Bundling films and sheeting Market Share, Size, Trends, Industry Analysis Report

By Packaging Type (Flexible Packaging, Rigid Packaging); By Material; By End-User; By Region; Segment Forecast, 2024 – 2032

- Published Date:Mar-2024

- Pages: 120

- Format: PDF

- Report ID: PM4533

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

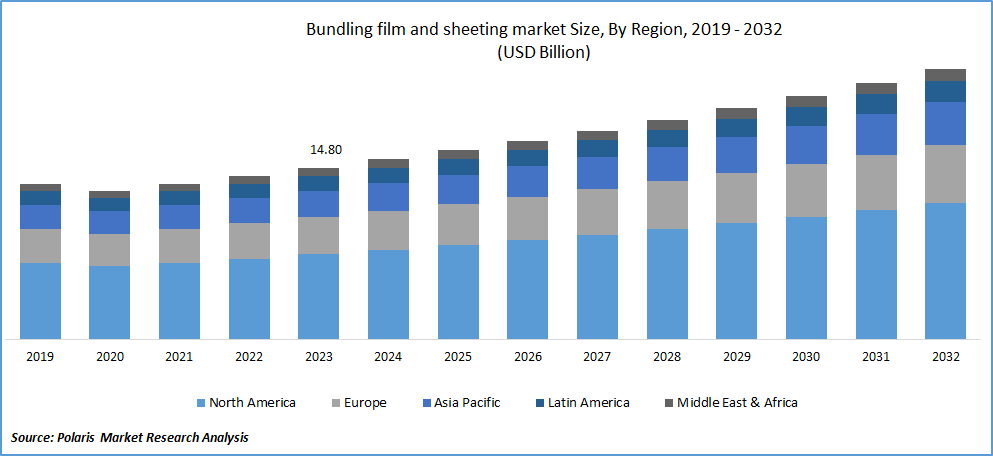

The global bundling film and sheeting market was valued at USD 14.80 billion in 2023 and is expected to grow at a CAGR of 5.2% during the forecast period.

Bundling films and sheeting are the kinds of films that are used to maintain the products while wrapping multi-packs for delivery properly. Bundling is used in a variety of manufacturing applications and is an affordable substitute for bags and boxes, among other materials. During the shipping and transit process, sheeting is frequently used to cover the outside layer of boxed material in order to protect it from external effects like cuts, edges, and tampering.

It is intended to simplify the product's user's life. It is typically packed for each sale and is specially produced for each product. Simple-to-use tabs for opening, unique branding, unique visuals, and more can be included. While bundling film and shrink wrap may be identical materials, the latter is made with the final product in mind. Compared to boxes, bags, or other more expensive packing methods, it is more affordable.

To Understand More About this Research:Request a Free Sample Report

The market is expanding and is vital to many different industries. Because of their affordability, flexibility, and longevity, these adaptable materials are highly sought after for use in building as well as packaging. The growing requirement for effective and secure packaging solutions is one of the main factors propelling the market for bundling films and sheeting.

One of the main factors propelling the growth of the market is the global packaging industry's rapid development. The market is growing more quickly because bundling films are widely used in the packing of heavy and multi-pack items, as well as for wrapping around firewood parcels, can packages, and other items to keep them together.

In addition, the market for bundling films is positively impacted by urbanization, the rise of end-use sectors, rising retail, and better lifestyles. In addition, over the forecast period, market participants will have profitable prospects due to the development of a completely automated production process with more modifications. Therefore, the market is increasing as the demand for goods packaging increases.

Furthermore, another element driving the bundling film market's rise is the lightweight stretch bundling film dispenser's ease of use for users. However, the higher initial cost of plastic materials and dispensers and consumer ignorance are the restraints impeding the growth of the bundling film market.

Industry Dynamics

Growth Drivers

- Increasing Online Business and Packaging Market Across the Globe

The market growth of bundling film and sheeting during the forecast period is primarily driven by the increasing online business and packaging market worldwide. Bags are so convenient to use for storage, transportation, and other purposes that packaging has become an essential part of modern living. The main factor contributing to the packaging items' growing demand is their accessibility.

It is one such product that is expanding at a healthy rate. And these show the significant growth in the market shares. The majority of bundling film bags are gusseted or laid flat, and they come in a variety of sizes. They can be specially made to match the exact specifications of the customer. Packaging customization in terms of capacity and space can boost the global market over the projected period.

The global market for these is expected to be driven in the near future by the usage of environmentally friendly bio-plastic materials. Because they primarily rely on bundling films and sheeting for the packaging of FMCG, agricultural products, and the production of industrial equipment and machinery, rising economies are opening up enormous market prospects. Modern infrastructure, effective transportation, networks, and a wide variety of consumer goods emerge as the global population moves closer to the center. These driving factors show the sub-sequential rise in the market product or market growth.

Report Segmentation

The market is primarily segmented based on packaging type, material, end-use, and region.

|

By Packaging Type |

By Material |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Packaging Type Analysis

- The flexible packaging is expected to witness the fastest CAGR during the forecast period.

The flexible packaging is expected to witness the fastest CAGR during the forecast period due to easily adapting to the shape of the product being packaged. This often includes materials such as films, sheets, and bags that offer versatility, durability, and convenience in packaging various goods. Increasing preference among consumers for products with flexible and convenient packaging and the emerging trends in the packaging industry favoring flexible solutions for various products drive the market.

Furthermore, the inherent benefits of flexible packaging, such as lightweight, space efficiency, and ease of use, and the introduction of innovative materials and technologies that enhance the flexibility and functionality of packaging solutions contribute to its increased adoption.

By End-User Analysis

- The food and beverages segment accounted for the largest market share in 2023

In 2023, The food and beverages segment accounted for the largest market share. The market players, manufacturers, and consumers are highly engaged in the use and demand for bundling film and sheeting specifically designed for food and beverage packaging.

Food and beverages are everyday consumer goods, and their packaging requires specific considerations such as freshness preservation, safety, and regulatory compliance. The bundling film and sheeting designed for this segment cater to the unique requirements of packaging in the food and beverage industry. The preference for bundling film and sheeting in the food and beverages segment indicates the importance of effective packaging in this industry. Factors such as convenience, shelf appeal, and product protection drive the market.

Regional Insights

- North America dominated the largest market share in 2023

In 2023, North America dominated the largest market. It has a robust consumer goods market, and the demand for bundling film and sheeting is closely tied to the packaging needs of various consumer products, including food, beverages, personal care items, and household goods. The continued growth of e-commerce in North America contributes to an increased demand for efficient and protective packaging materials. Bundling film and sheeting play a crucial role in securing products during shipping and handling.

Furthermore, the food and beverage sector is a major contributor to the demand for bundling film and sheeting. Packaging solutions that ensure freshness, safety, and compliance with regulatory standards are essential for this industry. Industries such as manufacturing and construction use bundling film and sheeting for packaging and protection of raw materials, finished goods, and equipment during transportation and storage. Also, adherence to packaging regulations and standards, including those related to food safety and environmental impact, influences the choice of bundling materials. Compliant solutions are in higher demand.

Asia Pacific markets are expected to witness the fastest growth throughout the forecast period. The market for plastic films and sheets is being driven by investments made in a variety of industrial advances by emerging nations, including China and India. Due to its dense population and expanding middle class, the Asia Pacific area has more consumer spending power. Also, the market is driven by a number of industries, such as construction, agriculture, automotive, and packaging, which need plastic sheets and films for things like building materials, agricultural films, automobile interiors, and packaging materials.

In addition, increased disposable income, changing trends, urbanization, and population growth are driving up the consumption of food, especially packaged items. In addition, the market for bundling films and sheets in the region is being propelled by growing industrialization, a rise in demand as a result of shifting demographics, and government initiatives to draw in capital from a range of sectors, including electronics, construction, packaging, and pharmaceuticals.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and eco-friendly products to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and scientific innovations to expand their product portfolios and maintain a competitive edge in the bundling film and sheeting market.

Some of the major players operating in the global market include:

- Amcor PLC

- Berry Global Group, Inc.

- Sabic

- Toray industries Inc.

- Sealed air corporation

- Oben holding group

- Dupont teijin films

- Jindal poly films

- Ufelx

- Toyobo co. LTD

Recent Developments

- In January 2021, INDEVCO Plastics introduced an eco-friendly shrink bundling film for multi-packs featuring a circular plastic film. It is prepared with 50% PCR (post-consumer recycled) resin; the film is completely recyclable at U.S. drop-off locations. Developed in collaboration with Dow, a member of the Alliance to End Plastic Waste, the film is designed for food and beverage manufacturers packaging multi-unit bundles. Dow's PCR resin, introduced in October for North American shrink applications, includes 70% certified PCR sourced locally in the U.S.

Bundling film and sheeting Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 15.54 billion |

|

Revenue forecast in 2032 |

USD 23.31 billion |

|

CAGR |

5.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Packaging Type, By Material, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The key companies in Bundling Films and Sheeting Market are Amcor PLC, Sabic, toyobo Co. Ltd, Jindal Polt Films, Oben Holding Group, Sealed Air Corporation

The global bundling film and sheeting market is expected to grow at a CAGR of 5.2% during the forecast period.

Bundling Films and Sheeting Market report covering key segments are packaging type, material, end-use, and region.

The key driving factors in Bundling Films and Sheeting Market Increasing Online Business and Packaging Market Across the Globe..

Bundling films and sheeting Market Size Worth $ 23.31 Billion By 2032.