Social Business Intelligence Market Size, Share, Trends, Industry Analysis Report

By Component (Solution, Services), By Business Function, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 120

- Format: PDF

- Report ID: PM6010

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

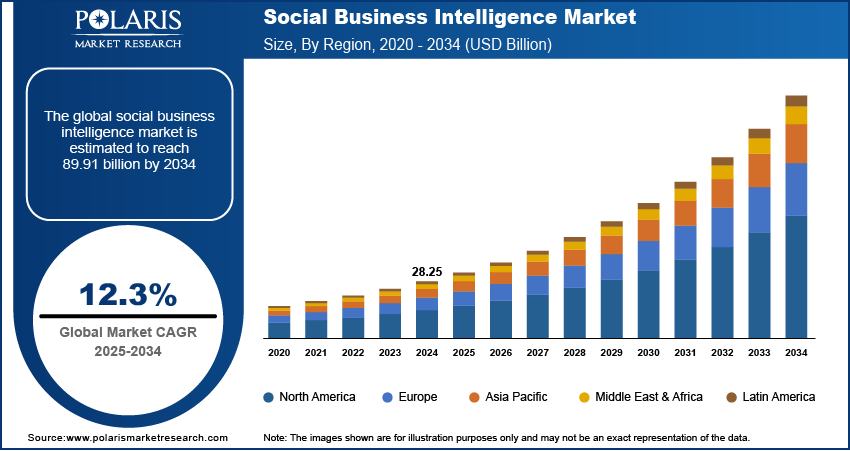

The global social business intelligence market size was valued at USD 28.25 billion in 2024 and is anticipated to register a CAGR of 12.3% from 2025 to 2034. The sector is primarily driven by the massive growth in social media use and the increasing need for businesses to make decisions based on data.

Key Insights

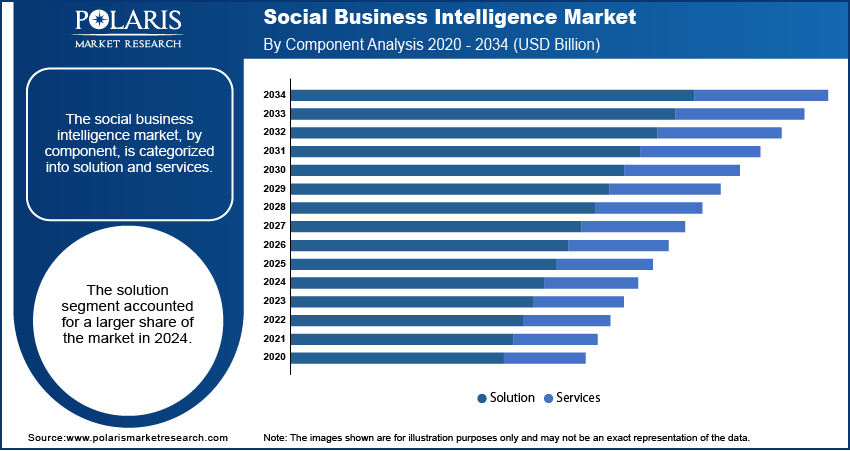

- By component, the solutions segment held the largest share in 2024. This is driven by the growing demand for advanced software platforms and tools that can effectively collect, process, and analyze vast amounts of data from social media.

- By business function, the sales and marketing function segment held the largest share in 2024 due to the direct and substantial value social media data provides to these departments.

- By end use, the retail and e-commerce segment held the largest share in 2024, largely due to its highly competitive nature and the critical need to understand consumer behaviors in a dynamic digital environment.

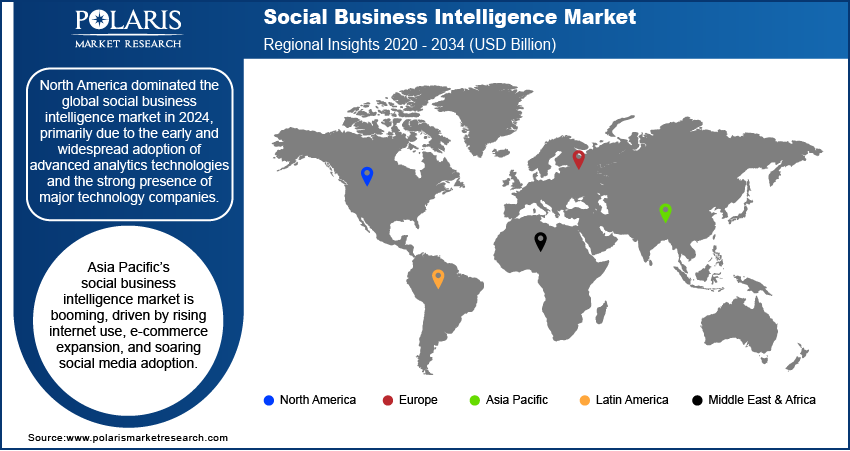

- By region, North America held the largest share in 2024, primarily due to the early and widespread adoption of advanced analytics technologies and the strong presence of major technology companies.

Social business intelligence (SBI) involves collecting, analyzing, and using data from social media platforms to help businesses make better decisions. It combines traditional ways of understanding business information with insights from online social interactions to get a full view of customer behavior, overall trends, and what competitors are doing.

Businesses are increasingly prioritizing customer experience as a key differentiator in competitive areas, making social business intelligence an essential tool. A strong customer experience leads to greater customer satisfaction, loyalty, and ultimately, increased revenue. Social media management platforms offer a direct channel for customers to share their experiences, whether positive or negative, in real time. Social business intelligence solutions allow companies to monitor these conversations, identify pain points, and proactively address customer issues before they escalate. This direct feedback loop enables businesses to understand customer needs, preferences, and frustrations, which is vital for delivering personalized experiences and improving service quality.

The rapid growth and increasing effectiveness of influencer marketing are significantly driving the adoption of social business intelligence. Influencer marketing involves collaborating with individuals who have a strong online presence and can influence their followers' purchasing decisions. As brands invest more in these partnerships, they need robust social business intelligence tools to measure the return on investment (ROI), track campaign performance, and identify the most suitable influencers. These tools help analyze an influencer's audience demographics, engagement rates, and the sentiment around their content, ensuring that collaborations are authentic and effective.

Industry Dynamics

- The global increase in the use of social media platforms is a significant driver.

- There is a growing demand for real-time data analytics among businesses, which boosts the industry expansion.

- The increasing need for competitive intelligence is fueling growth.

- Advancements in artificial intelligence (AI) and machine learning are contributing to expansion.

Increased Social Media Adoption: The widespread and growing adoption of social media platforms by individuals and businesses is a key driver. As more people use social media platforms such as Facebook, Instagram, and X (formerly Twitter) for communication, news, and purchasing, the volume of valuable data generated increases significantly. This vast amount of public data offers businesses a rich source of insights into consumer sentiment, market trends, and brand perception.

A study published in PubMed Central in 2021, titled "Patterns of use and perceived value of social media for population health among population health stakeholders: a cross-sectional web-based survey," highlighted that over 97% of surveyed population health stakeholders used social media. While this study focuses on health, it demonstrates the widespread active engagement on social media platforms, indicating the massive data generated across all sectors. This continuous flow of user-generated content and interactions creates a strong demand for social business intelligence solutions that can effectively collect, process, and analyze this information. Thus, the rising use of social media platforms drives the adoption of social business intelligence as companies seek to harness these insights.

Growing Demand for Real-Time Data Analytics: The need for businesses to make quick, informed decisions in a fast-paced environment is driving the demand for real-time data analytics, which is a core component of social business intelligence. Traditional data analysis often involves looking at past information, but real-time analytics allows businesses to respond to current events and quickly adapt their strategies. This capability is especially important when dealing with dynamic social media conversations, where trends and public opinion can shift rapidly.

A recent discussion in American Society of Clinical Oncology Daily News in 2025, from a podcast titled "From Clinic to Clinical Trials: Responsible AI Integration in Oncology," mentions how to structure data in real time using these tools is becoming critical for extracting information and making efficient decisions, even in complex fields such as oncology. While the context is healthcare, it reflects a broader industry trend where real-time data processing is essential for current decision-making. This immediate access to insights derived from social media data enables companies to quickly identify emerging issues, launch targeted campaigns, and manage their online reputation, thus fueling the industry growth.

Segmental Insights

Component Analysis

Based on component, the segmentation includes solution and services. The solution segment held a larger share in 2024. This dominance stems from the increasing demand for advanced tools and platforms that can effectively gather, process, and analyze the vast amounts of data generated on social media. Businesses are actively investing in these solutions to gain actionable insights into customer sentiment, brand perception, and competitive landscapes. These sophisticated platforms often include various features such as sentiment analysis, trend tracking, and predictive analytics, which are crucial for making informed strategic decisions. The ease with which these solutions can be integrated with existing business systems, such as customer relationship management (CRM) and marketing platforms, further contributes to their widespread adoption.

The services segment is anticipated to register the highest growth rate during the forecast period, driven by the increasing complexity of social media data and the specialized expertise required to implement, optimize, and manage social business intelligence tools effectively. Many organizations, especially those without dedicated in-house data analytics teams, rely on professional services such as consulting, integration, and managed services to maximize their investments in these solutions. These services help businesses navigate the challenges of data quality, privacy, and compliance, ensuring that they derive the most value from their social intelligence initiatives.

Business Function Analysis

Based on business function, the segmentation includes sales & marketing, customer service/support, operations, finance, human resources (HR), and product development/innovation (R&D). The sales & marketing segment held the largest share in 2024, primarily due to the direct and immense value social media data provides to these departments. Sales and marketing teams leverage social business intelligence to understand consumer sentiment, track brand perception, monitor competitor activities, and identify emerging trends in real time. This information is critical for crafting effective marketing campaigns, personalizing customer outreach, and optimizing sales strategies. For example, by analyzing discussions on social platforms, marketers can quickly assess the effectiveness of a product launch or a promotional event, allowing for immediate adjustments.

The product development/innovation (R&D) and customer service/support segments are anticipated to register significant growth rate during the forecast period. The increased focus on customer-centric product development and the growing importance of seamless customer experiences are driving this trend. For product development and innovation, social business intelligence provides invaluable insights into user needs, pain points, and desired features directly from customer conversations and feedback on social media. This allows companies to develop products that genuinely meet demand and innovate based on real user experiences.

End Use Analysis

Based on end use, the segmentation includes BFSI, retail & e-commerce, healthcare, IT & telecommunications, media & entertainment, and government & public sector. The retail & e-commerce segment held the largest share in 2024. This dominance is attributed to the highly competitive nature of the retail industry and the critical need for understanding consumer preferences and behaviors in a rapidly evolving digital landscape. Retailers and e-commerce companies extensively use social business intelligence to track brand mentions, monitor product reviews, analyze customer feedback, and identify purchasing trends on social media platforms. This allows them to quickly adapt their marketing strategies, personalize customer experiences, manage online reputation, and even influence product development.

The healthcare and BFSI (banking, financial services, and insurance) sectors are anticipated to record the significant growth rate during the forecast period. In healthcare, the increasing adoption of digital health platforms and the rising importance of patient engagement and public health communication are driving this growth. Healthcare organizations are leveraging social intelligence to monitor public sentiment regarding health policies, track disease outbreaks (as seen during global pandemics), understand patient experiences, and identify areas for service improvement. This allows for better public health outreach and more patient-centered care.

Regional Analysis

The North America social business intelligence market accounted for the largest share in 2024, mainly due to the early and widespread adoption of advanced analytics technologies and a strong presence of major technology companies in the region. Businesses across various industries in North America, including retail, BFSI, and IT and telecommunications, have been quick to recognize the value of social data for improving customer engagement, brand monitoring, and competitive analysis. The region's mature digital ecosystem, characterized by high internet penetration and extensive social media usage, creates a fertile ground for the growth of social business intelligence solutions. Companies in North America are continuously investing in innovative platforms that integrate artificial intelligence and machine learning to gain deeper insights from social data, thereby driving market expansion.

U.S. Social Business Intelligence Market Insights

The U.S. led the social business intelligence industry in North America in 2024. The country's strong digital infrastructure, coupled with a high rate of social media adoption among its population, creates a vast source of data for analysis. Enterprises in the country, from large corporations to small and medium-sized businesses, are actively using social intelligence for various purposes, including managing brand reputation, tracking customer sentiment, and understanding market trends. The presence of numerous key technology providers and substantial investments in market automation and data-driven strategies further contribute to the strong demand for social business intelligence solutions in the U.S. Businesses are keen on leveraging social insights to enhance their decision-making processes and maintain a competitive edge.

Europe Social Business Intelligence Market Trends

Europe represents a notable region in the global social business intelligence market, driven by increasing digital transformation efforts across various industries and a growing awareness of the importance of data-driven decision-making. Businesses in Europe are increasingly adopting social business intelligence tools to better understand their customer base, optimize marketing efforts, and enhance overall operational efficiency. The region's diverse economic landscape, with strong sectors such as retail, manufacturing, and BFSI, creates varied demands for social insights. Data privacy regulations, such as the General Data Protection Regulation (GDPR), also influence how social data is collected and used, pushing companies to adopt more compliant and ethical social intelligence practices.

The Germany social business intelligence market is a key country contributing to the regional market. The country benefits from strong government support for IT solutions and a high rate of adoption of advanced technologies, especially among its numerous small and medium-sized enterprises (SMEs). German businesses are investing in social business intelligence to streamline their workflows, improve digital processes, and gain real-time insights for strategic decisions. The demand for digital transformation across industries, coupled with innovations from both domestic and international companies, is accelerating the use of social intelligence platforms in Germany. This focus on leveraging data for operational improvements and competitive advantage is a significant driver for the market's expansion in the country.

Asia Pacific Social Business Intelligence Market Overview

Asia Pacific is rapidly emerging as a significant and fast-growing regional market for social business intelligence. This growth is fueled by increasing internet penetration, a booming e-commerce sector, and the immense growth in social media usage across countries such as China and India. Businesses in this region are increasingly recognizing the strategic value of social data for understanding vast and diverse consumer bases, identifying local trends, and adapting quickly to dynamic digital environments. The rising disposable incomes and the tech-savvy younger population in many Asian countries are also contributing to the surge in social media activity, creating an ever-expanding pool of data for social intelligence applications.

China Social Business Intelligence Market Analysis

China is a dominant country in Asia Pacific. The country's massive internet user base and highly active social media platforms, such as WeChat and Douyin, generate an unparalleled volume of social data. Chinese businesses are leveraging social business intelligence extensively for everything from direct social commerce and influencer marketing to understanding consumer behavior and product preferences. The rapid pace of digital innovation and intense competition among domestic companies further drive the adoption of sophisticated social intelligence solutions. Businesses in China are heavily invested in real-time analytics and data integration to gain a competitive advantage in its highly dynamic and consumer-driven areas.

Key Players and Competitive Insights

The social business intelligence market features a competitive landscape with several major players vying for share, including IBM, Salesforce, Microsoft, Oracle, SAP, SAS, and Adobe. These companies offer a range of solutions and services designed to help businesses extract valuable insights from social media data. The competition is driven by continuous innovation in data analytics, artificial intelligence, and machine learning capabilities, as companies strive to provide more accurate and actionable intelligence to their clients. Market players differentiate themselves through the breadth of their offerings, ease of integration with existing systems, scalability, and specialized features tailored to specific industry needs.

A few key players in the industry include IBM, Adobe, Google, Salesforce, Oracle, SAP SE, SAS Institute Inc., Microsoft, MicroStrategy, Qlik Technologies Inc., and Domo, Inc.

Key Players

- Adobe

- Domo, Inc.

- IBM

- MicroStrategy

- Microsoft

- Oracle

- Qlik Technologies Inc.

- Salesforce

- SAP SE

- SAS Institute Inc.

Social Business Intelligence Industry Developments

June 2025: Adobe Inc. and IBM Corporation deepened their collaboration by integrating IBM’s Watson AI into the Adobe Experience Platform. This integration aims to enhance personalized marketing, improve governance, and streamline workflow automation.

May 2025: Meltwater introduced Mira, an AI-driven assistant developed to optimize social and media intelligence. Featuring a conversational interface, Mira simplifies complex tasks such as brand monitoring and trend analysis, allowing organizations to make quicker, data-driven decisions.

Social Business Intelligence Market Segmentation

By Component Outlook (Revenue – USD Billion, 2020–2034)

- Solution

- Services

By Business Function Outlook (Revenue – USD Billion, 2020–2034)

- Sales & Marketing

- Customer Service/Support

- Operations

- Finance

- Human Resources (HR)

- Product Development/Innovation (R&D)

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- BFSI

- Retail & E-commerce

- Healthcare

- IT & Telecommunications

- Media & Entertainment

- Government & Public Sector

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Social Business Intelligence Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 28.25 billion |

|

Market Size in 2025 |

USD 31.65 billion |

|

Revenue Forecast by 2034 |

USD 89.91 billion |

|

CAGR |

12.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 28.25 billion in 2024 and is projected to grow to USD 89.91 billion by 2034.

The global market is projected to register a CAGR of 12.3% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include IBM, Adobe, Google, Salesforce, Oracle, SAP SE, SAS Institute Inc., Microsoft, MicroStrategy, Qlik Technologies Inc., and Domo, Inc..

The solution segment accounted for a larger share of the market in 2024.

The product development/innovation (R&D) and customer service/support segment is expected to witness the significant growth during the forecast period.