Buttock Augmentation Market Share, Size, Trends, Industry Analysis Report

By Product (Buttock Implants, Buttock Injections); By End-Use (Hospitals, Aesthetic Clinics); By Region; Segment Forecasts, 2021 - 2028

- Published Date:Aug-2021

- Pages: 106

- Format: PDF

- Report ID: PM1942

- Base Year: 2020

- Historical Data: 2016-2019

Report Outlook

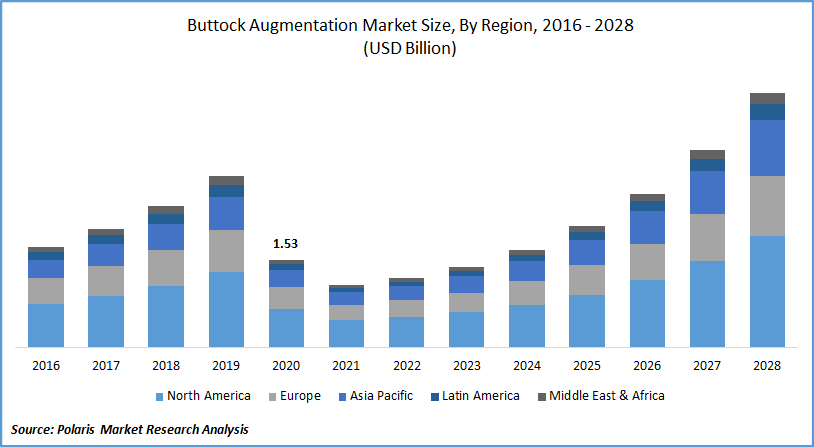

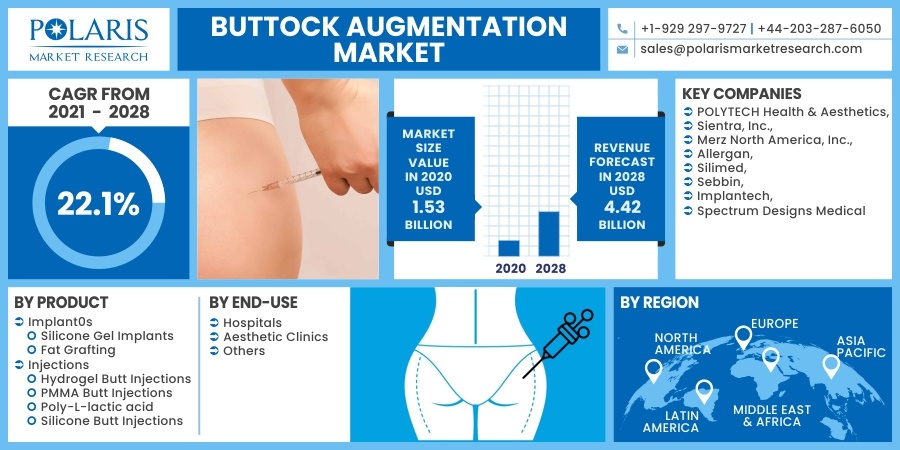

The global buttock augmentation market was valued at USD 1.53 billion in 2020 and is expected to grow at a CAGR of 22.1% during the forecast period. The increase in population consciousness about their physical appearance, particularly women adopting buttocks augmentation to improve their physical looks, accelerates the market growth. The surge in the number of buttock disfigurements due to the growth in the aging population is also expected to boost the global buttock augmentation market.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

These procedures currently account for around 5.0% of total surgical procedures performed worldwide and are increasing exponentially. Growing disposable income and technological advancements such as non-invasive surgeries are other factors driving the market. In addition, the greater use of social media among the younger generation and its influence over them to get surgical alterations to look a certain way provides market players with a profitable opportunity.

Industry Dynamics

Growth Drivers

During the forecast period, factors driving the global buttock augmentation market include increasing awareness about cosmetic surgeries among the public, advancements in implants, fewer side effects, and increased success rate of the buttock augmentation procedure.

There is a huge level of urbanization in many countries across the globe, and the per capita income has increased in many developing regions of the world, resulting in people spending their income on cosmetic procedures.

There is a huge market demand for cosmetic augmentation procedures, and more than 17 million procedures are conducted annually, including minimally invasive procedures such as Botox injections. The industry has the highest growth rate compared to all other surgical procedures from 2015 to 2019. These procedures grew by 38.4% compared to their previous year and by 65.9% since 2015. Buttock lifts also grew by mover 25% in 2019, compared to its last year, and since 2015, it has grown by more than 77%.

Advances in implant technology fuel the increase in procedures, and silicone-based products are commonly used in implants. Nearly 3.5 lakh of procedures that include implants and fat transfer were conducted in 2019. Brazil is one of the hotspots for cosmetic surgery in the world.

In Brazil alone, more than 75,000 buttock augmentation and 3,000 rear lift procedures were conducted in 2019. Non-invasive procedures are being developed for the procedure with hyaluronic or silicone gel injections. If these techniques are successful, it will provide a huge opportunity for the augmentation market to grow over the coming years.

COVID-19 pandemic is expected to have a negative impact on the global market during the forecast period. During the initial phase of the forecast period, the market growth will be hindered as cosmetic procedures across the globe are getting postponed due to the non-availability of beds and keeping patients' safety in mind.

Know more about this report: request for sample pages

Buttock Augmentation Market Research Scope

The market is primarily segmented on the basis of product, end-use, and region.

|

By Product |

By End-Use |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Product

The augmentation implants segment dominated the global market and generated the highest revenue in 2020. The segment is further categorized into silicone gel augmentation implants and fat grafting. Implants, buttock lifts, and fat grafting augmentation are the most typical implant procedures. According to the American Society of Aesthetic Plastic Surgery, augmentation surgery has risen by 252% since 2010.

Buttock augmentation with fat grafting is the most effective, common, and widely used procedure. It has a low risk of complications, large customer satisfaction, and a shorter recovery period. According to the International Society of Aesthetic Plastic Surgery, around 37,329 fat grafting buttock augmentation procedures were performed in the United States in 2019. This reflects the country's strong acceptance and demand for these procedures.

Insight by End-Use

The hospital segment generated the highest revenue in 2020. The hospitals in both developed and developing countries are well-built. They are well-equipped with advanced instruments and cutting-edge technology. Many professionals in the field of aesthetic procedures are associated with hospitals as they have all the requisite facilities for such procedures to be performed.

In addition, consumer preference enters the picture, as patients feel comfortable receiving care from a well-known hospital since those treatments are covered by insurance. Aesthetic clinics are expected to be the fastest-growing segment during the forecast period as these clinics are gaining popularity due to their improved service quality, personalized attention to customers, and lower care costs than other facilities.

Geographic Overview

North America is expected to be the biggest shareholder for the global market during the forecast period. In the U.S. alone, 32,268 buttock augmentation and 6,238 buttock lift procedures were conducted in 2019. The country uses advanced techniques currently available for cosmetic surgeries, which are expected to drive the growth of the market.

The Asia Pacific is expected to be the fastest-growing region for the market during the forecast period. The numbers of buttock augmentation procedures in China and India are increasing every year due to the public's booming economy and increased awareness. In 2019, more than 4,500 procedures were carried out in India.

Competitive Insight

Companies in the market are looking to increase their manufacturing capacity due to the increasing demand for buttock augmentation procedures. The companies are also looking to develop non-invasive techniques expected to be adopted more in the coming decades.

Some of the major players operating in the market include POLYTECH Health & Aesthetics, Sientra, Inc., Merz North America, Inc., Allergan, Silimed, Sebbin, Implantech, and Spectrum Designs Medical.

Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 1.53 billion |

|

Revenue forecast in 2028 |

USD 4.42 billion |

|

CAGR |

22.1% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Product, By End-Use, By Region |

|

Regional scope |

North America Europe Asia Pacific Latin America; Middle East & Africa |

|

Key Companies |

POLYTECH Health & Aesthetics, Sientra, Inc., Merz North America, Inc., Allergan, Silimed, Sebbin, Implantech, and Spectrum Designs Medical |