Anchoring Fasteners Market Size, Share, Trends, & Industry Analysis Report

By Material Type, By Product Type, By Application, By End-use Industry, By Distribution Channel (Direct and Indirect), and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 118

- Format: PDF

- Report ID: PM5795

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

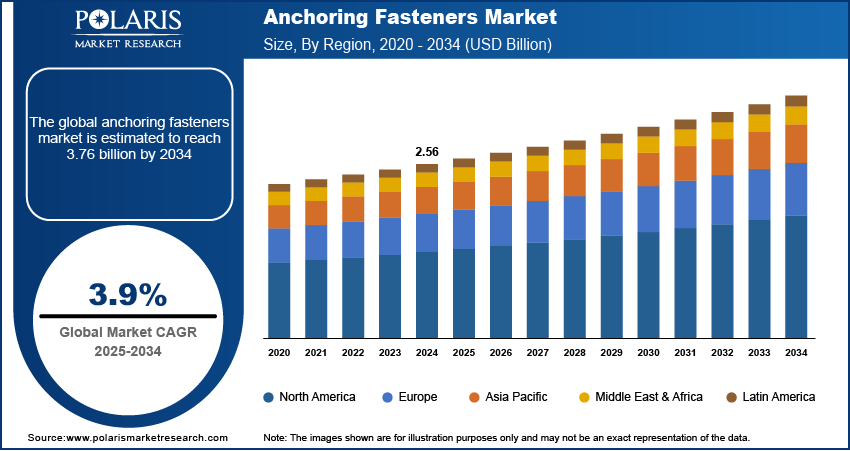

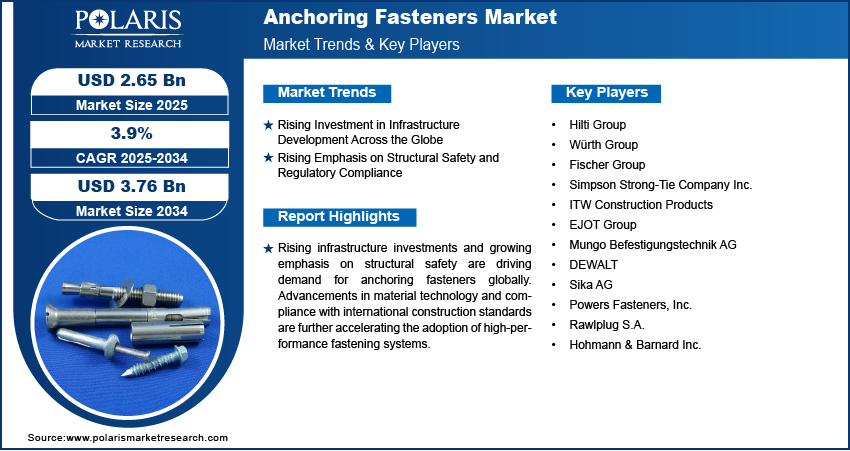

The global anchoring fasteners market size was valued at USD 2.56 billion in 2024, growing at a CAGR of 3.9% from 2025–2034. This expansion is being driven by increasing investments in infrastructure development in both emerging and advanced economies, such as increasing construction works, urbanization, and government efforts to modernize transport networks, industrial buildings, and commercial buildings.

Anchoring fasteners are essential mechanical components used to attach structural and non-structural elements to concrete, masonry and other base materials. It helps to ensure structural stability, safety and longevity across a wide range of construction applications emphasize industrial fasteners growing significance in global infrastructure development.

Anchoring fasteners include a variety of products including wedge anchors, sleeve anchors, undercut anchors and chemical anchors, among others. These components serve a vital function in heavy-duty installations, securing machinery, structural steel, racking systems, curtain walls, and façade elements. The versatility of these fasteners makes them indispensable in new-build projects as well as in retrofitting, renovation, and seismic strengthening applications. Rising complex architectural designs and engineered load requirements in high-rise buildings and industrial facilities continues to scale that further fuels the adoption of these fasteners.

This industry is witnessing technological advancements that improves performance, durability, and installation efficiency. Manufacturers are increasingly focusing on developing products that offer higher load capacity, corrosion resistance, and compatibility with various base materials. For instance, in April 2025, Power Pro introduced its latest premium wood screw, showcasing next-generation fastening technology designed for enhanced performance. The new product emphasizes improved drive efficiency, reduced splitting, and superior holding power for wood applications. The integration of advanced materials such as stainless steel, carbon steel alloys, and engineered polymers help these fasteners to perform reliably in diverse environmental conditions, including marine, industrial, and high-vibration settings. These innovations provide end users to meet stringent construction standards while ensuring long-term structural stability.

The rising retrofitting and renovation activities across well-established regions is significantly driving the demand for anchoring fasteners. Aging infrastructure such as bridges, tunnels, and commercial buildings is being upgraded to meet modern safety and performance standards. These projects require reliable anchoring solutions for structural reinforcement in seismic-prone regions where compliance with earthquake-resilient norms is mandatory. Government-led urban renewal and sustainability initiatives are pushing investments in infrastructure modernization, thus driving the demand for anchoring fasteners.

Industry Dynamics

Rising Investment in Infrastructure Development

Rising investment in infrastructure development across the globe is driving the demand for anchor fasteners. Governments are prioritizing large-scale infrastructure programs to support urban expansion, economic growth, and transportation connectivity. These projects, including bridges, highways, metro systems, airports, and energy facilities, require secure anchoring solutions to ensure long-term structural stability. For instance, in February 2023, the US Bipartisan Infrastructure Law allocated USD 1.2 trillion for modernizing public infrastructure, including substantial investments in surface transportation and utility systems. Anchoring fasteners are essential in these developments as they provide reliable mechanical connections for structural elements and equipment installations.

Infrastructure projects further require compliance with international safety and performance standards, driving demand for certified anchoring systems. Construction firms and project contractors are adopting these fasteners that offer high load-bearing capacity, corrosion resistance, and durability under dynamic stress. These requirements are particularly critical in regions prone to seismic activity or heavy industrial use. Additionally, the repair and rehabilitation of aging infrastructure in developed economies is fueling the use of anchor fasteners in retrofitting and structural reinforcement projects. This widespread application across new construction and maintenance activities is accelerating global market growth.

Growing Emphasis on Structural Safety and Quality Compliance

The growing global emphasis on structural safety and quality compliance is further driving the anchoring fasteners industry. Regulatory bodies in regions such as North America, Europe, and Asia Pacific are implementing stringent design codes and performance standards for construction equipments, including anchoring systems. These measures ensure the structural integrity of buildings and infrastructure and reduce the risk of failures. For example, standards such as the American Concrete Institute (ACI) code ACI 355.2 and the Eurocode EN 1992-4 mandate the use of approved and tested fastening systems for critical structural applications, compelling contractors and engineers to invest in compliant anchoring products.

Governments and certifying agencies are also promoting the use of high-quality anchor fasteners through certification programs and mandatory testing protocols. This regulatory push is reinforcing product standardization and encouraging manufacturers to enhance their quality control and innovation capabilities. Construction firms are responding by selecting anchoring solutions that meet specific project requirements, minimize installation errors, and ensure safety across the structure’s lifecycle. These developments are making structural safety a priority consideration in public and private construction projects, thereby strengthening the adoption of advanced anchor fasteners in the global market.

Segmental Insights

Product Type Analysis

The global segmentation, based on product type includes, mechanical anchors, chemical anchors, expansion anchors, sleeve anchors, and drop-in anchors. The mechanical anchors segment accounted for fourth largest market share in 2024, owing to their reliability, ease of installation, and cost-efficiency. Mechanical anchors, including wedge, sleeve, and drop-in anchors, are extensively used in concrete and masonry applications across construction and industrial settings. Their ability to provide immediate load-bearing capacity without curing time makes them suitable for time-sensitive installations. Expansion anchors, a key subset, continue to be favored for their adaptability to various base materials and structural loads.

The chemical anchors segment is projected to grow fastest during the assessment phase. These anchors are increasingly used in seismic retrofitting, underwater applications, and heavy machinery foundations due to their strong bond strength and ability to conform to irregular base materials. In February 2025, MKT Metall-Kunststoff-Technik GmbH & Co KG announced to exhibit its comprehensive range of high-performance concrete anchoring solutions at this year’s Fastener Fair Global. This presentation includes chemical anchor systems, with a key highlight being the BZ3 wedge anchor that is designed to meet demanding structural and construction requirements. Chemical anchors are particularly suited for high-load conditions and offer enhanced performance in cracked concrete or dynamic environments. The growing use of high-strength resins and fast-curing formulations is further supporting segment expansion across construction and energy-intensive industries.

Application Analysis

The global segmentation, based on application includes, concrete, brick and masonry, drywall, wood, metal structures, and natural stone The concrete segment accounted for third largest revenue share in 2024 attributed to the widespread use of concrete as a primary construction material globally. Anchoring fasteners are essential in ensuring secure attachment of structural and non-structural components to concrete, particularly in foundations, columns, and load-bearing systems. Their ability to distribute loads evenly and prevent structural failure is critical in high-rise and infrastructure projects. Continuous urban development and public infrastructure upgrades are sustaining segment growth.

The brick and masonry segment is estimated to hold a substantial market share in 2034 due to its use in architectural restoration, low-rise buildings, and public facilities. Anchoring fasteners designed for masonry offer secure connections while minimizing damage to the base material. Drywall and wood segments are gaining traction in interior applications such as HVAC systems, shelving, and electrical installations. The metal structures and natural stone segments are also growing as prefabricated buildings and aesthetic facades gain popularity, requiring fasteners that accommodate non-traditional construction materials.

End-use Industry Analysis

The global segmentation, based on end-use industry includes, construction & real estate, energy & utilities, industrial & manufacturing, government & public sector, and other end-use industry. The construction and real estate segment is projected to grow during the forecast period. This rapid growth is attributed to the continuous demand for commercial, residential, and infrastructure development globally. Anchoring fasteners are used in foundation systems, wall installations, facade elements, and interior fittings, making them integral to all phases of construction. Urbanization, population growth, and government-led infrastructure investments are further driving adoption across this segment.

The energy and utilities segment is estimated to hold a significant market share in 2034. Projects related to power generation, transmission, and renewable energy installations require heavy-duty anchoring systems for equipment, structural supports, and cable management. Similarly, the industrial and manufacturing segment is adopting anchor fasteners for machinery mounting, plant construction, and safety railings. Government and public sector investments in schools, hospitals, and transport infrastructure are also contributing to the market expansion, while niche applications across other industries sustain demand diversity.

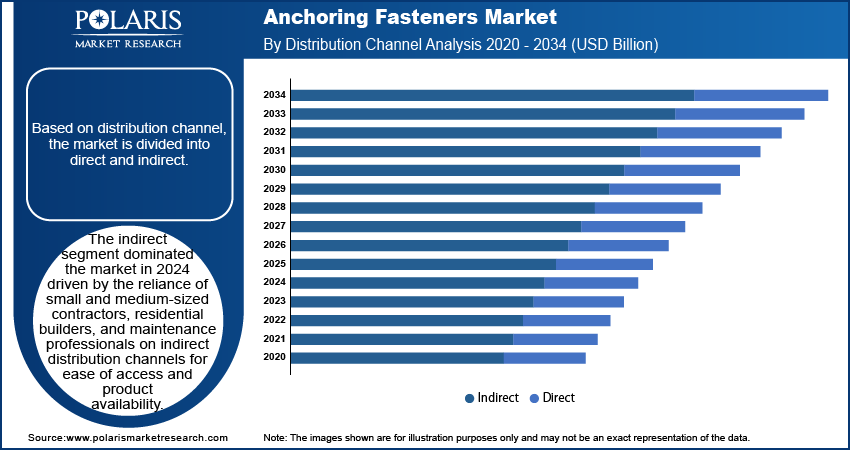

Distribution Channel Analysis

The global segmentation, based on distribution channel includes, direct and indirect. The direct segment is expected to grow significantly due to its adoption by many large-scale contractors, infrastructure developers, and industrial clients prefer sourcing anchor fasteners directly from manufacturers. Direct distribution ensures better pricing, technical support, and product customization, particularly for high-performance or project-specific fastening requirements. Bulk procurement and long-term supplier relationships are common in this channel, especially for infrastructure and energy projects.

The indirect segment dominated the market in 2024 driven by the reliance of small and medium-sized contractors, residential builders, and maintenance professionals on indirect distribution channels for ease of access and product availability. The growth of e-commerce platforms and hardware distribution networks is enhancing the reach of anchoring fasteners, particularly in emerging markets. As per the International Trade Administration (ITA), global B2B e-commerce sales registered consistent growth over the past decade and are projected to reach USD 36 trillion by 2026, driven largely by sectors such as advanced manufacturing, energy, healthcare, and business services. Product variety, fast delivery, and regional dealership networks are contributing to the expansion of the indirect sales channel.

Regional Analysis

North America anchoring fasteners market held substantial share in 2024, driven by the region’s strong focus on infrastructure modernization, industrial development, and structural safety compliance. The surging investments in transportation systems, energy facilities, and commercial buildings are significantly contributing to the widespread adoption of these fasteners across the region. Moreover, initiatives including the U.S. Infrastructure Investment and Jobs Act are further driving product adoption by funding large-scale upgrades in highways, bridges, and public transit systems that utilizes anchoring fasteners for structural integrity and long-term safety.

US Anchoring Fasteners Market Insights

The US regional market is primarily attributed to large-scale infrastructure investments under federal initiatives. For instance, under the Infrastructure Investment and Jobs Act (IIJA), an amount of USD 110 billion allocated to upgrade roads and bridges, targeting the rehabilitation of one in five deteriorated roads and major highways, along with approximately 45,000 structurally deficient bridges. Anchoring fasteners also offer secure structural components and equipment across these developments. Additionally, increasing awareness of construction safety, coupled with strict adherence to standards are encouraging the use of advanced anchoring systems in commercial and public infrastructure projects across the US.

Europe Anchoring Fasteners Market Assessment

The Europe anchoring fasteners market growth is supported by the region’s growing investment in green infrastructure, industrial renovation, and public sector construction. As an example, the government of Germany allocated USD 63 billion for green infrastructure by 2045, with approximately USD 20.8 billion in 2024 earmarked for subsidies in the construction sector, supporting building renovations and new developments to advance its sustainability objectives. Countries such as Germany, France, and the United Kingdom are driving market expansion by implementing regulations that promote structural resilience and safety in infrastructure projects.

The increasing demand for sustainable construction practices and the renovation of aging infrastructure across Western and Northern Europe are further accelerating product adoption. The presence of advanced manufacturing capabilities, stringent product certification requirements, and high awareness among engineers and contractors is fostering market maturity in the region. Moreover, anchoring fasteners are engaged in development of transportation networks, renewable energy installations, and prefabricated construction systems across the European market.

Asia Pacific Anchoring Fasteners Market Overview

Asia Pacific anchoring fasteners market dominated the revenue share in 2024, owing to the rapid urbanization, industrialization, and large-scale construction activities across emerging economies. Countries such as China, India, Indonesia, and Vietnam are experiencing a surge in residential, commercial, and public infrastructure development, requiring durable and efficient anchoring solutions. Government-led programs focusing on smart cities, transportation networks, and energy projects are further propelling demand.

For instance, the United Nations Human Settlements Programme projects that the urban population in Asia will increase by 1.2 billion by 2050, increasing the need for high-performance anchoring fasteners in dense and complex construction environments. Additionally, rising investments in industrial parks, logistics hubs, and special economic zones are creating sustained demand for mechanical and chemical anchors. The region’s growing construction workforce, improved contractor knowledge, and increasing adherence to international construction standards are further supporting market expansion in Asia Pacific.

Key Players & Competitive Analysis

The global anchoring fasteners industry is moderately fragmented, due to rising competition driven by key players that are engaged in product development and collaborations among different companies. Key players in the industry are investing in advanced anchoring solutions specifically for infrastructure, industrial, residential, and commercial uses, with the help of mergers and acquisitions to expand regional reach and access superior technologies. Additionally, automation in production, digital inventory systems, and customized solutions are reshaping market dynamics. Companies are also meeting with sustainability goals and international standards by developing certified, eco-friendly fasteners suited for varied construction and industrial applications.

Prominent companies in the anchoring fasteners market include Hilti Group; Würth Group; Fischer Group; Simpson Strong-Tie Company Inc.; ITW Construction Products; EJOT Group; Mungo Befestigungstechnik AG; DEWALT; Sika AG; Powers Fasteners, Inc.; Rawlplug S.A.; and Hohmann & Barnard Inc.

Key Players

- Hilti Group

- Würth Group

- Fischer Group

- Simpson Strong-Tie Company Inc.

- ITW Construction Products

- EJOT Group

- Mungo Befestigungstechnik AG

- DEWALT

- Sika AG

- Powers Fasteners, Inc.

- Rawlplug S.A.

- Hohmann & Barnard Inc.

Industry Developments

May 2025: Portland Bolt expanded its operations through the acquisition of Bennett Bolt Works, enhancing its manufacturing capabilities and product offerings. This strategic move strengthens its position in the anchor fastener industry.

January 2025: Simpson Strong-Tie announced to showcase its latest concrete screw anchors, anchoring adhesives, and rebar alignment solutions at the 2025 World of Concrete. The exhibit will highlight innovations in structural fastening and reinforcement systems.

May 2024: Rawlplug partnered with Saketh Seven Star Industries Ltd to transform India’s construction sector by introducing advanced anchoring and fixing solutions. The collaboration aims to boost local manufacturing and enhance infrastructure quality.

April 2024: Fischer introduced the FSU undercut anchor, engineered for high-performance fastening in demanding applications. The new solution ensures enhanced load-bearing capacity and safety in critical construction projects.

Anchoring Fasteners Market Segmentation

By Material Type Outlook (Revenue, USD Billion, 2020–2034)

- Steel

- Plastic/Polymer

- Zinc

- Brass

- Others

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Mechanical Anchors

- Chemical Anchors

- Expansion Anchors

- Sleeve Anchors

- Drop-In Anchors

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Concrete

- Brick and Masonry

- Drywall

- Wood

- Metal Structures

- Natural Stone

By End-use Industry Outlook (Revenue, USD Billion, 2020–2034)

- Construction & Real Estate

- Energy & Utilities

- Industrial & Manufacturing

- Government & Public Sector

- Other End-use Industry

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Direct

- Indirect

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Anchoring Fasteners Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.56 Billion |

|

Market Size in 2025 |

USD 2.65 Billion |

|

Revenue Forecast by 2034 |

USD 3.76 Billion |

|

CAGR |

3.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.56 billion in 2024 and is projected to grow to USD 3.76 billion by 2034.

The global market is projected to register a CAGR of 3.9% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Hilti Group; Würth Group; Fischer Group; Simpson Strong-Tie Company Inc.; ITW Construction Products; EJOT Group; Mungo Befestigungstechnik AG; DEWALT; Sika AG; Powers Fasteners, Inc.; Rawlplug S.A.; and Hohmann & Barnard Inc.

The indirect segment dominated the market share in 2024.

The chemical anchors segment is expected to witness the fastest growth during the forecast period.