industrialization, increasing urbanization, and the expanding manufacturing sectors across various countries. The booming electronics industry, particularly in consumer electronics and semiconductor manufacturing, drives a massive demand for PTFE's insulating and protective properties. Furthermore, significant infrastructure development, coupled with expanding automotive and chemical processing industries, consistently pushes the demand for durable and high-performance materials such as PTFE across the region.

China PTFE Tapes and Films Market Insights

China is a pivotal country in Asia Pacific. The country’s status as a global manufacturing hub for electronics, automotive components, and various industrial goods translates into immense demand for PTFE. The country's substantial investments in advanced manufacturing, telecommunications infrastructure, and electric vehicle production create a strong need for materials with superior electrical, thermal, and chemical resistance. Government initiatives supporting domestic manufacturing and technological innovation further increase the consumption of PTFE tapes and films across a wide array of industrial applications in China.

North America PTFE Tapes and Films Market Overview

North America represents a significant region in the global PTFE tapes and films market. The presence of well-established industries such as automotive, aerospace, and electronics drives a consistent demand for high-performance materials such as PTFE. These industries in North America often lead in adopting advanced manufacturing technologies and increasingly require components that can withstand extreme conditions. The emphasis on product quality, safety, and regulatory compliance within these sectors also favors the use of PTFE due to its durable and inert properties. Innovation and research and development activities further contribute to the steady growth of the PTFE tapes and films industry across the region.

U.S. PTFE Tapes and Films Market Insight

The U.S. is a key contributor to the North American PTFE tapes and films market. Its robust aerospace testing and defense industry, coupled with a strong electronics manufacturing base, creates substantial demand for these specialized materials. PTFE's use in various critical applications, from electrical insulation in advanced electronics to sealing components in aircraft, underpins its importance in the U.S. Furthermore, the country's continuous investments in research and development, aiming for more efficient and high-performance materials, support the ongoing adoption and development of PTFE solutions. The growing focus on advanced medical devices also contributes to the rising demand for PTFE in the US.

Europe PTFE Tapes and Films Market Trends

Europe is a substantial market for PTFE tapes and films, driven by its advanced manufacturing capabilities and a strong emphasis on sustainability and high-quality industrial solutions. The region's automotive industry, with a focus on EVs and lightweight materials, is a major consumer. Additionally, the well-developed chemical processing sector and stringent environmental regulations necessitate the use of highly resistant and inert materials such as PTFE for various applications, including linings, seals, and gaskets. The European focus on energy efficiency and renewable energy technologies also creates a steady demand for PTFE in insulation and protective applications.

In Europe, Germany stands out as a major country in the Europe PTFE tapes and films market. Its prominent automotive manufacturing sector, which includes leading luxury and performance car brands, is a significant driver. These manufacturers extensively use PTFE for critical components due to its low friction, high temperature resistance, and chemical inertness, contributing to vehicle performance and safety. Furthermore, Germany's strong engineering and industrial machinery sectors, alongside a growing focus on automation and precision manufacturing, further boost the demand for high-quality PTFE tapes and films. The country's commitment to technological advancement and industrial excellence reinforces its position in the market.

Key Players and Competitive Insights

The PTFE tapes and films market is characterized by a competitive landscape with several major players vying for market share. These companies compete based on product innovation, quality, application-specific solutions, global reach, and pricing strategies. Key players often invest in research and development to enhance the performance characteristics of their PTFE products, such as improving temperature resistance, reducing friction, or optimizing electrical properties. Strategic partnerships, and mergers and acquisitions are also common as companies aim to expand their product portfolios, strengthen their distribution networks, and gain a competitive edge in various end-use industries.

A few prominent companies in the industry include 3M; Saint-Gobain; Nitto Denko Corporation; W. L. Gore & Associates, Inc.; Rogers Corporation; The Chemours Company (Chemours); Daikin Industries, Ltd. (Daikin America, Inc.); AGC Inc. (AGC Chemicals); Guarniflon S.p.A.; Zeus Industrial Products, Inc.; DUNMORE Corporation; and Dongyue Group.

Key Players

- 3M

- AGC Inc. (AGC Chemicals)

- Daikin Industries, Ltd. (Daikin America, Inc.)

- Dongyue Group

- DUNMORE Corporation

- Guarniflon S.p.A.

- Nitto Denko Corporation

- Rogers Corporation

- Saint-Gobain (Compagnie de Saint-Gobain)

- The Chemours Company (Chemours)

- W. L. Gore & Associates, Inc.

- Zeus Industrial Products, Inc.

PTFE Tapes and Films Industry Developments

June 2025: Taconic launched the 6525-08 RD, a next-generation plasma spray masking tape designed to set a new benchmark for thermal spray applications.

PTFE Tapes and Films Market Segmentation

By Technology Outlook (Revenue – USD Million, 2020–2034)

- Skived

- Non-Adhesive

- Adhesive Backed

- Cast

- Non-Adhesive

- Adhesive Backed

- Extruded

- Non-Adhesive

- Adhesive Backed

- Expanded

- Non-Adhesive

- Adhesive Backed

- Others

By Application Outlook (Revenue – USD Million, 2020–2034)

- Medical & Pharmaceuticals

- Chemical Processing

- Automotive

- Aviation & Aerospace

- Electrical & Electronics

- Building & Construction

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

PTFE Tapes and Films Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 864.71 million |

|

Market Size in 2025 |

USD 912.71 million |

|

Revenue Forecast by 2034 |

USD 1,516.00 million |

|

CAGR |

5.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 864.71 million in 2024 and is projected to grow to USD 1,516.00 million by 2034.

The market is projected to register a CAGR of 7.0% during the forecast period.

A few key players in the market include Elanco Animal Health, 3M Company, Medtronic PLC, B. Braun, Virbac SA, NEOGEN Corporation, Dechra Pharmaceuticals PLC, Jorgensen Laboratories, Covetrus, Inc., Vetoquinol SA, and Boehringer Ingelheim.

The surgical wound care products segment accounted for the largest share of the market in 2024.

The livestock animal segment is expected to witness the fastest growth during the forecast period.