Building Automation Systems Market Size, Share, Trends, Industry Analysis Report

: By Offering (Facility Management Systems, Security & Access Controls, Fire Protection Systems, Building Energy Management Software), By Communication Technology, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 128

- Format: PDF

- Report ID: PM2852

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

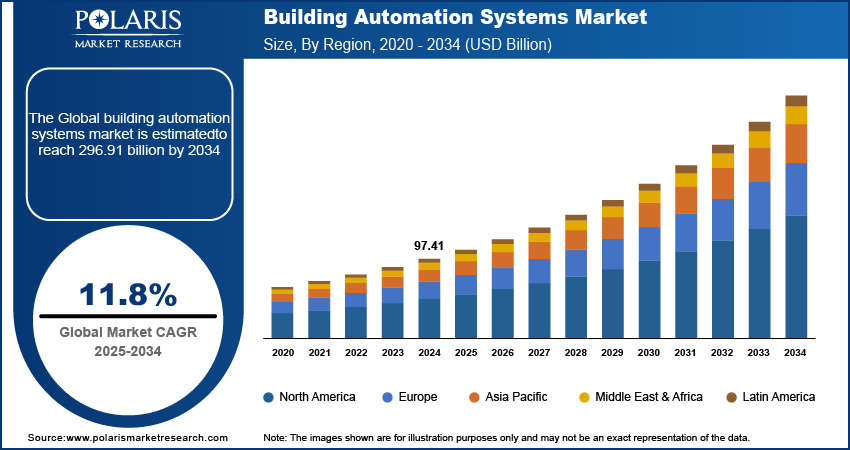

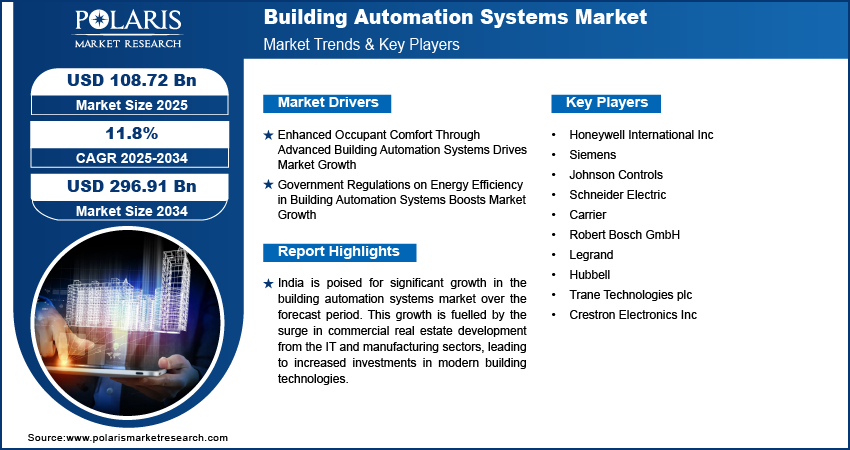

The building automation systems market size was valued at USD 97.41 billion in 2024, exhibiting a CAGR of 11.8% from 2025 to 2034. The market is growing with developments in IoT, AI, and machine learning, as well as increasing urbanization, enhanced occupant comfort, and government regulations regarding energy efficiency.

Key Insights

- The facility management systems sector retained the highest market share, due to the need for combined solutions that help improve efficiency, simplify operations, and minimize costs.

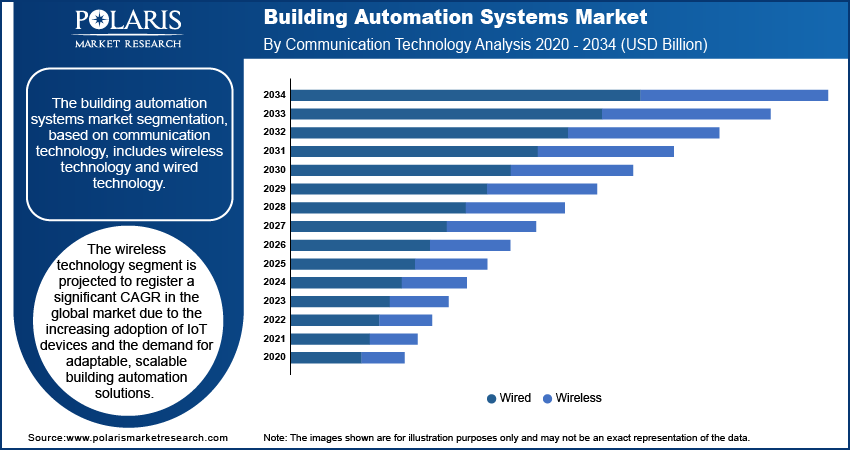

- The wireless technology industry will see a strong CAGR globally, driven by mounting demand for IoT devices and the requirement for flexible, scalable building automation solutions.

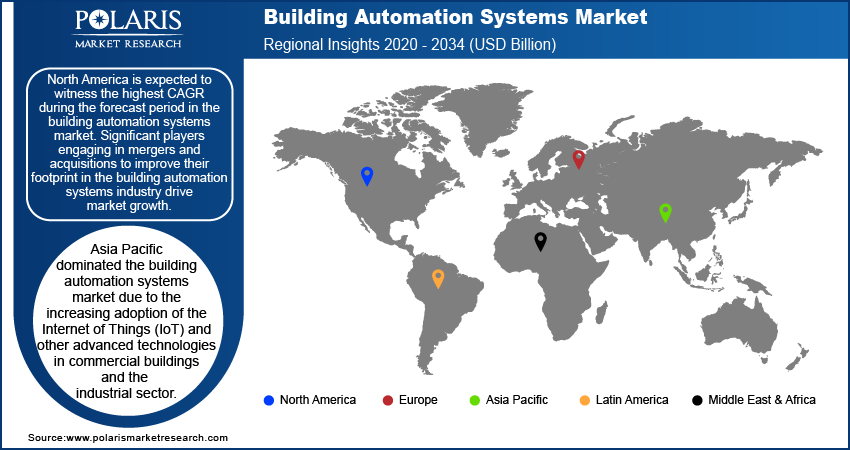

- North America led in revenue, with top companies expanding their market presence through mergers and acquisitions.

- Asia Pacific is expected to experience dynamic growth between 2025 and 2034, driven by the increasing adoption of IoT and emerging technologies in commercial and industrial assets.

Industry Dynamics

- Growing urbanization is fueling the need for effective, sustainable buildings, with BAS optimizing heating, cooling, lighting, and security to enhance efficiency and minimize waste.

- Building automation systems enhance office productivity by optimizing lighting, temperature, and air quality, creating more comfortable and efficient workplaces for staff.

- Increased government regulation on energy efficiency and sustainability is increasing demand for building automation systems.

- High installation costs upfront and the difficulty of integrating building automation systems with an existing infrastructure are the major market restrictions.

Market Statistics

2024 Market Size: USD 97.41 billion

2034 Projected Market Size: USD 296.91 billion

CAGR (2025-2034): 11.8%

North America: Largest Market Share

AI Impact on Building Automation Systems Market

- AI helps predict equipment failures before they occur, enabling proactive maintenance and reducing downtime and repair costs.

- AI optimizes occupant comfort by adapting environmental conditions such as temperature and air quality in response to personal preferences and activity levels.

- AI maximizes energy use, ensuring buildings are sustainable by minimizing wastage and helping achieve environmental objectives.

- AI-based security systems enhance security by identifying abnormal patterns and potential vulnerabilities, providing real-time notifications.

To Understand More About this Research: Request a Free Sample Report

Building automation systems (BAS) are sophisticated integrated control systems that oversee and regulate a building's diverse operational functions, such as HVAC, lighting, security, and energy management. These systems utilize sensors, controllers, and software to automate processes, optimize resource utilization, enhance occupant comfort, and improve energy efficiency. Through centralized control and real-time data analytics, BAS empowers building managers to make informed decisions, reduce operational costs, and ensure compliance with sustainability regulations.

Technological advancements are driving building automation systems market growth. The Internet of Things (IoT), artificial intelligence (AI), and machine learning have elevated BAS to a new level of sophistication, efficiency, and user-friendliness, which increases their adoption. This has contributed to the building automation systems market expansion. For instance, in January 2024, Honeywell introduced Advance Control for Buildings, an innovative platform that represents a significant advancement in building control technology. This platform is designed to automate building management and serve as the cornerstone of a building's energy efficiency strategy.

The building automation systems market is further driven by rising urbanization, resulting in increased demand for efficient and sustainable buildings. BAS is crucial in optimizing building functions such as heating, cooling, lighting, and security through integrated control systems, resulting in improved operational efficiency and reduced waste. For instance, according to the World Economic Forum, the urban population is projected to reach nearly 70% by 2050. The World Bank is actively assisting cities in leveraging data and advanced technology to achieve inclusive and sustainable growth. With the increasing emphasis on occupant comfort and safety in compact urban living spaces, advanced BAS is essential for monitoring indoor environments and ensuring optimal living conditions. Therefore, the rise in urbanization is driving market growth.

Trends and Drivers Analysis

Enhanced Occupant Comfort Through Advanced Building Automation Systems

Building automation systems are essential for creating occupant-centric environments through the integration of advanced controls for lighting, temperature, and air quality. An intelligently designed and automated workspace has a profound effect on employee productivity. Building automation systems provide advanced features such as dynamic lighting control, which modulates lighting levels based on ambient light and specific task requirements. This fosters a visually comfortable and efficient environment, thereby reducing eye strain and fatigue. Furthermore, automated temperature regulation ensures that the workspace maintains an optimal temperature, which in turn enhances focus and concentration. By fine-tuning environmental conditions, building automation systems play a pivotal role in improving employee engagement, fostering creativity, and ultimately boosting overall productivity. Therefore, the increase in building automation systems in the workplace is driving building automation systems market growth.

Government Regulations on Energy Efficiency in Building Automation Systems

The increasing government regulations on building automation systems for energy efficiency, sustainability, and compliance with environmental standards are driving the market growth. Many countries have implemented strict regulations to reduce energy consumption in buildings due to increasing concerns about climate change and resource depletion. Building automation systems are a crucial component of a building's infrastructure. Unauthorized access to the communication of these systems can lead to interference and result in undesired outcomes such as damage to HVAC and other equipment, as well as potential life-safety risks. For instance, in July 2019, the American Society of Heating, Refrigerating, and Air-Conditioning Engineers (ASHRAE) emphasized the criticality of securing building automation systems due to the potential for malicious attacks to pose a significant threat to the health and safety of building occupants. ASHRAE standards are regularly updated to improve energy performance, emphasizing the significance of automation in achieving compliance. Therefore, the increasing government regulations are propelling the building automation systems market.

Segment Analysis

Market Assessment by Offering

The building automation systems market segmentation, based on offering, includes facility management systems, security and access controls, fire protection systems, building energy management software, building automation system services, and others. The facility management systems segment held the largest revenue share of the market due to the demand for integrated solutions that optimize operations, improve efficiency, and cut costs. These systems provide real-time monitoring and management of building functions like HVAC, lighting, security, and energy usage, giving facility managers comprehensive control. Organizations are increasingly investing in advanced facility management solutions to meet sustainability goals and regulatory requirements. For instance, in August 2021, the California Energy Commission (CEC) officially implemented the 2022 Building Energy Efficiency Standards (Energy Code) for newly constructed and renovated buildings. These standards are designed to contribute to the state's public health, climate, and clean energy objectives. The regulations aim to minimize energy consumption and reduce pollution from buildings while maintaining comfortable and healthy indoor environments. Therefore, the facility management systems segment is driving the building automation systems market.

Market Evaluation by Communication Technology Insights

The building automation systems market segmentation, based on communication technology, includes wireless technology and wired technology. The wireless technology segment is projected to register a significant CAGR in the global market due to the increasing adoption of IoT devices and the demand for adaptable, scalable building automation solutions. Wireless technologies offer a cost-effective way to integrate various building systems without the limitations of traditional wired infrastructure, addressing the need for enhanced operational efficiency and connectivity sought by organizations. For instance, in November 2022, EnOcean announced a partnership with Aruba Networks to develop an innovative cloud solution called IoTC, which represents EnOcean devices on the cloud by utilizing the existing infrastructure of Aruba’s access points. EnOcean’s IoTC thereby enables the rollout of maintenance-free IoT devices for offices without the need to create any new infrastructure, including additional gateways or access points. This flexibility is especially advantageous in retrofitting existing buildings, where the installation of wired systems can be disruptive and expensive. Therefore, the wireless technology segment is driving the building automation systems market.

Market Share by Region

By region, the study provides the building automation systems market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest revenue share due to the significant players engaging in mergers and acquisitions to improve their footprint in the building automation systems market within this region. For instance, in June 2024, Honeywell announced the acquisition of Carrier Global Corporation. This acquisition opens up avenues for rapid innovation in the dynamic realm of cloud-based services and solutions. Additionally, it reinforces Honeywell's strategic focus on three significant megatrends, such as automation, and complements its Building Automation segment. Therefore, the increase in mergers and acquisitions by key players to enhance their footprint in the region is driving the building automation systems market in North America.

Asia Pacific is projected to register a substantial CAGR from 2025 to 2034 due to the increasing adoption of the Internet of Things (IoT) and other advanced technologies in commercial buildings and the industrial sector in the region. Cities in China and India are attracting investors in industrial expansion by providing affordable land, top-notch infrastructure, and a large labor force. For instance, in August 2023, Honeywell announced the launch of its Airfield Ground Lighting (AGL) manufacturing facility in Gurugram, India. AGL is a Make in India product engineered and manufactured completely in India. AGL plays a crucial role in airport operations and is subject to comprehensive safety and compliance regulations by global aviation standards and regulatory bodies. Thus, the growing adoption of the Internet of Things (IoT) and advanced technologies is propelling the building automation systems market in the Asia Pacific.

The building automation systems market in India is expected to witness significant growth due to urbanization, energy efficiency awareness, and government initiatives. The surge in commercial real estate development from the IT and manufacturing sectors is leading to increased investments in modern building technologies. For instance, in July 2023, the Union Minister of Power and New & Renewable Energy announced various initiatives being undertaken by the government of India towards energy efficiency in the building sector as part of 'Azadi Ka Amrut Mahotsav.’ The Indian government is prioritizing the enhancement of energy efficiency in both residential and commercial buildings. They have undertaken the training of more than 15,000 architects, engineers, and government officials on the Energy Conservation Building Code (ECBC) and Eco Niwas Samhita (ENS). Therefore, government initiatives in the region are anticipated to propel the building automation systems market growth.

Key Players & Competitive Analysis Report

The building automation systems market is a dynamic and rapidly evolving environment with several players striving to innovate and differentiate from each other. Major global companies are dominating the market by leveraging extensive research and development capabilities, advanced technologies, and broad distribution networks to maintain a competitive edge. The players are engaged in strategic activities such as mergers and acquisitions, partnerships, and collaborations to enhance their portfolios and expand their market presence.

Additionally, startups are contributing to the market by introducing novel technologies in building automation systems. Major players in the building automation systems market include Honeywell International Inc., Siemens, Johnson Controls, Schneider Electric, Carrier, Robert Bosch GmbH, Legrand, Hubbell, Trane Technologies plc, and Crestron Electronics Inc.

Crestron, headquartered in Rockleigh, New Jersey, is a manufacturer of advanced control and automation systems tailored for office, campus, and home environments. Their comprehensive control solutions encompass wall-mounted keypads, tabletop touch screens, and cloud-based network control, providing users with full oversight and command over lighting, shades, climate, and audio/video media. This level of control can be exercised within a single room or across an entire building automation system. Crestron's portfolio includes engineering, automated control systems, audio/video, lighting, manufacturing, technology, commercial and residential solutions, unified communications, enterprise AV distribution, unified communications, network AV solutions, smart homes, IoT, home automation, AV, control systems, workplace technology, campus technology, and video conferencing solutions. In August 2024, Crestron Electronics announced the latest enhancements to the Crestron Home OS 4, set to debut at CEDIA Expo 2024. The OS is designed to cater to both dealers and homeowners, and the recent updates reflect this commitment with additional customization options, an expanded device ecosystem, and new tools and resources aimed at bolstering businesses and streamlining management.

Legrand, established in 1904 in France, is an electrical and digital building infrastructure company. The company specializes in an extensive array of products and solutions for residential, commercial, and industrial markets. Its portfolio encompasses wiring devices, power distribution systems, building automation solutions, structured cabling, and digital infrastructure products, all of which are engineered to optimize safety, efficiency, and energy management.

List of Key Companies

- Honeywell International Inc

- Siemens

- Johnson Controls

- Schneider Electric

- Carrier

- Robert Bosch GmbH

- Legrand

- Hubbell

- Trane Technologies plc

- Crestron Electronics Inc

Building Automation Systems Industry Developments

May 2024: Honeywell opened its first assembly line dedicated to Fire Alarm and Building Management solutions in Saudi Arabia. The facility, located in Dhahran, marks a significant expansion of Honeywell’s Building Automation capabilities in both Saudi Arabia and the broader Middle East region.

April 2024: Johnson Controls, a global leader in sustainable building solutions, announced the development of Security Lifecycle Management with OpenBlue Services. The new solution empowers customers in improving building security, mitigating risks, and optimizing the ROI on security technology investments.

October 2023: Hubbell Incorporated finalized a definitive agreement to purchase Northern Star Holdings, Inc.

Building Automation Systems Market Segmentation

By Offerings Outlook (Revenue – USD Billion, 2020–2034)

- Facility Management Systems

- Lighting Controls

- HVAC Controls

- Security & Access Controls

- Video Surveillance Systems

- Biometric Systems

- Fire Protection Systems

- Sensors & Detectors

- Fire Sprinklers

- Fire Alarms

- Others

- Building Energy Management Software

- Building Automation System Services

- Installations & Maintenance

- Training

- Others

By Communication Technology Outlook (Revenue – USD Billion, 2020–2034)

- Wireless Technology

- Wired Technology

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Building Automation Systems Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 97.41 billion |

|

Market Size Value in 2025 |

USD 108.72 billion |

|

Revenue Forecast in 2034 |

USD 296.91 billion |

|

CAGR |

11.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The building automation systems market size was valued at USD 97.41 billion in 2024 and is projected to grow to USD 296.91 billion by 2034.

The market is projected to register a CAGR of 11.8% from 2025 to 2034.

Asia Pacific had the largest share of the global market.

The key players in the market are Honeywell International Inc., Siemens, Johnson Controls, Schneider Electric, Carrier, Robert Bosch GmbH, Legrand, Hubbell, Trane Technologies plc, and Crestron Electronics Inc.

The wireless technology segment is projected to experience substantial growth with a significant CAGR in the global market due to the increasing adoption of IoT devices and the demand for adaptable, scalable building automation solutions

The facility management systems segment accounted for a significant revenue share of the market due to the demand for integrated solutions that optimize operations, improve efficiency, and cut costs.