U.S. Rainscreen Fasteners Market Size, Share, Trends, Industry Analysis Report

By Facades Product (Mechanical Visible Fixing, Mechanical Invisible Fixing), By Substructure Product, By Cladding Material, By Substructure Type, By End Use, By Distribution Channel – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM6017

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

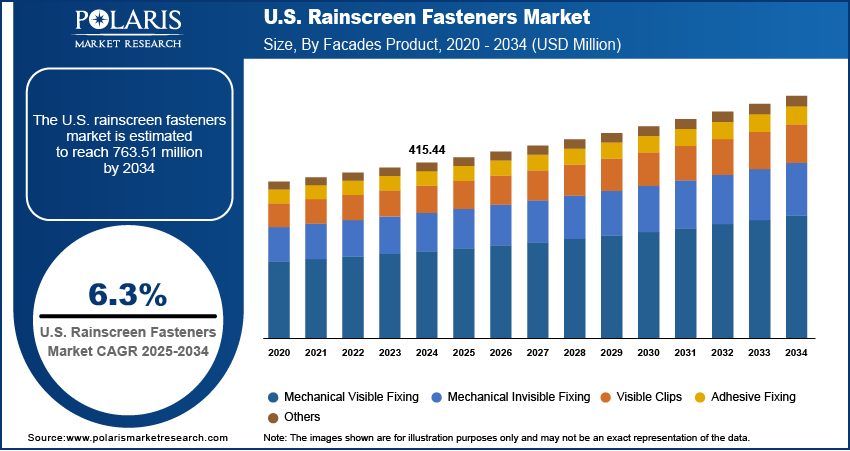

The U.S. rainscreen fasteners market size was valued at USD 415.44 million in 2024 and is anticipated to register a CAGR of 6.3% from 2025 to 2034. The market is driven by growing demand for energy-efficient buildings, stringent building codes, increased focus on sustainable construction, rising urbanization, and advancements in cladding materials and installation technologies promoting durable and moisture-resistant building envelopes.

Key Insights

- By facades product, the mechanical visible fixing segment held the largest share in 2024. This is due to its ease of installation, high structural reliability, and cost-effectiveness, making it a preferred choice for a wide range of commercial and large-scale building projects.

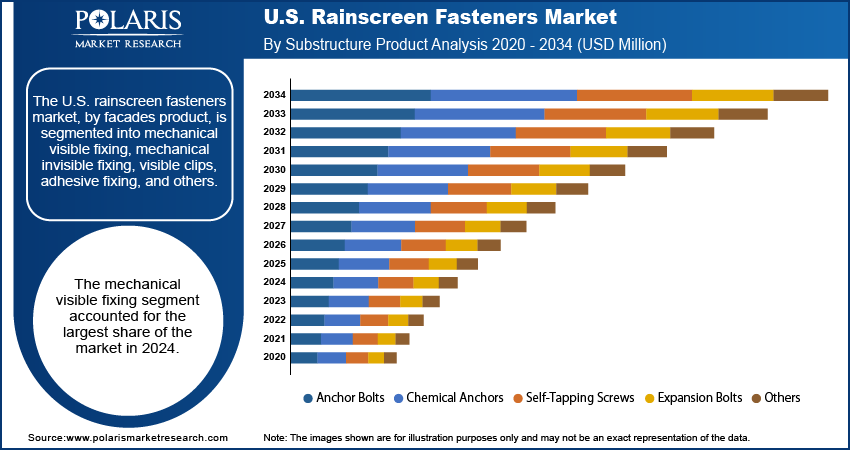

- By substructure product, the anchor bolts segment held the largest share in 2024. Their strong load-bearing capabilities and ability to provide secure connections to concrete and masonry structures make them essential for ensuring the stability and safety of building facades.

- By cladding material, the metal panels segment, including aluminum, steel, and zinc, held the largest share in 2024. Their widespread use in commercial, government, and institutional architecture is attributed to their favorable strength-to-weight ratio, durability, and modern aesthetic appeal.

- By substructure type, the aluminum framing systems segment held the largest share in 2024. This dominance is driven by their excellent balance of lightweight properties, high structural strength, and resistance to corrosion, making them highly versatile for various rainscreen applications.

- By end use, the construction and real estate sector held the largest share in 2024. This is driven by ongoing new construction, renovation projects across residential and commercial buildings, and the growing adoption of rainscreen systems to enhance building performance and sustainability.

- By distribution channel, the direct distribution channel segment held the largest share in 2024. This preference stems from large construction firms and façade contractors directly engaging with manufacturers for bulk procurement, technical support, and tailored solutions for their specific project requirements.

Rainscreen fasteners are special hardware items that connect exterior wall panels, or cladding, to a building's structure. They are a key part of rainscreen systems, which create a ventilated gap behind the cladding to help manage moisture and improve energy efficiency. These fasteners are available in various materials, such as stainless steel and aluminum, to suit different cladding systems and types and building needs.

Ongoing technological advancements in fastener design are significantly driving the U.S. rainscreen fasteners market. Manufacturers are continuously innovating to create fasteners that are more efficient, durable, and adaptable to various building materials and design complexities. These advancements include the development of corrosion-resistant resins and materials, specialized coatings, and thermally broken fasteners that minimize heat transfer, further enhancing the energy performance of rainscreen systems. Innovations in concealed fastening systems are also gaining traction, allowing for cleaner, more modern aesthetic finishes without visible hardware.

The increasing adoption of modular and prefabricated construction methods is another important driver for the U.S. rainscreen fasteners market. In modular construction, building components, including facade assemblies, are manufactured off-site in a controlled environment and then transported to the construction site for assembly. This method offers advantages such as faster construction times, reduced waste, and improved quality control. Rainscreen fasteners and industrial fasteners play a crucial role in these systems, enabling efficient and secure attachment of pre-assembled panels and modules.

Industry Dynamics

- The U.S. rainscreen fasteners market is significantly driven by the increasing emphasis on creating energy-efficient buildings, where rainscreen systems are crucial for improving thermal performance and reducing overall energy consumption.

- Another major driver for the U.S. rainscreen fasteners market is the rise in stringent building codes and fire safety regulations.

- Continuous technological advancements in fastener design are also fueling the U.S. market demand.

- The increasing adoption of modular and prefabricated construction methods is boosting demand for rainscreen fasteners in the U.S.

Growing Demand for Energy-Efficient Buildings: The increasing focus on energy efficiency in buildings is a primary driver for the U.S. rainscreen fasteners market. Rainscreen systems help create a thermally efficient building envelope by allowing for continuous insulation and managing moisture, which significantly reduces energy consumption for heating and cooling. This leads to lower utility bills and a smaller carbon footprint for buildings.

The U.S. Department of Energy (DOE) reported in their "NREL Researchers Reveal How Buildings Across United States Do—and Could—Use Energy" article in September 2023, that buildings are responsible for 40% of the total energy use in the U.S. This significant energy consumption highlights the ongoing need for solutions such as rainscreen systems that can improve building performance. This strong push toward energy conservation across the U.S. is directly boosting the demand for rainscreen fasteners.

Strict Building Codes and Fire Safety Regulations: The introduction of stringent building codes and fire safety regulations is another major factor driving the U.S. rainscreen fasteners market growth. These regulations often require non-combustible materials and specific assembly designs for exterior wall systems, especially in taller buildings. Rainscreen systems, when properly designed with appropriate fasteners, can meet these rigorous safety standards.

The National Fire Protection Association (NFPA) 285 standard, which is widely adopted in the U.S. building codes such as the International Building Code (IBC), specifically tests the fire propagation characteristics of exterior wall assemblies. This test evaluates how fire can spread through the entire wall system, including the cladding, insulation, and fasteners. The need to comply with such critical safety standards, as detailed in various architectural and engineering publications discussing NFPA 285, ensures that rainscreen systems and their specialized fasteners are essential for meeting current safety requirements, thereby driving their growth.

Segmental Insights

Facades Product Analysis

Based on facades product, the segmentation includes mechanical visible fixing, mechanical invisible fixing, visible clips, adhesive fixing, and others. The mechanical visible fixing segment held the largest share in 2024. This dominance is attributed to its straightforward installation, reliable structural performance, and cost-effectiveness, especially for big commercial and institutional projects. Builders and installers often favor visible fixings as they are easy to align and adjust, which is very helpful when working with dense materials such as fiber cement or metal panels. These fasteners provide a strong mechanical connection between the facade panels and the building’s frame, ensuring long-term stability and resistance to various environmental stresses.

The adhesive fixing segment is anticipated to register the highest growth rate during the forecast period. This trend is driven by a growing preference for sleek, uninterrupted facade finishes in modern architecture. Adhesive systems remove the need for visible mechanical fasteners, offering a clean, smooth look that many contemporary designs require, especially in high-end residential and commercial buildings where visual appeal is crucial. These systems are particularly well-suited for lighter cladding materials and renovation projects where drilling might damage the existing surface. The ability of adhesive fixings to reduce thermal bridging, which can improve a building’s energy performance, also contributes to their rising popularity.

Substructure Product Analysis

Based on substructure product, the segmentation includes anchor bolts, chemical anchors, self-tapping screws, expansion bolts, and others. The anchor bolts segment held the largest share in 2024. Their widespread use is attributed to their critical role in securely attaching rainscreen substructures to the main building frame, especially in concrete or masonry buildings. Anchor bolts offer high load-bearing capacity and a very strong connection, which is essential for the stability and safety of tall buildings and large commercial projects. They are versatile and can be used in many different construction scenarios, making them a go-to choice for engineers and contractors who prioritize durability and structural integrity. The reliability and established performance of anchor bolts and anchoring fasteners in heavy-duty applications contribute significantly to their dominant position in the market.

The chemical anchors segment is anticipated to register the highest growth rate during the forecast period, driven by their ability to provide superior load distribution and extremely high bond strength, even in challenging base materials or when dealing with irregular surfaces. Chemical anchors work by injecting a resin into a drilled hole, which then hardens around the threaded rod or rebar, creating a bond that is often stronger than the base material itself. This method helps avoid the stress points that mechanical anchors can create, making them ideal for delicate substrates or for situations where crack resistance is vital.

End Use Analysis

Based on end use, the segmentation includes construction & real estate, energy & utilities, industrial & manufacturing, government & public sector, and others. The construction & real estate segment held the largest share in 2024, driven by the continuous demand for new residential, commercial, and institutional buildings, as well as significant renovation and retrofitting projects. Rainscreen systems are increasingly being specified in these projects due to their proven benefits in enhancing building performance, including improved energy efficiency, moisture management, and façade longevity. The ongoing urban development, coupled with a focus on creating durable and sustainable structures, ensures a steady and substantial demand for rainscreen fasteners in this end use segment.

The government and public sector is anticipated to exhibit the highest growth rate during the forecast period. This growth is largely fueled by government initiatives to modernize public infrastructure, improve the energy efficiency of government buildings, and adhere to stringent safety and sustainability mandates. There is a growing commitment to "green building" practices in public projects, often driven by policies aimed at reducing carbon emissions and operational costs over the long term. Public sector buildings, such as schools, hospitals, and administrative offices, are increasingly being designed or renovated with advanced building envelope solutions, including rainscreen systems, to achieve these goals.

Distribution Channel Analysis

Based on distribution channel, the segmentation includes direct and indirect. The direct segment held the largest share in 2024, as major construction firms and façade contractors often prefer to deal directly with manufacturers for large-scale projects. This approach allows for direct communication, ensuring faster delivery, better product education, and more accurate matching of specific product specifications to project needs. For specialized building materials such as rainscreen fasteners, which often require precise engineering and adherence to strict building codes, having a direct line to the manufacturer helps in resolving technical queries and customizing solutions. This direct relationship fosters trust and efficiency, which are highly valued in the complex world of commercial construction, and ensures that the right products are delivered precisely when needed.

The indirect segment is anticipated to register the highest growth rate during the forecast period. This trend is driven by the increasing need to reach a broader base of small to mid-sized contractors and cater to diverse geographic areas. Distributors, wholesalers, and specialized retailers play a crucial role in making rainscreen fasteners widely accessible, especially in fragmented regional markets where direct manufacturer presence might be limited. These indirect channels offer advantages such as local inventory availability, faster turnaround times for smaller orders, and established logistics networks. The rise of e-commerce platforms and improved supply chain integration also contributes significantly to the growth of the indirect segment.

Key Players and Competitive Insights

The U.S. rainscreen fasteners industry features a mix of established global players and specialized regional manufacturers. Key companies in the market include SFS Group AG, Hilti Corporation, Ejot Holding GmbH & Co. KG, Fischerwerke GmbH & Co. KG, and Sto Corp. These companies compete based on product innovation, material science advancements, and their ability to offer comprehensive system solutions that meet complex architectural and engineering demands. The competitive landscape is shaped by the need for high-performance, durable, and code-compliant fastening systems, pushing players to continuously develop products that support increasingly sophisticated rainscreen designs.

A few key players in the market include SFS Group AG, Hilti Corporation, Ejot Holding GmbH & Co. KG, Fischerwerke GmbH & Co. KG, Sto Corp., ITW Commercial Construction. Bostik (Arkema S.A.), TR Fastenings Ltd. (Trifast plc), James Hardie Building Products Inc., Kingspan Group plc, and OmniMax International, Inc.

Key Players

- Bostik (Arkema S.A.)

- Ejot Holding GmbH & Co. KG

- Fischerwerke GmbH & Co. KG

- Hilti Corporation

- Illinois Tool Works Inc.

- James Hardie Building Products Inc

- Kingspan Group plc

- OmniMax International, Inc.

- SFS Group AG

- Sto Corp.

- Trifast plc

U.S. Rainscreen Fasteners Industry Development

October 2021: Kingspan Group announced the acquisition of Minnesota Diversified Products, Inc., a U.S.-based company. This strategic acquisition broadened Kingspan’s customer reach in the U.S. and reinforced its core building insulation business in a market projected to experience substantial growth.

U.S. Rainscreen Fasteners Market Segmentation

By Facades Product Outlook (Revenue – USD Million, 2020–2034)

- Mechanical Visible Fixing

- Mechanical Invisible Fixing

- Visible Clips

- Adhesive Fixing

- Others

By Substructure Product Outlook (Revenue – USD Million, 2020–2034)

- Anchor Bolts

- Chemical Anchors

- Self-Tapping Screws

- Expansion Bolts

- Others

By Cladding Material Product Outlook (Revenue – USD Million, 2020–2034)

- High-Pressure Laminate

- Natural Stone

- Fibre Cement Panels

- Ceramic & Porcelain Panels

- Metal Panels

- Glass Panels

- Wood & Composite Panels

- Terracotta

- Building Integrated Photovoltaics

- Aluminum Composite Panels

- Others

By Substructure Type Product Outlook (Revenue – USD Million, 2020–2034)

- Aluminum Framing Systems

- Steel Support Structures

- Wood Framing

- Hybrid Substructures

- Stainless Steel Substructures

- Others

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Construction & Real Estate

- Energy & Utilities

- Industrial & Manufacturing

- Government & Public Sector

- Others

By Distribution Channel Outlook (Revenue – USD Million, 2020–2034)

- Direct

- Indirect

U.S. Rainscreen Fasteners Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 415.44 Million |

|

Market Size in 2025 |

USD 440.57 Million |

|

Revenue Forecast by 2034 |

USD 763.51 Million |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 415.44 million in 2024 and is projected to grow to USD 763.51 million by 2034.

The market is projected to register a CAGR of 6.3% during the forecast period.

A few key players in the market include SFS Group AG, Hilti Corporation, Ejot Holding GmbH & Co. KG, Fischerwerke GmbH & Co. KG, Sto Corp., ITW Commercial Construction. Bostik (Arkema S.A.), TR Fastenings Ltd. (Trifast plc), James Hardie Building Products Inc., Kingspan Group plc, and OmniMax International, Inc.

The mechanical visible fixing segment accounted for the largest share of the market in 2024.

The chemical anchors segment is expected to witness the fastest growth during the forecast period.