Satellite NTN Market Size, Share, Trends, Industry Analysis Report

By Component (Hardware, Software), By Frequency, By Orbit, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 120

- Format: PDF

- Report ID: PM6015

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

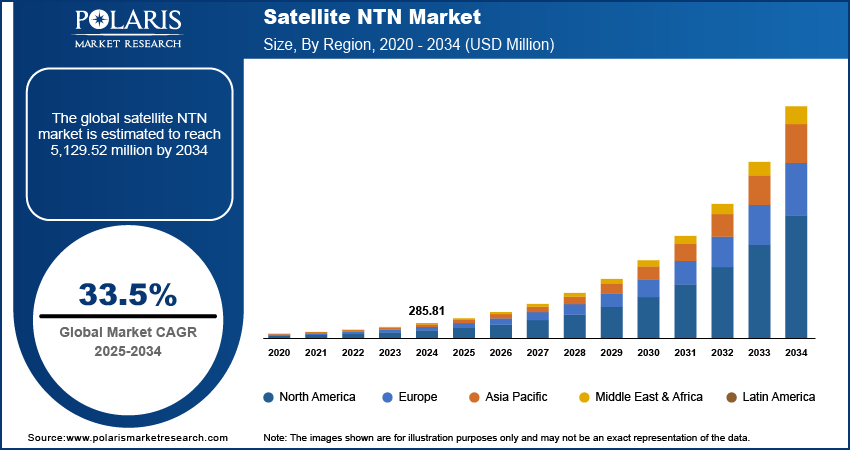

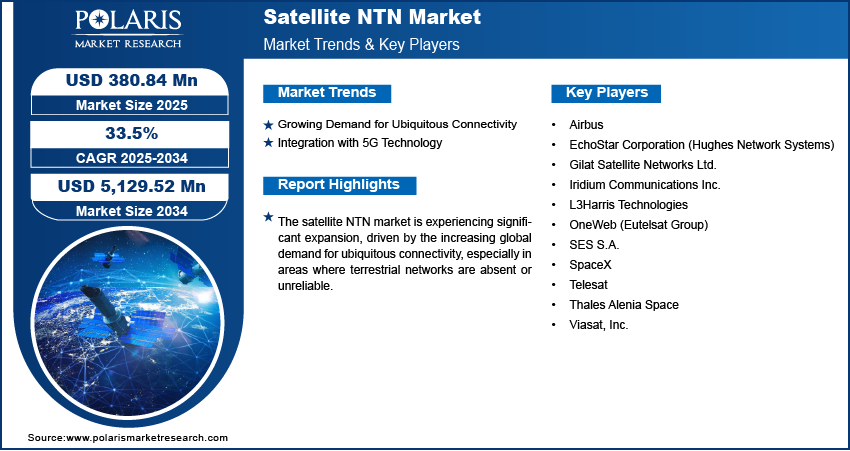

The global satellite non-terrestrial network (NTN) market size was valued at USD 285.81 million in 2024 and is anticipated to register a CAGR of 33.5% from 2025 to 2034. The industry is driven by the growing demand for global connectivity, especially in remote areas where traditional networks are limited.

Key Insights

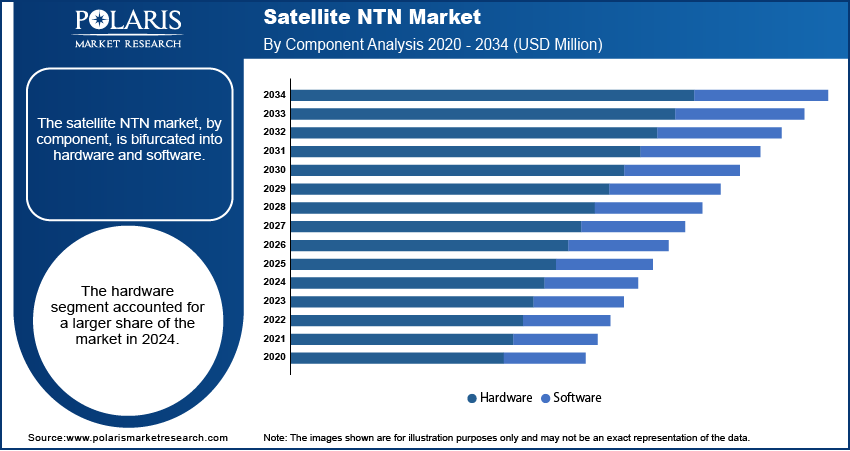

- By component, the hardware segment held a larger share in 2024, largely due to the fundamental need for physical infrastructure such as satellites themselves, ground stations, antennas, and various terminal equipment.

- In terms of frequency, the Ka-band frequency segment held the largest share in 2024 due to its superior capacity for high-throughput data transmission and wide bandwidth.

- Based on orbit, the LEO segment held the largest share in 2024, primarily owing to its inherent advantages of low latency and high data transfer speeds resulting from the satellites' close proximity to Earth.

- By end use, the commercial sector held the largest share in 2024, driven by widespread adoption of satellite connectivity across diverse industries such as maritime, aviation, energy, and agriculture.

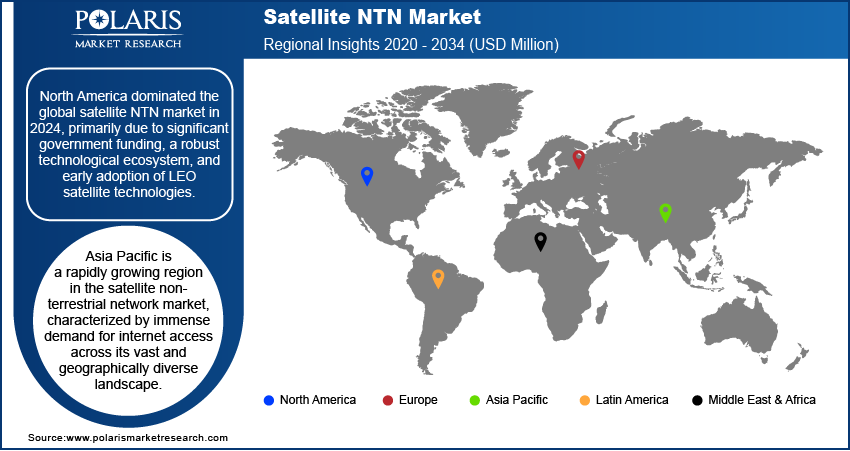

- By region, North America held the largest share in 2024, primarily due to significant government funding, a robust technological ecosystem, and the early adoption of LEO satellite technologies.

The satellite NTN (non-terrestrial network) involves the use of satellite communication systems to provide connectivity, extending beyond the reach of traditional land-based networks. This technology aims to bridge digital divides by offering satellite internet access and communication services in remote, rural, and underserved areas, as well as for mobile platforms such as ships and aircraft.

The rising demand for ubiquitous Internet of Things (IoT) connectivity propels the requirement for satellite NTN. Many IoT applications, such as asset tracking, environmental monitoring, smart agriculture, and industrial automation, operate in remote or widespread areas where terrestrial cellular networks are unavailable. Satellite NTNs provide the essential backhaul and direct connectivity for these devices, enabling data collection and control from virtually anywhere on Earth. As the number of connected IoT devices continues to grow exponentially, the need for a global and reliable communication infrastructure that only satellites can provide becomes increasingly critical, driving the expansion of satellite NTN solutions tailored for IoT.

The critical need for resilient and reliable communication during natural disasters and emergencies is another major driver. When terrestrial communication infrastructure is damaged or destroyed by calamities such as earthquakes, hurricanes, or floods, satellite networks often remain operational due to their independence from ground-based systems. This makes them indispensable for coordinating emergency response efforts, facilitating communication among first responders, and providing essential connectivity for affected populations. Satellite NTNs ensure that critical information can be shared and relief operations can be managed effectively, even in the most challenging post-disaster environments.

Industry Dynamics

- The growing demand for connectivity everywhere, including remote and rural areas, is a major driver. This also applies to mobile platforms such as ships and airplanes.

- The way satellite networks are integrated with 5G technology is creating new chances for smooth and advanced communication.

- New developments in satellite technology, such as placing many small satellites in low Earth orbit and using rockets that can be reused, are making satellite NTNs more practical and affordable.

Growing Demand for Ubiquitous Connectivity: The increasing global demand for constant and widespread connectivity drives the industry growth. Many parts of the world still lack reliable internet access, hindering economic and social development. Satellite NTNs can bridge this gap by providing broadband services to remote and underserved communities, as well as to sectors such as maritime and aviation that operate beyond the reach of traditional ground networks. This drive for universal access pushes the expansion of satellite infrastructure and services.

The Press Information Bureau (PIB), Government of India, in its "Universal connectivity and Digital India initiatives reaching to all areas, including tier-2/3 cities and villages" released on August 2, 2024, highlighted that as of April 2024, 95.15% of villages in India had access to internet with 3G/4G mobile connectivity. While significant progress has been made, the remaining percentage, especially in hard-to-reach areas, still represents a substantial opportunity for satellite-based solutions to ensure true ubiquitous connectivity. This ongoing effort to connect the unconnected is a fundamental driver for the demand for the satellite NTN.

Integration with 5G Technology: The ongoing integration of satellite NTNs with 5G cellular technology is a major force shaping the growth. This convergence aims to create a hybrid network that leverages the strengths of both terrestrial 5G for high-density areas and satellite NTNs for wide-area coverage, especially in remote or challenging environments. This enables new applications and services that require continuous, high-performance connectivity regardless of location. The standardization efforts by bodies such as 3GPP are making this integration a reality, fostering a unified ecosystem.

According to a 3GPP article titled "Rel-18 Status and Rel-19 Progress in TSG RAN" published on March 7, 2024, Release 18 and the ongoing work in Release 19 of 3GPP standards include significant focus on non-terrestrial networks (NTN) evolution for both new radio (NR) and IoT applications. This dedicated effort by a leading global standards body underscores the importance and maturity of integrating NTNs into the future of 5G, directly driving the development and adoption of satellite NTN solutions. This standardization and integration are crucial for enabling widespread commercial deployment and scaling the growth.

Segmental Insights

Component Analysis

Based on component, the segmentation includes hardware and software. The hardware segment held a larger share in 2024, due to the essential physical components required to establish and maintain these complex networks. This includes the manufacturing and deployment of satellites themselves, whether they are in low Earth orbit (LEO), medium Earth orbit (MEO), or geostationary orbit (GEO). Additionally, ground infrastructure, such as antennas, transceivers, base stations, and other earth terminal equipment, forms a substantial part of the hardware segment. The continuous launch of new satellite constellations, particularly the large LEO constellations, drives significant investment in hardware.

The software segment is anticipated to register a higher growth rate during the forecast period. This growth is driven by the increasing complexity of managing vast satellite constellations and integrating them seamlessly with existing terrestrial 5G networks. Software plays a critical role in network orchestration, enabling dynamic resource allocation, automated fault management, and optimizing data flow between satellites and ground stations. As satellite NTN services become more sophisticated, there is a rising demand for advanced software solutions for network virtualization, artificial intelligence-driven analytics, and cybersecurity.

Frequency Analysis

Based on frequency, the segmentation includes L-Band, S-Band, C-Band, KU- Band, Ka-Band, and HF/VHF/UHF-Bands. The Ka-Band segment held the largest share in 2024. This dominance stems from its ability to support high-throughput data transmission and provide wide bandwidth. As Ka-band operates at higher frequencies, typically between 26.5 GHz and 40 GHz, it allows for significantly faster internet speeds and greater data capacity compared to lower frequency bands. This makes it ideal for data-intensive applications such as broadband internet access, video streaming, and enterprise connectivity, particularly for LEO and GEO satellite deployments. The demand for high-speed, low-latency communication is continuously growing across various end-use sectors, including commercial, government, and defense applications.

The L-band frequency segment is anticipated to register the highest growth rate during the forecast period. This growth is primarily driven by its excellent propagation characteristics and reliability, even in adverse weather conditions, and its suitability for mobile and low-power applications. L-band, operating typically from 1 to 2 GHz, offers strong signal penetration through obstacles such as buildings and vegetation, making it highly effective for ubiquitous connectivity in challenging environments. It is particularly favored for mobile satellite services (MSS), including maritime, aviation, and land mobile communications, as well as for Internet of Things (IoT) devices.

Orbit Analysis

Based on orbit, the segmentation includes LEO, GEO, and MEO. The LEO segment held the largest share in 2024. This is primarily due to the inherent advantages of LEO satellites, such as their close proximity to Earth, which results in significantly lower latency and higher data transfer speeds compared to satellites in higher orbits. These characteristics make LEO constellations ideal for applications requiring real-time communication, such as high-speed broadband internet, video conferencing, and mobile connectivity, directly addressing the growing demand for low-latency services. The rapid deployment of large LEO constellations by several key players, driven by significant investments from both private and public sectors, has greatly expanded their global coverage and capacity, thus solidifying LEO's leading position.

The LEO segment is anticipated to exhibit the highest growth rate during the forecast period. This strong growth forecast is a continuation of the aggressive deployment strategies seen in recent years, with more mega-constellations planned for launch. The ongoing development of direct-to-device communication capabilities, allowing regular smartphones to connect directly to satellites, is a major factor boosting this growth. Furthermore, the decreasing cost of manufacturing and launching LEO satellites, combined with advancements in satellite technology such as miniaturization and improved onboard processing, makes these deployments increasingly economical and scalable.

End Use Analysis

Based on end use, the segmentation includes commercial, defense, and government. The commercial segment held the largest share in 2024. This is mainly driven by the widespread adoption of satellite-based connectivity across various industries. Businesses are increasingly relying on satellite NTNs for reliable, high-speed internet access in remote locations, such as construction sites, energy exploration areas, and agricultural operations, where terrestrial infrastructure is limited or nonexistent. Furthermore, the maritime and aviation sectors are major consumers of commercial satellite NTN services for onboard connectivity, navigation, and operational communications. The growing demand for enhanced mobile broadband services, especially in underserved areas, and the rising need for IoT connectivity in various commercial applications, such as asset tracking and remote monitoring, significantly contribute to the commercial segment's dominant position.

The defense segment is anticipated to register the highest growth rate during the forecast period. This accelerated growth is fueled by increasing global geopolitical tensions and the rising importance of secure and resilient communication for military operations worldwide. Defense organizations are rapidly adopting satellite NTNs for critical applications such as battlefield communication; intelligence, surveillance, and reconnaissance (ISR); and command and control. These networks provide reliable and robust connectivity in hostile or remote environments where traditional communication methods might be compromised or unavailable.

Regional Analysis

The North America satellite NTN market accounted for the largest share in 2024, largely driven by substantial government funding and early adoption of LEO constellations. The region benefits from a robust technological environment and significant investments in advancing satellite communication capabilities. The widespread demand for broadband in rural areas, coupled with major advancements in LEO satellite deployments from private sector companies, further accelerates innovation and adoption. This proactive approach to integrating satellite technology into the broader communication landscape makes North America a leading region for satellite NTN development and deployment.

U.S. Satellite NTN Market Insights

The U.S. plays a crucial role in the North America market, demonstrating a strong commitment to enhancing global connectivity. The country benefits from a favorable regulatory environment and substantial investments in both commercial and defense satellite programs. Key telecommunication providers are actively partnering with satellite operators to ensure extensive, always-on connectivity, even in remote and previously underserved areas. This strong collaborative ecosystem and a focus on integrating satellite capabilities with advanced cellular networks, such as 5G, position the U.S. as a major force in driving the regional market.

Europe Satellite NTN Market Trends

Europe is a dynamic region in the global satellite non-terrestrial network industry, showing strong growth driven by increasing demand for reliable connectivity across its diverse geography. The region's focus on digital transformation and its commitment to bridging the digital divide, particularly in rural and remote areas, are key factors. European countries are actively investing in next-generation communication infrastructure, including the integration of satellite NTNs with 5G and future 6G networks. Initiatives from organizations that promote space technology and connectivity are fostering research and development, leading to innovative solutions and greater adoption of satellite-based services for both commercial and governmental applications.

The Germany satellite NTN market stands out as a major contributor in Europe. The country's strong industrial base, advanced technological capabilities, and strategic investments in space infrastructure are significant drivers. Germany is actively involved in developing and deploying advanced satellite technologies, including those related to LEO constellations and advanced ground segments. The nation's focus on high-speed broadband access for all its citizens and its emphasis on critical communications for various sectors, including automotive and logistics, further propel the demand for satellite NTN solutions. This commitment to technological leadership and widespread connectivity positions Germany as a key player in the European satellite NTN landscape.

Asia Pacific Satellite NTN Market Overview

Asia Pacific is a rapidly growing region in the global satellite non-terrestrial network market, characterized by immense demand for internet access across its vast and geographically diverse landscape. Many parts of the region, especially rural and island communities, still lack adequate terrestrial infrastructure, making satellite NTNs a vital solution for extending connectivity. Governments and private entities across Asia Pacific are increasingly recognizing the strategic importance of satellite communication for economic development, disaster management, and public safety. This strong push for digital inclusion and the need for resilient communication systems in challenging terrains are major factors driving the adoption and expansion of satellite NTN services across the region.

China Satellite NTN Market Outlook

China is a significant country within the Asia Pacific satellite NTN market, demonstrating substantial progress and investments in this sector. The country is rapidly expanding its space capabilities, including the development and launch of its own LEO and GEO satellite constellations. China's ambitious national strategies for digital connectivity and its focus on integrating satellite communication with its extensive 5G network are propelling the growth of its satellite NTN. The demand for reliable and high-capacity communication for various applications, ranging from remote sensing and agricultural monitoring to disaster relief and defense, further underscores China's crucial role in shaping the regional satellite NTN landscape.

Key Players and Competitive Insights

The satellite non-terrestrial network (NTN) market sees a dynamic competitive landscape with key players such as SpaceX (Starlink), OneWeb (Eutelsat Group), Amazon (Project Kuiper), Iridium Communications Inc., and SES S.A. These companies are heavily investing in deploying and expanding their satellite constellations, particularly in LEO, to offer global connectivity solutions. The competitive environment is marked by rapid technological advancements, strategic partnerships between satellite operators and terrestrial telecom providers, and a strong focus on enhancing service capabilities such as low latency and high bandwidth. This intense competition is driving innovation in satellite design, launch capabilities, and the integration of NTNs with 5G NTN networks, aiming to capture share across commercial, defense, and government end-use segments.

A few prominent companies in the industry include SpaceX; OneWeb (Eutelsat Group); Iridium Communications Inc.; SES S.A.; Telesat, Viasat, Inc.; EchoStar Corporation (Hughes Network Systems); Thales Alenia Space (Thales Group and Leonardo S.p.A.); Airbus; L3Harris Technologies; and Gilat Satellite Networks Ltd.

Key Players

- Airbus

- EchoStar Corporation (Hughes Network Systems)

- Gilat Satellite Networks Ltd.

- Iridium Communications Inc.

- L3Harris Technologies

- OneWeb (Eutelsat Group)

- SES S.A.

- SpaceX

- Telesat

- Thales Alenia Space (Thales Group and Leonardo S.p.A.)

- Viasat, Inc.

Satellite NTN Industry Developments

July 2025: Starlink, a division of SpaceX, received final regulatory approval from India to launch its high-speed internet services in the country.

May 2025: Iridium announced a new partnership with Syniverse to support the rollout of Iridium NTN Direct service, integrating with Syniverse's global platform.

Satellite NTN Market Segmentation

By Component Outlook (Revenue – USD Million, 2020–2034)

- Hardware

- Software

By Frequency Outlook (Revenue – USD Million, 2020–2034)

- L-Band

- S-Band

- C-Band

- KU- Band

- Ka-Band

- HF/VHF/UHF-Bands

By Orbit Outlook (Revenue – USD Million, 2020–2034)

- LEO

- GEO

- MEO

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Commercial

- Defense

- Government

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Satellite NTN Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 285.81 million |

|

Market Size in 2025 |

USD 380.84 million |

|

Revenue Forecast by 2034 |

USD 5,129.52 million |

|

CAGR |

33.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 285.81 million in 2024 and is projected to grow to USD 5,129.52 million by 2034.

The global market is projected to register a CAGR of 33.5% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market are SpaceX; OneWeb (Eutelsat Group); Iridium Communications Inc.; SES S.A.; Telesat, Viasat, Inc.; EchoStar Corporation (Hughes Network Systems); Thales Alenia Space (Thales Group and Leonardo S.p.A.); Airbus; L3Harris Technologies; and Gilat Satellite Networks Ltd.

The hardware segment accounted for the largest share in 2024.

The L-band segment is expected to witness the fastest growth during the forecast period.