Rainscreen Fasteners Market Size, Share, Trends, Industry Analysis Report

By Facades Product (Mechanical Visible Fixing, Mechanical Invisible Fixing), By Substructure Product, By Cladding Material, By Substructure Type, By End Use, By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 120

- Format: PDF

- Report ID: PM6016

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

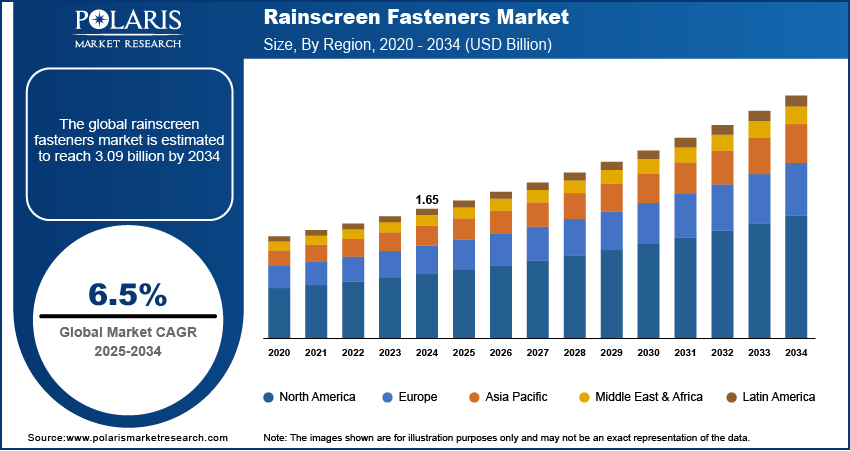

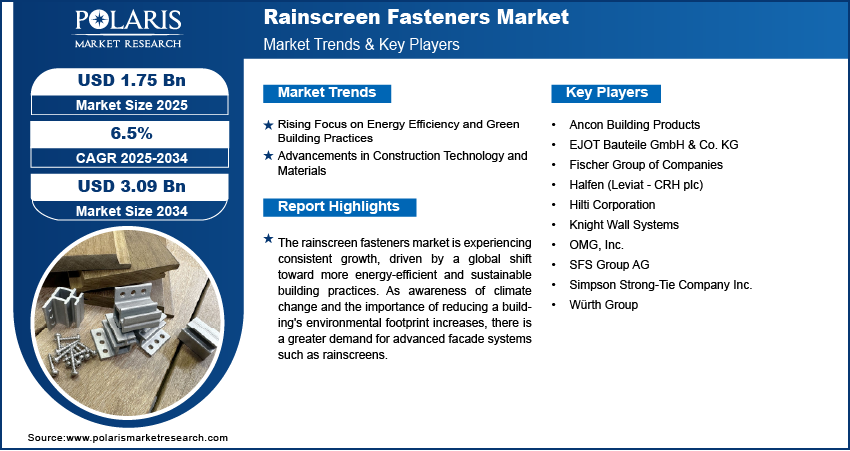

The global rainscreen fasteners market size was valued at USD 1.65 billion in 2024 and is anticipated to register a CAGR of 6.5% from 2025 to 2034. The main growth factors for the rainscreen fasteners are the increasing demand for rainscreen cladding systems in building and construction, the rising focus on energy efficiency and green building practices, and continuous advancements in fastener technology.

Key Insights

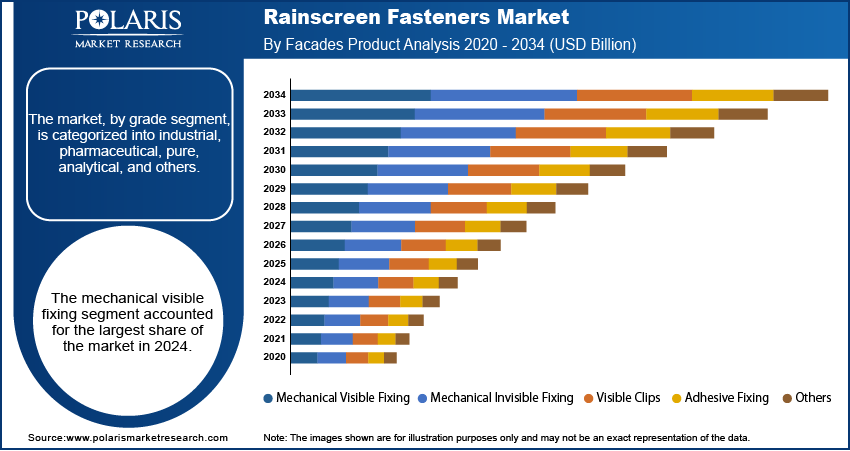

- By facades product, the mechanical visible fixing segment held the largest share in 2024 due to its proven reliability and straightforward installation. Mechanical visible fixings provide strong structural performance, crucial for ensuring the stability and safety of cladding panels on various building types.

- By substructure product, the anchor bolts segment held the largest share in 2024 as they offer robust and secure connections between the rainscreen substructure and the main building structure.

- By cladding material, the metal panels segment held the largest share in 2024 due to their widespread use in commercial, government, and institutional buildings. These materials offer an excellent strength-to-weight ratio, high durability, corrosion resistance, and a long service life, making them ideal for both new construction and renovation projects.

- By substructure type, the aluminum framing systems segment held the largest share in 2024 to their exceptional balance of lightweight properties and structural strength. They provide a robust and versatile substructure for supporting a wide range of cladding materials.

- By end use, the construction & real estate segment held the largest share in 2024, driven by continuous growth in both new construction and renovation activities across residential, commercial, and industrial segments.

- By distribution channel, the direct distribution channel held the largest share in 2024, primarily because of the specialized nature of rainscreen systems and the need for close collaboration between manufacturers and large construction firms.

Rainscreen fasteners are specialized components used to attach exterior cladding panels to a building's substructure, creating a ventilated cavity that helps manage moisture and improve thermal performance. These fasteners are crucial for the proper functioning and durability of modern rainscreen cladding systems.

Modern architectural trends are increasingly prioritizing visually appealing and seamless building facades, which significantly drives the demand for specific types of rainscreen fasteners. Architects and designers are continuously seeking innovative ways to create unique and striking exteriors that make a statement. This often involves using a wide variety of cladding materials, from natural stone and ceramic to metal and advanced composites, each with its own fastening requirements.

The rising stringency of building codes and regulations worldwide, particularly concerning fire safety, energy efficiency, and structural performance, is a major growth factor for the rainscreen fasteners. Governments and regulatory bodies are continuously updating and enforcing stricter standards to ensure buildings are safer, more resilient, and environmentally responsible. These regulations often dictate the type of materials that can be used, the methods of installation, and the performance criteria for building envelopes. Rainscreen systems, by their very nature, are designed to meet many of these elevated standards, especially regarding moisture management, thermal performance, and fire resistance. As a result, the fasteners used in these systems must also comply with these rigorous requirements, leading to demand for higher-quality, more certified, and specialized fastening solutions.

Industry Dynamics

- The increasing use of rainscreen cladding in various building projects worldwide is directly boosting the need for compatible fastening solutions. This trend is seen in both new construction and renovation efforts, as rainscreen systems offer enhanced building performance.

- Stricter building codes and a global push toward sustainable construction methods are driving the adoption of energy-efficient rainscreen systems.

- Continuous innovations in building techniques and the development of new, high-performance materials are improving rainscreen panels and fastener designs.

Rising Focus on Energy Efficiency and Green Building Practices: The global emphasis on sustainable construction and reducing energy consumption in buildings is a significant growth factor for rainscreen fasteners. As environmental concerns grow, there is a strong push toward constructing buildings that are more energy-efficient and have a lower environmental impact. Rainscreen systems, which are inherently designed to improve thermal performance and manage moisture, are becoming a preferred choice in this shift. These systems create a ventilated air cavity between the building's insulation and the exterior cladding, which significantly contributes to better energy performance.

This drive for green buildings is supported by various government initiatives and regulations worldwide. For instance, the U.S. Green Building Council's LEED certification, a widely recognized green building rating system, encourages designs and materials that reduce energy use. According to a 2025 article titled "50+ Green Building Stats: Growth, Impact & Benefits" published by REsimpli, LEED-certified buildings have 34% lower CO2 emissions and consume 25% less energy. Such trends highlight the increasing importance of building components, including rainscreen fasteners, that contribute to achieving these green building standards, thereby driving their demand.

Advancements in Construction Technology and Materials: Ongoing innovations in construction techniques and the development of new materials are significantly influencing the rainscreen fasteners market. As building designs become more complex and the performance requirements for facades increase, there is a continuous need for advanced fastening solutions. This includes fasteners made from more durable, corrosion-resistant resins and materials, as well as designs that allow for quicker and more secure installation. The integration of smarter and more efficient fastening methods is crucial for supporting the evolving construction landscape.

The development of new alloys and composite materials for both cladding panels and fasteners is improving the overall longevity and performance of rainscreen systems. A technical bulletin from Tropical Forest Products on "Rain Screen Clip Design," updated in March 2022, discusses advancements in clip systems, including the use of glass-filled nylon polymer that offers more strength than aluminum while eliminating galvanic reactions. Such innovations enhance the functionality and ease of use for installers, making rainscreen systems more attractive for a wider range of projects. These technological improvements directly contribute to the growing adoption of rainscreen systems and drive the demand for specialized fasteners.

Segmental Insights

Facades Product Analysis

Based on facades product, the segmentation includes mechanical visible fixing, mechanical invisible fixing, visible clips, adhesive fixing, and others. The mechanical visible fixing segment held the largest share in 2024. Mechanical visible fixings offer strong structural performance, which is particularly important for high-rise buildings and structures exposed to harsh weather conditions. Their straightforward installation process also makes them attractive to contractors, as they allow for easy alignment and adjustment of cladding panels. Furthermore, the visible nature of these fixings allows for easier quality control during installation and simplifies long-term maintenance and inspection. This reliability and ease of use in diverse applications, especially with materials such as fiber cement and metal panels, firmly establishes mechanical visible fixings as the leading choice in the current landscape.

The adhesive fixing segment is anticipated to register the highest growth rate during the forecast period. This rapid expansion is mainly fueled by a growing architectural preference for clean, uninterrupted facade aesthetics. Adhesive systems eliminate the need for visible screws or clips, resulting in a sleek and seamless building exterior that aligns with modern design trends. Beyond aesthetics, adhesive fixings also offer performance benefits such as reducing thermal bridging, which can improve a building's energy efficiency by minimizing heat loss through fasteners.

Substructure Product Analysis

Based on substructure product, the segmentation includes anchor bolts, chemical anchors, self-tapping screws, expansion bolts, and others. The anchor bolts segment held the largest share in 2024. Anchor bolts are essential for creating strong and stable connections between the rainscreen substructure and the primary building structure, especially in applications where high load-bearing capacity and long-term durability are critical. This includes large commercial buildings, high-rise structures, and projects in areas prone to significant wind loads or seismic activity. Their ability to provide a secure mechanical fix into concrete, masonry, or other robust substrates makes them a foundational component for many rainscreen installations.

The chemical anchors segment is anticipated to register the highest growth rate during the forecast period. This rising trend is driven by their suitability for complex anchoring fastener conditions and retrofit projects where traditional mechanical fixings might be challenging or less effective. Chemical anchors involve injecting a resin into a drilled hole, which then cures to create a strong, durable, and highly secure bond with the substrate, often offering superior load distribution and exceptionally high bond strength.

End Use Analysis

Based on end use, the segmentation includes construction & real estate, energy & utilities, industrial & manufacturing, government & public sector, and others. The construction & real estate segment held the largest share in 2024, driven by the continuous demand for new building projects, as well as the renovation and retrofitting of existing structures across residential, commercial, and industrial segments. Modern construction practices increasingly prioritize energy efficiency, durability, and aesthetic appeal, all of which are significantly enhanced by the use of rainscreen cladding systems. These systems, and by extension, their specialized fasteners, play a crucial role in preventing moisture ingress, improving thermal performance, and extending the lifespan of building facades.

The government and public sector segment is anticipated to record the highest growth rate during the forecast period. This accelerated growth is largely attributed to increasing investments in public infrastructure projects, including government buildings, educational institutions, healthcare facilities, and transportation hubs. There is a growing global trend for public buildings to meet higher standards of sustainability, energy efficiency, and long-term resilience. Government mandates and initiatives aimed at reducing carbon footprints and improving the performance of public assets are compelling the adoption of advanced building envelopes such as rainscreen systems.

Distribution Channel Analysis

Based on distribution channel, the segmentation includes direct and indirect. The direct segment held a larger share in 2024. This dominance stems from the specialized nature of rainscreen systems, which often require close collaboration between manufacturers and large-scale construction firms, facade contractors, and project developers. Direct sales allow manufacturers to offer tailored technical support, specialized product customization, and comprehensive after-sales services, which are critical for complex building projects. This channel provides a streamlined supply chain, ensuring that the right fasteners are delivered precisely when needed, minimizing delays and errors on critical construction timelines.

The indirect distribution channel is anticipated to register the highest growth rate during the forecast period. This growth is driven by the increasing awareness and adoption of rainscreen systems among a wider range of builders, including smaller contractors and those involved in mid-sized commercial or residential projects. Indirect channels, which include distributors, wholesalers, and retailers, offer crucial logistical support, localized inventory, and quicker delivery times for smaller, more routine orders.

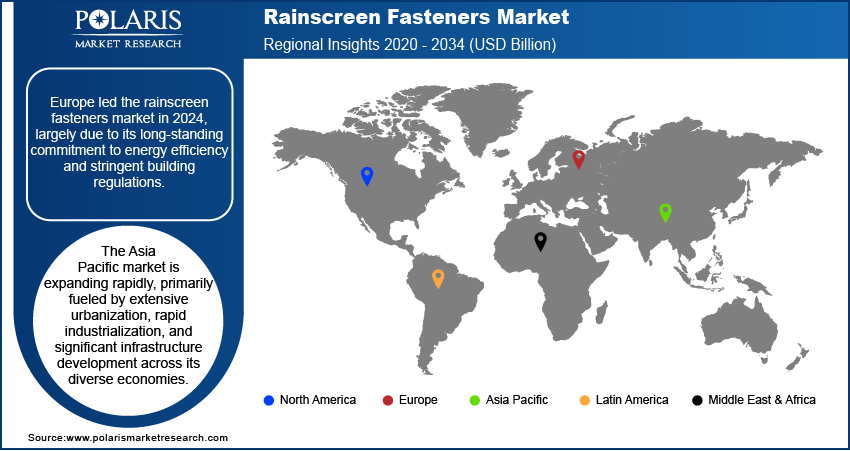

Regional Analysis

Europe Rainscreen Fasteners Market Overview

Europe held the largest share of the global market in 2024. Europe represents a mature and substantial market for rainscreen fasteners, heavily influenced by its long-standing commitment to energy efficiency and stringent building regulations. Countries across Europe have actively adopted directives and standards aimed at reducing building energy consumption and enhancing safety. This regulatory environment has spurred widespread adoption of rainscreen cladding systems, which inherently improve thermal insulation and moisture management in buildings. It is also driven by a strong architectural heritage that values both aesthetics and durability, leading to a high demand for advanced and long-lasting facade solutions.

The Germany rainscreen fasteners market plays a key role in Europe. It is at the forefront of adopting new building technologies and sustainable practices. The country's robust construction sector, combined with its ambitious energy efficiency targets and emphasis on high-quality engineering, makes it a significant driver for rainscreen system demand. German architects and builders prioritize durable, high-performance facade solutions that contribute to reducing energy consumption and providing a comfortable indoor climate. This focus on long-term building performance and strict adherence to technical standards ensures a consistent and strong demand for advanced rainscreen fasteners in Germany.

North America Rainscreen Fasteners Market Trends

North America is a significant region for rainscreen fasteners, with steady demand driven by both new construction and renovation activities. The region's focus on sustainable building practices and stricter energy efficiency codes, such as those promoted by LEED and the International Energy Conservation Code (IECC) in the U.S., actively supports the adoption of rainscreen cladding systems. This boosts the demand for compatible fastening solutions. There is also a strong emphasis on architectural aesthetics and building longevity, leading to the use of high-performance facade systems that rely on durable and reliable fasteners.

U.S. Rainscreen Fasteners Market Analysis

In North America, the U.S. is a leading country in the North America rainscreen fasteners sector. The country's strong construction activity, coupled with a growing awareness of the benefits of rainscreen systems, contributes to its prominent position. The landscape in the U.S. is also characterized by a focus on technological advancements, with manufacturers developing innovative fasteners that offer improved corrosion resistance, thermal performance, and ease of installation. This is particularly important for commercial and institutional projects where durability and compliance with stringent building regulations are critical. The ongoing development of green building initiatives further reinforces the demand for advanced rainscreen fastener solutions across the U.S.

Asia Pacific Rainscreen Fasteners Market Overview

The Asia Pacific market is expanding rapidly, owing to extensive urbanization, rapid industrialization, and significant infrastructure development across its diverse economies. Countries in this region are experiencing a boom in residential, commercial, and public sector construction projects, leading to a substantial increase in demand for modern building materials and systems. As living standards rise and environmental awareness grows, there is an increasing adoption of energy-efficient and aesthetically pleasing building facades, which prominently feature rainscreen cladding. This rapid pace of development, coupled with a growing emphasis on sustainable construction, is a key factor driving the demand for rainscreen fasteners across Asia Pacific.

China Rainscreen Fasteners Market Insights

China stands out as a dominant country in Asia Pacific. Its unparalleled rate of urbanization and massive investments in infrastructure development, including smart cities and large-scale commercial complexes, create immense opportunities for rainscreen cladding systems. The Chinese construction industry and industry fasteners are increasingly integrating modern architectural designs and prioritizing energy-efficient building envelopes to meet environmental goals and accommodate its vast population growth. This strong government support for sustainable construction, combined with a large manufacturing base and a continuous pipeline of mega-projects, makes China a powerhouse in the demand for rainscreen fasteners within Asia Pacific.

Key Players and Competitive Insights

The rainscreen fasteners market features a competitive landscape with several major players vying for share. Companies, including Hilti, SFS Group AG, EJOT, Fischer Group of Companies, and the Würth Group, offer a diverse range of fastening solutions designed to meet the evolving demands of modern construction. The competition is primarily based on product innovation, material advancements, technical support, and the ability to provide comprehensive fastening systems that comply with various building codes and performance standards. Companies are continuously investing in research and development to offer more efficient, durable, and sustainable fastener options, often emphasizing ease of installation and long-term reliability for complex facade applications.

A few prominent companies in the industry include Hilti Corporation; SFS Group AG; EJOT Bauteile GmbH & Co. KG; Fischer Group of Companies; Würth Group; Simpson Strong-Tie Company Inc.; OMG, Inc. (FastenMaster); Knight Wall Systems; Halfen (CRH plc); and Ancon Building Products (Leviat - CRH plc).

Key Players

- Ancon Building Products

- EJOT Bauteile GmbH & Co. KG

- Fischer Group of Companies

- Halfen (Leviat - CRH plc)

- Hilti Corporation

- Knight Wall Systems

- OMG, Inc.

- SFS Group AG

- Simpson Strong-Tie Company Inc.

- Würth Group

Rainscreen Fasteners Industry Development

April 2024: 4PS by Hilti, a software supplier for the construction industry, launched a new branch in Sweden. This expansion indicates Hilti's continued investment in digital solutions that support the construction industry, which can indirectly benefit the adoption and efficient management of projects involving rainscreen fasteners.

Rainscreen Fasteners Market Segmentation

By Facades Product Outlook (Revenue – USD Billion, 2020–2034)

- Mechanical Visible Fixing

- Mechanical Invisible Fixing

- Visible Clips

- Adhesive Fixing

- Others

By Substructure Product Outlook (Revenue – USD Billion, 2020–2034)

- Anchor Bolts

- Chemical Anchors

- Self-Tapping Screws

- Expansion Bolts

- Others

By Cladding Material Product Outlook (Revenue – USD Billion, 2020–2034)

- High-Pressure Laminate

- Natural Stone

- Fiber Cement Panels

- Ceramic & Porcelain Panels

- Metal Panels

- Glass Panels

- Wood & Composite Panels

- Terracotta

- Building Integrated Photovoltaics

- Aluminum Composite Panels

- Others

By Substructure Type Product Outlook (Revenue – USD Billion, 2020–2034)

- Aluminum Framing Systems

- Steel Support Structures

- Wood Framing

- Hybrid Substructures

- Stainless Steel Substructures

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Construction & Real Estate

- Energy & Utilities

- Industrial & Manufacturing

- Government & Public Sector

- Others

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Direct

- Indirect

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Rainscreen Fasteners Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.65 billion |

|

Market Size in 2025 |

USD 1.75 billion |

|

Revenue Forecast by 2034 |

USD 3.09 billion |

|

CAGR |

6.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.65 billion in 2024 and is projected to grow to USD 3.09 billion by 2034.

The global market is projected to register a CAGR of 6.5% during the forecast period.

Europe dominated the market share in 2024.

A few key players in the market include Hilti Corporation; SFS Group AG; EJOT Bauteile GmbH & Co. KG; fischer Group of Companies; Würth Group; Simpson Strong-Tie Company Inc.; OMG, Inc. (FastenMaster); Knight Wall Systems; Halfen (CRH plc); and Ancon Building Products (Leviat - CRH plc).

The mechanical visible fixing segment accounted for the largest share of the market in 2024.

The chemical anchors segment is expected to witness the fastest growth during the forecast period.