Bronchodilators Market Size, Share, Trends, Industry Analysis Report

: By Disease (Asthma, COPD, Others), By Route of Administration, By Drug Class, By Mode of Action, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 116

- Format: PDF

- Report ID: PM3204

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

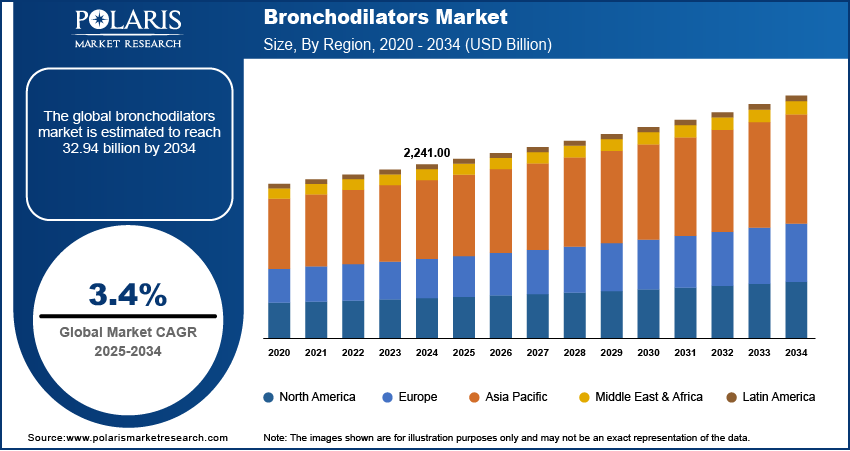

The global bronchodilators market size was valued at USD 23.64 billion in 2024, exhibiting a CAGR of 3.4% during 2025–2034. The market is driven by the rise in respiratory disorders, air pollution, innovative treatments, combination and long-acting therapies, the development of inhalers and biologics, supportive regulations, and increased access to healthcare in developing nations.

Key Insights

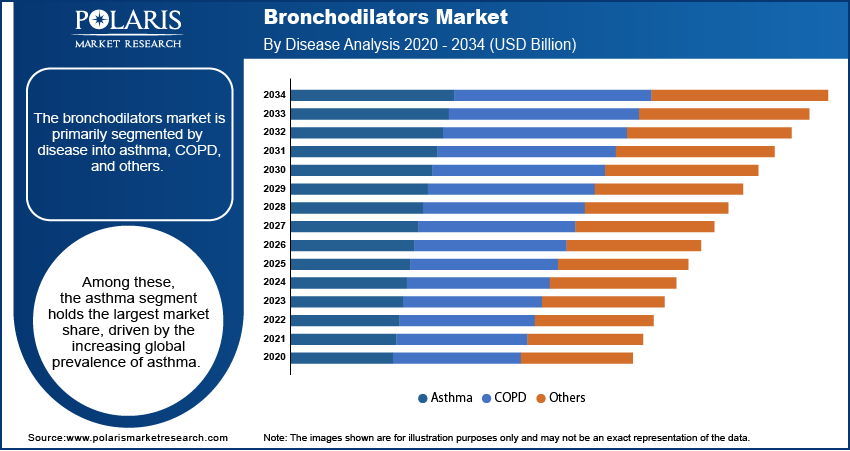

- The asthma segment leads the global market for bronchodilators, primarily due to the high prevalence of asthma worldwide.

- The category of inhalable holds the biggest market share because it delivers medicine directly to the lungs, providing rapid relief with minimal side effects.

- North America holds the largest share of the bronchodilators market owing to high rates of asthma and COPD, strong healthcare infrastructure, and favorable regulatory support for advanced respiratory treatments.

- Europe's growth is driven by its well-developed healthcare infrastructure, good regulations, and increased awareness about respiratory illnesses.

Industry Dynamics

- The rising cases of respiratory diseases, particularly asthma and COPD, are a key driver of market growth.

- Advancements in drug delivery technologies, including advanced inhalers and intelligent devices, are improving treatment outcomes and enhancing patient compliance, driving market growth.

- Regulatory approval and the development of improved healthcare infrastructure in emerging economies are expected to support the market's expansion.

- High cost of treatments, side effects, and difficulties in patient compliance with prolonged therapies restrain the market.

Market Statistics

2024 Market Size: USD 23.64 billion

2034 Projected Market Size: USD 32.94 billion

CAGR (2025-2034): 3.4%

North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

The bronchodilators market encompasses pharmaceutical products designed to relax airway muscles and improve airflow in respiratory conditions such as asthma and chronic obstructive pulmonary disease (COPD).

The market is driven by the increasing prevalence of respiratory disorders, rising pollution levels, and growing awareness regarding advanced treatment options. The demand for long-acting bronchodilators is rising due to their efficacy in managing chronic conditions, while combination therapies integrating bronchodilators with corticosteroids are gaining traction. Additionally, technological advancements in inhaler devices and the development of biologics for respiratory diseases are shaping market growth. Regulatory approvals and expanding healthcare infrastructure in emerging markets further contribute to the bronchodilators market expansion.

Market Dynamics

Increasing Prevalence of Respiratory Diseases

The rising incidence of respiratory conditions, particularly asthma and chronic obstructive pulmonary disease (COPD), significantly propels the bronchodilators market growth.

Technological Advancements in Drug Delivery Systems

Innovations in drug delivery mechanisms have enhanced the efficacy and patient compliance of bronchodilator treatments. The development of advanced inhalation devices, such as metered-dose inhalers and dry powder inhalers, ensures precise medication delivery to the lungs, improving therapeutic outcomes. For instance, in August 2022, Aptar Pharma acquired global rights to Pharmaxi’s Orbital inhaler, a clinical-stage device enabling high-payload dry powder delivery (up to 400mg) to the lungs. Originally developed for cystic fibrosis therapy, it addresses the need for efficient large-dose drug inhalation. Additionally, the integration of digital technology into inhalers, exemplified by smart inhalers, enables monitoring of patient usage patterns, fostering better disease management and adherence to treatment protocols. Thus, technological advancements in drug delivery systems drive the bronchodilators market development.

Growing Geriatric Population

The expanding elderly population contributes to the increased demand for bronchodilators, as aging is associated with a higher prevalence of respiratory ailments. The United Nations projects that the global population aged 65 and older will more than double by 2050, reaching approximately 1.5 billion. This demographic shift underscores the need for effective management of age-related respiratory conditions, positioning bronchodilators as a critical component in treatment regimens for older adults.

Segment Insights

Market Assessment – Disease-Based Insights

The bronchodilators market is segmented by disease into asthma,

The COPD segment is experiencing significant growth, attributed to the rising geriatric population and increasing prevalence of COPD. The WHO identifies COPD as a leading cause of morbidity and mortality globally, with a higher incidence observed in individuals aged over 65 years. This demographic trend underscores the escalating demand for bronchodilators tailored to manage COPD effectively. Moreover, the segment benefits from ongoing research and development efforts aimed at introducing advanced therapies. The focus on improving patient outcomes and quality of life for COPD sufferers is driving innovation within this segment, contributing to its rapid expansion in the bronchodilators market.

Market Evaluation – Route of Administration-Based Insights

The bronchodilators market, segmented by route of administration, includes inhalable, oral, and

The oral segment is experiencing significant growth within the bronchodilators market. Oral bronchodilators offer advantages such as ease and simplicity of administration, along with controlled dosing, making them suitable for patients who may have difficulties using inhalation devices. This route is particularly beneficial in managing chronic respiratory conditions where consistent medication levels are required. The increasing prevalence of respiratory diseases and the need for versatile treatment options contribute to the rising demand for oral bronchodilators.

Market Outlook – Drug Class-Based Insights

The bronchodilators market is segmented by drug class into beta-adrenergics, anticholinergics, xanthine derivatives, phosphodiesterase inhibitors, and combination drugs. The beta-adrenergics segment holds the largest market share. These medications, including widely used agents like albuterol and levalbuterol, function by stimulating beta-2 adrenergic receptors, leading to the relaxation of bronchial smooth muscles and subsequent airway dilation. Their rapid onset of action makes them the preferred choice for immediate relief in acute asthma exacerbations and COPD management. The extensive clinical efficacy and established safety profiles of beta-adrenergic bronchodilators have solidified their dominance in the market.

The combination drugs segment is experiencing the fastest growth within the bronchodilators market. These therapies integrate multiple bronchodilator classes or combine bronchodilators with corticosteroids into a single inhaler device, enhancing patient compliance and therapeutic effectiveness. For instance, products that merge long-acting beta-agonists with inhaled corticosteroids address both bronchoconstriction and underlying inflammation, offering comprehensive management for conditions like asthma and COPD. The increasing adoption of these combination therapies is driven by their convenience and the synergistic benefits they provide in controlling respiratory diseases.

Market Assessment – Mode of Action-Based Insights

The bronchodilators market is segmented by mode of action into short acting and long acting. Iin the

The long acting segment is experiencing the fastest growth within the market. Long acting bronchodilators, including agents like salmeterol and formoterol, are designed for maintenance therapy, offering prolonged bronchodilation to control chronic respiratory conditions. Their extended duration of action reduces the frequency of dosing and helps in maintaining stable airway function, which enhances patient adherence to treatment regimens. The increasing emphasis on long-term disease management and the development of combination inhalers that pair long-acting bronchodilators with corticosteroids further contribute to the accelerated growth of this segment.

Regional Analysis

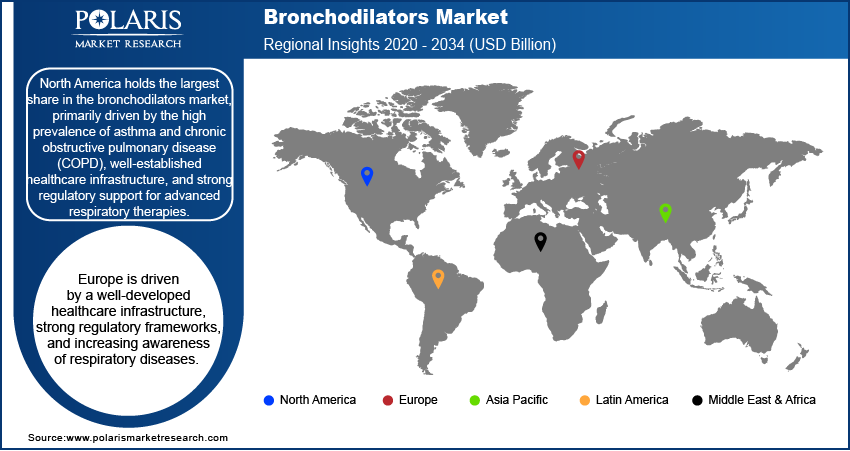

By region, the study provides the bronchodilators market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share in the bronchodilators market, primarily driven by the high prevalence of asthma and COPD, well-established healthcare infrastructure, and strong regulatory support for advanced respiratory therapies. The presence of key pharmaceutical companies and ongoing research initiatives further contribute to market dominance in the region. Additionally, the increasing adoption of combination therapies and technological advancements in inhalation devices support market growth. Europe also represents a significant market, with a strong focus on improving respiratory care through government initiatives and healthcare investments. Asia Pacific is experiencing rapid growth due to rising pollution levels, increasing disease burden, and expanding access to healthcare in emerging economies such as China and India. Latin America and the Middle East & Africa show steady growth, driven by improving healthcare facilities and growing awareness of respiratory disease management.

Europe is driven by a well-developed healthcare infrastructure, strong regulatory frameworks, and increasing awareness of respiratory diseases. The region has a high burden of asthma and COPD, leading to a consistent demand for effective bronchodilator therapies. Government initiatives focused on improving respiratory healthcare and reducing air pollution further support market expansion. Additionally, the presence of key pharmaceutical companies engaged in research and development contributes to the availability of advanced treatment options. Increasing adoption of combination therapies and biologics is also shaping the market landscape.

The Asia Pacific bronchodilators market is experiencing significant growth due to rising pollution levels, increasing cases of respiratory diseases, and improving access to healthcare in emerging economies such as China and India. The expanding geriatric population, which is more susceptible to chronic respiratory conditions, is further driving the demand for bronchodilators. Government healthcare initiatives and rising investments in pharmaceutical research and development are supporting market expansion. Additionally, the growing availability of cost-effective generic bronchodilators is enhancing accessibility, particularly in developing countries. The increasing adoption of inhalation therapies and smart inhaler technologies is also contributing to market growth in the region.

Key Players and Competitive Insights

The competitive landscape of the bronchodilators market features global and regional players competing through innovation and strategic alliances. Global players leverage R&D capabilities and technological advancements to deliver advanced solutions, meeting the demand for disruptive technologies. Market trends highlight rising technological adoption driven by economic growth and geopolitical shifts. Companies focus on strategic investments, mergers, and joint ventures to strengthen market positions. Regional players offer cost-effective solutions tailored to local needs. The market experiences ongoing technological transformation, with companies investing in supply chain management and sustainability strategies. Competitive intelligence and pricing insights are critical for identifying growth opportunities. The industry's growth is driven by technological innovation, market adaptability, and strategic regional investments, ensuring sustained competitiveness in a dynamic global market. A few key players are AstraZeneca plc; Boehringer Ingelheim International GmbH; Chiesi Farmaceutici S.p.A.; Cipla Limited; Glenmark Pharmaceuticals Ltd.; GlaxoSmithKline plc; Merck & Co., Inc.; Mylan N.V. (now part of Viatris Inc.); Novartis AG; Sun Pharmaceutical Industries Ltd.; and Teva Pharmaceutical Industries Ltd.

AstraZeneca plc is a global, science-led biopharmaceutical company focused on developing innovative medicines across various therapeutic areas, including respiratory diseases. It has a strong presence in the respiratory sector with products targeting conditions such as asthma and COPD. The company's respiratory portfolio includes treatments such as Breztri Aerosphere, a triple-combination therapy for COPD, which demonstrates its commitment to improving lung health. AstraZeneca’s respiratory focus is more aligned with comprehensive management of chronic respiratory conditions through a range of treatments beyond just bronchodilators. AstraZeneca's broader strategy involves investing heavily in research and development, with significant investments in new manufacturing facilities and R&D centers globally, further solidifying its position as a leader in the biopharmaceutical industry.

Cipla Limited is a global pharmaceutical company based in India, recognized for its extensive range of respiratory therapies, particularly bronchodilators. Cipla has pioneered the development of various inhaled medications aimed at managing asthma and COPD. The company offers a wide portfolio that includes well-known bronchodilators such as Asthalin (Salbutamol) and Duolin (a combination of Levosalbutamol and Ipratropium), which are designed to relax airway muscles and facilitate easier breathing for patients experiencing bronchospasm. Cipla's commitment to respiratory health is further exemplified by initiatives such as Breathefree, which aims to educate patients about asthma management and promote the use of inhalers. The company has also introduced innovative devices, such as the world's first breath-actuated inhalers and combination therapies, enhancing the delivery and effectiveness of bronchodilator treatments. Cipla strives to improve the quality of life for individuals with respiratory conditions globally by continuously expanding its product offerings and focusing on patient educatio.

List of Key Companies

- AstraZeneca plc

- Boehringer Ingelheim International GmbH

- Chiesi Farmaceutici S.p.A.

- Cipla Limited

- GlaxoSmithKline plc

- Glenmark Pharmaceuticals Ltd.

- Merck & Co., Inc.

- Mylan N.V. (now part of Viatris Inc.)

- Novartis AG

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

Bronchodilators Industry Developments

- March 2024: AstraZeneca announced an expansion of its savings programs, capping out-of-pocket costs for eligible patients at no more than USD 35 per month for its US inhaled respiratory medicines. This initiative aims to enhance the affordability of treatments for asthma and COPD patients.

- June 2023: GSK announced an agreement to acquire BELLUS Health, a late-stage biopharmaceutical company, for approximately USD 2 billion. This acquisition strengthens GSK's respiratory pipeline by adding camlipixant, a highly selective P2X3 antagonist currently in Phase III development for treating refractory chronic cough, potentially enhancing GSK's portfolio in respiratory therapies.

Bronchodilators Market Segmentation

By Disease Outlook (Revenue – USD Billion, 2020–2034)

- Asthma

- COPD

- Others

By Route of Administration (Revenue – USD Billion, 2020–2034)

- Inhalable

- Oral

- Injection

By Drug Class Outlook (Revenue – USD Billion, 2020–2034)

- Beta-Adrenergics

- Anticholinergics

- Xanthine Derivatives

- Phosphodiesterase Inhibitors

- Combination Drugs

By Mode of Action Outlook (Revenue – USD Billion, 2020–2034)

- Short Acting

- Long Acting

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Bronchodilators Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 23.64 billion |

|

Market Size Value in 2025 |

USD 24.38 billion |

|

Revenue Forecast by 2034 |

USD 32.94 billion |

|

CAGR |

3.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The ronchodilators market has been segmented into detailed segments of disease, route of administration, drug class, and mode of action. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The growth and marketing strategy in the bronchodilators market focuses on product innovation, strategic partnerships, and market expansion. Companies are investing in research and development to introduce advanced inhalation devices, combination therapies, and digital health solutions that enhance treatment adherence. Expansion into emerging markets, particularly in Asia Pacific and Latin America, is a key focus due to the rising prevalence of respiratory diseases. Additionally, patient affordability initiatives, such as price capping and savings programs, are being implemented to improve access to medications. Marketing efforts emphasize physician education, direct-to-consumer advertising, and collaborations with healthcare organizations to strengthen market presence.

FAQ's

The bronchodilators market size was valued at USD 23.64 billion in 2024 and is projected to grow to USD 32.94 billion by 2034.

The market is projected to register a CAGR of 3.4% during the forecast period.

North America had the largest share of the market in 2024.

A few key players are AstraZeneca plc; Boehringer Ingelheim International GmbH; Chiesi Farmaceutici S.p.A.; Cipla Limited; Glenmark Pharmaceuticals Ltd.; GlaxoSmithKline plc; Merck & Co., Inc.; Mylan N.V. (now part of Viatris Inc.); Novartis AG; Sun Pharmaceutical Industries Ltd.; and Teva Pharmaceutical Industries Ltd.

The asthma segment accounted for the largest share of the market in 2024.

Bronchodilators are medications that help relax the muscles around the airways, allowing them to widen and making it easier to breathe. They are primarily used to manage respiratory conditions such as asthma and chronic obstructive pulmonary disease (COPD). These drugs work by targeting specific receptors in the lungs, reducing airway constriction and improving airflow. Bronchodilators are available in different forms, including inhalers, nebulizers, tablets, and injections. They are classified into short-acting and long-acting types, with short-acting bronchodilators providing quick relief from symptoms and long-acting bronchodilators being used for ongoing maintenance therapy.

A few key trends in the market are described below: Increasing Adoption of Combination Therapies – The demand for inhalers combining multiple bronchodilators or bronchodilators with corticosteroids is rising due to improved treatment efficacy for asthma and COPD. Advancements in Inhalation Devices – The development of smart inhalers with digital tracking features is improving patient adherence and disease management. Rising Prevalence of Respiratory Diseases – Increasing cases of asthma and COPD, driven by pollution and lifestyle changes, are fueling market growth. Focus on Cost Reduction and Patient Access – Pharmaceutical companies are launching affordability programs and generic alternatives to expand patient access to bronchodilators.

A new company entering the bronchodilators market can focus on developing innovative inhalation devices, such as smart inhalers with digital monitoring features, to improve patient adherence and disease management. Investing in cost-effective generic formulations and combination therapies can help capture market share, especially in price-sensitive regions. Expanding into emerging markets with high respiratory disease prevalence, such as Asia Pacific and Latin America, can provide growth opportunities. Additionally, forming strategic partnerships with healthcare providers and leveraging telemedicine for remote patient management can enhance market penetration. Prioritizing regulatory compliance and streamlining the drug approval process will be essential for a competitive advantage.

Companies manufacturing, distributing, or purchasing bronchodilators and related products, and other consulting firms must buy the report.